North America Utility Transmission Pole Market Size, Share & COVID-19 Impact Analysis, By Pole Size (Below 40ft, Between 40ft – 70ft, and Above 70ft), By Material (Steel, Concrete, Composite, and Wood), and Regional Forecast, 2025-2032

North America Utility Transmission Pole Market Size

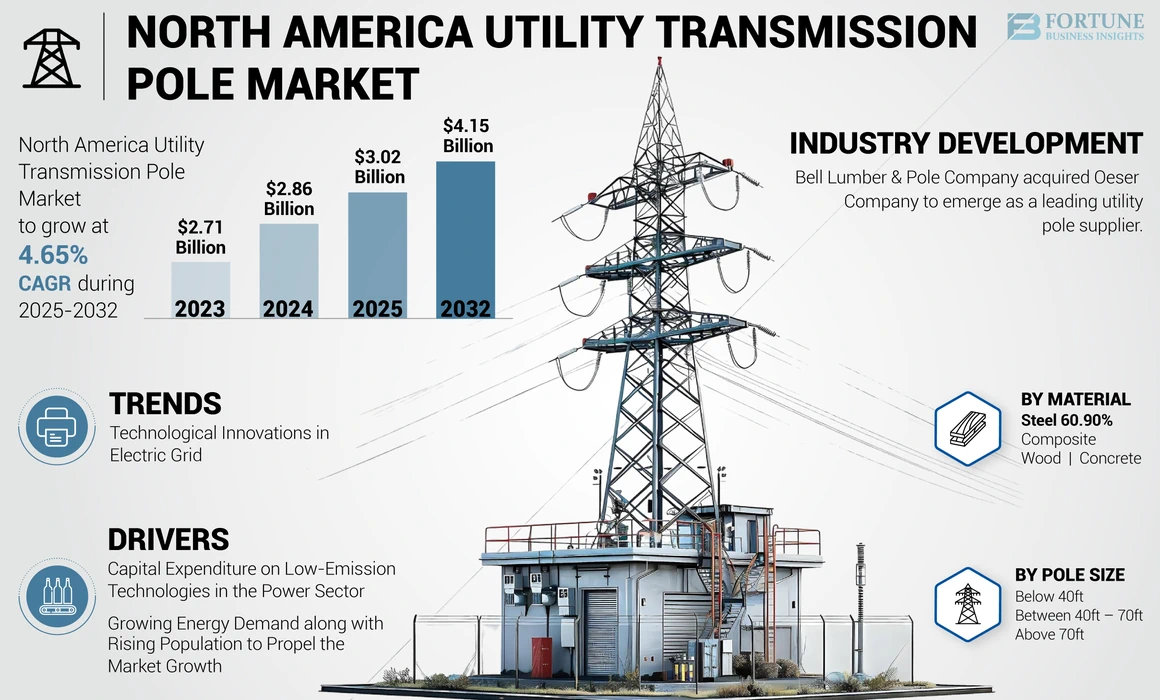

The North America utility transmission pole market size was valued at USD 2.86 billion in 2024. The market is projected to grow from USD 3.02 billion in 2025 to USD 4.15 billion by 2032, exhibiting a CAGR of 4.65% during the forecast period. The North America Utility Transmission Pole Market in the U.S. is projected to grow significantly, reaching an estimated value of USD 3.69 billion by 2032.

Utility transmission poles are special structures designed to hold the wires of electricity transmission, distribution lines, telecommunication, street lighting, heavy power lines, and sub-transmission lines at a given distance from each other and the earth's surface. The power transmission poles are made of wood, concrete, composite, and steel, designed to perform a specific function.

COVID-19 IMPACT

Disruptions in Energy Transmission Projects Hampered the Market Growth amid the Pandemic

Governments in many countries had to implement lockdown measures during the pandemic to contain the further spread of the virus. However, these measures severely impacted the economies of nations across the region. The pandemic also disrupted supply chains as governments imposed travel bans. This caused delays in many utility transmission pole projects and a shortage of workforce. Many industries were not operational during the lockdown, reducing the power demand of the industrial sector in the region.

For example, in 2020, the World Bank published an article about transmission line construction delays that positioned financial pressure on approximately six wind projects in the development phase. In addition, several open proffers postponed in April 2020 were redlined due to the government's no-leverage policy amid the pandemic-related financial crisis.

However, this industry displayed immediate revival in the deployment as various nations were in the advanced stages of vaccine development and highly focused on implementing carbon-neutral technologies in public and private transportation activities.

