Pen Needles Market Size, Share & Industry Analysis, By Product Type (Standard Pen Needles, and Safety Pen Needles), By Drug Type (Insulin, GLP-1, Growth Hormone, and Others), By Disease Indication (Diabetes, Obesity, Hormone Deficiency, and Others), By Needle Size (4 mm, 5 mm, 6 mm, 8 mm, and 12 mm), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

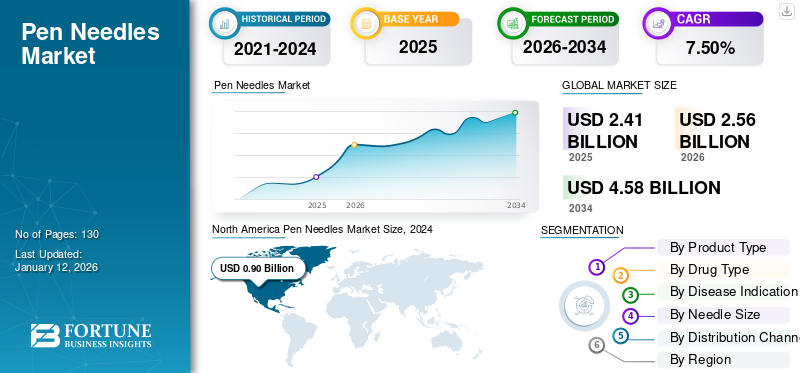

The global pen needles market size was valued at USD 2.41 billion in 2025. The market is projected to grow from USD 2.56 billion in 2026 to USD 4.58 billion by 2034, exhibiting a CAGR of 7.50% during the forecast period. North America dominated the pen needles market with a market share of 39.60% in 2025.

Injection pens for drug delivery, such as insulin and GLP-1, among others, have needles screwed on the top of it. These needles are required to be replaced either once daily or after every 4-5 usage, depending upon their application. Therefore, the increasing prevalence of diseases such as osteoporosis, diabetes, growth hormone deficiency, and others, along with the increased usage of injections for drug delivery, is responsible for the global pen needles market growth.

- For instance, according to data published by Ypsomed in November 2023, the demand for its pen injections, UnoPen and YpsoPen, increased significantly in the past years, and sales exceeded 100 million units of Uno (now part of MTD Medical Technology and Devices S.p.A.) Pen and 10 million units of YpsoPen.

During the COVID-19 pandemic, the market experienced slow growth due to the limited number of hospital and clinic visits by the population for the diagnosis and treatment of growth hormone deficiency and osteoporosis. However, after the COVID-19 outbreak in 2021 and 2022, the market experienced significant growth due to the increased number of hospital visits for disease diagnosis and treatment.

Global Pen Needles Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 2.41 billion

- 2026 Market Size: USD 2.56 billion

- 2034 Forecast Market Size: USD 4.58 billion

- CAGR: 7.50% from 2026–2034

Market Share:

- Region: North America dominated the market with a 39.60% share in 2025. This leadership is attributed to the strong presence of major market players and the high adoption rate of injection pens for various chronic disease treatments.

- By Product Type: The standard pen needles segment held the largest market share in 2024. This is driven by the high and rising prevalence of diseases such as type 1 and type 2 diabetes, which require frequent injections, coupled with less awareness regarding the risks of needlestick injuries.

Key Country Highlights:

- Japan: Demand is driven by the increasing focus of major pharmaceutical companies on launching advanced injectable drug delivery devices and therapies to meet the needs of the growing patient population in the Asia Pacific region.

- United States: The market is fueled by the high burden of chronic diseases, with millions suffering from diabetes and a significant percentage of older women affected by osteoporosis. Growth is also supported by manufacturers expanding product accessibility, including making some pen needles available over-the-counter.

- China: The market is impacted by the high burden of diseases requiring injectable medications. There is also a documented risk of needlestick injuries in hospital settings, which is expected to drive future demand for safety-engineered pen needles.

- Europe: Growth is propelled by a high prevalence of diabetes in countries such as the U.K., and a strong patient preference for self-administration of insulin. The market is also boosted by major European companies, such as Novo Nordisk, launching new and advanced insulin pens.

