Organic Edible Oil Market Size, Share & Industry Analysis, By Type (Palm Oil, Soybean Oil, Rapeseed Oil, Sunflower Oil, Olive Oil, Coconut Oil, and Others), By Distribution Channel (Supermarket/hypermarket, Specialty Stores, Convenient Stores, Online Retail Stores, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

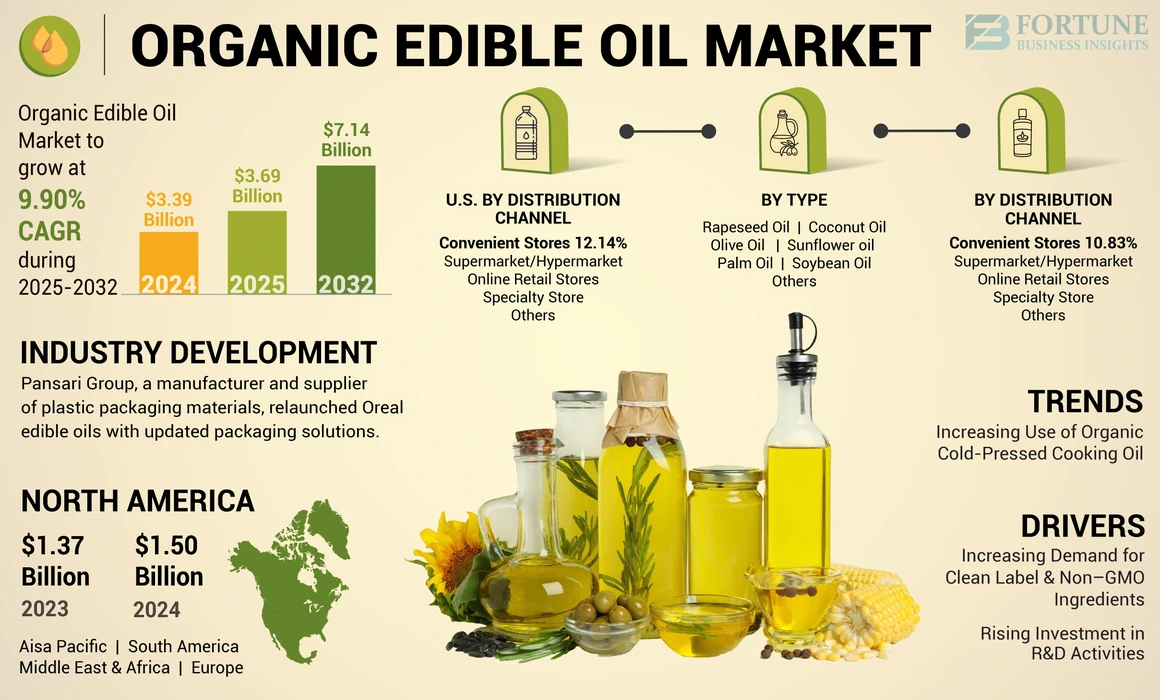

The global organic edible oil market size was valued at USD 3.39 billion in 2024. The market is projected to grow from USD 3.69 billion in 2025 to USD 7.14 billion by 2032, exhibiting a CAGR of 9.90% during the forecast period. North America dominated the organic edible oil market with a market share of 40.41% in 2024. Moreover, the organic edible oil market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 3.18 billion by 2032, driven by growing consumer inclination towards organic food due to their health benefits, coupled with increasing agricultural area under organic oilseed production.

Consumer demand for organic food ingredients is surging globally, and their acceptance from different end-use sectors, including food processing, food service, and household is likely to propel market growth of organic edible oil. Consumers' increasing health and environmental consciousness primarily drive market expansion. To cater to the rising product demand, various oil manufacturing companies are expanding their product range. For instance, in October 2022, Vitamin Cottage Natural Food Markets, Inc., a Colorado-based health food chain, expanded its house brand with organic extra virgin unrefined coconut oil. The product is USDA Organic certified and used for sautéing and baking. The product contains medium-chain fatty acids and is beneficial for brain and immune system function, and is available at affordable prices for health-conscious consumers. The product is ideal for salads, marinades, stir-frying, and sautéing. Furthermore, the rising income level of consumers, enhancement in the standard of living, and rapid urbanization are factors supporting the global organic edible oil market growth.

