Network as a Service Market Size, Share & Industry Analysis, By Type (WAN as a Service and LAN as a Service), By Enterprise Type (Small and Medium-sized Enterprise and Large Enterprise), By Application (Wide Area Network, Virtual Private Network, Cloud-based Services, Bandwidth on Demand, and Others), By End User (Corporate Customers and Individual Customers), By Industry (Corporate Customers (BFSI, IT & Telecommunication, Manufacturing, Healthcare, Retail, Others)), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

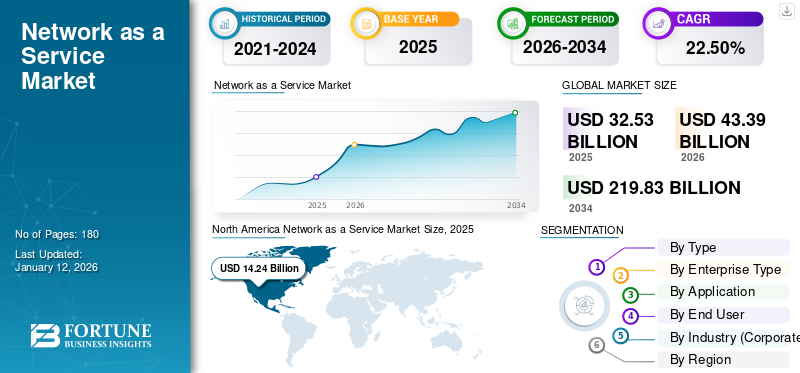

The global network as a service market size was valued at USD 32.53 billion in 2025. and is projected to grow from USD 43.39 billion in 2026 to USD 219.83 billion by 2034, exhibiting a CAGR of 22.50% during the forecast period. North America dominated the global network as a service market with a share of 43.80% in 2025. Additionally, the U.S. network as a service market is projected to grow significantly, reaching an estimated value of USD 75.31 billion by 2032.

Leading market players such as Cisco Systems, Inc., providing solutions such as network security, software-defined WAN, and secure web gateway are included in the scope of the report. Verizon Wireless Inc. provides private IP, Managed SD-WAN, and others.

- According to a survey by the Project Management Institute’s pulse survey, inefficient project management processes cause nearly 12% wastage of organizational resources.

These solutions are in high demand due to the growing need to acquire a 360-degree perspective of the full project lifecycle. The use of cloud-based services for remote monitoring of project operations is expected to drive market expansion.

Digitization, remote working, and automation propel market growth in government, engineering, construction, healthcare, BFSI, and IT & telecommunications. In a dynamic and hypercompetitive business environment, small vendors use these solutions to make faster and better decisions. SaaS PPM can be connected with existing business process management systems to provide additional functionality in a single solution. As a result, the solutions make substantial contributions to its adoption. Furthermore, the combined coordination of the software with application lifecycle management systems is expected to drive market growth.

The global impact of COVID-19 has positively impacted the network as a service market growth as many firms adopted a remote workplace strategy during the pandemic. This resulted in increased utilization of VPN and firewall for ease of use and convenience in network management. For instance, according to the hybrid workplace report 2020, 74% of organizations maintain and increase their investment in SD-Branch, SD-WAN, and 83% of firms will increase their investment in cloud-based networking.

Nearly all organizations adopted a work-from-home model amid the pandemic. For instance:

- A 2021 survey by Talent Works showed that more than 90% of senior executives planned remote working across the U.S.

- According to a workforce happiness index survey conducted in May 2020, people working from home scored 75 out of 100 as opposed to 71 workers operating from the office.

Network as a Service Market Trends

Surge in Adoption of Cloud Services among Enterprises to Drive Market Growth

The growing adoption of cloud services among enterprises provides numerous advantages for Network as a Service. Cloud services provide a highly flexible infrastructure that easily accommodates organizations' evolving needs. NaaS leverages this scalability by offering adaptable network resources that can be adjusted based on demand, enabling enterprises to scale their network capabilities without significant investments in hardware or infrastructure upgrades.

Additionally, implementing cloud services is a crucial backbone for businesses in the U.S. It is a cost-effective approach, supporting several functions, including data storage, databases, servers, and networking software. It is an essential tool enabling businesses to operate effectively and efficiently. For instance,

- In 2022, according to a report by Zippia, Inc., a provider of online recruitment services, 94 percent of enterprises in the U.S. implemented cloud services, 67 percent of enterprises' infrastructure is cloud-based, and 92% of enterprises have a multi-cloud strategy. This factor is expected to expand the U.S. network as a service market share over the forecast period.

