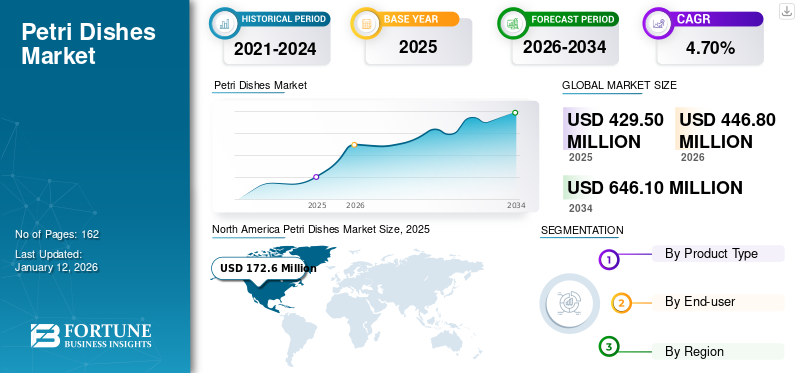

Petri Dishes Market Size, Share & Industry Analysis, By Product Type (Glass and Plastic), By End-user (Hospital & Clinical Laboratories, Diagnostic Centers, Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

Petri dishes are lidded and shallow plates used to grow bacterial cultures and serve a variety of uses, such as testing the virulence of bacterial cultures and examining the efficacy of antibiotic drugs under development. They can be made up of either glass or plastic, providing space and protecting the micro-organisms from contamination. The increasing prevalence of chronic disorders is resulting in a growing demand for drugs, therapies, and vaccines, which is subsequently supporting the increasing R&D activities across the globe. Growing R&D activities are further increasing the demand for labware, such as petri dishes, and thus supporting the market’s growth.

- According to a 2022 annual report published by Corning Incorporated, the company invested USD 0.9 billion in R&D activities, driving the demand for novel product launches in the global market.

Along with this, the key players are intensifying their focus on mergers and acquisitions with other market players. This strategic approach aims to develop novel dishes that are environmentally friendly and affordable, contributing to the expansion of the petri dishes market.

Petri Dishes Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 429.5 million

- 2026 Market Size: USD 446.8 million

- 2034 Forecast Market Size: USD 646.1 million

- CAGR: 4.70% from 2026–2034

Market Share:

- North America dominated the global petri dishes market with a 40.20% share in 2025, driven by increasing R&D investments by pharmaceutical and biotech companies, and geographical expansion of healthcare firms. For example, Thermo Fisher Scientific and Avantor, Inc. expanded R&D and manufacturing facilities to meet rising demand for labware.

- By product type, plastic petri dishes are expected to retain the largest market share in 2025 due to their cost-effectiveness, durability, and chemical inertness, making them ideal for high-volume lab use. However, glass dishes are gaining traction for their reusability and suitability for high-precision research, especially in academic and hospital settings.

Key Country Highlights:

- Japan: Demand is supported by strong investments from companies like Sumitomo Bakelite Co., Ltd. in sustainable and reusable labware materials, and by rising R&D activity for personalized medicine and regenerative therapies.

- United States: The country leads global R&D spending, with investments reaching USD 716.95 billion in 2020. Key players such as Thermo Fisher Scientific, Avantor, and Corning continue to launch new facilities and collaborate with research labs, fueling high adoption of petri dishes in academic and biotech sectors.

- China: Growth is supported by local collaborations such as Merck KGaA's partnership with Biotheus, aimed at speeding up drug development, thereby increasing demand for cell culture and microbiology labware.

- Europe: The region benefits from initiatives promoting sustainable laboratories and personalized therapies. Countries like Germany and Austria are focused on reducing plastic waste and supporting reusable products, boosting the market for eco-friendly petri dishes. SARSTEDT AG & Co. KG and Greiner AG are leading product innovation in this space.

COVID-19 IMPACT

Growing Research amid COVID-19 Pandemic Had a Positive Impact on Global Market

The COVID-19 outbreak had a positive impact on the global market. During the pandemic, research activities rapidly increased among research institutes, pharmaceutical & biotechnological companies, and other healthcare facilities, focusing on COVID-19 vaccines as well as other chronic conditions. Along with this, the companies were also working to find treatments in order to cater for the huge number of patients suffering from COVID-19.

- According to the data published by the National Center for Science and Engineering Statistics, it was reported that R&D investment in the U.S. witnessed a growth of around 16.2% and increased to USD 716.95 billion in 2020, as compared to USD 666.15 billion in 2019.