The COVID-19 pandemic impact increased consumer awareness more toward nutrition and health. Diet and immunity were the major drivers for changing consumers' shift toward healthy foods. As a result, organic food became the most preferred option for consumers. The pandemic led people to prepare food regularly at home due to travel bans and changing food hygiene and diet.. For instance, according to the Global Organic Trade, organic packaged food consumption in India increased from USD 11.1 million in 2019 to USD 11.8 million in 2020. A surge in demand for more sustainable and organic foods simultaneously reflected the increased demand for organic edible oil.

Organic Edible Oil Market Snapshot & Highlights

Market Size & Forecast:

- 2024 Market Size: USD 3.39 billion

- 2025 Market Size: USD 3.69 billion

- 2032 Forecast Market Size: USD 7.14 billion

- CAGR: 9.90% from 2025–2032

Market Share:

- North America dominated the organic edible oil market with a 40.41% share in 2024, driven by growing consumer preference for organic food products due to health benefits and an expanding area under organic oilseed cultivation.

- By type, soybean oil is expected to retain the largest market share in 2025, supported by the abundant availability of organic soy and its versatility in cooking applications such as sautéing, baking, frying, and roasting.

Key Country Highlights:

- U.S.: Market projected to reach USD 3.18 billion by 2032, driven by rising demand for clean-label, non-GMO, and organic ingredients, as well as a growing area under organic oilseed cultivation (83,883 hectares in 2019).

- India: Rising consumption of organic packaged food (USD 11.8 million in 2020 vs. USD 11.1 million in 2019) and health-driven dietary shifts post-COVID-19 pandemic support market growth.

- Australia: Infrastructure investments, such as Daabon Organic Australia’s vegetable oil refinery, are enhancing domestic supply of organic oils and improving product quality.

- Germany & Italy: Strong consumption of organic olive and rapeseed oil in cooking, salads, dressings, and margarine production is driving market growth in Europe.

- Brazil & Argentina: Expanding organic farming and partnerships (e.g., UPL, Bunge Ltd acquiring 40% of SEED CORP HO) support regional production and availability of organic edible oils.

Organic Edible Oil Market Trends

Increasing Use of Organic Cold-pressed Cooking Oil Positively Impacted Market Proliferation

As consumers opt for healthy cooking oil, which supports long-term well-being, the demand for organic cooking oil is witnessing a surge in the global market. Organic cold-pressed oils are high in antioxidants and omega-3 and omega-6 fatty acids. These oils help burn the stored fat, which helps promote healthy thyroid function. These oils also help improve heart health and protect against cell damage. The flavor and aroma of these oils are not lost due to heat during extraction, which thus gives a distinct flavor to cold-pressed oils. The rise in acceptance of organic cold-pressed oils in the market will positively contribute to the expansion of the global market size.

Download Free sample to learn more about this report.

Organic Edible Oil Market Growth Factors

Increasing Demand for Clean Label and Non–GMO Ingredients to Boost Market Proliferation

Consumers are becoming health-conscious and favoring natural foods over artificial ones. Consumers are conscious about the food they consume and understand its importance in leading a healthy lifestyle. Clean-label products exhibit the list of ingredients used to produce final product clearly, and it is perceived that these products may not contain additives, artificial ingredients, or genetically modified organisms and are not over-processed. Therefore, to cater to the rising demand for organic, clean-labeled, and preservative-free foods, companies are introducing new products in the market. For instance, in March 2020, Nutiva Inc, a U.S.-based organic plant-based food, supplements, and body care products company, launched a new line of organic avocado oils. The new products were made available in three variants, Organic 100% Pure Avocado Oil, Organic MCT Oil Blend Avocado Oil, and Organic Extra Virgin Avocado Oil. The new non-GMO certified organic edible oils claim they are made without chemicals and have USDA organic and vegan certificates. These products are specially produced for edible purposes such as table top, dressings, and sauces.