The cost efficiency of cloud services to NaaS enables organizations to pay only for the network services they consume, avoiding upfront capital and expense and reducing operational costs. This pay-as-you-go model enables better resource allocation and budget optimization.

Download Free sample to learn more about this report.

Network as a Service Market Growth Factors

Increasing Need for Wireless Communication for Industrial and Commercial Operations to Surge the Demand for Network as a Service

The increasing need for wireless communication in industrial and commercial operations drives the demand for network as a service. As industries and businesses are interconnected and reliant on real-time data exchange, wireless communication is crucial in enabling efficient operations and seamless connectivity. NaaS offers a comprehensive solution by providing wireless networking infrastructure and services that cater to these demands.

In the industrial sector, wireless communication enables machine-to-machine communication, Internet of Things (IoT) connectivity, and automation. Manufacturing, logistics, and utilities require reliable and secure wireless networks to facilitate real-time monitoring, control systems, asset tracking, and remote operations. NaaS offers a robust wireless network infrastructure, ensuring seamless connectivity across various industrial environments and supporting the growing demand for wireless communication in industrial operations.

Furthermore, businesses increasingly rely on wireless communication for various operations in the commercial sector. Wireless networks enable flexible mobile connectivity for employees, customers, and devices in the retail, hospitality, healthcare, and transportation industries. NaaS provides businesses with wireless networking solutions supporting high-capacity data transmission, secure wireless access, and seamless mobility.

Additionally, Network as a service caters to the dynamic nature of wireless communication requirements in industrial and commercial settings, allowing organizations to scale their wireless networks based on evolving needs such as expanding coverage, increasing capacity, or integrating new technologies. Thus, the rising need for wireless communication in industrial and commercial operations fuels the demand for networks as a service.

RESTRAINING FACTORS

Lack of Standardization and Complex Deployment Procedures to Impede Market Growth

The complex deployment procedures involved in NaaS, such as API-based operation, Software-Defined Networking (SDN), and hybrid cloud distribution, pose challenges and increase organizations’ operational costs.

The global shortage of skilled cybersecurity professionals creates difficulties in delivering reliable and secure NaaS services to organizations, negatively impacting the market growth. Additionally, the lack of standardization within the sector leads to inconsistencies and difficulties when integrating different NaaS solutions, disturbing seamless business operations.

Further, organizations providing NaaS services must comply with specific regulations and legislation, which is difficult to navigate and maintain.

Hence, the above mentioned factors are expected to hinder the market during the forecast period.

Network as a Service Market Segmentation Analysis

By Type Analysis

Rising Demand for WAN Connectivity Solutions is Strengthening Market Growth

Based on type, the market is bifurcated into WAN as a Service and LAN as a Service.

The WAN as a Service segment will hold the dominant market with a share of 66.74% in 2026, owing to the widespread use of WAN solutions across enterprises in various industries. It develops a communication network using multiple resources such as mobile phones, computers, remote offices, and data centers. Depending on customer needs, WAN connectivity can be set up to allow users to connect to private or public gateways.

SD-WAN is one of the fastest-growing industry adoptions in recent years, as it can fulfill the criteria of next-generation technologies with a strong network built on scalability, agility, flexibility, security, and compliance. Also, it delivers a final premium customer experience by offering various branch services at sustainable costs. Leading players are introducing SD-WAN services to expand segmental growth. For instance,

- In May 2022, Colt Technology Services partnered with VMware to develop a managed WAN solution, leveraging VMware’s SD-WAN technology. The collaboration expanded Colt’s portfolio and enabled their clientele to access hybrid multi-cloud and SaaS capabilities, among others.

The LAN as a Service segment is anticipated to record the highest CAGR during the forecast period due to increasing demand for LANaaS solutions, such as on-demand ports and Wi-Fi hotspots, which enable connectivity to access internet services and allow corporations to deliver mobile device access to their employees.

To know how our report can help streamline your business, Speak to Analyst

By Enterprise Type Analysis

Large Enterprise Segment to Dominate Owing to Rising Use of Virtualized Technology

Based on enterprise type, the market is bifurcated into small and medium-sized enterprise and large enterprise.

