Nitric Acid Market Size, Share & Industry Analysis, By Application (Fertilizers, Nitrobenzene, Adipic Acid, Toluene Di-isocyanate, and Others) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

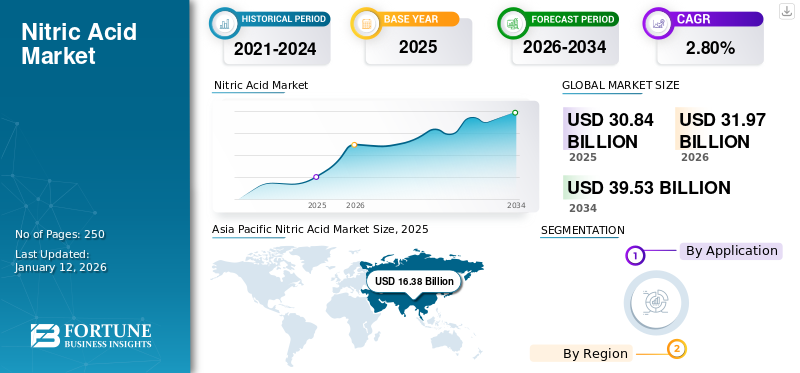

The global nitric acid market size was valued at USD 30.84 billion in 2025. The market is projected to grow from USD 31.97 billion in 2026 to USD 39.53 billion by 2034, exhibiting a CAGR of 2.80% during the forecast period. Asia Pacific dominated the nitric acid market with a market share of 51% in 2025.

Nitric acid (HNO3), commonly referred to as aqua fortis, is a colorless substance that gradually turns yellow over time due to the breakdown of nitrogen and water into oxides. This compound is highly corrosive and plays a key role in producing ammonium nitrate and various other chemicals used in fertilizer manufacturing. Additionally, nitric acid is utilized to create chemicals such as nitrobenzene, adipic acid, and chloronitrobenzene, which serve as important raw materials in industries such as plastics, automotive, and construction. The growing automotive industry in developing regions has surged the consumption of these products, influenced by population growth and rising consumer demand, thereby fueling market expansion. Furthermore, the escalating need for plastics in both industrial and consumer markets continues to bolster the development of this market. The major key players operating in the market are BASF, Nutrien, DuPont, and CF Industries Holdings, Inc.

MARKET OPPORTUNITIES

High Demand for Lightweight Automobiles to Create Several Growth Opportunities for Market

The growing consumer demand for lightweight vehicles has driven manufacturers to focus on innovation and advancements within the automotive industry, thereby creating significant consumption opportunities for HNO3 that positively influence the market. HNO3 is utilized in the production of adipic acid, a key ingredient in the manufacturing of nylon. Manufacturers are increasingly adopting polymer composites such as nylon to reduce vehicle weight and enhance fuel efficiency. Additionally, the rising demand for personal vehicles and a growing global population have greatly boosted lightweight vehicle production. Government regulations aimed at reducing CO2 emissions have also encouraged chemical producers to implement advanced technologies for creating fuel-efficient and cost-effective automotive solutions. This escalating trend toward lightweight vehicles is fueling nitric acid market growth.

NITRIC ACID MARKET TRENDS

Tighter Environmental Regulations Cause Producers to Invest In NOₓ Abatement and Green Production Technologies

The nitric acid industry is moving toward sustainable production because of strict global environmental rules. Since nitric acid plants release harmful gases like NOₓ and N₂O, producers are adopting technologies to cut emissions, sometimes by as much as 90%. Many are also testing carbon capture methods to reduce N₂O and using green ammonia from renewable energy as a cleaner feedstock. Companies such as Yara and BASF are leading with low-emission projects, while digital tools are helping improve efficiency. Although these steps raise costs at first, they create new opportunities for green nitric acid and help companies stay compliant and competitive in the long run.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Demand from Various End-use Industries, such as Agriculture and Construction, to Aid Market Growth

Nitric acid plays a vital role in the agriculture sector, primarily in the production of fertilizers including ammonium nitrate, potassium nitrate, calcium ammonium nitrate, and nitro phosphate. These fertilizers help boost crop yields to meet the increasing food demand driven by population growth. Additionally, rising disposable incomes have increased consumer demand for organic and high-quality food, encouraging the use of bio-based fertilizers and supporting the agriculture industry.

