North America and Europe Table Eggs Market Size, Share & Industry Analysis, By Product Type (Regular Eggs and Specialty Eggs), By Distribution Channel (Supermarkets/Hypermarkets, Grocery Stores, and Others), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

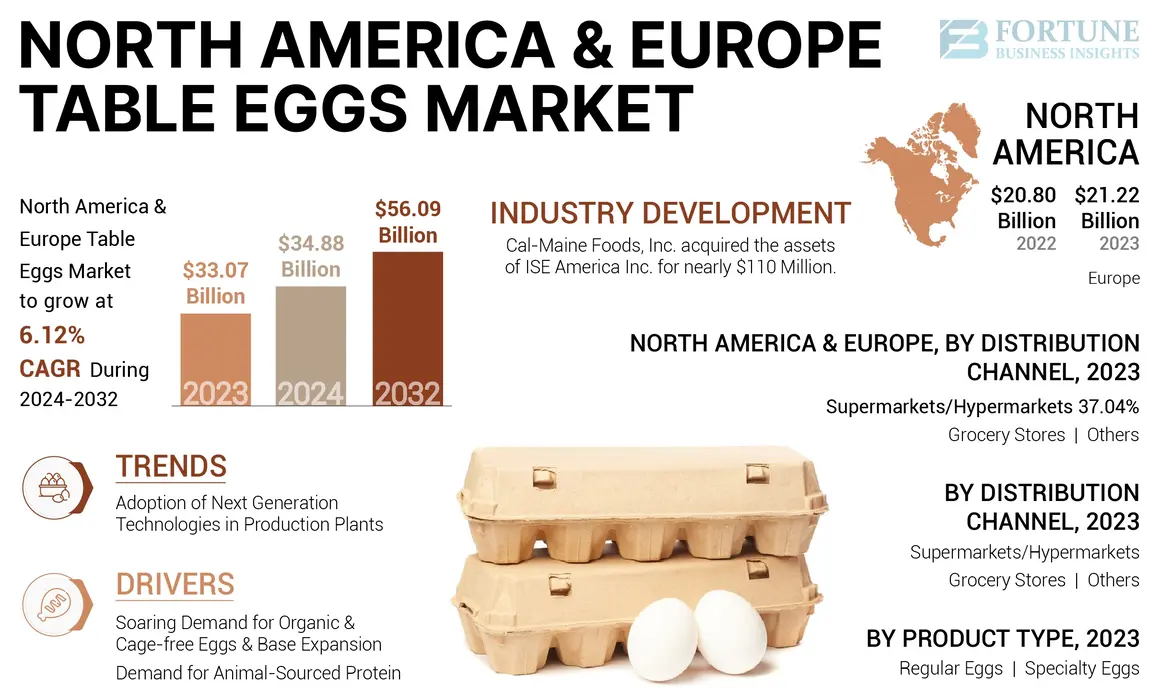

The North America and Europe table eggs market size was valued at USD 33.07 billion in 2023. The market is expected to grow from USD 34.88 billion in 2024 to USD 56.09 billion by 2032, exhibiting a CAGR of 6.12% during the forecast period. Cal-Maine Foods, Inc., Rose Acre Farms, Inc., Danish Agro, Ovostar Union Public Company Limited, and Noble Foods are a few prominent players in the market.

Table eggs are sold to end-users in their shell and without any significant processing or treatments. In recent years, the poultry market in North America and Europe has shown significant growth and developments in technology, production, consumption, and supply chain. The rising protein-rich food consumption in these regions is attributed to the changing consumer buying pattern. Furthermore, owing to the rapid growth in urbanization, the working population and busier lifestyle have impacted table egg consumption in the market.

Poultry foods, including table eggs, chicken, and turkey, are rich in protein, minerals, and vitamins and offer many health benefits. Furthermore, these eggs are easily available in the market at a lower price range, which helps consumers achieve their protein requirements. The industry is set to scale new heights in the upcoming years owing to increasing new entrants to the industry, along with innovative technologies.