The large enterprise segment is anticipated to dominate the market contributing 57.25% globally in 2026 , due to increasing use of cloud services such as NaaS and Platform as a Service. Large enterprises are using virtualized technology to manage connections among remote enterprise sites and rising support for Bring Your Own Device (BYOD) trend, which allow them to manage their diverse sources cost-effectively. These technologies are likely to accelerate the adoption of networks as a service as they reduce investment costs and enable companies to focus on other priorities.

Small and medium-sized enterprise segment is expected to grow at the highest CAGR due to lower infrastructure costs. SMEs have turned their focus on digital transformation to profit from emerging technologies such as cloud, SDN, analytics, and IoT due to the availability of low-cost cloud services and the as-a-service model.

By Application Analysis

Heightened Adoption of Mobility Services and Solutions across Multiple Sectors to Boost Market

Based on application, the market is segmented into vast area network, virtual private network, cloud-based services, bandwidth on demand, and others (integrated network security as a service).

Wide Area Network (WAN) holds the largest market with a share of 32.59% in 2026, due to increased demand for enterprise mobility. Mobile personal devices, such as smartphones, laptops, and tablets, are increasingly used to access corporate networks. The growing size of mobile datasets necessitates parallel processing across several servers and seamless interfaces. As a result, the adoption rate of SD-WAN has increased owing to these reasons.

The cloud-based services segment is expected to grow at the highest CAGR during the forecast period due to transmission from on-premise modules to cloud-based services and rising investments in cloud-related services by various end-use industries.

By End User Analysis

Rapid Adoption among Corporate Customers to Propel Demand for NaaS

Based on end user, the market is classified into corporate customers and individual customers.

The corporate customers segment held the largest market share in 2024. The segment is also expected to register a high CAGR over the forecast period, owing to the rising adoption of cloud-based everything as a service offerings by leading players. Corporations have the highest spending on cloud services adoption, owing to its benefits such as storage availability and easy access to remote workers.

According to the IDC Aruba NaaS study 2021, nearly 1/3rd of the organizations have deployed NaaS for cloud or edge use cases. Out of this, around 62% have done so in the past three years.

By Industry Analysis

Increased Adoption of Network as a Service Software across the IT & Telecommunication Segment to Drive Market

By industry, the market is divided into IT & telecommunications, BFSI, healthcare, manufacturing, retail, and others (transportation).

Among these, the IT & telecommunications segment is anticipated to dominate the market share. IT & telecommunication firms are modernizing their outdated enterprise networks with virtualization technology due to significant financial advantages. Cloud-enabled virtualization techniques allow telecom carriers and network service providers to deliver network services more quickly while simultaneously addressing the concerns of bandwidth scarcity. The market's expansion will be fueled by cloud and networking technologies, which provide clients with on-demand network services while lowering IT equipment procurement and maintenance costs. The BFSI segment is projected to dominate the market with a share of 23.42%% in 2026.

The healthcare segment will record notable growth during the projected period. The demand for a secure, reliable network as a service has increased as the adoption of remote patient monitoring and in-home health aid has increased.

REGIONAL INSIGHTS

The global market scope is classified across five regions, North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America

North America Network as a Service Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market in North America will account for the largest market share during the forecast period. Northamerica dominated the global market in 2025, with a market size of USD 14.24 billion. The market’s growth in the region is attributed to its technological maturity in data centers and network infrastructure and extensive research & development in network expansion technology. The region's economies are well-established and stable, allowing it to invest heavily in R&D and contribute to the creation of innovative technologies in the era of network service providers. The presence of leading market players focusing on launching new service partnerships will boost the market growth. The U.S. market is projected to reach USD 13.25 billion by 2026.

- In April 2023, CradlePoint, a subsidiary of Ericsson, acquired Ericom Software to enhance its Secure Access Service Edge (SASE) and zero trust offerings for hybrid 5G and wireline environments. The acquisition combined Ericom’s service edge capabilities to the NetCloud Exchange, providing zero-trust-based access for devices and users.

Asia Pacific

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific is estimated to record the highest CAGR during the forecast period. Asia Pacific is likely to provide the most lucrative outlook for NaaS providers owing to increasing investment in cloud-based networking technology. In this region, China and India are likely to surge the demand for NaaS. For instance, according to the hybrid workplace report 2020, 45% of APAC enterprises plan to increase their investment in cloud-based networking. The Japan market is projected to reach USD 1.25 billion by 2026, the China market is projected to reach USD 2.21 billion by 2026, and the India market is projected to reach USD 2.4 billion by 2026.