Pen Needles Market Trends

Market Players have been Focusing On Enhancing Their Product Offerings

The demand for advanced delivery devices for drugs such as insulin, GLP 1, parathyroid hormone, and others has been increasing significantly. In order to fulfill this demand, market players have been focusing on new product launches.

- In September 2022, Novo Nordisk A/S announced the launch of a generic version of the branded biologic Tresiba injection, which is also available as a pen injection. The sale of these products will ultimately increase the sales of pen needles.

The increasing demand for pen injection drug delivery has also been fueling the demand for these needles. Therefore, market players have also been emphasizing increasing the accessibility of these needles globally.

- In April 2024, MTD Medical Technology and Devices S.p.A., through its subsidiary HTL-STREFA, Inc., announced the availability of its Droplet Micron portfolio as OTC products in the U.S. This expanded the availability of the company's pen needles on online pharmacy stores as well.

Download Free sample to learn more about this report.

Pen Needles Market Growth Factors

Increasing Demand for Effective Treatment Due to Growing Burden of Diseases has been Fueling Market Growth

The burden of diseases such as diabetes, osteoporosis, and deficiency of growth hormones among children and others has been growing significantly.

- For instance, as per the data published by Healthline in November 2023, around 13.1% of women between 50 and 64 years of age have osteoporosis, and around 27.5% of women aged 65 years and above have osteoporosis in the U.S.

- Moreover, as per the data published by International Diabetes Federation, in 2021, around 10.5% of the adult population between the ages of 20 and 79 years had been suffering from diabetes globally. This prevalence of diabetes is expected to grow by 46% by 2045.

The growing burden of these diseases has been fueling the demand for effective drug delivery devices such as pen injections. With the increasing demand for pen injections, pen needle sales are also growing.

Furthermore, the market players have also increased their focus on the expansion of their product portfolio and the adoption of technological advancements in pen needles by the acquisition of other companies’ business segments.

- In March 2024, MTD Medical Technology and Devices S.p.A. acquired pen needle and Blood Glucose Monitoring systems (BGMs) businesses from Ypsomed, thereby enhancing its product offerings.

Therefore, the increasing demand for effective treatment, along with the growing emphasis of market players on expanding their product portfolio, is anticipated to drive the growth of the pen needle industry.

RESTRAINING FACTORS

Risk Factors Associated with Pen Needles Limits Market Growth

The growing burden of diseases such as osteoporosis, type 1 and type 2 diabetes, and others, and the increasing demand for pen injections for effective drug delivery, have been fueling the demand for pen needles. However, there are certain risk factors associated with the use of these needles exist, such as the chances of injection-site reactions such as allergy, lipoatrophy, skin infections, and lipohypertrophy, among others. The reaction is more prone to improper injection technique and repeated injections in the same area.

Furthermore, these needles also have a high risk of transmitting infection to both patients and healthcare providers. For instance, as per the data published by SAGE Journals in 2023, around 3.2% of the nurses in hospitals in China have reported cases of HBV infections due to needlestick injuries.

The factors mentioned above, as well as the presence of alternate options for disease treatment, such as oral medicines, have been limiting pen needles market growth.

Pen Needles Market Segmentation Analysis

By Product Type Analysis

Increasing Prevalence of Diseases Such as Diabetes has been Fueling Demand for Standard Pen Needles

On the basis of product type, the market is segmented into standard pen needles and safety pen needles.

The standard pen needles segment dominated the market with a share of 67.97% in 2026 and is expected to grow at a significant CAGR during the forecast period. The segment’s dominance is attributed to the increasing prevalence of diseases such as type 1 and type 2 diabetes mellitus. Furthermore, the less awareness regarding needlestick injuries is also responsible for the increased sales of these needles.

- For instance, as per the data published by the Centers for Disease Control and Prevention (CDC) in May 2024, around 29.7 million population in the U.S. suffer from diabetes among all age groups.

The safety pen needle segment is expected to grow at the fastest CAGR during the forecast period. The segment’s growth is attributed to the safety features associated with these needles and increasing awareness regarding needle-associated injuries.

