Peaking Power Plant Market Size, Share & COVID-19 Impact Analysis, By Type (Natural Gas, Hydropower, Diesel, and Others), By End-User (Industrial, Commercial, Residential, and Utility), and Regional Forecast, 2026-2034

Peaking Power Plant Market Size

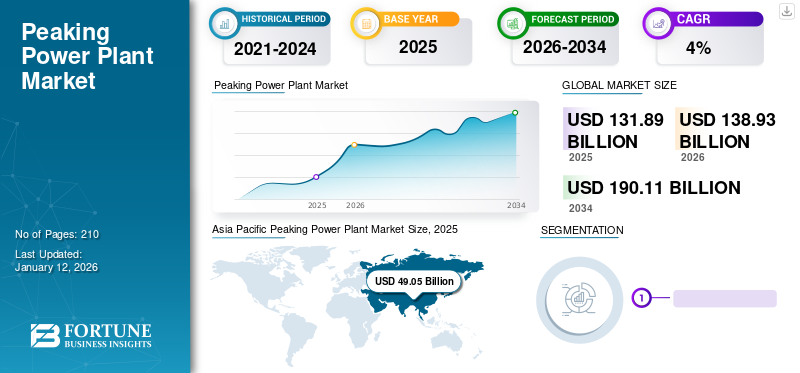

The global peaking power plant market size was valued at USD 131.89 billion in 2025 and is projected to grow from USD 138.93 billion in 2026 to USD 190.11 billion by 2034, exhibiting a CAGR of 4% during the forecast period. Asia Pacific dominated the global market with a share of 37.19% in 2025. The Peaking power plant market in the U.S. is projected to grow significantly, reaching an estimated value of USD 42.30 billion by 2032.

A peaking power plant also known as peaker plant is a type of power generation facility designed to provide electricity during periods of high demand, known as peak demand. These plants are typically used to meet short-term spikes in electricity consumption, which often occur during certain times of the day or in specific seasons. Peaking-based power plants are characterized by their ability to quickly start up and ramp up production to supply electricity during peak demand periods. They are often equipped with technologies that allow them to respond rapidly to changes in demand, ensuring a reliable power supply during times when the regular baseload power plants may not be sufficient.

COVID-19 IMPACT

Supply Chain Disruptions Caused by COVID-19 Hampered Market Growth

The pandemic disrupted manufacturing processes globally. Many countries experienced factory closures, reduced workforce availability, and interruptions in the production of components critical to peaker plants. This led to delays in acquiring turbines, generators, control systems, and other essential equipment. The peaking power plant industry often relies on a global network of suppliers for specialized components. Restrictions on international travel and trade made it challenging to coordinate and receive shipments, contributing to project delays and increased costs. Lockdowns and travel restrictions affected the transportation of heavy and oversized components required for peaker plants. These logistical challenges slowed down the delivery of equipment to project sites, further impeding construction timelines.

Peaking Power Plant Market Trends

Increasing Integration of Energy Storage Technology to Enhance Market Growth

The peaker plants are designed with integrated energy storage systems, such as batteries. This allows them to store excess energy during periods of low demand and discharge quickly during peak demand, providing a more flexible and responsive solution to grid fluctuations. The trend is aligned with the broader push toward cleaner energy. By combining peaker plants with energy storage, there is potential for better integration of renewable energy sources, addressing the challenge of variability and intermittency associated with wind and solar power.

Download Free sample to learn more about this report.

Peaking Power Plant Market Growth Factors

Emerging Technologies to Play a Key Role in Boosting Market Growth

Emerging technologies are expected to play a key role in the expansion of the market. Some key emerging technologies are likely to impact the peaking power plant market growth. Continued advancements in battery technologies enhance the energy storage capabilities of peaker plants. Improved energy density, longer cycle life, and faster response times contribute to greater flexibility in managing peak demand.