Europe

The Europe market will showcase considerable growth due to adoption practices, rising awareness, and network service concerns. Spain, Germany, and the U.K. have the highest rate of adoption of NaaS. Companies are widely adopting NaaS to boost productivity. The UK market is projected to reach USD 1.68 billion by 2026, while the Germany market is projected to reach USD 1.91 billion by 2026.

Middle East & Africa

The economic growth of the Middle East & Africa due to government projects, cloud, significant data adoption, and technological innovation has contributed to the market growth.

South America is expected to grow steadily during the forecast period owing to increasing investment by leading players and the rising number of digital start-ups in Brazil.

KEY INDUSTRY PLAYERS

Leading Players Focus on Service Offerings to Boost Market Growth

Leading market players, such as Fortinet, Inc., ARE focusing on designing and providing network as a service worldwide. Fortinet offers extensive network services, next-generation firewalls, and SD-WAN.

- In February 2023, Aarna Networks launched AES, a SaaS solution, which provides zero touch edge orchestration, edge storage sharing, and multi-cloud connectivity. Recent collaborations with RedHat, Keysight and Capgemini Engineering enabled the company and other organizations to deploy cloud-native and virtual network functions (CNF/VNF) to consumers.

List of Top Network as a Service Companies:

- Amdocs Inc. (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Megaport Limited (Australia)

- Hewlett Packard Enterprise (Aruba Networks) (U.S.)

- NEC Corporation (Japan)

- ARTERIA Networks Corporation (Japan)

- NTT Group (Japan)

- Cisco Systems Inc. (U.S.)

- Cloudflare, Inc. (U.S.)

- Verizon Communications Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- May 2023 – Cloudflare Inc. partnered with IT services giant Kyndryl to introduce a new managed WAN as a Service offering. This collaboration combined networking services with the company’s Magic WAN DDoS mitigation and connectivity platform, aiming to enhance performance and security for users transitioning to modern IT technologies.

- April 2023 – Hewlett Packard Enterprise (HPE) launched an updated version of its cloud management platform, HPE Aruba Networking Central, at its Atmosphere event, offering AI for IT operations (AIOps) and enhanced network capabilities. Leveraging the GreenLake platform, the company offered Artificial Intelligence (AI)-powered data analytics and performance optimizations for network administrators.

- May 2023 – Megaport collaborated with colocation provider Element Critical to launch its NaaS platform. Through this partnership, customers can leverage the company’s software defined networks and cloud interconnection services to connect their allocated assets directly to multiple cloud providers and branch offices, all through a single network port, offering greater control and cost management capabilities.

- July 2022 – Amazon Web Services, Inc. announced the general availability of AWS Cloud WAN, a managed WAN service that connected site-to-site, inter-region workloads, and site-to-cloud in AWS. The platform was integrated with leading SD-WAN vendors, including Aruba, Checkpoint, Prosimo, Aviatrix, Cisco, and VMware.

- April 2022 – Aryaka received software-defined core (SD-core) technology and software-defined wide area network (SD-WAN) service from SoftBank Corp, a Japanese conglomerate. For SoftBank Corp to provide its customers with high-speed and stable data communications, it needed a network that was both adaptable and highly secure, which necessitated this collaboration.

REPORT COVERAGE

The research report includes prominent areas across the globe to get a better knowledge of the market. Furthermore, it provides insights into the most recent industry and market trends as well as an analysis of technologies that are being adopted quickly on a global scale. It also emphasizes some of the growth-stimulating restrictions and elements, allowing the reader to obtain a thorough understanding of the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021 – 2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026 – 2034 |

|

Historical Period |

2021 – 2024 |

|

Growth Rate |

CAGR of 22.50% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Type

By Enterprise Type

By Application

By End User

By Industry (Corporate Customers)

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global market was valued at USD 32.53 billion in 2025.

According to Fortune Business Insights, the market is expected to reach USD 219.83 billion by 2034.

Growth of 22.50% CAGR will be observed in the market during the forecast period (2026-2034).

Within a type, WAN as a Service is expected to lead the market during the forecast period.

Increasing need for wireless communication for industrial and commercial operations to drive this market.

Amdocs Inc., Amazon Web Services, Inc., Megaport Limited, Hewlett Packard Enterprise (Aruba Networks), NEC Corporation, ARTERIA Networks Corporation, NTT Group, Cisco Systems Inc., Cloudflare, Inc., and Verizon Communications Inc. are the top players in the market.

Asia Pacific is expected to grow with a remarkable CAGR.

By application, the cloud-based services segment is expected to grow with the highest CAGR.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us