North America Operational Audit Software Market Size, Share & Industry Analysis, By Deployment (Cloud and On-premise), By Enterprise Type (Large Enterprises and Small & Medium Enterprises (SMEs)), By End-user (Manufacturing, Healthcare, Retail, BFSI, Hospitality, Transportation & Logistics, and Others), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

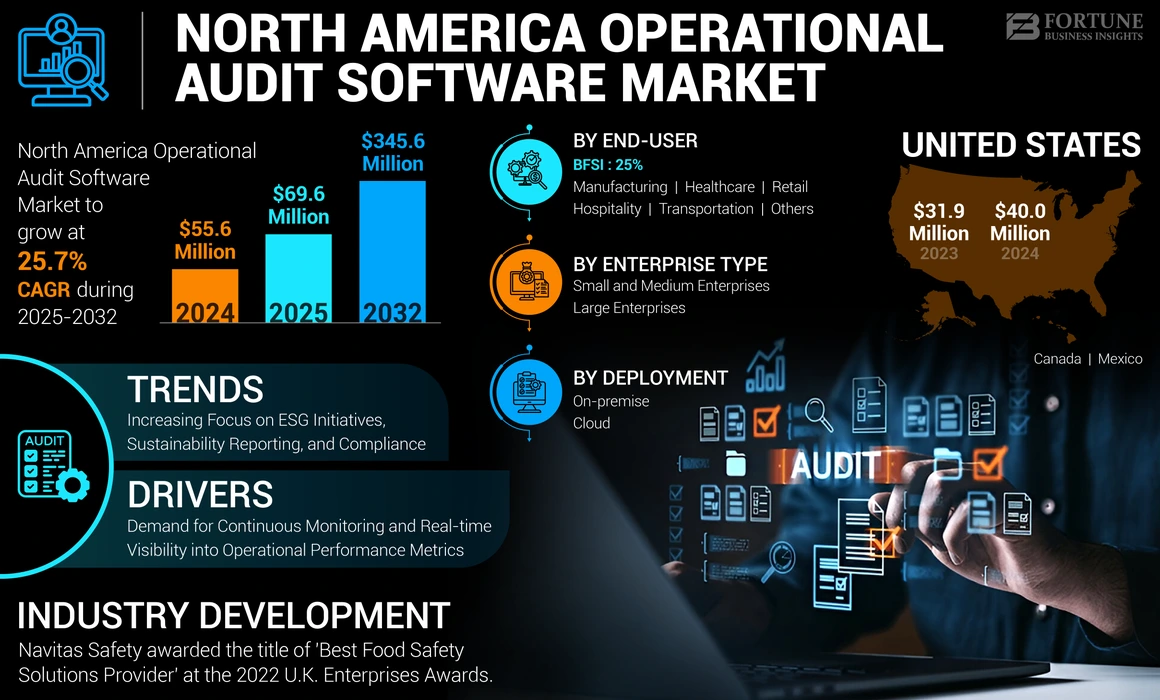

The North America operational audit software market size was valued at USD 55.6 million in 2024. The market is projected to grow from USD 69.6 million in 2025 to USD 345.6 million by 2032, exhibiting a CAGR of 25.7% during the forecast period.

Operational audit software is a type of application designed to assist in auditing an organization’s operational processes, procedures, and controls. It aids auditors to systematically review and evaluate the effectiveness, efficiency, and the compliance of several business operations within the company. These tools typically provide features such as risk assessment, data analysis, reporting, and workflow management to streamline the operational auditing process.

In the manufacturing industry, the software is used to audit processes such as production, quality control, inventory management, and supply chain operations. In healthcare, it audits clinical processes, regulatory compliance, and patient care procedures. Retail organizations use it to audit store operations, inventory management, and customer service processes. BFSI firms audit financial transactions, regulatory compliance, risk management, and customer data security.