Fluctuations in Electricity Demand is Boosting Market Growth

Electricity demand varies significantly throughout the day due to factors, such as waking hours, work schedules, and domestic activities. Peaking power plants are designed to meet the highest points of this daily demand, ensuring a reliable supply during periods of increased consumption, often referred to as peak hours. Seasonal variations, influenced by factors, such as weather conditions, also impact electricity demand. Peaking power plants play a crucial role during seasons with heightened energy consumption, such as summer or winter, when Heating, Ventilation, and Air Conditioning (HVAC) systems are in high demand.

RESTRAINING FACTORS

Transition to Cleaner Energy Sources to Restrict Market Growth

The increasing adoption of renewable energy sources, such as wind and solar, is altering the dynamics of the energy market. These renewable sources, along with advancements in energy storage technologies, offer alternatives for meeting peak demand without relying on traditional peaking power plants. Renewable energy sources, while clean, often exhibit intermittency and variability. The growth of energy storage solutions and advancements in grid management technologies are helping address these challenges, potentially reducing the reliance on peaking power plants. Governments, businesses, and consumers are increasingly prioritizing sustainability and environmental responsibility.

In regions with a strong emphasis on clean energy goals, traditional peaking power plants relying on fossil fuels may face a competitive disadvantage. Supportive policies, incentives, and regulations promoting renewable energy projects may create an environment that favors cleaner alternatives over traditional peaking power plants. This can impact the market dynamics and the attractiveness of investments in traditional peaking facilities.

Peaking Power Plant Market Segmentation Analysis

By Type Analysis

Natural Gas Segment Led the Market Due to Its High Efficiency and Lower Emissions

Based on type, the market is segmented into natural gas, hydropower, diesel and others.

The natural gas segment held a major share in the market during 2024. The natural gas segment in the peaking plant market involves power plants that primarily utilizes the natural gas as their fuel source. These plants are designed to quickly respond to periods of high electricity demand, providing additional power to the grid during peak load periods. Natural gas turbines can be quickly started and ramped up to full capacity, making them ideal for meeting short-term spikes in electricity demand, which is a characteristic of peaking power plants.

The hydropower segment is often considered the second dominant source in power generation due to several key factors. Hydropower provides a reliable and consistent source of electricity by harnessing the energy of flowing water.

To know how our report can help streamline your business, Speak to Analyst

By End-User Analysis

Increasing Electricity Demand among Industrial Facilities Boost Segment Growth

Based on the end-user, the market is divided into industrial, commercial, residential and utility.

The industrial segment is the most dominating segment in the market due to increasing deployment of peaking plants to meet the electricity needs of industrial facilities. Industrial peaking power plants are strategically located near or within industrial zones to provide reliable and timely power during periods of high electricity demand.

The commercial segment in the market refers to the deployment of peaking plants to meet the electricity demands of commercial establishments. These establishments include office buildings, retail centers, hotels, and other commercial facilities that experience concentrated periods of high energy demand. Due to its installation in various spaces, this segment is second dominant in the industry.

REGIONAL INSIGHTS

Geographically, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Peaking Power Plant Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific held a dominating share of the market, with the market size valued at USD 49.05 billion in 2025 and rising to USD 51.85 billion in 2026 as countries, such as China and India, is characterized by rapid urbanization and industrialization, leading to concentrated periods of high energy demand. The Japan market is projected to reach USD 3.72 billion by 2026, the China market is projected to reach USD 31.77 billion by 2026, and the India market is projected to reach USD 6.35 billion by 2026.

In North America, including the U.S. and Canada, the market is influenced by factors, such as a growing emphasis on grid reliability, natural gas abundance, and efforts to integrate renewable energy. Environmental regulations and policies also play a role in shaping the energy landscape. The US market is projected to reach USD 31.41 billion by 2026.

Europe has been at the forefront of renewable energy adoption, and the peaking power plant market share may see integration with clean energy solutions. The European Union's targets for reducing greenhouse gas emissions and increasing renewable energy share can impact the choice of technologies in peaking plants. The UK market is projected to reach USD 4.53 billion by 2026, while the Germany market is projected to reach USD 5.66 billion by 2026.

