North America Power Tools Market Size, Share & COVID-19 Impact Analysis, By Mode of Operation (Electric, Pneumatic and Others), By Tool Type (Drilling & Fastening Tools, Material Removal Tools, Sawing & Cutting Tools, Demolition Tools, and Others), By Application (DIY and Industrial (Manufacturing, Automotive, Construction, Energy, Others (Ship Building))), and Regional Forecast, 2025-2032

North America Power Tools Market Size

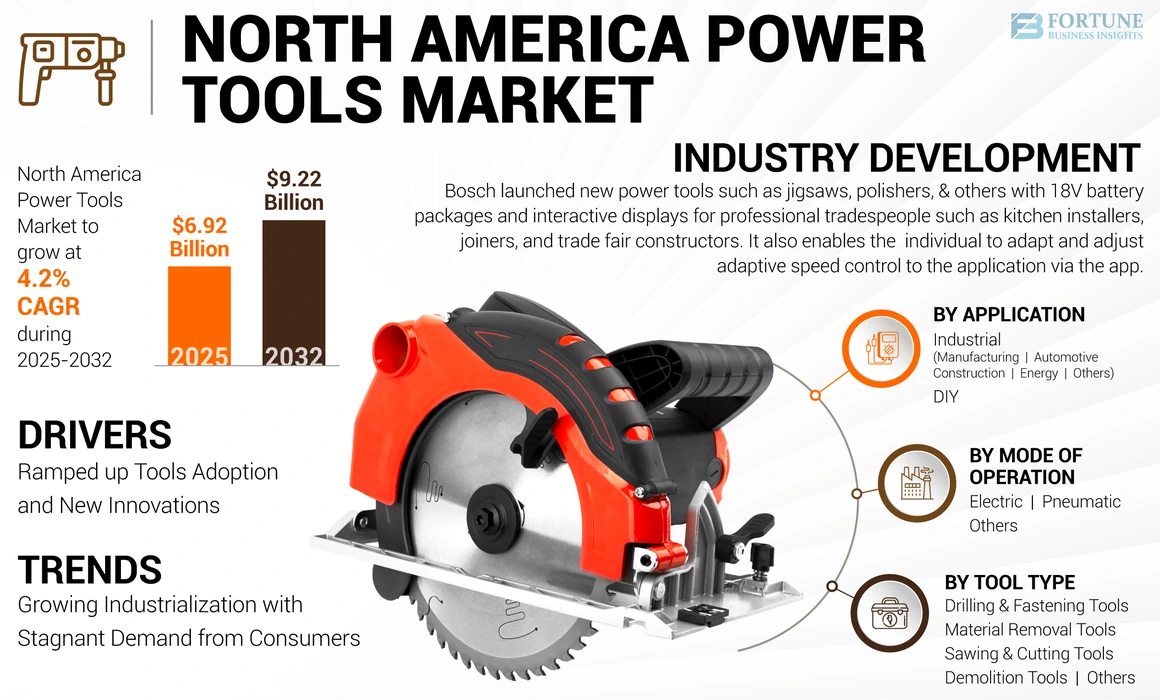

The North America power tools market size is projected to grow at a CAGR of 4.2% during the forecast period. The North America market for power tools is projected to grow from USD 6.92 billion in 2025 to USD 9.22 billion by 2032.

North America has observed stagnant growth with the rising use of electric power tools in the production, automotive, and manufacturing sectors. Technological advancements such as smart tool ergonomics, app-based tracking, and efficient power capabilities help reduce the workload. Also, growing pneumatic tools and hydraulic tools are used in heavy-duty applications to grow the North America power tools market share steadily over the forthcoming period.

Also, expanding demand for power tools to ease operation and smooth connectivity has helped the tool to grow. Various types of tools used in drilling & fastening, material removal, sawing & cutting, and demolition steadily help expand the market share. Moreover, stagnant demand for power tools in industries and growing D.I.Y activities led to the stable growth of the market over the forecast period.