To know how our report can help streamline your business, Speak to Analyst

By Drug Type Analysis

Increasing Demand for Insulin Pens for Diabetes Treatment is Responsible for Segment’s Growth

Based on the drug type, the market is segmented into insulin, GLP-1, growth hormone, and others.

The insulin segment dominated the market with a share of 75.39% in 2026. The segment’s growth is attributed to the strong demand for insulin for diabetes management. Furthermore, the increasing focus of insulin pen manufacturing companies on expanding the accessibility of their products has also been fueling the demand for needles in insulin pens.

- For instance, in July 2023, Civica, Inc. partnered with Ypsomed AG (now a part of MTD Medical Technology and Devices S.p.A.) to manufacture and supply its insulin injector pens in America at affordable dosage.

Furthermore, the others segment is expected to grow at a significant CAGR during the forecast period. The growth of the segment is attributed to the increasing focus of pharmaceutical companies on launching therapeutics in the form of injections for diseases such as osteoporosis.

By Disease Indication Analysis

Increasing Focus of Market Players on New Advanced Insulin Pen Launches has been Fueling Diabetes Segment’s Growth

Based on the disease indication, the market is segmented into diabetes, obesity, hormone deficiency, and others.

The diabetes segment dominated the market contributing 83.59% globally in 2026. The segment’s dominance is attributed to the increasing prevalence of the disease, which has increased the demand for effective treatment. To fulfill this demand, market players have increased their focus on new product launches.

- For instance, in March 2024, Novo Nordisk A/S received regulatory approval for Awiqli, a basal insulin icodec in Switzerland and Canada.

The obesity segment is expected to grow at the fastest CAGR during the forecast period due to the high burden of obesity globally.

- For instance, as per the data published by the World Health Organization (WHO), in 2022, around one out of eight people were living with obesity worldwide.

By Needle Size Analysis

Increasing Demand for 4 mm Needles Owing to Low Risks Associated with Administration is Responsible for Segment Growth

Based on the needle size, the market is segmented into 4 mm, 5 mm, 6 mm, 8 mm, and 12 mm.

The 4 mm needle size dominated the market with a share of 49.61% in 2026. The segment’s dominance is attributed to the safety and efficacy associated with these needles. For instance, 4 mm needles lower the risk of administration of insulin in the muscles, as injection of medicine in the muscles hinders the efficacy of the medicine.

Furthermore, the 6 mm needle segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment is attributed to its safety and efficacy in providing painless and non-traumatic injections.

By Distribution Channel Analysis

Preference of Patient Population toward Retail Pharmamcies for Effective Delivery is Responsible for Segment’s Dominance

Based on the distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy.

Retail pharmacies dominated the global pen needles market in 2023. High share of the segment is attributable to the increasing preference of patients for pen injections for effective and easy drug delivery at home convenience.

The online pharmacy segment is expected to grow at the fastest CAGR during the forecast period. The segment's growth is attributed to the increasing availability of needles and injections through online stores and the shift in the population's preference for buying medications online so they can be delivered at the convenience of their home.

REGIONAL INSIGHTS

Based on geography, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Pen Needles Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market in 2024, accounting for USD 0.90 billion of the global market. The growth of the market in the region is attributed to the strong presence of players such as Embecta Corp., Cardinal Health, and Allison Medical, Inc., among others. The U.S. market is projected to reach USD 0.96 billion by 2026.

The market in Europe is expected to grow at a substantial CAGR during the forecast period. The market growth in the region is attributed to the high burden of diabetes and the growing preference for self-administration of insulin. The UK market is projected to reach USD 0.14 billion by 2026, while the Germany market is projected to reach USD 0.16 billion by 2026.

- For instance, as per the data published by The British Diabetic Association, in May 2024, around 4.3 million people were living with diabetes in the U.K.

The Asia Pacific market is expected to grow at the fastest CAGR during the forecast period. The growth of the market in the region is attributed to the increasing focus of pharmaceutical companies on injection pen launches. The Japan market is projected to reach USD 0.14 billion by 2026, the China market is projected to reach USD 0.18 billion by 2026, and the India market is projected to reach USD 0.09 billion by 2026.

