Pharmacy Automation Devices Market Size, Share & Industry Analysis, By Product (Automated Medication dispensing systems [Robotic Dispensing Systems, and Automated Dispensing Cabinets (ADC’s)], Automated Packaging Systems, and Others), By Distribution Model (Centralized and Decentralized), By End User (Hospital Pharmacies, Retail Pharmacies, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

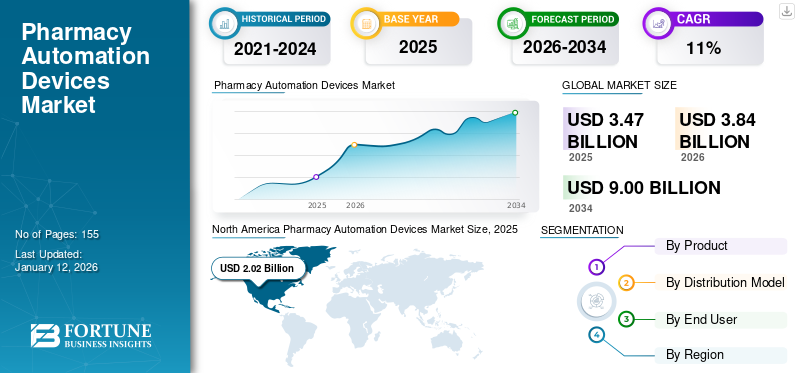

The global pharmacy automation devices market size was valued at USD 3.47 billion in 2025 and is projected to grow from USD 3.84 billion in 2026 to USD 9 billion by 2034, exhibiting a CAGR of 11.08% during the forecast period. North America dominated the pharmacy automation devices market with a market share of 58.31% in 2025.

Pharmacy automation devices are electronic systems used for distributing, sorting, packaging, and counting prescription medications across centralized dispensing pharmacies and inpatient care units in health settings. These systems increase the efficiency of pharmacies, standardize the workflow, help to maintain medication inventory stocks, and improve patient adherence.

Certain elements, such as the complexity of handling large volumes of prescription medicines among the rising number of patients and the potential hazards caused by manual dispensing errors, have led to the demand for automated systems. Thus, hospital pharmacy departments across health settings emphasize optimizing drug preparation, dispensing, and distribution systems and developing comprehensive policies and procedures that provide safer distribution of all medications and related supplies to inpatients and outpatients. Moreover, the potential advantages of adopting these systems, such as high speed, accuracy, real-time inventory tracking, data confidentiality, data protection, and patient adherence in the drug dispensing systems, further boost the market growth.

- In January 2022, according to the data published in the American Journal of Health-System Pharmacy, the use of automated dispensing cabinets (ADCs) is increasing in healthcare settings, with 93.0% of hospitals using ADCs in their medication-use systems in which 70.2% of hospitals using ADCs as a primary method of dose distribution.

Thus, the rising adoption of these systems across acute care settings in hospital and retail pharmacies and technological advancements in automation solutions will boost market growth.

During the COVID-19 pandemic in 2020, the pharmacy automation market witnessed a negative impact as there was a decline in patients visiting health settings, such as hospitals and outpatient & retail pharmacies for treatment. However, in 2021 and 2022, the hospitals and retail pharmacies emphasized automating the routine distribution workflow of medicines among patients to maintain social distancing, enroute safe administration, and limit the number of medical errors, which augmented the market growth in 2021.

Global Pharmacy Automation Devices Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 3.47 billion

- 2026 Market Size: USD 3.84 billion

- 2034 Forecast Market Size: USD 9 billion

- CAGR: 11.08% from 2026–2034

Market Share:

- Region: North America dominated the market with a 58.31% share in 2025. This leadership is driven by the launch of new, technologically advanced devices, the extensive presence of major market players, and the rising adoption of robotic dispensing systems across retail pharmacies.

- By Product: The Automated Medication Dispensing Systems segment held the largest market share in 2024. The segment's dominance is due to the high adoption of Automated Dispensing Cabinets (ADCs) across hospital and outpatient pharmacies, which offer high accuracy and significantly reduce medication dispensing errors.

Key Country Highlights:

- Japan: As a key market in the fast-growing Asia Pacific region, Japan is experiencing increased demand for pharmacy automation, driven by a growing number of hospital and retail pharmacies and a rising need for efficient prescription drug management. The presence of major domestic players like Yuyama Co., Ltd. also fuels innovation.

- United States: The market is propelled by a strong need to reduce medication dispensing errors, which cause 7,000 to 9,000 deaths annually. This has led to high adoption rates, with 93% of hospitals using ADCs. Recent developments include the launch of robotic micro-fulfillment centers by major chains like Walgreens.

- China: The market is expanding as part of the high-growth Asia Pacific region. Growth is supported by the increasing number of retail and hospital pharmacies and a rising demand for prescription drugs, which necessitates the adoption of automation to manage high volumes and ensure accuracy.

