North America Utility Pump Market Size, Share & Industry Analysis, By Product Type (Transfer Pumps, Submersible Pumps, Dewatering Pumps, and Others), By Power Source (Gas Powered, Electric Powered, Battery Powered, and Others), By End-user (Residential, Commercial, Industrial, and Utility), and Regional Forecast, 2025-2032

North America Utility Pump Market Size

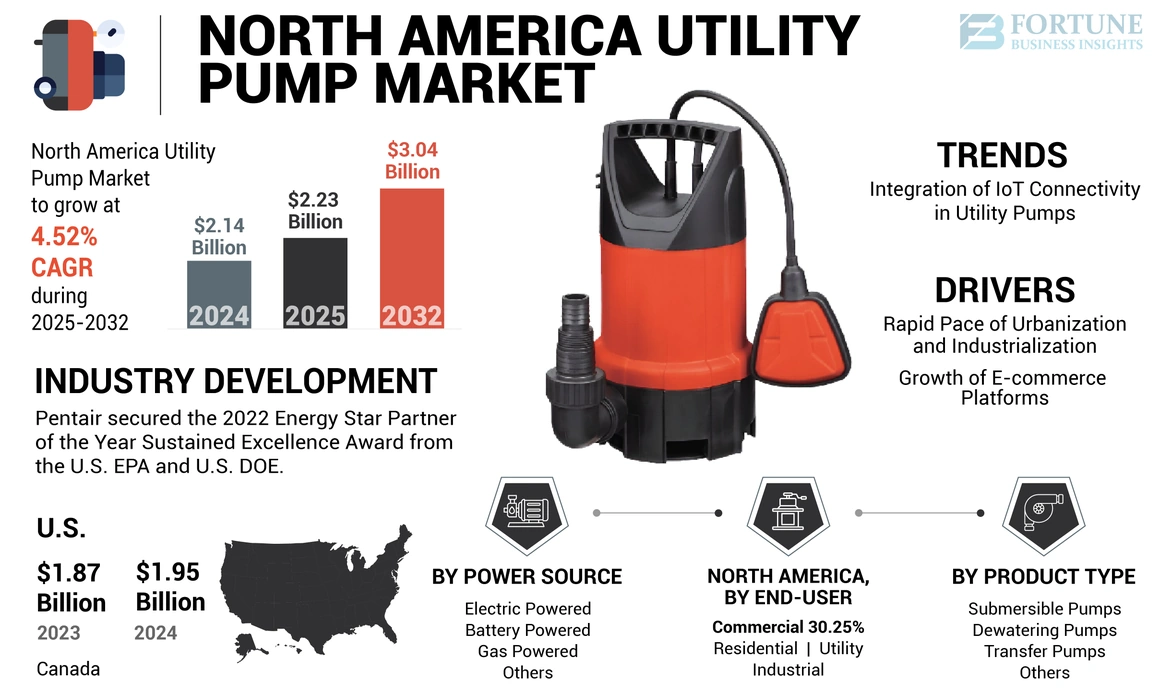

The North America utility pump market size was valued at USD 2.14 billion in 2024. The market is projected to grow from USD 2.23 billion in 2025 to USD 3.04 billion by 2032, exhibiting a CAGR of 4.52% during the forecast period.

Pumps are essential for flood control and drainage systems. With a growing emphasis on effective water management to prevent flooding in urban areas, there is likely an increased demand for pumps capable of handling large volumes of water efficiently. As municipalities and industries focus on improving wastewater treatment processes, pumps are integral for the transportation and processing of wastewater. The demand for these pumps may increase with the expansion and upgradation of wastewater treatment facilities. The integration of smart technologies in water management, including the use of sensors and automation, requires advanced pumps. Pumps equipped with smart features can provide real-time data, optimize operations, and contribute to more efficient water distribution and usage. With ongoing urbanization and infrastructure development projects, there is a need for reliable water supply and distribution systems. Ongoing infrastructure development projects, especially in developing regions, may contribute to the rising demand for utility pumps. Construction projects often require effective water removal and control systems, boosting the market share for utility pumps.