Rising Investment in R&D Activities to Aid Market Escalation

The product demand is increasing significantly in developed as well as developing countries, which creates an ample opportunity for the industry players to develop new products within this category. Several companies operating in the industry are launching novel products to expand their market positions. It is one of the driving factors to elevate the market in the upcoming years. For instance, in October 2022, Single & Fat, an olive oil food brand for modern consumers, launched the USDA-certified organic extra virgin olive oil. The product is ideal to be used in cooking and it is harvested and sourced using sustainable practices. Some countries are developing plans to reduce their reliance on imports and increase self-sufficiency in edible oil production, including organic oil.

RESTRAINING FACTORS

High Price of Products to Impede Market Growth

Organically cultivated food products are generally more expensive than their conventional counterparts, mainly due to limited supply compared to demand. The product's raw materials are made from organic agricultural products, which require high maintenance. The product's high price forces some low and middle-class income households to opt for conventional cooking oil, hampering the market's growth. Lack of strong quality control can impact the quality of organic edible oils sold in the market. A recent study published in the BMC Public Health in 2024 shows that industrially produced vegetable oils can contain high traces of cadmium, lead, iron, arsenic, zinc and other toxic elements. Hence, manufacturers must improve their production and quality control processes to ensure their products are safe for consumption.

Organic Edible Oil Market Segmentation Analysis

By Type Analysis

Soy Oil Segment to Lead the Market Owing to Rising Area Under Organic Soy Production

By type, the market is categorized into palm oil, soybean oil, rapeseed oil, sunflower oil, olive oil, coconut oil, and others. The soybean oil segment is anticipated to account for a significant market proportion of the global market share. The abundant availability of organic soy is the major factor supporting the segment growth. According to the FiBL survey 2022, organic oilseeds had grown on almost 578,000 hectares in Asia, which is around 32.7% of world’s organic oilseeds area, in which organic soybean production accounted for 74% of total organic oilseeds area in Asia Pacific. Soybean oil contains a high amount of Omega-6 fats and mostly consists of polyunsaturated fatty acids. The oil contains a high proportion of vitamin K, which helps regulate bone metabolism. It has a neutral and mild taste, which lets the real taste of the food come through. Soy oil has a high smoke point of about 450°F, and this versatile quality of the oil makes its major application in cooking, including sautéing, baking, frying, and roasting. Several prominent/key players in the oil manufacturing industries offer organic oils in their product portfolio due to increased consumer preference for organic oils. For instance, in March 2021, Protein Industries Canada, one of the leading plant protein companies, invested in new partnerships with DJ Hendrick International, Semences Prograin, Agrocorp Processing, Synthesis Network, and Ingrédients Protéiques du Canada. The aim of these partnerships is to develop soybean protein ingredients and soybean oil with non-GMO and organic labeling standards.

By Distribution Channel Analysis

To know how our report can help streamline your business, Speak to Analyst

One-stop Shopping Experience to Propel Product Sales from Supermarkets/Hypermarkets

By distribution channel, the market is categorized into supermarkets/hypermarkets, specialty stores, convenience stores, online retail stores, and others. Supermarkets/hypermarkets hold the largest market share, as they offer a range of brands and product varieties in a single place. High convenience in the shopping experience is the major factor driving the demand for supermarkets. Consumers get a plethora of food options in one place. The emergence of private-label brands and the modernization of grocery stores help drive sales of food products from supermarkets.

