Online Trading Platform Market Size, Share & Industry Analysis, By Type (Commissions and Transaction Fees), By Interface Type (Desktop, Web-based, and Mobile App based), By End-Users (Banking and Financial Institutions Investors, Retail Investors, Brokers, and Others), and Regional Forecast, 2026-2034

Online Trading Platform Market Size & Share

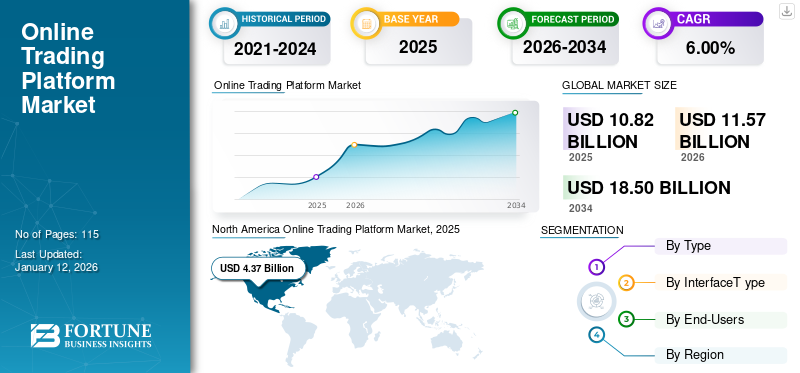

The global online trading platform market size was valued at USD 10.82 billion in 2025. The market is projected to grow from USD 11.57 billion in 2026 to USD 18.50 billion by 2034, exhibiting a CAGR of 6.00% during the forecast period. North America dominated the global market with a share of 40.30% in 2025. Additionally, the U.S. online trading platform market is predicted to grow significantly, reaching an estimated value of USD 4,300.3 million by 2032.

An online trading platform is a software platform used to monitor live market prices and accordingly assist the user in performing the activity of selling, buying, and holding the stock. Trading platforms include trading services, such as trading in bonds, international currencies, stocks (shares), and other financial tools. The market for online trading platforms and solutions assists banks, traders, and individual brokers in evaluating the financial market opportunities and eliminating risk factors.

The increasing demand for customized trading platforms from end-users, such as government and non-profitable banks, is anticipated to drive the demand for these solutions. Technological advancements and the integration of trading platforms on smartphones are a few major factors expected to create various market opportunities for key players. In addition, companies in the market are focused on expanding their business units across the globe. For instance,

- In January 2024, NFTFN launched a perpetual trading platform for Ordinals and Inscriptions in the realm of Bitcoin NFTs. The company aimed to create opportunities for active engagement within the rapidly expanding digital asset ecosystem.

The COVID-19 pandemic triggered social stress and led to economic disruptions across the globe. With the closure of production facilities and manufacturing units around the globe, the unemployment rate also increased in several countries. The World Trade Organization (WTO) forecasted a drop in foreign trade between 13% and 32% during the pandemic. This significant decline in global trade volumes highlighted the interconnected nature of economies and supply chains globally. Furthermore, the pandemic exposed vulnerabilities in the existing trade systems, prompting calls for diversification and localization of supply chains to mitigate similar risks in the future.

- The S&P 500 index dropped by around 20% in just over three weeks and then dropped another 30% in a record 30 days.

- The Euro STOXX 50 index fell at its fastest pace in history.

- Similarly, in 2020, from February 20th to March 9th, the 10-year U.S. Treasury note yield declined from 1.52% to 0.54%.

IMPACT OF GENERATIVE AI

Enhanced Market Prediction and Decision-making to Boost the Integration of Generative AI

Generative AI has modernized online trading platforms by deploying sophisticated algorithms capable of analyzing vast datasets to predict market trends with unprecedented accuracy. These AI-driven systems employ advanced techniques such as recurrent neural networks and generative adversarial networks to stimulate market scenarios, enabling traders to make informed decisions in real-time. By leveraging generative AI, online trading platforms have witnessed enhanced efficiency, reduced risks, increased automation, and increased profitability, empowering investors to navigate volatile markets with greater agility.

Online Trading Platform Market Trends

Platforms Supporting NFT and Cryptocurrency Trading to be an Emerging Trend

The surge in popularity of Non-Fungible Tokens (NFTs) and the continuous growth of the cryptocurrency market has given rise to the development and widespread adoption of platforms dedicated to NFT and crypto trading. These platforms serve as digital marketplaces where users can buy, sell, and trade NFTs and several cryptocurrencies. By leveraging blockchain technology, these platforms ensure transparent and secure transactions by recording them on a decentralized ledger, providing users with immutable proof of ownership. For instance, in December 2023, Robinhood expanded its crypto services to the European Union, enabling users to trade over 25 digital currencies. The company is set to open a waitlist for stock trading in early 2024, aligning with the growing opportunities of U.S.-based crypto firms.

Another aspect that is driving the trend is the integration of smart and self-executing contracts with the terms of the agreement directly written into code. In addition, the use of decentralized finance protocols on these platforms enhances liquidity and enables users to participate in financial activities, such as lending and borrowing, directly within the ecosystem.