- For instance, in April 2024, Sanofi announced the launch of Soliqua, a daily injectable mixture of insulin glargine, basal insulin, and lixisenatide in India, to fulfill the growing demand for advanced delivery devices for effective drug delivery.

The market in Latin America and the Middle East & Africa is expected to grow at a substantial CAGR. The market’s growth in these regions is attributed to the high burden of diseases such as diabetes and osteoporosis.

- For instance, as per the data published by the International Diabetes Federation (IDF), the prevalence of diabetes in Brazil was around 15.7 million adults in 2021, accounting for 10.5% of the total adult population.

KEY INDUSTRY PLAYERS

Increasing Focus of Market Players on New Product Launches to Expand its Product Portfolio has Enhanced Company’s Revenue Growth

Market players such as Novo Nordisk A/S, Terumo Corporation, and MTD Medical Technology and Devices S.p.A. are among the major players, accounting for a significant portion of the global pen needles market share. The strong presence of these companies in the market is attributed to their focus on new product launches.

- For instance, in September 2022, Terumo Corporation launched FineGlide, sterile pen needles in India for requiring regular insulin or other sel-medications.

Moreover, other players such as Embecta Corp., F. Hoffmann-La Roche Ltd, and BD have been emphasizing on the increasing the availability of their products globally to enhance their revenue growth from these needles.

- For instance, in January 2021, NHS Wales partnered with Owen Mumford and made it the sole provider of pen needles in NHS Wales Hospital.

List of Top Pen Needles Companies:

- Novo Nordisk A/S (Denmark)

- Embecta Corp. (U.S.)

- B. Braun SE (Germany)

- Owen Mumford (U.K.)

- BD (U.S.)

- Cardinal Health (U.S.)

- SOL-Millennium (U.S.)

- Terumo Corporation (Japan)

- MTD Medical Technology and Devices S.p.A. (Italy)

- UltiMed, Inc. (U.S.)

- Allison Medical, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- April 2024 – MTD Medical Technology and Devices S.p.A., through its subsidiary HTL-STREFA, Inc., expanded the indication of its pen needles to GLP-1 and other therapies. This expanded the treatment options through the company's pen needles and enhanced patient accessibility.

- March 2024 – Owen Mumford announced its partnership with Duopharma Biotech Berhad to distribute its diabetes and eye care products in Malaysia and Brunei.

- June 2023 – Novo Nordisk A/S entered into a negotiation to acquire BIO JAG, BIOCORP’s main shareholder. With this acquisition, the company aimed to enhance its drug-delivery device portfolio for chronic diseases.

- May 2022 – Owen Mumford announced that its next-generation safety pen needles portfolio will join the Unifine SafeControl brand in order to enhance its offerings for these needles.

- May 2022 – F. Hoffmann-La Roche Ltd announced the launch of Accu-Fine pen needles in India, which allow patients to receive virtual painless insulin delivery.

REPORT COVERAGE

The global pen needles market report provides a detailed competitive landscape and market insights. It also includes key insights, such as top industry developments covering partnerships, mergers, and acquisitions. Additionally, it focuses on key points, such as new solution launches in the market. Furthermore, it covers regional analysis of different market segments, profiles of key market players, market trends, and the impact of COVID-19 on the market. It consists of quantitative and qualitative insights that have contributed to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.50% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product Type

|

|

By Drug Type

|

|

|

By Disease Indication

|

|

|

By Needle Size

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 2.41 billion in 2025 and is projected to record a valuation of USD 4.58 billion by 2034.

In 2025, the North American market value stood at USD 0.96 billion.

The market is predicted to grow at a CAGR of 7.50% during the forecast period.

By product type, the safety pen needles is the leading segment in the market.

The increasing demand for effective treatment due to the growing burden of diseases and new product launches has been fueling the market growth.

Novo Nordisk A/S, Terumo Corporation, and MTD Medical Technology and Devices S.p.A. are the top players operating in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us