Online retail stores are projected to grow at a high CAGR in the forecast period. The pandemic is reshaping the consumer's buying behavior and aiding in adopting online shopping among individuals. The mobile e-commerce service provides consumers with increased accessibility, competitive pricing, and customization, which is driving the product sales from online retail stores.

REGIONAL INSIGHTS

North America Organic Edible Oil Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is currently the leading market, and is projected to account for a significant share in the market during the forecast period. Americans’ appetite for organic foods has been growing steadily over the past few decades. People’s health concern is a major driver of increased organic food consumption. Larger number of individuals believe organically produced products are healthier than conventionally produced ones. Furthermore, the abundant availability of raw materials due to the rising area under organic oilseed cultivation across North American countries is likely to support the steady growth of the regional market in the coming years. According to the Research Institute of Organic Agriculture (FiBL), in the U.S., the organic oilseed production area increased from 61,164 hectares in 2017 to 83,883 hectares in 2019.

Consumers in the U.S. tend to purchase packaged organic foods as they are considered premium products in the region. The consumption of organic food has been increasing in the region due to its characteristics. Furthermore, several regional organic edible oil players adopted strategies such as mergers and acquisitions, investments, and others to meet the increasing demand for organic products. For instance, in December 2020, B&G Foods, an American-branded foods company, acquired the Crisco brand from The J. M. Smucker Co. The company also acquired a manufacturing facility and a warehouse in Cincinnati, Ohio, which helped to expand its organic edible oil product portfolio.

To know how our report can help streamline your business, Speak to Analyst

The market in Asia Pacific is expected to grow at a speedy pace owing to rising consumer awareness of organic products, rising availability of organic products on retail shelves, and increasing individuals earning capacity. Furthermore, there is rising consumer preference for healthy cooking oils, especially organic sunflower oil. The oil contains a high amount of oleic acid and is rich in Omega-3 and a lower amount of Omega-6 fatty acids. Polyunsaturated Fatty Acids (PUFAs) reduce cholesterol and triglycerides in the blood and are thus used in major food industries. Several regional players use new technologies to meet the increasing demand for the product in the region. For instance, in March 2019, Daabon Group, one of the leading producers of organic ingredients, announced building an organic vegetable oil refinery in Australia - Daabon Organic Australia. The refinery has the capability of single-processing oils and special blends. The quality of oils is ensured with constant monitoring of the in-house laboratory, allowing multiple tests and developing new techniques. Global economic uncertainty caused by the long-term effect of the COVID-19 pandemic and the geopolitical conflicts in Europe are affecting the supply chain and global trade. Hence, countries dependent on imports suffer due to supply chain constraints. For instance, the Russia-Ukraine war impacted India's export of sunflower oil from Ukraine in 2022.

Europe is one of the rising markets that contributes considerable revenue to the global market of organic edible oil. Europe is one of the major consumers of organic rapeseed/canola oil. It is mainly used in cooking and salads and serves as the main component in margarine, mayonnaise, and dressings. Furthermore, the growing popularity of extra virgin olive oil drives market expansion. The Mediterranean oil pressed from olives is considered a healthy fat for maintaining a balanced lifestyle. Organic olive oil contains antioxidant properties, aids in weight loss, and is rich in vitamin E. Thus, major consumption of organic olive oil boosts the demand for the product in the region.

The market in South America is predicted to grow at a crucial pace owing to the constantly expanding organic farming in countries such as Brazil and Argentina. Several regional competitors adopt strategies such as acquisitions, mergers, investment in R&D, and others to sustain themselves in the market. For instance, in November 2022, United Phosphorous Ltd, UPL’s Advanta seeds and Bunge Ltd, announced the acquisition of a combined 40% stake in SEED CORP HO. Through the acquisition, Bunge Ltd intended to expand its barter portfolio to reinforce its grain sourcing position in Brazil, which helped meet the demand for organic edible oil in the region.