North America Utility Transmission Pole Market Trends

Technological Advancements in Electric Grid to Spur Market Opportunities

Technological advancement can play an important role in alleviating energy supply strains while reducing costs. In the transmission business, digital investment is primarily devoted to the automation of substations, the digitalization of power transformers, and the development of energy management systems used to monitor, control, and optimize the generation and transmission system performance. Advanced transmission technologies are diverse in maturity, application, and capabilities. These technologies all possess different abilities that present growth opportunities to improve transmission systems.

For example, in April 2022, Iveda, a leading provider of digital transformation technology, announced the launch of Utilus, a smart power system that helps tap information regarding existing power. Utilus is equipped with solutions, such as AI-based video analytics, a communication network with a wireless local area network, fourth & fifth-generation mobile communications standards, and many other wireless protocols that have helped establish an artificial intelligence (AI) search technology for remote management.

Download Free sample to learn more about this report.

North America Utility Transmission Pole Market Growth Factors

Capital Expenditure on Low-Emission Technologies in the Power Sector to Propel Market Growth

Investment in the power sector is experiencing significant growth in North America, and the renewable industry remains one of the most prominent categories of the power sector for investment. As per the International Energy Agency (IEA)'s World Energy Investment Outlook 2022 report, power sector investment was expected to grow by 6% in 2022 after a strong rebound of 7% in 2021, and renewable capacity is forecast to account for almost 95% of the increase in power capacity through 2026. This has also boosted spending on electricity networks through governments' fiscal support. For example, the Department of Energy (DoE) invests USD 20 to 25 billion annually for the transmission grid.

In addition, in January 2022, the U.S. Department of Energy launched a "Building a Better Grid" initiative included in President Joe Biden's Bipartisan Infrastructure Law. It aimed to promote collaboration and investment in the nation's grid. Moreover, in April 2022, the Federal Energy Regulatory Commission issued a notice of a proposed new rule named RM21-17, which intended to address transmission planning and cost allocation problems.

Increasing Energy Demand Coupled with Rise in Population to Drive Market Growth

The energy demand is constantly growing across the region, resulting in the increased focus of electricity providers on expanding their electricity transmission capabilities to meet the increasing demand. This, in turn, increases the demand for transmission lines, ultimately increasing the need to install utility poles for transmission applications.

For example, California's San Joaquin Valley, a stretch between the Diablo Range and the Sierra Nevada, largely accounts for the state's farming output and revenue. The state faces frequent water withhold due to climate change, which has resulted in the state government adopting a solar-powered system, which can offer reliable and potential solutions to water shortage.

To address its energy requirements, California is implementing a plan that emphasizes the enhancement of transmission infrastructure capable of efficiently accommodating a considerable portion of solar power. This upgraded transmission capacity focuses to offer electricity to around 10 million households. This effort lines up with California's objective to attain 100% clean power by 2045. As a result, it is projected that the execution of this plan will necessitate the establishment of new utility transmission pole lines.

RESTRAINING FACTORS

Growing Inclination toward Underground Connection May Hinder the Market Growth

The transmission sector is transforming and the adoption of underground cable laying is increasing rapidly. Earlier, underground cables and wiring cables were used where the overhead lines could be dangerous or difficult to use. However, countries across the region are quickly switching toward underground connections. This is due to the multiple advantages that underground connections offer, such as increased reliability for the transmission network, limited space of substations, and no impact from weather disturbances, which may pose challenges to the North America utility transmission pole market growth. Despite high maintenance, several countries plan to adopt the underground connection.

For example, in June 2022, WSP USA, an engineering and consulting service company, unveiled that it would offer services for the development of the Champlain Hudson Power Express transmission line project, the largest underground high-voltage transmission project ever developed and constructed in North America. The transmission line will deliver 10.4 terawatt hours annually of electricity to New York City after completion.

North America Utility Transmission Pole Market Segmentation Analysis

By Pole Size Analysis

Poles Above 70ft to Dominate the Market due to their Installation Near City Outskirts

Based on pole size, the market is segmented into below 40ft, between 40ft – 70ft, and above 70ft. The pole size generally varies based on the application and space where the pole is supposed to get installed. The above 70ft segment is expected to dominate the North America utility transmission pole market since most utilities are widely installed near city outskirts and are generally used to transmit high-voltage electricity.

By Material Analysis

Steel Material to Hold the Largest Share Owing to its Advantages

Based on material, the market is segmented into steel, concrete, composite, and wood. The steel segment dominates the market as steel utility poles are about 50% lighter compared to other pole material, reducing transportation costs and making them easier to handle on the job site.