Pumps play a key role in maintaining water circulation and pressure in urban areas, helping meet the demands of a growing population. During the COVID-19 pandemic, the pump market, similar to many other industries, experienced disruptions in the supply chain due to lockdowns, restrictions on movement, and manufacturing shutdowns in various regions. This led to delays in the production, transportation, and delivery of pumps. The pumps used in essential services, such as water supply and wastewater management, continued to be in demand. Governments and municipalities recognized the critical role of these systems and prioritized their maintenance and operation during the pandemic.

North America Utility Pump Market Trends

Integration of Internet of Things Connectivity in Utility Pumps to Drive Market Growth

IoT-enabled pumps allow for remote monitoring of pump performance, status, and operational parameters. This capability is particularly valuable for users who need real-time insights into their pump systems from a distance. Remote monitoring helps identify issues promptly, reduce downtime, and improve overall operational efficiency. Internet of Things (IoT) connectivity facilitates the collection of vast amounts of data from pumps. This data can be analyzed to gain insights into pump performance trends, energy consumption patterns, and potential issues. Analytics tools can optimize pump operation, improve energy efficiency, and contribute to cost savings.

IoT technology enables predictive maintenance by continuously monitoring the condition of pumps. By analyzing data on factors such as vibration, temperature, and usage patterns, predictive maintenance algorithms can anticipate potential failures and schedule maintenance activities proactively. This helps in avoiding unexpected breakdowns and minimizing downtime.

Download Free sample to learn more about this report.

North America Utility Pump Market Growth Factors

Rapid Pace of Industrialization and Urbanization in the North America Region Leads to Increased Demand

Urbanization often involves the construction of new buildings, roads, and infrastructure. Pumps play a crucial role in various construction activities, including dewatering of construction sites, sewage handling, and water supply. The growing urban population increases the demand for municipal water services. Pumps are essential for various water management applications, such as water supply, wastewater treatment, and storm water management. As industries expand, there is a higher demand for water in manufacturing processes. Pumps are used in industrial settings for water supply, circulation, and wastewater handling. Industries such as manufacturing, chemical processing, and power generation rely on pumps for their water-related needs. Urbanization can lead to increased impervious surfaces, reducing natural water absorption. This can result in higher volumes of stormwater runoff, necessitating effective stormwater management systems. Pumps are integral to flood control and drainage systems in urban areas.

The concentration of industries and urban areas leads to higher volumes of wastewater. Utility pumps are used in wastewater treatment plants to transport and process sewage. As industrial and municipal wastewater treatment facilities expand, the demand for pumps increases. Urbanization can result in changes in land use, affecting agricultural practices. Pumps are used for irrigation purposes in agriculture to supply water to crops. As urban areas expand, there may be a need for more efficient water distribution systems in nearby agricultural regions.

Growth of E-Commerce Platforms Contributes to the Market Demand

E-commerce platforms provide a convenient and accessible way for consumers and businesses to browse, compare, and purchase pumps from the comfort of their homes or offices. This convenience encourages more people to explore and invest in pumps. E-commerce platforms offer a broader range of products, allowing customers to choose from various pumps based on specifications, features, and price points. This variety accommodates diverse consumer needs and preferences. Online platforms provide detailed product information, specifications, and customer reviews, enabling buyers to make informed decisions about pumps. This transparency builds trust and confidence in the purchasing process.

E-commerce platforms streamline the order processing and delivery system. Customers can place orders quickly, track their shipments, and receive timely deliveries, reducing the time and effort associated with traditional purchasing methods. Online platforms allow users to compare prices, features, and customer reviews across different brands and models of pumps. This transparency empowers buyers to make informed choices and find the best value for their investment. E-commerce eliminates the need for physical visits to stores, saving time and travel costs for customers. This convenience is particularly valuable for businesses that need to procure pumps efficiently.

RESTRAINING FACTORS

Competition from Alternate Technologies to Restrain Market Demand

Alternative technologies, such as gravity-based systems or passive drainage solutions, may offer cost-effective options compared to traditional pumps. End-users, particularly those with budget constraints, may opt for more economical solutions. Energy-efficient alternatives, including solar-powered pumps, may be perceived as more sustainable and environmentally friendly. Increasing emphasis on green practices and sustainability goals can drive users to choose alternatives that align with these principles.