North America and Europe Table Eggs Market Overview

Market Size & Forecast:

- 2023 Market Size: USD 33.07 billion

- 2024 Market Size: USD 34.88 billion

- 2032 Forecast Market Size: USD 56.09 billion

- CAGR: 6.12% from 2024–2032

Market Share:

- North America held the largest share in the North America and Europe table eggs market in 2023, driven by strong consumer preference for eggs as a staple breakfast item, high protein awareness, and widespread availability.

- By product type, regular eggs held the largest share in 2023 due to affordability and widespread demand, while specialty eggs (organic, free-range) are expected to grow at the highest CAGR, fueled by rising health consciousness and demand for cage-free production methods.

Key Country Highlights:

- United States: Over 40% of hens used for egg production are cage-free as of March 2024; retail giants like Walmart and Kroger are committed to 100% cage-free eggs by 2025, supporting strong market growth.

- Germany: Increasing emphasis on animal welfare and sustainable food sourcing is promoting demand for organic and cage-free eggs.

- France: High per capita egg consumption and strong domestic production are contributing to steady market expansion.

- United Kingdom: Growing demand for high-protein and convenient breakfast options supports table egg consumption across age groups.

Market Dynamics

Market Drivers

Surging Demand for Organic and Cage-Free Eggs and Base Expansion to Drive the Market Momentum

In this evolving lifestyle, the demand for organic food is expected to maintain its upward trajectory, which is mainly driven by affluent consumers and rising health awareness. The ongoing trends in the organic food industry are influencing consumer choices, further reshaping agricultural practices across North America and the European region. Consumers are becoming more aware of the benefits of organic produce. They are prioritizing food items that are cultivated using organic practices. The organic method of egg production helps to promote biodiversity and the products are believed to be more safe and nutritious than conventional products.

Even though the nutritional differences between cage-free and caged hens are minimal, cage-free eggs have a better quality of life than caged hens. Such factors influence the consumer’s purchasing behavior and necessitate manufacturers to launch cage-free eggs. For instance, in March 2023, Giant Eagle, a supermarket chain in the U.S. market, announced their new cage-free policy, which states that the firm will transform its fresh egg production to cage-free by 2025. Increasing cage-free and organic eggs will significantly drive the North America and Europe table eggs market growth in the near future.

Download Free sample to learn more about this report.

Rising Demand for Animal-Sourced Protein to Boost the Consumption of Table Eggs

Animal-sourced proteins are recognized as the main contributors to a healthy diet, specifically owing to their nutritional value. These proteins have the potential to prevent a broad range of health ailments. They are thus considered an ideal alternative due to their high efficiency and economic stability. Likewise, the product have also emerged as a cost-effective protein solution that can be used in daily diets. Moreover, the product’s culinary versatility leads to a surge in the utilization of eggs for preparing a variety of cuisines, which can be easily cooked and consumed.

Coupled with the above factors, the rising population of hens in the North American and European regions also aids in improving consumption. The U.S. Department of Agriculture (USDA) stated that the per capita consumption of eggs in the U.S. reached 287.4 eggs in 2023, which shows a hike of 3.90% from 2022.

Market Restraint

Increasing Risk of Disease Outbreaks May Hamper the Market Growth

One of the pivotal challenges faced in egg production is the surging risk of diseases. Health ailments such as highly pathogenic avian influenza, Newcastle disease, fowl pox, and coccidiosis are commonly found in poultry and are responsible for negatively impacting hatchability and egg production. Moreover, the condition is mainly characterized by a dip in egg production capacity coupled with poor egg quality, leading to thin-shelled or soft-shelled eggs. As a result, such rising incidences of diseases in poultry stocks can limit the purchase of the product, leading to poor product sales. Furthermore, increasing popularity of plant-based substitutes may hamper the market growth in North America and Europe.