- Europe: The market is driven by efforts to combat the high incidence of medication errors, with an estimated 237 million occurring annually. This has led to increased adoption of automated systems, such as the installation of advanced compounding systems in hospitals in Finland and new distribution agreements for automation systems in Sweden.

Pharmacy Automation Devices Market Trends

Rising Demand for Robotics Dispensing Devices Across Hospital and Retail Pharmacies to Aid Market Growth

The robotic dispensing system (RDS) plays a crucial role by automatically storing, counting, and dispensing various medication pills to enable centralized pharmacies to fulfil high-volume prescriptions safely and efficiently. Owing to the high accuracy and efficiency of the robotic system, the demand for drug barcoding, dispensing, and intravenous compounding is increasing across acute care settings. Similarly, the rising emphasis of leading industry players in launching technologically advanced robotic dispensing systems across health settings augments the automation devices in the pharmacy market growth.

- According to an article published by the National Center for Biotechnology Information (NCBI) in March 2023, robotic dispensing systems have become a general solution for medication errors occurring during the dispensing process. These devices fill over 90,000 patient prescriptions per day in central pharmacy systems.

Moreover, several pharmacy settings across outpatient and institutional settings are now emphasizing automating the medication dispensing system to limit the rising incidence of medical errors and increased demand for speciality drug dispensing that requires more complicated techniques than traditional prescription drugs.

- In March 2022, the Wirral Hospitals NHS Trust reported a 50.0% reduction in medication dispensing errors within four months after implementing a pharmacy robot.

- In October 2022, the results from a research study published by BioMed Central Ltd suggested that the use of the robotic dispensing system along with pharmacy support staff is one of the ways to enhance clinical care for patients, ensuring the quality and safety of medication by pharmacists.

Thus, high potential advantages of robotic systems, such as improved workflow and error-free medication dispensing, coupled with increased demand across hospital pharmacies in developed countries, further aid market growth.

Download Free sample to learn more about this report.

Pharmacy Automation Devices Market Growth Factors

Increasing Medication Dispensing Errors Across Pharmacies to Fuel the Demand for Automated Devices

Medication dispensing errors are inconsistencies between drugs prescribed and dispensed in pharmacy settings. The increasing number of people adopting self-treatment, the availability of expansive prescription drugs, the growing number of chronic diseases globally, and the increase in the consumption of medicines further raise the chances of medication dispensing errors. The rising incidence of these errors by the health workforce raises the financial burden and significant fatal outcomes among patients across healthcare organizations.

- In 2023, a research study published by the National Center for Biotechnology Information (NCBI) stated that in the U.S., 7,000 to 9,000 people die as a result of a medication error every year.

- According to an article published by Asian Robotics Review LLC in 2021, the U.S. encounters around 51.5 million dispensing errors, accounting for 0.1 million deaths annually.

Thus, growing concerns over preventing medication dispensing errors and the lack of skilled clinical pharmacists and nurses in patient care management increase the demand for these devices in retail and hospital pharmacies. Similarly, increasing initiatives by inpatient and outpatient pharmacies to control costs associated with drug distribution, safe dispensing among patients, and minimising medical errors will further boost the demand for these devices and market growth.

- The Journal of Medical Systems published a research study in November 2022 at the ICUs of National Cheng Kung University Hospital (NCKUH) in Taiwan. After the adoption of ADCs in the ICUs, the rate of errors reduced from 3.87 to 0 per 100,000 dispensations, respectively.

Therefore, the rising incidence of medical dispensing errors across pharmacy settings and the demand for safe medication dispensing among patients are key factors anticipated to drive market growth.

RESTRAINING FACTORS

High Capital Investments to Install Pharmacy Automation Devices to Hamper Market Growth

Despite the potential advantages of these systems, many professionals hesitate to adopt such devices due to the high capital investment in the installation compared to manual setups. Additionally, the concerns over return on investment (ROI) related to these devices limit its adoption by hospitals and pharmacies.

- As per ScreenVend estimates in January 2021, a typical investment for a robot is between USD 84,210.0 and USD 189,473.6, depending on the size and dispensing capability of the robot.

- As per CARE DIRECT, LLC estimates, an automated dispensing cabinet costs between USD 30,000 to USD 100,000 for a single unit over a 5-year window. Moreover, these complex devices can consume months for optimal utilization.

Along with installation, the maintenance cost associated with pharmacy automation devices is high. These devices use advanced software to regulate the routine workflow of the pharmacy. Some software requires regular updates for better performance, which in turn increases the expenditure on the devices.

- For instance, in November 2023, an article published by eBizneeds stated that the estimated cost of developing a basic pharmacy management software system may start at around USD 50,000 to USD 100,000, while a more inclusive solution with advanced functionality can exceed USD 200,000.