The North America operational audit software market growth is majorly attributed to technological advancements in cloud-based solutions and the requirement for remote auditing capabilities. Adoption of audit software is instrumental in optimizing costs within organizations by identifying areas of waste and inefficiency, enabling the elimination of unnecessary costs and allocate resources more efficiently. This is especially critical in industries where profit margins are narrow, where effective cost control is essential for financial success. This delivers the visibility and transparency needed to monitor and manage costs effectively, empowering organizations to make strategic decisions that enhance financial performance.

The COVID-19 pandemic accelerated the demand for operational audit software in North America owing to increased adoption of digital solutions. Several major organizations prioritized risk management and compliance efforts amid uncertainty.

IMPACT of GENERATIVE AI

Integration of Generative AI Models within Operational Audit Software to Fuel Market Growth

The integration of generative AI models within audit software has presented a transformative opportunity to streamline and enhance the auditing process. Generative AI models, such as large language models and text-to-image generators, are leveraged to automate the creation of audit reports, summaries, and narratives. By ingesting and analyzing operational data from multiple sources, these AI models generate human-readable and visually compelling audit reports, detailing findings, recommendations, and actionable insights.

This automation reduces manual effort in report writing and ensures consistent and accurate communication of audit results across the organization. Generative AI models can adapt their language and tone to cater to different stakeholder groups, ensuring that audit reports are tailored to the specific needs and understanding of each audience. Furthermore, generative AI can be employed to generate synthetic data for training machine learning models used in operational auditing. By leveraging techniques such as generative adversarial networks (GANs) and variational autoencoders (VAEs), synthetic data can be created that mimics the characteristics of real operational data while preserving data privacy and confidentiality. This approach enables the development of more robust and diverse machine learning models, enhancing the accuracy and reliability of operational auditing processes.

North America Operational Audit Software Market Trends

Increasing Focus on ESG Initiatives, Sustainability Reporting, and Compliance has created a Demand for Audit Software

The growing emphasis on environmental, social, and governance (ESG) initiatives, sustainability reporting, and compliance has ushered in a new era of accountability and transparency for organizations across various industries. As stakeholders, governments, and consumers increasingly demand responsible and ethical business practices, the need for comprehensive auditing and reporting mechanisms has become a paramount concern. This paradigm shift has directly fueled the demand for operational audit software capable of assessing and auditing an organization's adherence to ESG standards, regulations, and relevant compliance requirements.

Operational audit software designed to address ESG and compliance needs must be equipped with robust data collection, analysis, and reporting capabilities. These solutions must seamlessly integrate with an organization's diverse data sources, including financial systems, supply chain management tools, environmental monitoring systems, and human resource platforms. By processing this multifaceted data, the audit software can provide a holistic view of an organization's ESG performance, enabling auditors to evaluate compliance with relevant standards and regulations.

- In April 2023, Simplifya, in collaboration with leading insurance carriers and brokers, introduced the Risk Mitigation Alliance (RMA) to provide cannabis operators with substantial savings on insurance premiums and compliance solutions, including their tailored audit software. This alliance aimed to aid cannabis businesses manage compliance needs more affordably, protect their licenses, and streamline operational processes.

Download Free sample to learn more about this report.

North America Operational Audit Software Market Growth Factors

Rising Demand for Continuous Monitoring and Real-time Visibility into Operational Performance Metrics to Drive the Implementation of Operational Audit Solutions

The dynamic nature of modern business operations has necessitated a shift from periodic, static auditing practices to a more proactive and continuous approach. Conventional audit methodologies, which rely on retrospective assessments and snapshot-based evaluations, often fail to capture the real-time intricacies and complexities of rapidly evolving operational landscapes. This limitation has given rise to an increasing demand for operational audit solutions that offer continuous monitoring capabilities, enabling organizations to maintain a constant pulse on their performance metrics and key risk indicators.

Operational audit solutions equipped with continuous monitoring functionalities leverage sophisticated data ingestion and processing mechanisms to capture and analyze operational data streams in real-time. These solutions integrate with an organization's core systems, applications, and data sources, enabling them to ingest structured and unstructured data from disparate sources. Advanced analytical engines and machine learning algorithms are then employed to process this data, providing deep insights into operational performance metrics, such as process efficiency, resource utilization, and compliance adherence.