List of Key Companies in Organic Edible Oil Market

Rising Product Demand is Encouraging Companies to Expand Product Portfolio

Growing demand for organic foods has brought significant changes in markets and the supply chain. Organic retailers, manufacturers, and distributors face constant challenges from their conventional food counterparts. Organic products which do not contain preservatives, partially hydrogenated or hydrogenated oil, and artificial flavors are always in demand. Thus, companies develop products to meet the increasing demand for such organic products. For instance, in February 2021, Pompeian, Inc., a company offering a line of olive oil products, expanded its olive oil portfolio with new product innovation. The innovation includes Pompeian organic smooth extra virgin olive oil with two varieties, smooth and robust.

LIST OF KEY COMPANIES PROFILED:

- Cargill Inc (U.S.)

- Nutiva (U.S.)

- Catania Spagna (U.S.)

- EFKO Group (Russia)

- Aryan International (India)

- Adams Group (Canada)

- Daabon Organic (Australia)

- NOW Foods (U.S.)

- B&G Foods, Inc. (U.S.)

- Viva Naturals (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- November 2023: U.K.-based oil manufacturer KTC (Edibles) launched new palm oil in the U.K. market. The company partnered with sustainable agricultural company DAABON to develop new organic palm oil products.

- October 2022: Natural Grocers, an American family-operated organic and natural grocery retailer, expanded its product offerings by adding Organic Extra Virgin Unrefined Coconut Oil to its product line. It is available in three different sizes such as 17.5 oz, 32 oz, and 48 oz.

- June 2022: Pansari Group, a manufacturer and supplier of plastic packaging materials, relaunched Oreal edible oils with updated packaging solutions. The company engages in manufacturing organic edible oils. The new product is cold-pressed and has some significant packaging changes, including virgin food-grade packing material, a larger label for clear health claims, and the bottle’s mouth has also been widened to facilitate oil pouring.

- March 2022: Bunge Limited, an American agribusiness and food company, partnered with the European Bank for Reconstruction and Development (EBRD) and received a long-term loan from the bank of USD 50 million. The EBRD and Bunge partnered in sustainability projects to develop certified organic olive production in Turkey and analyze the climate change resilience of the olive supply chain.

- April 2020: Nutiva, a U.S.-based plant-based organic foods company, launched two new organic liquid coconut oils available in classic and garlic options. The new products are ideal for cooking, sautéing, and baking up to 350°F. The new products are USDA Certified Organic and Non-GMO Project Verified liquid oils extracted from fresh organic coconuts.

- February 2020: QNET, one of Asia’s leading direct-selling companies, launched a new product Nutriplus Virgin Coconut Oil (VCO), under their health and wellness product category. The new product is unrefined, cold-pressed, and sourced from high-quality organic coconuts. The products have multipurpose uses, including cooking, and address many hair and skin problems.

REPORT COVERAGE

The research report provides qualitative and quantitative insights into the market and a detailed analysis of the global market share, market size, market segmentation, and growth rate for all possible segments in the market. The report also provides an elaborative industry analysis of different countries’ markets. The report provides various key insights, the overview of related markets, market dynamics, SWOT analysis, recent industry developments such as mergers & acquisitions, regulatory scenario in key countries, key organic edible oil market trends, and the competitive landscape.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 9.76% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Distribution Channel

|

Frequently Asked Questions

Fortune Business Insights says that the global market was USD 3.39 billion in 2024.

Growing at a CAGR of 9.90%, the market will exhibit robust growth during the forecast period (2025-2032)

The soybean oil segment is expected to hold a significant share in the forecast period.

Increased awareness of clean-label and non-GMO food products is expected to drive the growth of the global market.

Cargill Inc., EFKO Group, Catania Spagna, NOW Foods, and Nutiva are some of the top players in the market.

North America is expected to hold the highest market share in the global market.

The supermarket/hypermarket segment is expected to hold the dominant share in the global market.

The rapidly increasing consumers concerns regarding health & environment and increasing export to various countries are the key trends driving the market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us