Offshore Drilling Market Size, Share & Industry Analysis, By Rig Type (Drillships, Semisubmersibles, and Jackups), By Water Depth (Shallow Water, Deepwater, and Ultra-Deepwater), and Regional Forecasts, 2026-2034

Offshore Drilling Market Size

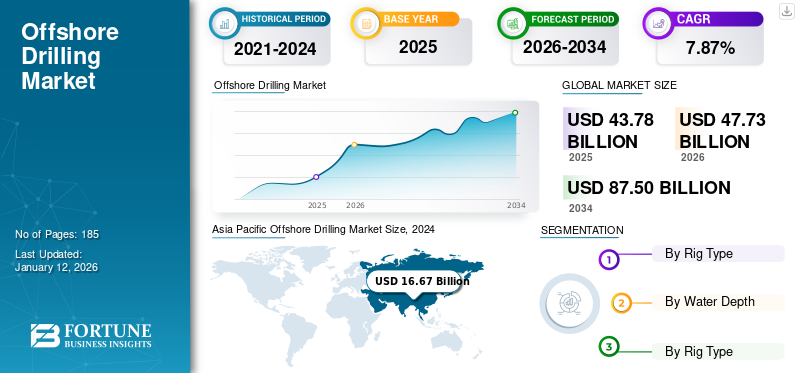

The global offshore drilling market size was valued at USD 43.78 billion in 2025. The market is projected to be worth USD 47.73 billion in 2026 and reach USD 87.50 billion by 2034, exhibiting a CAGR of 7.87% during the forecast period. Asia Pacific dominated the global market with a share of 41.36% in 2025. The offshore drilling market in the U.S. is projected to grow significantly, reaching an estimated value of USD 3.75 billion by 2032, driven by the growing energy consumption and export opportunities in the country.

Offshore drilling refers to drilling holes in the continental shelf's seabed and applies to drilling in lakes and inland seas. Some advantages of offshore drilling are increased oil production, promoted energy independence, and encouraged economic growth. Since this technology's advent, oil production has increased with the increasing demand. In addition, many countries can now scour the ocean for oil and gas, promoting self-reliance. Furthermore, nations bordering oceans can explore and grow their marine oil reserves.

COVID-19 spread rapidly everywhere in the world in 2020. From 2020 to 2021, every country was at different stages of the pandemic. The market participants witnessed challenges due to lockdowns. In 2020, the collective effects of the COVID-19 pandemic, the noteworthy decline in oil demand, and the considerable surplus in oil supply resulted in a dramatic drop in the demand and day rates for offshore drilling. Simultaneously, intervention by the OPEC+ in the form of historic production cuts was insufficient to offset the decline in oil & gas demand. As a result, Brent oil prices dropped from pre-COVID levels of USD 50-70 to USD 20-40 per barrel.

Offshore Drilling Market Trends

Increasing Trend of Unmanned Offshore Oil Platforms is Expected to Propel Market Growth

Reducing production costs through Unmanned Wellhead Platforms (UWHPs) could be the revolution the offshore oil industry desperately needs. The benefits of automation include improvements in efficiency and safety. For instance In July 2022, China National Offshore Oil Corporation stated that China built its first unmanned offshore oil platform at Enping Oilfield in the South China Sea. The platform, EP10-2, has no offices or living quarters. As a result, it's much more inexpensive to build and maintain, allowing oil companies to drill fields that aren't cost-effective for traditional rigs. Its deck size is compact, and its total weight is only a third of conventional platforms. It can also work in extreme conditions, such as typhoons, as it is primarily remote-controlled.

Download Free sample to learn more about this report.

Offshore Drilling Market Growth Factors

Growing Investment Due to Surging Oil & Gas Demand will Drive the Market Growth

Oil companies across the globe are spending vast amounts on drilling to reverse a long decline in spending on decades-old projects. In addition, rising oil prices are boosting investment and Europe's rising energy needs as the war between Ukraine and Russia drags on.