Market Opportunity

Increasing Adoption of Novel Technology in Packaging to Push Market Growth in the Upcoming Years

In this modern era, businesses are trying to switch to recyclable and renewable business practices, which can increase the usage of sustainable packaging materials. As compared to conventional packaging, sustainable packaging utilizes fewer resources and reduces the risk of pollution. Furthermore, sustainable packaging solutions minimize the chances of carbon footprints and support animal welfare. Therefore, the companies are also trying to build sustainable packaging for egg commodities. In the evolving world of the poultry industry, farmers are adopting advanced technologies that help to reshape the landscape of the table eggs market. From utilizing smart sensors to flock management applications, the technology is strengthening farm operations and ensuring bird welfare. For instance, artificial intelligence plays a substantial role in analyzing early symptoms of illnesses in birds. With the help of AI, farmers can easily predict and minimize the risk of diseases.

North America and Europe Table Eggs Market Trends

Adoption of Next Generation Technologies in Production Plants to Drive the Market Growth

The emerging adoption of novel and advanced technologies, including AI in the production and transportation stages, will positively change the industry landscape. Poultry and table eggs industry players are focusing on adopting new technologies to achieve their business operations economically and effectively. These emerging technologies are set to transform the poultry industry and tackle various challenges, including Net Zero, transparency, and traceability. For instance, in July 2020, Capgemini SE, a French IT company, collaborated with SeeMAx, a biotech company, to develop AI and an automatic system to control and classify eggs according to their quality for Rica Granja, a Portuguese food manufacturer. Therefore, the adoption of novel technologies to control the quality of the product will significantly influence the North America and Europe table eggs market growth.

Download Free sample to learn more about this report.

Impact of COVID-19 on the Market

The COVID-19 pandemic changed consumers purchasing patterns across the market. During the period, consumers shifted from eating at food service options to eating-at-home. As a result, grocery stores experienced a rapid growth in the demand for shell eggs. The sudden shift in product demand led to a shortage of the product in the back end. The imbalance of the product supply and demand caused a rapid push in price. As a result, egg prices rose sharply in many states. According to the U.S. Bureau of Labor Statistics, the average retail price of shell eggs reached USD 2.02 per dozen in July 2020, increasing nearly 38% from July 2019. The shift of food consumption from food-away-from-home to food-at-home at the onset of the COVID-19 pandemic affected the market across North America and Europe.

Segmentation Analysis

By Product Type

Increasing Organic and Cage-free Eggs Popularity to Drive the Specialty Eggs Demand Growth

Based on product type, the market is segmented into regular eggs and specialty eggs.

The specialty eggs segment is anticipated to grow at the highest CAGR during the forecast period. The segment comprises organic eggs, free-range eggs, and enriched eggs, primarily produced using organic and cage-free production methods. The increasing production of cage-free and organic shell eggs production across the region is significantly driving the specialty eggs demand. According to the U.S. Department of Agriculture National Agricultural Statistics Service, the production of specialty eggs reached 34% in 2022, an increase of 28% from 2020.

The regular eggs segment holds the largest market share of the North American and European table egg market. Regular eggs are produced from hens kept inside climate-controlled sheds. Owing to their affordability and wide availability, regular eggs are witnessing a huge demand amongst consumers across North America and Europe. Furthermore, the increasing awareness of animal-sourced protein in the region further contributes to the demand for regular eggs.

By Distribution Channel

Availability of Range of Products and Convenience Offered leads to the Dominance of Grocery Stores

On the basis of distribution channel, the market is segmented into supermarkets/hypermarkets, grocery stores, and others. The other segment contains individual stores, farm stores, online retail stores, and others.

The grocery stores segment dominates the market by holding the largest market share. Grocery stores provide a wide range of products ranging from food to household essentials and add convenience while purchasing. In addition, grocery stores offer a range of payment options and provide home delivery options, which further attract the consumer’s attention. Moreover, compared to the stock in supermarkets and hypermarkets, grocery stores receive fresh products daily and provide high-quality products to consumers. All such instances support the growth of grocery stores in the region.