Furthermore, pharmacy automation constantly needs human intervention, and the staff members need extensive training to handle pharmacy automation devices. Lack of proper training and education among health professionals may result in incorrect programming of the machines, ultimately dispensing the wrong medication or dose.

Thus, a surge in challenges of installing these devices and the need for constant maintenance and software upgradation limit the adoption of pharmacy automation devices across health settings, further hampering market growth.

Pharmacy Automation Devices Market Segmentation Analysis

By Product Analysis

Rising Adoption of Automated Dispensing Systems across Hospital Pharmacies Augmented Automated Dispensing Systems Segment Growth

Based on product, the market is segmented into automated medication dispensing systems, automated packaging systems, and others.

The automated medication dispensing systems segment accounted for the highest market share in 70.18% in 2026. The higher share was attributed to the rise in the adoption of automated dispensing cabinets for drug dispensing across inpatient and outpatient pharmacies. Moreover, the high potential advantages of these systems, such as high accuracy and safe dispensing of medications across pharmacy settings, propels the segment growth.

- In April 2023, a research study published by the National Center for Biotechnology Information (NCBI) stated that the adoption of automated dispensing cabinets (ADC) effectively reduced medication errors in the ICU and concluded that the dispensing error rate declined from 3.87 to 0 per 100,000 dispensations, while the prescription error rate decreased from 3.03 to 1.75 per 100,000 prescriptions.

Similarly, due to high demand, an increase in the introduction of technologically advanced devices by key manufacturers, such as robotic dispensing systems and unit dose systems, will further drive segment growth.

On the other hand, the automated packaging systems segment is expected to witness a moderate CAGR during the forecast period. The growth was due to the rising errors in manual packaging and labelling for medication management in pharmacy settings. Also, increasing retail and outpatient pharmacies' emphasis on automating the regular medication workflow will further propel the segment growth.

- According to data revealed by Pharmaceutical Processing World, an estimated 50.0% of all pharmaceutical device recalls come down to errors in the labelling or packaging process in pharmacies worldwide.

To know how our report can help streamline your business, Speak to Analyst

By Distribution Model Analysis

High Potential Advantages of Decentralized Distribution Model to Drive Decentralized Segment Growth

By distribution model, the market is segmented into centralized and decentralized.

The decentralized segment held the dominant share 79.80% globally in 2026 and is anticipated to grow at the highest CAGR during the forecast period. The dominant share in 2023 is attributed to the rising adoption of satellite pharmacies and ADCs across retail pharmacies for drug prescription and dispensing among patients. Moreover, the high potential advantages of the decentralized model, such as patient safety, care efficiency, and cost-effectiveness compared to the centralized model, will further augment the market growth.

- According to study estimates published by SAGE Publications in April 2021, patient satisfaction significantly improved with the help of the decentralized model.

On the contrary, the centralized segment is expected to grow at a moderate CAGR during 2023-2030. The growth was attributed to the high focus on hospitals and retail pharmacies over traditional manual unit dose systems across developing economies such as China and India.

By End User Analysis

Increasing Number of Automated Retail Pharmacies Globally to Boost Hospital Pharmacies Segment Growth

Based on end user, the market is segmented into hospital pharmacies, retail pharmacies, and others.

The hospital pharmacies segment held the highest market share 44.33% in 2026, owing to the rising emphasis of hospitals on automating the pharmacy workflow to minimize the rising incidence of medication errors among patients. Moreover, the rising number of routine drug prescriptions and dispensing across hospital pharmacies owing to the high number of patient hospitalizations will further augment the segment growth.

- Omnicell Inc. estimated that in 2022, about 50.0% of U.S. hospitals will adopt its pharmacy automation systems.

Similarly, the retail pharmacies segment is expected to grow at the highest CAGR owing to a rising number of retail pharmacies with a need for advanced robotic and workflow management devices in prescription filling and inventory management.

- In January 2023, Walgreens Boots Alliance, Inc., a global innovator in retail pharmacy, launched nine retail micro-fulfillment centers across the U.S. The micro-fulfilment centers are facilitated with robots for prescription filling and can fill 300 prescriptions per hour.

REGIONAL INSIGHTS

North America Pharmacy Automation Devices Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

The North American region accounted for the largest market of USD 1.83 billion in 2024. The growth of this market in North America was attributed to rising new technologically advanced device launches and the extensive presence of major players in the market. Moreover, the rising adoption of robotic dispensing systems across retail pharmacies will further benefit regional growth. The U.S. market is projected to reach USD 1.9 billion by 2026.

- In December 2022, Baxter introduced ExactaMix Pro, a next-generation automated nutrition compounder certified by the U.S. Food and Drug Administration (FDA) with a recognized UL 2900-2-1 cybersecurity standard.