Government incentives and regulations favoring the adoption of specific alternative technologies, such as renewable energy solutions, can shift market dynamics by encouraging end-users to opt for alternatives that align with regulatory requirements. Alternative solutions incorporating smart technologies and innovative features may attract users seeking advanced functionalities and real-time monitoring capabilities. This competition can impact the market share of traditional pumps. Some alternative technologies may be better suited for specific applications or industries, diverting demand away from traditional pumps in those particular segments. Increasing awareness of environmental concerns may drive public perception and preferences toward alternative technologies perceived as more eco-friendly. This can influence purchasing decisions and restrain the demand for traditional pumps.

North America Utility Pump Market Segmentation Analysis

By Product Type Analysis

Submersible Segment Leads Market amid Construction Boom

Based on product type, the market is categorized into transfer pumps, submersible pumps, dewatering pumps, and others.

Submersible segment is the leading segment in the North America utility pump market. Growth in construction and infrastructure projects in the region, such as residential buildings, commercial complexes, and municipal infrastructure, often drives demand for submersible pumps for applications such as water supply, drainage, and wastewater management. Ongoing advancements in submersible pump technology, including improvements in materials, design, and control systems, are also the major factors driving the segment demand in North America.

Transfer pumps is the fastest growing segment in the North America utility pump market. Transfer pumps in North America are used in construction for tasks such as dewatering, concrete mixing, and transferring liquids within construction sites. An increase in construction and infrastructure projects can drive the demand for transfer pumps in North America. In the oil and gas industry, transfer pumps are essential for moving crude oil, refined products, and various fluids throughout the production and distribution processes. Increased exploration and production activities can contribute to the growing demand for transfer pumps in the region.

By Power Source Analysis

Battery-Powered Pump Segment to Witness Rapid Growth, Fueled by Environmental Awareness

Based on power source, the market is categorized into gas-powered, electric-powered, battery-powered, and others.

The battery-powered segment is expected to grow at the fastest rate over the forecast period. The increasing awareness of environmental sustainability has led to a preference for cleaner and greener technologies. Battery-powered pumps are observed as more environmentally friendly compared to some gas-powered alternatives as they produce fewer emissions during operation. Ongoing advancements in battery technology contribute to the popularity of battery-powered pumps. Improved battery efficiency, longer run times, and faster charging capabilities make these pumps more practical and reliable for users.

Gas-powered pumps segment is the second leading segment in the utility pump market and is often preferred in applications where portability and mobility are essential. They can be easily moved to different locations without the constraints of electrical cords, making them ideal for outdoor and remote settings.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

Commercial Segment Expected to Drive the Market Due to Rise in Construction Activities

Based on end-user, the market is subdivided into residential, commercial, industrial, and utility.

The commercial segment is expected to dominate the market share during the forecast period. The commercial sector, including construction and real estate development, often requires utility pumps for various applications such as drainage, water supply, and wastewater management. As construction activities and infrastructure development projects increase, the demand for utility pumps in the commercial sector is likely to rise.

The increasing incidence of heavy rainfall, storms, and other weather-related events due to climate change has elevated the risk of flooding in residential areas. Homeowners are more likely to invest in flood prevention measures such as sump pumps to safeguard their homes. The availability of user-friendly pump kits and installation guides makes it easier for homeowners to install pumps themselves, creating opportunities for the North America utility pump market growth. This accessibility encourages residential property owners to take preventive measures and grow the overall pump industry.

COUNTRY INSIGHTS

Based on geography, the market is subdivided into the U.S. and Canada.

The U.S. has the highest North America utility pump market share. Utility pumps are commonly used in commercial and industrial settings for various purposes, including wastewater management, flood control, and fluid transfer in the U.S. Growth in commercial and industrial activities can lead to an increased demand for utility pumps in the U.S. Increased awareness of the importance of emergency preparedness and the need for effective flood control measures contribute to higher demand in the U.S. ongoing advancements in pump technology, including improvements in efficiency, automation, and smart pump systems, make utility pumps more attractive and efficient for various applications in the U.S.