Followed by steel, the concrete segment holds a significant North America utility transmission pole market share. Concrete possesses the advantages of being stronger and more rigid, has low maintenance, potential lifespan, and low cost per year.

Subsequently, composite utility transmission pole is lightweight and strong. It has low conductivity properties, and corrosion resistance, which results in composite poles not losing strength as they age, so maintenance is minimal. Based on the abovementioned parameters, the composite segment is expected to experience significant growth in the forthcoming years.

Furthermore, the ready availability of wood as raw material and less electrical conductivity has resulted in the adoption of wood-based utility transmission poles.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

This market has been analyzed across the U.S. and Canada. The U.S. dominates the regional market due to the catalyzing development of thousands of new and upgraded transmission lines in the country to reduce electricity costs.

Subsequently, most of Canada's demand for electricity systems is integrated with the regional market, with 98% of Canadians connected to the continent's bulk power system. The Canadian transmission network extends over 160,000 km, and major transmission and infrastructure upgrades have been planned across the country, including major lines in British Columbia, Alberta, Saskatchewan, Manitoba, and Quebec. Owing to this factor, the Canada utility transmission pole market is expected to experience significant growth in the coming years.

KEY INDUSTRY PLAYERS

Key Participants Focus on Product Quality to Maintain Competitiveness

The North America utility transmission pole market is highly competitive. Market players compete with a broad spectrum of companies that manufacture, distribute, and market utility poles and related products. They also compete based on product quality, engineering expertise, high levels of customer service, and timely, complete, and accurate product delivery.

The market has numerous competitors in the region and internationally. The sales of utility transmission poles are usually made through a competitive bid process, whereby the lowest bidder is awarded the contract, provided the competitor meets all other qualifying criteria.

The market also constitutes various small-scale key players with high competitiveness at the regional or domestic level, leading them to respond more quickly to changes in customer requirements.

List of Top North America Utility Transmission Pole Companies:

- Valmont Utility (U.S.)

- Pelco Structural, LLC (U.S.)

- RS Technologies Inc. (Canada)

- Bell Lumber & Pole (U.S.)

- Nello Corporation (U.S.)

- Nova Poles (Canada)

- Bridgewell Resources (U.S.)

- Sabre Industries, Inc. (U.S.)

- Creative Composites Group (U.S.)

- StressCrete Group (Canada)

- Locweld (Canada)

KEY INDUSTRY DEVELOPMENTS:

- September 2022 – Bell Lumber & Pole Company completed the acquisition of the assets of Oeser Company, a utility pole producer and supplier located in Bellingham, Washington. The acquisition would allow Bell Lumber & Pole to establish itself as a leading utility pole supplier across North America and expand its market in the Pacific Northwest.

- September 2022 – Creative Composites introduced StormStrong technology, which offers an option to upgrade the utility poles, light poles, and others. The offering enables additional durability in utmost weather conditions.

- March 2022 - Sabre Industries Inc planned to begin a USD 25 million expansion, including a galvanizing plant. The construction started in January 2021, and the building is expected to be finished in early summer. The facility will allow Saber to galvanize power poles in Sioux City.

- July 2021 - StressCrete Group announced the launch of its revolutionary new product, the VoltLock. It offers a discreet and convenient way for electric vehicle owners to charge their cars as the Electric Vehicle Supply Equipment (EVSE) is encased with concrete poles and provides a consistent & reliable charging source.

- January 2020 - Locweld announced an exclusive partnership with Valmont Utility, a Valmont Industries, Inc. division, and a leading producer and distributor of infrastructure products and services. The two companies look to deliver the best solution to North American utilities and EPC firms to supply and design lattice structures for large-scale projects.

REPORT COVERAGE

The report provides detailed market analysis and focuses on key aspects such as major companies, competitive landscape, product/service types, porters five forces analysis, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the above factors, the report encompasses several factors that contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 4.65% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Pole Size, Material, and Region |

|

Segmentation |

By Pole Size

|

|

By Material

|

|

|

By Region

|

Frequently Asked Questions

A study by Fortune Business Insights study shows that the market size was USD 2.86 billion in 2024.

The market is projected to grow at a CAGR of 4.65% during the forecast period.

The U.S. dominated the market in 2024.

Based on material, the steel segment holds the dominating share in the market.

The market size is expected to reach USD 4.15 billion by 2032.

The key market drivers are increasing expenditure on low-carbon technologies and rising energy demand.

The top players in the market are Valmont Utility, Pelco Structural, RS Technologies, and others.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us