This resulted in a considerable increase in the demand for labware, which aided in the increased revenue of the key players operating in the market. Increasing focus on R&D activities supported the adoption of labware, including cell culture dishes, among researchers, thus contributing positively to the growth of the market. Additionally, companies were working with a different business strategy to overcome the issue of supply chain disruption during the pandemic, which also resulted in the growth of the market.

- For instance, Thermo Fisher Scientific generated a revenue of USD 12,168.0 million and witnessed a growth of 77.5% from its life science solutions segment in 2020 compared to USD 6,856 million in 2019.

Although the demand for petri dishes increased during the pandemic, the market witnessed normalization in demand due to already procured labware for various research purposes among researchers. This normalization in demand resulted in a lower growth rate in segmental revenue among the key players in the market compared to the previous year.

- For instance, Thermo Fisher Scientific Inc. witnessed a growth of around 28.5% in 2021 compared to 77.5% in 2020 from its life science solutions segment.

Petri Dishes Market Trends

Increasing Focus Toward Launching of Biodegradable Labware

The increasing concerns among researchers toward the disposability and recyclability of petri dishes, especially the dishes made up of plastic, are resulting in the preferential shift of biodegradable and innovative materials for the manufacturing of these dishes. Along with this, the growing awareness and focus toward a sustainable future is directing research institutes and governmental and non-governmental organizations toward inorganic growth strategies to support the manufacturing of biodegradable dishes.

- According to a 2021 report published by the Emory Office of Sustainability Initiatives (EOSI), The Morran Lab in Biology reduced waste by testing and implementing reusable alternatives to disposable dishes.

Strong initiatives by the government, research institutes, various healthcare facilities, and others to encourage researchers to create sustainable labs for the future are expected to spur the adoption of biodegradable materials for the manufacturing of labware.

- In November 2022, Green Labs Austria, Merck KGaA, and the University of Vienna organized a workshop on ‘The Sustainable Lab of the Future: Rethinking Single-use Plastics’ with an aim to develop systemic solutions to analyze and evaluate potential recycling solutions.

Thus, increasing efforts by prominent players along with researchers toward green labs are expected to become a sustainable trend in the near future.

- North America witnessed a growth from USD 158.1 Million in 2023 to USD 165.1 Million in 2024.

Download Free sample to learn more about this report.

Petri Dishes Market Growth Factors

Increasing Research and Development Activities among Healthcare Providers across the Globe to Spur Market Progress

The increasing prevalence of infectious and chronic conditions globally is increasing the demand for drugs and novel therapies for treatment. This demand is fueling growth in R&D activities in the life sciences sector to develop and introduce novel therapies for these conditions.

The growing R&D activities among these healthcare providers are supporting the adoption of petri dishes for cell culturing processes. Additionally, this trend is increasing the revenue of certain key players operating in the market, thus contributing to the growth of the market.

- For instance, in 2022, Avantor Inc. generated a revenue of USD 2,898.4 million from its proprietary materials and consumables, showing a growth of around 13.7% compared to the previous year. The growth is due to the increased demand for consumables in various healthcare settings.

Along with this, the increasing support from governmental organizations to support R&D activities is another key factor bolstering research initiatives. Manufacturers focusing on expanding their facilities along with increasing their investment in research activities are anticipated to increase the adoption of these dishes in the market.

- For instance, the R&D expenditure of GSK plc in 2022 was around USD 6,533.3 million and witnessed a growth of around 9.3% compared to the previous year.

Thus, the increasing number of research procedures, along with growing collaborations among biopharmaceutical companies with CROs and CMOs for outsourcing the R&D activities for the manufacturing of drugs and therapies, is expected to boost the adoption of petri dishes during the forecast period.

RESTRAINING FACTORS

Increasing Use of Alternatives to these Dishes May Limit Product Adoption

Despite the growing demand for novel dishes globally, certain factors are restricting the growth of the market. Among them is the rising use of other alternatives to petri dishes, such as multiwell plates and PCR plates among researchers. The shift toward these alternatives is primarily driven by the awareness of culturing multiple cells under identical conditions in the same plate, offering high throughput and convenient handling, leading to a decreased adoption of traditional dishes.

Increased use of these alternatives, especially during the pandemic, prompted key players in the market to launch technologically advanced multiwell plates, PCR plates, and others, which further limited the adoption of these dishes. For instance, Bioprocess Equipment Specialists developed a nanofiber well plate for high throughput cell culture, cancer research, stem cells, and regenerative medicine.

Moreover, the competitive pricing of multiwell plates with higher media capacity from major players is another factor expected to promote the use of these plates among researchers.