The expansion of construction activities also contributes to market growth, as Toluene di-isocyanate (TDI) and HNO3 intermediates are essential in producing polyurethane foams, wood and floor coatings, and insulation materials. Furthermore, improved living standards, ongoing renovation projects, and new government infrastructure initiatives serve as additional growth drivers for the nitric acid market. The product’s application in dye manufacturing also propels market expansion, with the fashion industry's growth fueling demand for dyes in the textile sector.

Increasing Product Demand to Produce Raw Materials for Polymers to Drive Market Growth

The increasing population and completion of the product cycle, such as toothbrushes, wear pads, gloves, fishing lines, tents, and other plastic consumer products, increase the demand. Nylon 6 is the polymer that can be used in these applications owing to its versatile properties. The polymer offers great thermal stability, enhanced flame resistance, and a high melting point ranging from 210-220 degrees Celsius. Nitric acid is the chemical used for the production of adipic acid, which is further utilized to formulate Nylon 6. The nitric acid completes the synthesis in two steps, increasing the production rate of adipic acid. Thus, the increasing demand for Nylon 6 and the use of adipic acid in its formulation drive the demand for nitric acid.

MARKET RESTRAINTS

Strict Governmental Regulations for Products Owing to their Corrosive Nature to Hinder Market Growth

Nitric acid is released from chemical manufacturing plants, exhaust fumes from vehicles, and polluted wastewater from farming areas. This environmental pollution leads to respiratory problems when inhaled. Governmental regulations for environmental protection and reduced industrial waste are restraining factors for market growth. Moreover, rising concerns over CO2 emissions from vehicles are further restraining the market.

MARKET CHALLENGES

Environmental and Economic Constraints in Nitric Acid Manufacturing

The production of nitric acid is subject to environmental challenges, especially due to emissions of nitrogen oxides. Strict regulations—particularly in Europe and North America—drive up compliance costs and require the adoption of cleaner, more energy-efficient technologies. Additionally, fluctuating prices of key inputs such as natural gas and ammonia contribute to rising production costs. Market stability is further affected by economic fluctuations and variability in agricultural demand for fertilizers.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Application

To know how our report can help streamline your business, Speak to Analyst

Fertilizers Segment to Dominate Market Due to Growth of Agriculture Industry

Based on application, the market is segmented into fertilizers, nitrobenzene, adipic acid, toluene di-isocyanate, and others.

The fertilizers segment accounted for the highest nitric acid market with a share of 80.23% in 2026, due to the rising agricultural activities to fulfill the growing population demand. Nitric acid is used to manufacture fertilizers such as ammonium nitrate and calcium ammonium nitrate, which provide extensive and quality crop yields. The growing need for nitrogen-based fertilizers over the years is driving market growth.

GLOBAL NITRIC ACID MARKET REGIONAL OUTLOOK

Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Nitric Acid Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market in 2026 and stood at USD 16.38 billion. The growth is attributed to increasing product demand from various end-use industries, including agriculture, chemical intermediates, and mining in China, India, Japan, and South Korea. The economic development and growing population within India, China, and Japan create a significant demand in the agriculture industry. China dominated the Asia Pacific region due to rapid population growth, rising infrastructure projects, and an increase in middle-class income, causing high nitric acid consumption. The Japan market is projected to reach USD 1.73 billion by 2026, the China market is projected to reach USD 7.36 billion by 2026, and the India market is projected to reach USD 3.61 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America maintains a substantial presence due to established fertilizer and mining industries , along with industrial applications in the automotive and plastics sectors. The market in the region is estimated to have a significant share of the global market with a share of 4.75% in 2026, in which the U.S. holds the major share. The growth is associated with rapid technological advancement and high disposable income of the region's consumers. The growing demand for lightweight and fuel-efficient automobiles and increasing new construction and renovation activities lead to market growth. The U.S. market is projected to reach USD 3.65 billion by 2026.