Download Free sample to learn more about this report.

Online Trading Platform Market Growth Factors

Artificial Intelligence Powered Market Insights to Drive the Adoption of Trading Platforms, Fuelling the Market Growth

Artificial Intelligence (AI) is expected to transform the future of online trading platforms. Companies are deploying AI in their trading platforms in the form of robo-advisors. The platform enables analysts to study the market with high precision and helps trading firms efficiently mitigate risks to provide higher returns. Some of the companies that have implemented AI and its applications with their trading platforms include:

- Tracxn Technologies (Epoque Plus)- Epoque’s completely automated AI trading comprises three engines powered by AI, including a strategy engine that analyzes potential trades, an order engine that performs operational actions, and an active engine that uses machine learning to improve its performance.

- Kavout Corporation, Seattle, Washington – Kavout, an AI platform, uses predictive analytics, big data, and machine learning coupled with the company’s Kai quantitative analysis model. The platform helps traders and users identify potential short-term winners and losers in the stock market.

RESTRAINING FACTORS

Stringent Rules and Regulations May Impede the Adoption of Online Trading Platforms

Online trading software businesses are extensively regulated by government rules, foreign regulatory agencies, self-regulatory organizations, and numerous exchanges. Vendors must comply with regulatory and compliance functions. Similarly, to conduct customer activities, these vendors are obliged under certain rules mandated by primary regulators. The inability to do so may result in penalties to the vendor. Furthermore, the lack of awareness about the solutions across developing nations may hamper the online trading platform market growth in the near future.

Online Trading Platform Market Segmentation Analysis

By Type Analysis

Enhanced Trader Participation and Transparency to Boost the Commissions Segment Growth

Based on type, the market has been bifurcated into commissions and transaction fees.

Among them, the commissions segment is anticipated to hold the largest market share of 66.15% in 2026. Commissions provide clarity and transparency for traders enabling them to easily understand and predict their trading costs. It also enhances the trust and participation in the platform. Thus, these factors are poised to lead to the commissions segment growth.

The transaction fees segment is expected to grow substantially during the forecast period. Transaction fees involve charging a fee for every transaction made within the platform, including buying and selling securities. These models are driven by the increasing implementation of subscription-based models and the rise of digital assets.

By Interface Type Analysis

High Demand for Downloadable Trading Platforms to Propel the Desktop Segment Expansion

Based on interface type, the market for online trading platform has been segmented into desktop, web-based, and mobile app based.

Among them, the desktop segment is predicted to capture the largest market share of 48.64% in 2026. The growth is due to the increasing demand for downloadable trading platforms through which traders can scan and edit online trading positions with the help of graphs and other indicators. Desktop platforms offer more comprehensive analytical tools and customization options, making them the preferred choice for professional traders and investors. Moreover, the availability of powerful computing resources and larger screen sizes, enhances the overall trading experience, contributing to its dominance in the market.

The mobile app based segment is expected to grow substantially during the forecast period. Growing usage of smartphones and adoption of media devices and social media platforms helps boost the demand for mobile app based trading platforms. This factor is anticipated to enhance the online trading market growth in the mobile app based trading platform segment.

By End-users Analysis

To know how our report can help streamline your business, Speak to Analyst

Banking and Financial Institutions Investors Segment to Lead Due to Growing Adoption of Customer-made Trading Software Deployment

Based on end-users, the market is divided into banking and financial institutions investors, retail investors, brokers, and others.

The banking and financial institutions investors segment is anticipated to hold the largest online trading platform market share of 37.33% in 2026. The segment's growth is mainly due to the surging adoption of customer-made trading software deployment across banking and financial institutions. These institutions require robust and scalable trading platforms to handle large volumes of transactions and cater to the diverse needs of their clients, ranging from individual investors to institutional clients. Additionally, the increasing focus on digitalization and providing seamless online trading experiences have prompted banks and financial institutions to invest heavily in advanced online trading platforms, further driving its growth.

- For instance, in January 2024, Emirates Islamic introduced a Shariah-compliant digital wealth and equity trading platform on its EI+ mobile banking application. This platform enabled consumers to manage their investments by trading in Shariah-compliant equities across local and international markets, providing a comprehensive view of their investment portfolio.

The broker segment is projected to display a significant growth rate during the forecast period. This is attributed to the escalating implementation of cloud-based trading solutions across broker firms to advance an in-depth analysis of threats and lessen complexity.

REGIONAL INSIGHTS

The geographies covered in this study include North America, South America, Europe, the Middle East & Africa, and the Asia Pacific. These regions are further categorized into several dominating countries.

North America Online Trading Platform Market, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America is expected to dominate the market during the forecast period. The growth in the region is mainly owing to the presence of major players, such as ETNA, EffectiveSoft Ltd., Artezio LLC., TD Ameritrade Holding Corporation, Chetu Inc., and others. In addition, key players in the market are planning to expand their business presence globally. The U.S. market is projected to reach USD 3.18 billion by 2026.