- For instance, Thermo Fisher Scientific Inc.’s 96-well deep well microplates cost around USD 9-10, and the 96-well deep well plate by Merck KGaA costs around USD 4-5.

The rising adoption of reusable products due to growing concerns about disposability and plastic reduction is a major factor limiting the growth of the market.

Petri Dishes Market Segmentation Analysis

By Product Type Analysis

Certain Distinct Advantages of Plastic Dishes over Glass Dishes Led to Plastic Segment Dominance

By product type, the market is segregated into glass and plastic.

The plastic segment held a lion’s share 55.93% of the market during 2026, attributed to factors such as high-grade quality of the end product, low cost, durability, and comparatively chemical inertness.

- For instance, according to Corning 2022 labware price list, it was reported that the retail price of Gosselin polystyrene petri dish was around USD 412.15 while PYREX glass petri dish was priced around USD 733.0. Thus, the cost-effectiveness of these products is to support the high demand for these dishes worldwide.

However, the glass segment is expected to grow at a considerable CAGR during the forecast period. Advantages such as reusability and the ability to withstand repeated autoclaving, among other factors, are contributing to the growth of this segment. Glass dishes are ideal for use in research laboratories, hospitals & clinical labs, and other settings requiring extensive research. Thus, increasing adoption of glass dishes for cell culturing is expected to boost the growth of this segment during the forecast period.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

Pharmaceutical & Biotechnology Companies Segment Dominated Owing to Increasing R&D Activities Among Pharmaceutical & Biotechnological Companies

Based on end-user, the market is segmented into hospital & clinical laboratories, diagnostic centers, pharmaceutical & biotechnology companies, academic & research institutes, and others.

- The Pharmaceutical & Biotechnology Companies segment is expected to hold a 56.5% share in 2024.

The pharmaceutical & biotechnology companies segment dominated and accounted for the highest market share 56.98% in 2026. The increasing demand for various drugs and therapies has led to increased investment in research & development activities by these healthcare companies, contributing to the market growth.

- For instance, in July 2023, Avantor, Inc. expanded the company’s Bridgewater, N.J. innovation center, a technology-driven research & collaboration environment where the company works to enhance their offerings. This is subsequently driving the demand for novel dishes to be launched in the global market.

On the other hand, the academic & research institutes segment is anticipated to grow with a considerable CAGR during the study period. The growth is credited to a growing number of academic and research institutes across the globe, resulting in a greater number of research activities, subsequently driving the adoption of labware products worldwide.

- According to 2022 data published by CEIC data, it was reported that there are approximately 1.7 million researchers in the U.S., resulting in the increasing demand for labware consumables and supporting the growth of this segment.

The hospital & clinical laboratories, diagnostic centers, and others segments are anticipated to grow at a faster rate during the forecast period owing to growing demand and adoption of these products. Thus, these key factors are fueling the growth of this segment during the forecast period.

REGIONAL INSIGHTS

Based on geography, the market for petri dishes is studied across North America, Asia Pacific, Europe, and the rest of the world.

North America Petri Dishes Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The market size in North America stood at USD 172.6 million in 2025. The regional dominance is mainly attributed to the increasing demand for drugs and therapies in the region, subsequently boosting the adoption of labware among researchers during the study period. Moreover, geographical expansions by healthcare companies are resulting in an increasing penetration rate of products in the region.The U.S. market is projected to reach USD 174.8 billion by 2026.

- For instance, in March 2023, Thermo Fisher Scientific Inc. opened a cell therapy facility at the University of California, San Francisco, with the aim of accelerating the development of breakthrough therapies. It is expected to increase the demand for labware instrumentation required in the research process.

Asia Pacific is anticipated to grow with a considerable CAGR during the forecast period. Increasing focus on the establishment of new distribution centers to enhance the supply of labware, such as cell culture dishes to support the biopharma & biotech industry, is expected to increase the adoption of the product in this region.The Japan market is projected to reach USD 47.7 billion by 2026, and the China market is projected to reach USD 58.3 billion by 2026.

- For instance, in July 2023, Avantor Inc. expanded the Singapore Hub, which includes newly added cGMP manufacturing and a QC laboratory with an aim to strengthen the region’s innovation and biopharma systems.

Europe contributed a considerable share of the market in 2024 owing to an increasing focus on personalized therapies among the patient population. The escalating research activities aimed at improving survival rates among patients require an extensive amount of labware and related products, prompting key players to launch innovative products in the region.The UK market is projected to reach USD 35.9 billion by 2026, while the Germany market is projected to reach USD 28.3 billion by 2026.

- For instance, in September 2022, SARSTEDT AG & Co. KG launched a new biofloat cell culture plate for spheroid culture with the aim of offering a simple and cost-effective variant of the cell culture.