Online stores offer convenience and provide a broad range of products of numerous brands and prices which captivates the consumer’s attention. Further, the ease of comparing products with different brands and order/return facility contributes to the industry growth. Apart from this, convenience stores also attract consumers due to their close proximity and wide availability of products also supports the growth. Therefore, the others segment is anticipated to grow at the highest CAGR during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

North America and Europe Table Eggs Market Regional Outlook

Based on geography, the market for table eggs has been studied across North America and Europe.

North America

Among the North America and Europe table eggs market share, North America holds the largest share of the market. In the North American region, the eggs have been recognized as a popular breakfast item for centuries. The wide availability, easy-to-prepare, and cost-effectiveness are the major factors supporting the use of the product in breakfast meals. With respect to the factors mentioned earlier, American consumers stockpile the eggs in their refrigerators, which are later utilized for preparing breakfast dishes. Baked eggs, scrambled eggs, and egg omelets are a few of the famous breakfast dishes cherished by consumers. Apart from this, the growing emphasis on animal-sourced protein products also adds to the overall consumer demand. Thus, this addition of eggs to breakfast meals can lead to nutrient intake and contribute to dietary adequacy.

The product is considered a staple in the American’s daily diet. The individuals residing in America consume eggs owing to their nutritional value and easy-to-cook nature. Moreover, with respect to convenience, the Americans in the region seek nutrient-dense and ready-to-prepare meals, which further contributes to the consumption of table eggs. In addition, apart from being a nutrient powerhouse, eggs offer numerous culinary possibilities, which makes them an invaluable part of the daily routine.

The U.S. is one of the key markets that holds a prominent share in the North America market. Increasing organic and cage-free egg demand among individuals is anticipated to drive the market to a further height. According to the latest statistics from the U.S. Department of Agriculture, more than 40% of hens used for egg production in the U.S. are cage-free till March 2024. Furthermore, retail giants such as Walmart, Meiji and Kroger are voluntarily involved in promoting cage-free eggs. These companies voluntarily pledged to 100% transition to cage-free table eggs on their retail shelves by 2025. It is further contributing to the market growth in the U.S.

To know how our report can help streamline your business, Speak to Analyst

Europe

Among the two regions, Europe is the fastest growing market. With the increasing importance of protein-infused products and easy affordability, the product is expected to play a crucial role in the nutrition of European individuals. Furthermore, the growing number of women working professionals increases the reliance on convenient products as the females struggle to maintain the household chores along with work life. This boosts the demand for convenient breakfast options, including table eggs. Furthermore, increasing egg production in European countries is further driving the market growth. According to the European Commission, the total egg production in 2021 reached 6.51 million tonnes, which is an increase of nearly 3% from 2020.

Competitive Landscape

Key Industry Players

Companies Focus on Mergers and Acquisitions to Strengthen their Market Presence

To know how our report can help streamline your business, Speak to Analyst

The North America and Europe market is highly fragmented, with the presence of a larger number of large, medium, and small-scale players in the market. Leading players such as CAL-MAINE FOODS, INC., DANISH AGRO, Ovostar Union Public Company Limited, Hillandale Farms, and Noble Foods hold nearly 13% of the market share in 2023. Since the industry has less entry barriers, a number of new entrants are entering the industry. Therefore, the industry was exposed an intense competition from established players. Therefore, companies are emphasizing merger and acquisition activities to strengthen their market presence. Such steps assist key players in widening their market presence and secure market share and product portfolio expansion, moving the industry to the next height. For instance, in February 2023, MPS EGG FARMS announced the acquisition of Country Charm Eggs, a family-owned egg farm in the U.S. This acquisition emerged as the first expansion of MPS EGG FARMS in the Southeast U.S. market. This purchase helped MPS expand its universal footprints and add around 1.8 million laying hens to the existing flock of 12 million hens.