The market growth is based on oil & gas demand and production. Over the years, hydrocarbons have been used extensively in power generation, transportation, manufacturing goods, and many other essential things. However, the exponential demand for conventional fuel due to globalization, urbanization, and massive economic development will dampen the balance of supply and demand. In addition, many countries are increasing their capital expenditure (CAPEX) to meet future energy needs. Offshore hydrocarbons are a reliable energy source, attracting many investors. Hence, the rising interest in extracting untapped hydrocarbon reserves is expected to drive the market.

The rising investment in the offshore area is propelling the market growth. For example, the global oil and gas investment will increase by USD 26.5 billion this year as the industry is continuing its recovery from the most horrible time of the pandemic and the hurdles imposed by the outbreak. Overall oil and gas investments will grow by 3.9% to USD 628.25 billion. A substantial contributor is a 13.9% increase in upstream gas & LNG investments. The segments will be the fastest growing this year, with an investment leap from USD 131.25 billion in 2021 to around USD 148.8 billion in 2022. Thus, the growing investment scenario in the oil & gas sector is propelling the demand for drilling in offshore locations.

Massive Demand for Hydrocarbons for Heat and Electricity Generation to Boost Market Growth

The exponential growth in the population has increased the demand for heat and electricity. A considerable part of heat and electricity is generated by using conventional fuel. Following this trend, operators are likely to invest in unexploited reserves of hydrocarbon, which is set to boost the market. Further, the developed and emerging economies are extensively investing in infrastructure, welfare schemes, and innovation & technology, which spurs the demand for hydrocarbons. Therefore, local key players are increasing drilling activities to meet domestic demand and reduce oil & gas imports.

Along with growth in renewable energy consumption, global natural gas demand will surge by approximately 33% through 2045 as consumers across the globe continue switching to natural gas from greater carbon-emitting energy sources. According to the U.S. Energy Information Administration (EIA), while renewables will grow, hydrocarbons will still be the world’s largest energy source in 2050. Furthermore, many of the world's potential hydrocarbon reserves lie under the sea. The hydrocarbon industry has developed techniques suited to offshore conditions to find oil & gas and produce them successfully. Oil production from the offshore sector is expected to grow over the forecast period, owing to increasing oil and gas investments and the growing energy demand.

Additionally, the significant growth of the international crude oil market is influencing the global upstream oil and gas sector to regularly change the frequency of production and operation, which has led to increased drilling activities. For instance, according to the U.S. Energy Information Administration (EIA), 98.8 million barrels per day (b/d) of petroleum and liquid fuels were consumed in July 2022 globally, an increase of 0.9 million b/d from July 2021. In addition, global consumption of petroleum and liquid fuels for 2022 has an average of around 99.4 million barrels per day, an increase of 2.1 million barrels per day from 2021.

RESTRAINING FACTORS

Growing Environmental Concerns are Expected to Hamper Market Growth

Due to the growing concerns about environmental pollution, various governments across the globe have implemented various regulations and policies to reduce gasoline and diesel vehicle emissions. China, the United States, Germany, France, Norway, and the U.K. have established specific targets for the deployment of electric vehicles, with plans to phase out Internal Combustion Engine (ICE) vehicles. Thus, the increase in the usage of electric vehicles is expected to hamper the oil & gas demand and consequently the market. This, in turn, will adversely affect the market growth during the forecast period.

For instance, global sales of electric passenger cars passed 6.6 million in 2021, approximately more than double the previous year (3 million in 2020). In India, almost 10% of global car sales were electric cars in 2021, which is about 16.5 million. Global sales of electric cars kept growing strongly in 2022, with 2 million units sold in the first quarter.

Furthermore, the COP26 Paris agreement, where countries signed an agreement to meet net zero carbon emission till 2050, will hamper the market. Offshore drilling releases toxic pollution into the air and water. In addition, exploration and drilling on the platform, transportation by tanker, and refining of the oil onshore may release greenhouse gases, volatile organic compounds, and other air pollutants. Therefore, environmental concerns about achieving net zero carbon emission hinder the market growth.