Europe

Europe market for online trading platform is expected to grow with a significant CAGR during the forecast period. Private banking institutions in countries such as France, Germany, Italy, Spain, Benelux, and others are highly investing in the adoption of electronic trading platform solutions. Moreover, key players in the market are planning to develop an advanced trading platform. The UK market is projected to reach USD 0.46 billion by 2026, while the Germany market is projected to reach USD 0.53 billion by 2026. For instance,

- In November 2023, goodcryptoX utilized Ethereum’s account abstraction feature to offer users advanced trading features and a smooth user interface. The DeFi and centralized exchanges leveraged trust-less networks to bypass intermediaries and construct diverse portfolios.

Asia Pacific

The Asia Pacific is amongst the fastest-growing regions in the market. Banking and financial institutions in countries such as Japan, China, India, Oceania, South Korea, and Southeast Asia are increasing their investments to adopt customized trading platform solutions. These countries have a wide number of providers of electronic trading platform solutions and services. Furthermore, governments and enterprises in countries such as Japan, South Korea, and Oceania are also encouraging the adoption of cryptocurrency. The adoption of cryptocurrency would assist in creating various market opportunities for key players in the upcoming years. The Japan market is projected to reach USD 0.4 billion by 2026, the China market is projected to reach USD 1.45 billion by 2026, and the India market is projected to reach USD 0.61 billion by 2026.

South America and the Middle East & Africa

South America and the Middle East & Africa (MEA) are projected to exhibit stable growth during the forecast period. Companies in these regions have started focusing on developing trading platform solutions for the diverse banking and financial industries.

Key Industry Players

Key Players Develop Innovative Trading Platform Solutions to Strengthen Their Positions

The competitive landscape of the online trading platform market is moderately fragmented, with the presence of well-known brands, along with some regional and local players. TD Ameritrade Holding Corporation, Interactive Brokers, E-TRADE, Chetu Inc., Ally Financial Inc., Merrill Edge, and Plus500 are the prominent players in the global market. In addition, key players in the market are deploying trading platform solutions with advanced technologies, such as AI, cloud, and others, to advance their products and offer cutting-edge solutions. They aim to make high investments in R&D, mergers & acquisitions, and enhanced procurement processes in the case of software services.

List of Top Online Trading Platform Companies:

- Td Ameritrade Holding Corporation (U.S.)

- Interactive Brokers (U.S.)

- E-TRADE (U.S)

- Profile Software (U.K.)

- Chetu Inc. (U.S.)

- Empirica (Poland)

- Pragmatic Coder (Poland)

- EffectiveSoft Ltd. (U.S.)

- Rademade Technologies (Estonia)

- Devexperts LLC (Germany)

KEY INDUSTRY DEVELOPMENTS:

- December 2023 – CFI introduced its AI Trading Assistant, enhancing online trading for new users. This initiative followed the launch of Capitalise AI, enabling traders to automate trading strategies without requiring advanced development skills, empowering them through AI technology.

- November 2023 – TD Direct introduced TD Active Trader, offering advanced features for trading U.S. securities and option strategies. Its cloud-based infrastructure provided a streamlined trading experience with innovative charting capabilities and customizable workspaces.

- November 2023 – Devexperts collaborated with FX Blue to offer turnkey trading solutions for CFDs and spread-betting brokers, combining DXTrade’s backend infrastructure with FX Blue’s mobile and web-based interfaces to enhance the trading experience. It also offered fast cross-border connection and stability for Forex traders operating globally.

- October 2023 – Multi Commodity Exchange of India (MCX) launched its web-based commodity derivatives platform after receiving approval from SEBI. Changes for the members included the ability to access the new front-end setup, including the MCX Member Control station and Trade Station.

- April 2023 – Twitter (X) partnered with eToro to offer users real-time information on several investments, including stocks, commodities and cryptocurrencies, directly on the microblogging platform. It enabled users to access eToro’s trading platform from Twitter, integrating social media with financial services.

REPORT COVERAGE

The research report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product types, and leading product applications. Besides this, it offers insights into the key online trading platform market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the advanced market over recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 6.00% from 2026 to 2034 |

|

Segmentation |

By Type

By Interface Type

By End-Users

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value is poised to reach USD 18.50 billion by 2034.

In 2026, the global market was valued at USD 11.57 billion.

The market is expected to grow at a CAGR of 6.00% during the forecast period (2026-2034).

By end-users, the banking and financial institutions investors segment is expected to lead the market during the forecast period.

Artificial Intelligence (AI) powered market insights are expected to drive the adoption of trading platforms, boosting the market growth.

TD Ameritrade Holding Corporation, Interactive Brokers, E-TRADE, Chetu Inc., Ally Financial Inc., Merrill Edge, and Plus500 are the top players operating in the market.

North America dominated the global market with a share of 40.30% in 2025.

By type, the transaction fees segment is expected to grow substantially during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us