Latin America and the Middle East & Africa are expected to grow at a considerable CAGR during the forecast period. This is owing to increasing initiatives by pharmaceutical & biotechnological companies, research institutes, and hospital labs to engage in collaboration with players in the region, thus supporting the growth of the market.

- For instance, in December 2021, Merck KGaA collaborated with Innovative Biotech with an aim to support the establishment of the first vaccine production facility in Nigeria, which stimulated the market.

Key Industry Players

Increasing R&D activities Among Major Players is Responsible for the Dominant Share

The current market scenario of the industry is marked by fragmentation, with numerous players offering a wide range of products in their portfolios. Strong brand presence and a global product range create significant growth opportunities for certain players, including Corning Incorporated, Merck KGaA, and Thermo Fisher Scientific Inc.

- For instance, in January 2022, Thermo Fisher Scientific Inc. launched sterile culture media plates in Lenexa, Kansas, with the aim of supporting the pharmaceutical industry.

Additionally, certain other players, such as Greiner AG, Avantor Inc., and Phoenix Biomedical Products, are focusing on expanding their distribution channels with the aim of widening their geographical presence. This is expected to increase their global petri dishes market share during the forecast period.

- For instance, in November 2022, Avantor Inc. established a new R&D center with the aim of supporting the biopharma industry, with a focus on enhancing the supply of labware.

Apart from that, the growing focus on research & development activities coupled with certain inorganic strategies among the key players operating in the market is contributing to the future growth of the leading players such as Crystalgen, Inc., Sumitomo Bakelite Co., Ltd., and others in the market during the study period.

- For instance, in November 2021, Sumitomo Bakelite Co., Ltd. granted the Plastics e-Axle Study Program as a part of the R&D and social implementation promotion program with an aim to materialize a carbon-free society.

The growing adoption of petri dishes in research facilities, owing to an increasing number of R&D activities, is a major factor expected to augment the market growth.

List of Top Petri Dishes Companies:

- Corning Incorporated (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- SARSTEDT AG & Co. KG (Germany)

- Sumitomo Bakelite Co., Ltd. (Japan)

- Greiner AG (Austria)

- TPP Techno Plastic Products AG (Switzerland)

- Avantor, Inc. (Japan)

- Crystalgen, Inc. (U.S.)

- Wuxi NEST Biotechnology Co., Ltd. (China)

- CELLTREAT Scientific Products (U.S.)

- Phoenix Biomedical Products (Canada)

- Merck KGaA (Germany)

- Zhejiang Aicor Medical Technology Co. (China)

- MULTIGATE (Australia)

KEY INDUSTRY DEVELOPMENTS:

- May 2023: Avantor, Inc., collaborated with Labguru, a research-to-production platform for leading global pharma, national research institutes, and others, aiming to provide high-quality products at the lab bench.

- November 2022: Merck KGaA collaborated with Biotheus to accelerate the drug submission and approval process for the biopharmaceutical industry in China. This collaboration further increased the requirement for labware.

- May 2022: Thermo Fisher Scientific Inc. partnered with LabShares, a lab facility and co-working space for life science and biotech companies, aiming to accelerate early-stage discovery and development with shared lab spaces, thus contributing to the market.

- May 2022: Avantor, Inc., collaborated with Cytovance Biologics, Inc., a biologics contract development and manufacturing organization specializing in the manufacture of high-quality plasmid DNA. This supported the research and development activities and further contributed to the market.

- November 2021: Corning Incorporated accelerated the delivery of life-saving treatments and critical drugs with an expanded glass pharmaceutical portfolio. This supported the growth of the market due to rising R&D activities.

REPORT COVERAGE

The global market report provides a detailed market overview and market segmentation on the basis of product type and end-user. It focuses on key aspects such as company profiles, SWOT analysis, and applications. Besides this, it offers insights into the market dynamics, trends and highlights strategic market growth analysis. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.70% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Product Type

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

The global petri dishes market size was valued at USD 429.5 million in 2025. The market is projected to grow from USD 446.8 million in 2026 to USD 646.1 million by 2034, exhibiting a CAGR of 4.70% during the forecast period.

In 2025, North America stood at USD 172.6 million.

The market will exhibit steady growth at a CAGR of 4.70% during the forecast period (2026-2034).

Based on product type, the plastic segment held the lions share in the market.

The increasing R&D activities, growing number of product launches, and technological advancements are some of the key drivers of the market.

Corning Incorporated, Merck KGaA, Thermo Fisher Scientific Inc., SARSTEDT AG & Co. KG, are the top players in the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us