LATEST TRENDS

Growing Industrialization with Stagnant Demand from Consumers to Bolster the Market

Rising tool demand in the aftermarket for complex fabrication operations has eased up the complexities of end-users. Various complex demolition and manufacturing operations in the industrial and construction sectors have kept the demand graph stable. Similarly, the growing D.I.Y culture in urban and rural areas has pushed the use of tools for complex household operations. Also, the adoption of industry 4.0 to automate operational tool tracking and performance capabilities boosted the North America power tools market growth

For instance, on January 18, 2023, the U.S. state planner approved a sum of USD 218.35 billion for fixed asset investment projects. The amount is double last year’s value as authorities gear up to support the COVID-19 hit economy.

DRIVING FACTORS

Ramped up Tools Adoption and New Innovations to Bolster Market Growth

Growing do-it-yourself culture and rising interest in artisan work have ramped up the adoption of the tools in the residential segment. End-user home improvisation and D.I.Y habitat have helped the market grow. Also, new Internet of Things(IoT)-enabled innovations and smart safety features are the prime additions to the power tools lineup. This smart integration of power tools and easy monitoring has eased the operations, simultaneously reducing workshop downtime.

For instance, in January 2022, Bosch launched its new DIY Tools Advanced Trim Router 18V-8. It is a compact yet powerful trim router with 18V power for DIY, gardening, and home appliances.

RESTRAINING FACTORS

High Initial Cost and Demand Supply Gap on Field to Restrain Market Development

The market has various corded and cordless tools that offer more efficiency and time savings. However, high initial cost and need for preventive maintenance hamper the market growth. Additionally, industry players have recognized the revenue deficit owing to an increased supply gap. The reason behind this was the heavy import reliability on countries such as Chile for raw materials, such as copper and lithium ion, to produce highly efficient tools.

For instance, according to the U.S. Geological Study Report, in the U.S., from 2020 to 2021, mined copper production remained unchanged but its reliance on copper import increased from earlier 37% to 45%, a growth of 8% from 2020 to 2021.

Download Free sample to learn more about this report.

KEY INDUSTRY PLAYERS

In the global competitive landscape, established and emerging players in the market have observed a deficit in revenue and production fall owing to high source material prices. In contrast, prominent players widened their product portfolio with acquisition strategies to fill the supply-demand gap. Additionally, DIY culture in the market has endorsed small players to enter the tools market with a subsequently expanding the market size.

List of Top North America Power Tools Companies:

- Robert Bosch GmbH (Germany)

- Stanley, Black & Decker, Inc. (U.S.)

- Hilti Corporation (Liechtenstein)

- Atlas Copco AB (Sweden)

- Makita Corporation (Japan)

- Emerson Electric Co. (U.S.)

- Hitachi Koki Ltd. (Japan)

- Ingersoll Rand (U.S.)

- Techtronic Industries Co. Ltd. (Hong Kong)

- Enerpac Tool Group (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- November 2022 –Bosch launched new power tools such as jigsaws, polishers, and others with 18V battery packages and interactive displays for professional tradespeople such as kitchen installers, joiners, and trade fair constructors. It also enables the individual to adapt and adjust adaptive speed control to the application via the app.

- October 2022 – Stanley Black & Decker has launched its reviva segment on the retail platform. The housing of the products is made from 50% recycled material.

REPORT COVERAGE

To gain extensive insights into the market, Download for Customization

The market research report provides a detailed market analysis. It focuses on key aspects such as an overview of technological advancements, the dominance of these tools in the U.S. and Canada, and pricing analysis. Additionally, it includes an overview of the market scenario for DIY and the industrial sector. It also focuses on new product launches, key industry developments, such as mergers, partnerships & acquisitions, strategies, and the impact of COVID-19 on the market. Besides this, the report offers insights into the market trends, supply gap analysis, and highlights key industry dynamics. In addition to the aforementioned factors, it encompasses several factors that have contributed to the market growth in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 4.2% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Mode of Operation

|

|

By Tool Type

|

|

|

By Application

|

|

|

By Country

|

Frequently Asked Questions

North America will exhibit a CAGR of 4.2% over the forecast period.

Ramped adoption of tools and new innovative products to bolster market growth.

Robert Bosch GmbH, Stanley, Black & Decker, Inc., Emerson Electric Co., Ingersoll Rand, Enerpac Tool Group are the major players in the North America market.

U.S. is dominating the market share with highest share in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us