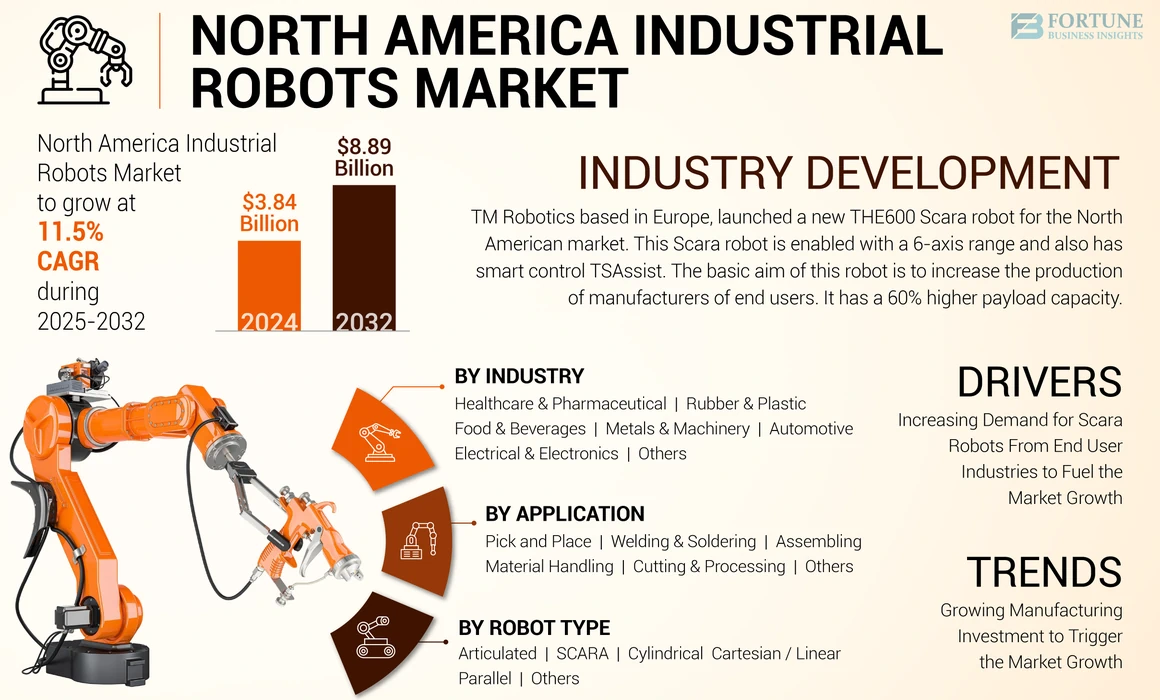

North America Industrial Robots Market Size, Share & COVID-19 Impact Analysis, By Robot Type (Articulated, SCARA, Cylindrical, Cartesian/Linear, Parallel, and Others), By Application (Pick and Place, Welding & Soldering, Material Handling, Assembling, Cutting & Processing, and Others), By Industry (Automotive, Electrical & Electronics, Healthcare & Pharmaceutical, Food & Beverages, Rubber & Plastic, Metals & Machinery, and Others), and Country Forecast, 2025-2032

North America Industrial Robots Market Size

North America is the third largest region in the global industrial robots market. It is projected to grow at a CAGR of 11.5% during the forecast period. The North America market is projected to grow from USD 3.84 billion in 2024 to USD 8.89 billion by 2032.

Rising demand for industrial robots from various industry verticals such as healthcare, food & beverages, electronics, automotive, aerospace, and agriculture sectors across the U.S., and Canada among others. Also, growth in the automotive sector, which creates the demand for these systems for improving the productivity of operations, drives the growth of the market in the North American region. Also, growth in robotics automation across countries such as the U.S., and Canada, fuels the demand for robots for manufacturing operations across end users such as electric, automotive, electronics, and food & beverages sectors. Such factors create the demand for robotics for applications such as pick & place, welding & soldering, material handling, assembling, cutting & processing, and painting applications.  In COVID-19 pandemic, the market registered a loss in net sales in the market in the first quarter of 2020, due to supply chain disruption of robotics technologies among automotive, and electronics, and electrical sector.

In COVID-19 pandemic, the market registered a loss in net sales in the market in the first quarter of 2020, due to supply chain disruption of robotics technologies among automotive, and electronics, and electrical sector.