Offshore Drilling Market Segmentation Analysis

By Rig Type Analysis

Drillship Segment Garnered Highest Share due to Adoption in Deepwater and Ultra-Deepwater

The drillship segment led the market accounting for 46.87% market share in 2026. Based on rig type, the market is classified into drillships, semisubmersibles, and jackups. Drillships segment holds the highest share. In recent years, drillships have been used in deepwater and ultra-deepwater and have become very large and no longer have a mooring system. Instead, they are equipped with state-of-the-art data processing systems. These DP systems maintain a drillship’s position within a small specified tolerance by controlling their thrusters to counteract wind, wave, and current forces. Without a mooring system, drillships may not be able to service shallow water areas due to the angle limitation of drill risers.

By Water Depth Analysis

Deepwater Segment to Dominate the Market owing to its Hydrocarbon Potential

The deepwater segment dominated the market accounting for 40.33% market share in 2026. Based on water depth, the market is classified into shallow water, deepwater, and ultra-deepwater. The deepwater segment garnered the highest share in the market due to significant hydrocarbon potential. Due to this, operators are focusing on deepwater production. Deepwater and ultra-deepwater contain a considerable amount of hydrocarbons. In addition, major oil & gas companies are increasingly investing in producing untapped hydrocarbon reserves.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

Asia Pacific Offshore Drilling Market Size, 2024

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific holds the largest share of the global offshore drilling market, supported by extensive offshore oil & gas reserves across China, Southeast Asia, India, and Australia. Rapid economic growth, industrialization, and urbanization are driving sustained increases in regional energy demand, positioning offshore drilling as a critical supply source. Additionally, the presence of major national and regional oil & gas companies investing in advanced deepwater and ultra-deepwater drilling technologies is enabling access to previously untapped offshore reserves, further strengthening market dominance. The Asia Pacific market is projected to reach USD 19.67 billion by 2026.

Latin America

Latin America is expected to witness the fastest growth in the offshore drilling market, primarily driven by deepwater and ultra-deepwater drilling expansion in Brazil and Mexico. Rising offshore exploration activity, supported by favorable government policies and long-term production contracts, is accelerating regional growth. Notably, Petrobras achieved a record-breaking offshore exploration depth of 7,700 meters in December 2021, highlighting technological advancements. Furthermore, increasing contract awards—such as offshore service agreements secured by Reach Subsea—are strengthening drilling activity across the region. The Latin America market is projected to reach USD 4.21 billion by 2026.

Middle East & Africa

The Middle East & Africa represents a strategically significant offshore drilling region, supported by its critical role in global oil & gas supply. Offshore drilling remains essential for sustaining export-driven economies, particularly amid rising global energy demand. Countries across the Middle East and West Africa are investing in offshore field development to maintain production capacity and economic stability. Recent contract awards underscore this momentum; for example, Saipem secured offshore drilling contracts worth approximately USD 800 million across the Middle East and West Africa in November 2022, reflecting continued capital inflows into offshore projects. The Middle East & Africa market is projected to reach USD 10.88 billion by 2026.

North America

North America remains a mature and technologically advanced offshore drilling market, led by the U.S. and Mexico, with significant activity in the Gulf of Mexico. Growth is supported by continued investment in deepwater drilling, subsea infrastructure upgrades, and enhanced recovery techniques. The region benefits from strong regulatory frameworks, established offshore service ecosystems, and the adoption of digital drilling solutions to improve operational efficiency and cost optimization. The North America market is projected to reach USD 3.10 billion by 2026.

Europe

Europe’s offshore drilling market is driven by sustained exploration and redevelopment activities in the North Sea, primarily across the UK and Norway. The region focuses on maximizing output from mature offshore fields through enhanced oil recovery (EOR), well intervention, and redevelopment drilling. Additionally, Europe’s emphasis on energy security, amid declining onshore reserves, continues to support selective offshore investments despite growing renewable energy integration. The Europe market is projected to reach USD 9.87 billion by 2026.