RESTRAINING FACTORS

Integration of Audit Software with Legacy Systems, Applications, and Data Sources to Hinder Product Adoption

Legacy systems and applications are often built on outdated technologies, proprietary architectures, and monolithic designs, making them inherently resistant to seamless integration with modern, modular software solutions such as operational audit tools. One of the primary hurdles in integrating audit software with legacy systems is the lack of standardized data formats and interfaces. Legacy systems frequently rely on customized data structures, proprietary protocols, and legacy file formats, which can be difficult to reconcile with the data ingestion and processing mechanisms of operational audit software. This incompatibility necessitates the development of complex data mapping and transformation processes, often requiring substantial investments in time, resources, and specialized expertise.

Furthermore, the complexity of integration with legacy systems is compounded by the need to maintain data integrity and ensure end-to-end security. Legacy systems lack robust security mechanisms, exposing sensitive operational data to potential risks during the integration process. All these factors are expected to hinder North America operational audit software market growth.

North America Operational Audit Software Market Segmentation Analysis

By Deployment Analysis

Cloud-based Segment to Dominate owing to Increased Adoption by SMEs

Based on deployment model, the market is segmented into cloud and on-premise.

Cloud is poised to hold the major North America operational audit software market share and record the highest CAGR during the forecast period due to the numerous advantages offered by cloud deployment such as centralized audit management, real-time monitoring, scalability, and accessibility. The cloud-based audit software enables access from anywhere with an internet connection, facilitating remote audits and collaboration among teams situated at different locations. Additionally, enterprises can scale up or down cloud-based software as per the business requirements, adjusting to growth or fluctuations in audit requirements.

On-premises operational audit software helps organizations to have better control over their data and security. This option is highly preferred by enterprises with stringent regulatory compliance needs or sensitive data concerns.

By Enterprise Type Analysis

Small and Medium-sized Enterprises to Dominate owing to Adoption of Advanced Technology

Based on enterprise type, the market is divided into large enterprises and SMEs.

The SMEs are expected to grow with the highest CAGR during the forecast period due to the rapidly growing utilization of digital technologies by SMEs globally. Advanced technology adoption helps SMEs boost productivity, efficiency, and sustain competition.

Large enterprises dominated the North America operational audit software market in 2023. The audit software is increasingly used by large enterprises to enhance the accuracy and efficiency of audits. Operational audit software help large enterprises simplify their internal processes, improve efficiency, and ensure compliance with regulations.

By End-user Analysis

Growing Focus on Efficiency and Automation to Surge the Market Demand in the BFSI Industry

Based on end-user, the market is divided into manufacturing, healthcare, retail, BFSI, hospitality, transportation, and others.

BFSI dominated the North America operational audit software market in 2024, as financial institutions increasingly use operational audit software for compliance requirements, The BFSI sector involves strict regulatory requirements, and operational audit software helps in ensuring compliance by automating processes, tracking changes, and developing comprehensive reports.

To know how our report can help streamline your business, Speak to Analyst

Retail is anticipated to expand at the highest CAGR. The audit software helps retailers better track inventory, manage stock movements, and improve inventory reconciliation, helping to minimize overstocks, stockouts, and shrinkage. In addition, operational audit software is useful for the assessment of the performance of suppliers, monitoring supply chain operations, and recognizing pain points for improvement to ensure the efficient flow of goods.

COUNTRY INSIGHTS

Based on geography, the market is studied across three major countries, including the U.S., Canada, and Mexico.

U.S. is expected to account for the largest market share during the forecast period due to the rapid surge in adoption of AI-driven applications across various sectors, robust technology investment activity bolstered by government support, and the presence of major players.

Moreover, the Canada market is anticipated to show the highest growth rate due to the increased cyber threats. With an increasing number of cyberattacks and financial risks, the BFSI sector is leveraging operational audit software to determine, analyze, and mitigate risks across their operations.