Our report on the North America industrial robots market covers the following countries/regions – U.S., and Canada.

North America Industrial Robots Market Trends

Growing Manufacturing Investment to Trigger the Market Growth

Many governments and local sectors, across the U.S., and China are planning to invest in the manufacturing and automotive industry. Also, growth in the manufacturing sector, electronics sector, and electrical sector enhances the demand to increase automation in the manufacturing facilities to improve the production efficiency of the companies present in the market. Such a factor is anticipated to increase the demand for installing new robots in various industry verticals such as pharmaceuticals, automotive, and electronics sectors, which enhance the growth of the market share. For instance, according to the International Federation of Robotics (IFR), in 2021, around 79 thousand units of industrial robots were being installed in the U.S. increased by 14% in 2021, as compared to 2020. These investments in the industrial sectors, which advancing automation in the robotics sectors, fuels the North America industrial robots market growth.

North America Industrial Robots Market Growth Factors

Increasing Demand for Scara Robots From End User Industries to Fuel the Market Growth

Growth in the electrical electronics industry, automotive, food & beverages, and material handling industries across the U.S., and Canada creates the demand for SCARA robots for applications such as material handling, assembling, cutting & processing, welding, and painting. For instance, in 2021, around 3% of the total GDP was contributed by the automotive sector in the U.S. Such as contribution helps companies to fuel the robotics industry. In addition, according to our analysis, the material handling segment dominates the market with a CAGR of 13.4%, during the forecast period owing to the increasing adopting of collaborative robots for pick and place, and material handling applications. Such factors enhance the size of North America industrial robots market share.

RESTRAINING FACTORS

High Installation Cost for Small and Medium Enterprises to Restrain the Market Growth

Articulated robots, gantry robots, and Cartesian robots are some of these robots adopted by several enterprises such as small-scale, medium, and large enterprises. In average, around USD 50,000 to USD 80,000 is required for installing these types of robots to boost the productivity of companies. These types of robots are able to perform various applications such as painting, material handling, assembling, and welding & soldering applications. These huge labor costs are not bearable for small as well as medium sizes businesses. Such factors are the restraints for the growth of the market.

KEY INDUSTRY PLAYERS

In terms of the competitive landscape, ABB, Omron Adept Technology Inc., and Kinova Inc. are the key players of the North America market. These key players are adopting partnerships, acquisitions, products launch, and product development as strategic developments for strengthening their product portfolio and distribution network through diversified locations to increase their market share in the Asia Pacific market.

List of Top North America Industrial Robots Companies:

- ABB (Switzerland)

- Fanuc Corporation (Japan)

- Omron Adept Technology Inc (U.S.)

- Kinova Inc (Canada)

- Kawasaki Heavy Industry Ltd (Japan)

- KUKA AG (Germany)

- Great Lakes Automation Services Inc (U.S.)

- Weldon Solutions (U.S.)

- Denso Corporation (Japan)

- Jaka Robotics (China)

KEY INDUSTRY DEVELOPMENTS:

-

April 2019: TM Robotics based in Europe, launched a new THE600 Scara robot for the North American market. This Scara robot is enabled with a 6-axis range and also has smart control TSAssist. The basic aim of this robot is to increase the production of manufacturers of end users. It has a 60% higher payload capacity.

REPORT COVERAGE

The market report provides qualitative and quantitative insights on the market and a detailed analysis of the North America market size & growth rate for all possible segments in the market. Along with the market forecast, the research report provides an elaborative analysis of the market dynamics and competitive landscape. Various key insights presented in the report are overview of the number of procedures, an overview of the price analysis of various types of products, overview of the regulatory scenario by key countries, pipeline analysis, new product launches, key industry developments – mergers, acquisitions & partnerships, and the impact of COVID-19 on the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 11.5% from 2025 to 2032 |

|

Unit |

Value (USD Billion), and Volume (Thousand Units) |

|

Segmentation |

By Robot Type

By Application

By Industry

By Country/ Sub-Region

|

Frequently Asked Questions

Growing at a CAGR of 11.5%, the market will exhibit steady growth in the forecast period (2025-2032).

The rising demand for SCARA robots and articulated robots among various end users is expected to drive market growth over the forecast period.

Great Lakes Automation Services Inc., Weldon Solutions, and Omron Adept Technology Inc are the major market players in the North America market.

The U.S. dominated the market in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us