Europe

Europe is expected to show substantial market growth with a share of 5.91% in 2026. This growth can be attributed to consumers' growing demand for fuel-efficient and eco-friendly lightweight automobiles. Growing awareness regarding environmental protection is the driving force for increasing fuel-efficient features and lightweight materials, such as polymer composites, for making automobiles, thus creating further market opportunities. Germany is one of the major countries for automotive manufacturing, supported by high economic growth and technological advancement in providing fuel-efficient solutions for lightweight automobiles. Moreover, strong consumption in fertilizer production and industrial uses under regulatory frameworks is further influencing the market growth. The UK market is projected to reach USD 0.65 billion by 2026, while the Germany market is projected to reach USD 1.03 billion by 2026.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa are moderate but growing markets, supported by agricultural expansion, commodity-based chemical industries, and infrastructure development.

In Latin America, Brazil is a major country for product consumption and is expected to show rapid market growth due to increasing food demand. Moreover, the usage of advanced technologies for applications in the construction industry has led to further market development. Furthermore, the Middle East & Africa are a central mining hub; thus, raw materials are easily available at lower costs for the manufacturers in the region, thereby providing low production costs. Moreover, the growing economy within the region leads to improved lifestyles among consumers, leading to high demand for quality organic food. This demand for food is further aiding the market growth.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Leading Companies Focus on Sustainable Organic Growth to Brighten their Market Prospects

Key players operating in the industry are BASF, Nutrien, DuPont, and CF Industries Holdings, Inc. Companies profiled are involved in capacity improvement, product innovation, acquisition, mergers, and collaboration to have a competitive edge in the global market. For example, in 2023, BASF expanded its nitric acid plant in Ludwigshafen, Germany. The expansion not only increased capacity to serve agrochemical and specialty sectors but was also designed to enhance production efficiency and lower emissions, aligning with the company’s sustainability goals.

LIST OF KEY NITRIC ACID COMPANIES PROFILED

- BASF SE (Germany)

- Nutrien (Canada)

- EuroChem (Switzerland)

- CF Industries Holdings, Inc. (U.S.)

- Omnia Holdings Limited (South Africa)

- Dyno Nobel (Australia)

- Enaex S.A. (Chile)

- Sasol (South Africa)

- LSB Industries (U.S.)

- IXOM (Australia)

KEY INDUSTRY DEVELOPMENTS

- In January 2023, BASF's monomers division, which includes MDI, TDI, propylene oxide, caprolactam, adipic acid, polyamide 6 and 6.6, nitric acid, is planning to expand its portfolio of products with a lower CO2 footprint. This expansion will help the company reach net-zero CO2 emissions by 2050.

- In July 2023, Nutrien completed a turnaround project at its Geismar, Louisiana nitrogen facility, aiming to ensure reliable operations and contribute to a more sustainable future. In addition to the direct economic and operational benefits, a voluntary environmental abatement project undertaken during the turnaround is expected to reduce CO2e emissions by approximately 200,000 tons per year from their highest production nitric acid manufacturing unit.

- November 2023- Enaex S.A. has announced that they are the first manufacturing company to produce carbon-neutral ammonium nitrate in Latin America. The company has implemented significant improvements at its nitric acid plant near Cuzco in Peru to reduce greenhouse gas emissions.

- In October 2023, CF Industries plans a USD 75 million investment in its Donaldsonville Nitrogen Complex in Louisiana, aiming to boost production of both merchant-grade nitric acid and Diesel Exhaust Fluid (DEF). The project focuses on upgrades to the Nitric Acid No. 3 plant and improvements to the DEF Unit. Specifically, the Nitric Acid plant will be modified to produce 65% nitric acid, an increase from the current 60% strength.

- July 2022- Nutrien agreed to acquire a Brazilian company, Casa do Adubo S.A. This acquisition includes 39 retail locations, under the brand Casa do Adubo, and 10 distribution centers, under the brand Agrodistribuidor Casal. The agreement supports Nutrien’s Retail growth strategy in Brazil and is expected to increase its sales by USD 400 million.

REPORT COVERAGE

The global market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, technologies, and leading application areas. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 2.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion) and Volume (Million Ton) |

|

Segmentation |

By Application

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size stood at USD 31.97 billion in 2026 and is projected to reach USD 39.53 billion by 2034.

Growing at a CAGR of 2.80%, the market will exhibit significant growth during the forecast period.

The fertilizers segment dominated the market in 2025.

Increasing demand from the automotive and agricultural industries is a key factor driving the market growth.

BASF, Nutrien, DuPont, and CF Industries Holdings, Inc. are the prominent players in the global market.

Asia Pacific held the dominant share of the global market in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us