In July 2021, Pentair announced the launch of its versatile sump pump controller to help minimize the risk of flooding at home. The Pentair Sump Controller is a smart, connected device that offers ease and confidence to homeowners by providing real-time pump alerts via the Pentair Home app and activating the sump pump when waters rise in the home during a weather event. Pentair manufactures pumps and fluid handling systems for various industrial applications, including agriculture, chemical processing, and oil and gas. This may include centrifugal pumps, diaphragm pumps, and other fluid control products in the U.S.

Canada has a significant market share in the North America utility pump market. In Canada, there has been a growing emphasis on energy-efficient pumps. Industries and municipalities are increasingly looking for pumps that can provide optimal performance while minimizing energy consumption and operational costs.

Key Industry Players

Zoeller's Reliable Pumps Serve Residential and Commercial Applications across the Market

Zoeller offers a diverse range of pumps designed to meet the needs of both residential and commercial customers. Their product line includes submersible pumps, sewage pumps, grinder pumps, sump pumps, and other pumps. Zoeller's pumps are designed for various applications, such as wastewater management, stormwater removal, basement flooding prevention, sewage handling, and general water transfer needs. This versatility allows them to cater to a broad customer base. Zoeller is known for producing high-quality and reliable pump systems. Their products often incorporate durable materials and advanced engineering to ensure long-lasting performance. Other major players in the market include Wayne, BURCAM, and Danner Manufacturing, among others.

List of Top North America Utility Pump Companies:

- Zoeller Pump (U.S.)

- Wayne (U.S.)

- Aquapro (U.S.)

- Beckson (U.S.)

- BURCAM (U.S.)

- Champion Power Equipment (U.S.)

- Danner Manufacturing Inc. (U.S.)

- Superior Pump (U.S.)

- Tsurumi Pump (U.S.)

- Moyno (U.S.)

- Pentair (U.S.)

- Franklin Electric (U.S.)

- Xylem (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- September 2023: Tsurumi's AVANT TM MQ series joined the MY and MMR product series to offer more solutions that cater to the needs of the sewer market. The MQ series has proven to be efficient and reliable owing to the energy saving of Tsurumi's highly efficient IE3 motors. Tsurumi's AVANT TM product line brings efficient solutions to even the most demanding applications.

- May 2022: Pentair received the 2022 Energy Star Partner of the Year- Sustained Excellence Award from the U.S. Environmental Protection Agency (EPA) and the U.S. Department of Energy. Pentair was the first pool equipment manufacturer to have an ENERGY STAR-certified pool pump and has been recognized as an ENERGY STAR Partner of the Year since 2013.

- January 2022: Franklin Electric announced that its wholly-owned subsidiary, Headwater Companies, LLC, acquired Blake Group Holdings, Inc., a Connecticut corporation, for USD 27.1 million in cash. Blake is a professional groundwater distributor operating in fourteen locations throughout the northeast U.S. Blake has approximately USD 74 million in consolidated annual sales.

- October 2021: As part of both Consumer Solutions and Industrial & Flow Technologies reporting segments, Pentair completed the acquisition of Pleatco Holdings, LLC and related entities (“Pleatco”) for USD 254.6 million in cash, net of cash acquired. Pleatco manufactures water filtration and clean air technologies for pool, spa, and industrial air customers.

- March 2020: Franklin Electric acquired the product lines and assets of CPS Pumps, along with its current manufacturing process, in Rossville, Tennessee. The acquisition would bring Franklin Electric a deep and diverse set of key products and expertise, including a full portfolio of line shaft turbines, split case, end suction, and ANSI-style pumps, allowing it to better serve its global customers in the agriculture irrigation, municipal, industrial, and mining markets.

REPORT COVERAGE

The report provides a detailed market analysis and focuses on key insights such as leading companies, product/service types, and leading product applications. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 4.52% from 2025 to 2032 |

|

Value |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Power Source

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

A study by Fortune Business Insights shows that the North America market size stood at USD 2.14 billion in 2024.

The North America market is projected to grow at a CAGR of 4.52% over the study period.

The market size of the U.S. stood at USD 1.95 billion in 2024.

Based on end-user, the commercial segment leads and is set to hold a dominating share of the market.

The North America market size is expected to reach USD 3.04 billion by 2032.

The expansion of e-commerce platforms plays a pivotal role in driving market growth.

The top players actively operating across the market are Zoeller Pump and Pentair.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us