Key Industry Players

Transocean Dominated with its Focus on Solid Operational Execution and Technical Capabilities

Transocean’s primary business is contract drilling services in a single operating segment, which involves contracting its mobile offshore drilling rigs, related equipment, and work crews to drill oil and gas wells. It specializes in technically demanding regions of the global drilling business with a particular focus on ultra-deepwater and harsh environment drilling service.

- In February 2022, Transocean owned or had partial holding interests in and operated a fleet of 37 mobile offshore drilling units comprising 10 cruel environment floaters and 27 ultra-deepwater floaters. As of February 14, 2022, they are building two ultra-deepwater drillships.

LIST OF TOP OFFSHORE DRILLING COMPANIES:

- Saipem S.p.A (Italy)

- Maersk Drilling (Denmark)

- Nabors Industries Ltd (U.S.)

- KCA Deutag (U.K.)

- Transocean (Switzerland)

- Seadrill (Bermuda)

- Valaris plc (U.K.)

- Odfjell Drilling (U.K.)

- Pacific Drilling (U.S.)

- Borr Drilling (Bermuda)

- Diamond Offshore Drilling, Inc. (U.S.)

- Noble Drilling (U.K.)

- COSL – China Oilfield Services Limited (China)

- Shelf Drilling (UAE)

- Archer Well Company (Bermuda)

KEY INDUSTRY DEVELOPMENTS:

- July 2022, IIT Madras has developed an indigenous life cycle management system for the Oil and Natural Gas Corporation (ONGC) to reduce the cost of maintenance and rehabilitation of offshore oil platforms.

- April 2022, Saipem was awarded two contracts in the Middle East for two high-specification jackup drilling units, comprising workover and drilling operations for five years. These projects will comprise a new high-specification jackup chartered from CIMC Group and one Saipem jackup unit for the project. The project is scheduled for the fourth quarter of 2022.

- March 2022, Nabors Industries Ltd. invested USD 8 million in GA Drilling. This strategic investment expands Nabors' pledge to deep drilling technologies to develop super-hot, ultra-deep rock reservoirs. In addition, Nabors continued to implement its energy transition strategy, aiming for low-carbon energy markets with excellent growth potential. Through its investments in several clean energy companies, Nabors has begun to build multiple ecosystems of complementary technologies that can benefit from synergies with Nabors' existing operations and capabilities.

- January 2022, Saipem was awarded two new offshore contracts in Australia and Guyana for a total of USD 1.1 billion. The contract is related to the Engineering, Procurement, Construction, and Installation (EPCI) of the subsea Umbilicals, Risers, and Flowlines (SURF).

- December 2021, Petrogas North Sea Ltd. and Maersk Drilling decided to exercise the previously agreed exclusive option to deploy the harsh-environment jackup rig Maersk Resilient to drill an appraisal well at the Birgitta field in the North Sea, UK sector.

REPORT COVERAGE

The research report highlights leading regions to offer a better understanding of the competitive landscape. Furthermore, the market research report provides insights into the latest industry trends and analyzes technologies that are being deployed at a rapid pace at a global level. It further highlights some of the growth-stimulating factors and restraints, helping the reader to gain in-depth knowledge about the industry.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.87% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Rig Type

|

|

By Water Depth

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 43.78 billion in 2025 and is projected to reach USD 87.50 billion by 2034.

In 2025, Asia Pacific market value stood at USD 18.11 billion.

The market will likely exhibit a CAGR of 7.87%, exhibiting substantial growth during the forecast period of 2026-2034.

Transocean, Valaris PLC, China Oilfield Services Limited, Seadrill, Maersk, Diamond Offshore Drilling. Inc., and Saipem are key players in this market.

Asia Pacific dominated the market in terms of share in 2025.

The jackups segment is anticipated to dominate this market during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us