List of Key Companies Profiled:

- CAL-MAINE FOODS, INC. (U.S.)

- Rose Acre Farms, Inc. (U.S.)

- Hillandale Farms (U.S.)

- VERSOVA (U.S.)

- MPS EGG FARMS (U.S.)

- Noble Foods (U.K.)

- HUEVOS GUILLÉN S.L (Spain)

- DANISH AGRO (Denmark)

- OVOSTAR UNION PUBLIC COMPANY LIMITED (Ukraine)

- Rujamar GRUPO AVICOLA (Spain)

Key Industry Developments

- July 2024 - Cal-Maine Foods, Inc, an American food company, acquired the assets of ISE America Inc., a commercial shell egg producer in the U.S., for nearly USD 110 million. The acquisition includes 1.2 million pullets, feed mills, about 4,000 acres of land, an egg products breaking facility and ISE’s current inventory.

- July 2024 - Vital Farms, a Texas-based company specializing in ethically produced foods nationwide, announced the expansion of its supply chain by inaugurating an egg-washing and packing facility located in Seymour, Indiana. The newly opened facility would provide 150+ jobs for locals and is anticipated to assist the company in generating over USD 350 million annually and reaching the company’s target of USD 1 billion by 2027.

- May 2024 - UkrLandFarming, one of the emerging Ukrainian agricultural enterprises, expanded its market reach to the European Union. The company planned to increase its chicken egg production to nearly 1.5 billion in the latter half of 2024 as a part of its growth plan.

- January 2022 - Cooper Farms Inc., an American company specializing in producing egg, chicken, turkey and pork, opened its new egg facility called Golden Heritage Cage-free egg farm in Western Ohio. The facility is located on 100 acres, contains 1.96 million layers, and offers 50 jobs to the locals.

- May 2021 - Butterfly, a Los Angeles-based private equity company that operates in the food sector, acquired a majority stake in Pete and Gerry’s Organics, LLC, an American organic and cage-free egg producer. The acquisition terms are not disclosed.

Investment Analysis and Opportunities Analysis

Adopt Novel Packaging Technologies to Stay Aligned with Emerging Trends of Sustainable & Recyclable Food Packaging across the Market

Consumers are highly concerned about environmentally friendly and sustainable packaging solutions in the food sector. As the demand for sustainable packaging solutions is increasing in the market, food companies, including egg producers, are seeking 100% recyclable packaging materials to use in the place of polystyrene. Additionally, regional government authorities are passing regulations to ban single-use plastic packaging in food packaging. This factor further forces egg manufacturers to adopt sustainable packaging solutions. To meet the rising demand for sustainable packaging solutions, companies are developing new products. It will additionally help companies to stay ahead in the competitive curve while contributing positively to consumers' health and the environment. For instance, in November 2023, Huhtamäki Oyj, a Finland-based food packaging company, developed a new fiber-based egg packaging solution made from 100% recycled material. The company launched this packaging solution for U.S. egg producers.

REPORT COVERAGE

The market research report provides detailed market data and analysis of key aspects, such as leading companies, product types, and distribution channels. It also offers detailed analysis and insights on North America and Europe table eggs market share analysis, trend analysis, growth factors, and key market trends. Besides this, it offers insights into key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 6.12% from 2024-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentatio |

By Product Type

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says the market size was valued at USD 33.07 billion in 2023 and is expected to reach USD 56.09 billion by 2032.

The market is likely to register a CAGR of 6.12% over the forecast period.

The regular eggs segment is the leading segment in the market.

Rising demand for animal-sourced proteins boosts the consumption of the product and is a key market driver.

CAL-MAINE FOODS, INC., DANISH AGRO, Ovostar Union Public Company Limited, Hillandale Farms, and Noble Foods and others are the major players in the market.

Upgradation in production and packaging plants with novel technologies to achieve effectiveness in business operation is a key industry trend.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us