In Latin America, factors, such as population growth, industrial expansion, and efforts to modernize energy infrastructure contribute to the expansion of the market.

The Middle East, with its hot climate and increasing urbanization, faces challenges related to peak energy demand for cooling.

Key Industry Players

Leading Players, such as GE, Offer a Range of Gas Turbine Technologies for Efficient Power Generation to Fortify Market Positions

Key industry players in this market share include General Electric, Siemens AG, Mitsubishi Hitachi Power Systems, Wärtsilä Corporation, and MAN Energy Solutions. These companies are known for providing advanced technologies and solutions for peak power generation, catering to the increasing demand for flexible and reliable energy sources.

General Electric (GE) is a major player in the global market, offering a range of gas turbine technologies for efficient and flexible power generation. Siemens AG is another leading provider known for its advanced gas turbine and combined cycle power plant solutions. Mitsubishi Hitachi Power Systems specializes in gas turbines and has a significant presence in the global power generation industry. Wärtsilä Corporation is recognized for its expertise in flexible power generation solutions, including gas and dual-fuel engines suitable for peaking applications. MAN Energy Solutions is a key player, providing a diverse portfolio of power plant technologies, including gas turbines and engines.

LIST OF TOP PEAKING POWER PLANT COMPANIES:

- Wartsila (U.S.)

- General Electric (U.S.)

- MAN Energy Solutions (U.S.)

- Edina (U.S.)

- Gama Investment A.S (U.S.)

- Clarke Energy (U.S.)

- WSP (U.S.)

- APR Energy (U.S.)

- ENGIE (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- November 2023 – GE Vernova and Duke Energy are joining forces for the nation's inaugural peaker plant fueled entirely by green hydrogen, marking a significant collaboration in the advancement of sustainable energy solutions.

- June 2023- TotalEnergies and Belgian start-up Tree Energy Solutions (TES) have announced their joint initiative to construct a synthetic natural gas plant in the U.S. This facility will utilize 'green' hydrogen and carbon dioxide to generate a methane-like gas suitable for combustion as fuel, aiming to produce 100,000 to 200,000 metric tons of synthetic natural gas annually.

- April 2023 - Centrica Business Solutions is enhancing its energy portfolio by building a 20MW gas-fired peaking plant in Worcestershire, designed to be hydrogen-ready.

- February 2023 – Peak Power secured a USD 200 billion Development Partnership with Madison Energy Investments.

- October 2022 – Vistra declared its intention to prolong the operational lifespan of Luminant's Comanche Peak Nuclear Power Plant until 2053, seeking an extension of 20 years beyond the original licenses. The company formally submitted its license renewal application to the Nuclear Regulatory Commission.

REPORT COVERAGE

The research and business intelligence report offers an in-depth analysis of the market. It further provides details on the adoption of peaking power plant across several regions. Information on trends, drivers, opportunities, threats, and restraints of the market can further help stakeholders gain valuable insights into the market. The report offers a detailed competitive landscape by presenting information on key players in the market, along with their strategies and key findings.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type, By End-User, and By Region |

|

Segmentation |

By Type

By End-User

|

|

By Region

|

Frequently Asked Questions

A study by Fortune Business Insights states that the global market size was USD 16.97 billion in 2025.

The global market is projected to grow at a CAGR of 4% over the forecast period.

The market size in Asia Pacific stood at USD 49.05 billion in 2025.

Based on end-user, the industrial segment holds a dominating share of the global market.

The global market size is expected to reach USD 190.11 billion by 2034.

Emerging technologies play a key role in driving market growth.

Wärtsilä, General Electric, MAN Energy Solutions, Edina, Gama Investment A.S, Clarke Energy, WSP, APR Energy, and ENGIE are some of the top players actively operating across the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us