Key Industry Players

Key Players Focus on Continuous Developments to Strengthen their Market Position

The market is dominated by the leading players such as Intouch Insight, Inc., AuditBoard Inc., BeepQuest, Clarke Executive Services Group LLC, ComplianceMate, Corporater AS, DoubleCheck Software, monitorQA, Oversight, and SafetyCulture. These key players are expanding their operations by adopting strategies such as mergers, acquisitions, product launch, collaborations, and partnerships. For instance, in February 2024, Global tech company SafetyCulture opened a new office in Manchester as a part of its expansion strategy. It spreads across 10,000 sq. ft. and has the potential to accommodate over 100 employees.

List of Top North America Operational Audit Software Companies:

- Intouch Insight, Inc. (Canada)

- AuditBoard Inc. (U.S.)

- BeepQuest (Mexico)

- Clarke Executive Services Group LLC (U.S.)

- ComplianceMate (U.S.)

- Corporater AS (Norway)

- DoubleCheck Software (U.S.)

- monitorQA (U.S.)

- Oversight (U.S.)

- SafetyCulture (Australia)

KEY INDUSTRY DEVELOPMENTS:

- March 2024 : AuditBoard, a cloud-based platform transforming audit, compliance, risk, and ESG management announced a strategic alliance with the audit, tax, and advisory firm, KPMG LLP. The alliance was made with an objective to leverage the combined power of KPMG’s deep expertise to elevate audit, risk, IT security, and ESG programs. Leveraging AuditBoard’s connected risk platform, the partnership aims to help both entities in navigating the growing risk challenges.

- October 2023: Intouch Insight Ltd. Completed acquisition of Brand Equity Builders, Inc. (BEB) the parent company of both Alta360 Research, Inc. (Alta) and its sister company Ardent Retail Services Inc.

- July 2023 : Fourthline Ltd. a U.K. based non-financial risk and resilience consulting & advisory firm, signed a strategic partnership with Corporater, a global software company providing integrated software solutions for Governance, Performance, Risk, and Compliance (GPRC). It builts on a single platform with an objective to offer risk and resilience solutions to financial sector.

- May 2023: GRC Outlook in its yearly Risk Management edition, acknowledged Oversight among top 10 innovator among risk management solution providers in 2023.

- August 2022: Navitas Safety, a company dedicated to providing food safety solutions, was recently awarded the title of 'Best Food Safety Solutions Provider' at the 2022 U.K. Enterprises Awards. The company has been consistently innovating to make seamless safety solutions for hospitality teams. One of their latest innovations is digital food safety kits that keeps teams ready for inspection at all times, while eliminating the need for paperwork in the kitchen.

REPORT COVERAGE

The report offers qualitative and quantitative market insights and a detailed analysis of the size & growth rate for all possible segments in the market. It also provides an elaborative analysis of market dynamics, emerging trends, and the competitive landscape. The market research report offers key insights, such as the implementation of automation in specific market segments, recent industry developments, such as partnerships, mergers, funding, acquisitions, consolidated SWOT analysis of key players, business strategies of leading market players, macro & micro economic indicators, and major industry trends. This detailed analysis provides a comprehensive view of the market and its potential for growth and development.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019 – 2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025 – 2032 |

|

Historical Period |

2019 – 2023 |

|

Growth Rate |

CAGR of 25.7% from 2025 to 2032 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Deployment

By Enterprise Type

By End-user

By Country

|

Frequently Asked Questions

According to Fortune Business Insights, the market is predicted to reach USD 345.6 million by 2032.

In 2024, the market value stood at USD 55.6 million.

The market is projected to record a CAGR of 25.7% during the forecast period.

By deployment, cloud led the market in 2024.

The demand for continuous monitoring and real-time visibility into operational performance metrics to drive the implementation of operational audit solutions.

Some of the top players in the market are Corporater AS, AuditBoard, Inc., Intouch Insight, Inc., and others.

The U.S. dominated the market in 2024 due to the presence of well-established companies.

By end-user, the retail segment is expected to show the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us