Europe

Europe accounted for a considerable market share in 2024. The market growth in the region was attributed to the rising adoption of automated systems across outpatient and retail pharmacies due to the rise in the incidence of medical errors among patients and the increasing number of geriatric population with chronic diseases. Moreover, rising awareness of healthcare robotic automation across developed countries will further augment regional growth. The UK market is projected to reach USD 0.2 billion by 2026, while the Germany market is projected to reach USD 0.3 billion by 2026.

- In September 2022, data published by the World Health Organization (WHO) stated that there are approximately 237.0 million medication errors every year in Europe.

- In October 2021, Satasairaala Hospital Pharmacy, Finland, installed NewIcon’s IV ICON Twins compounding system to expand its production capacity.

Asia Pacific

The market in Asia Pacific is expected to grow at the highest CAGR during the forecast period. An increasing number of retail and hospital pharmacies in the Asia Pacific region and rising demand for prescription drugs among patients will aid the increasing demand for pharmacy automation devices. Moreover, the rising focus of major players to extend their regional distribution network will further propel regional growth during the forecast period. The Japan market is projected to reach USD 0.09 billion by 2026, the China market is projected to reach USD 0.05 billion by 2026, and the India market is projected to reach USD 0.03 billion by 2026.

- According to statistics published by Industry Advisors in May 2021, there were 0.9 million retail pharmacy stores in India.

Middle East & Africa, and Latin America

Similarly, the Middle East & Africa, and Latin America region are expected to grow at a considerable CAGR during 2025-2032, owing to rising infrastructure developments and technological advancements in operational workflow across health settings.

List of Key Companies in Pharmacy Automation Devices Market

Rising Strategic Acquisitions and Product launches By Key Players to Propel Market Growth

The market is highly competitive and is primarily dominated by a few manufacturers, such as Omnicell Inc., BD, Capsa Healthcare, and Yuyama Co., Ltd. These major players are emphasizing strategic initiatives, such as collaborations, acquisitions, and mergers, to expand their existing portfolio in the market, further propelling their company share.

- In July 2022, BD acquired Parata Systems, LLC, which provides innovative pharmacy automation systems and solutions. The Parata Systems product portfolio includes vending machine-like robots for dispensing, capping, and sorting pills and software programs for pharmacy automation devices.

- In August 2021, Capsa Healthcare acquired Specialty Carts Inc. to expand LTC medication management capabilities. The acquisition will continue Capsa’s ability to provide a highly diverse product offering in pharmacy automation.

Moreover, other emerging players in the market include RxSafe LLC., NewIcon, ScriptPro LLC., and others. These players are focusing on R&D for new product launches to increase the accessibility of their pharmacy automation devices across the globe. Also, market players are focusing on technological advancements and improving the digital capabilities of automated devices to increase their demand in hospital and retail pharmacies. These elements will propel their global pharmacy automation devices market share.

- In May 2021, NewIcon signed a distribution agreement with MEDWISE, a healthcare software development company in Sweden. MEDWISE focuses on the sales, marketing, and maintenance activities of NewIcon’s pharmacy automation systems in Sweden, especially eMED ICON automated dispensing cabinets.

Thus, numerous collaborations and R&D activities within the industry players to launch new and advanced products globally are expected to drive the pharmacy automation devices market growth during the projected period.

LIST OF KEY COMPANIES PROFILED:

- Omnicell, Inc. (U.S.)

- BD (U.S.)

- Yuyama Co., Ltd. (Japan)

- Baxter (U.S.)

- Capsa Healthcare (U.S.)

- ScriptPro LLC (U.S.)

- RxSafe, LLC. (U.S.)

- NewIcon (Finland)

- Swisslog Healthcare (KUKA AG) (Switzerland)

- JVM (Netherlands)

KEY INDUSTRY DEVELOPMENTS:

- December 2024 – ASHP Exhibition Participation

Swisslog Healthcare showcased its latest pharmacy automation technologies at the American Society of Health-System Pharmacists (ASHP) Midyear Clinical Meeting & Exhibition. The company highlighted its advanced robotic solutions aimed at optimizing medication management.

- October 2023 – NextGen Supply Chain Conference Insights

At the NextGen Supply Chain Conference, Swisslog discussed the expanding role of AI in supply chain management, highlighting its ItemPiQ robot that uses AI to improve pick reliability and efficiency in warehouse operations.

REPORT COVERAGE

The global market report provides detailed market analysis and focuses on crucial aspects such as leading players, product types, and major indications of products. Additionally, it offers insights into market trends, key industry developments such as mergers, partnerships, & acquisitions, and the impact of COVID-19 on the market. In addition to the factors mentioned above, the report includes the factors that have contributed to the market's growth in recent years with a regional analysis of different segments.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD billion) |

|

Growth Rate |

CAGR of 11.08% from 2026-2034 |

|

Segmentation |

By Product

|

|

By Distribution Model

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 3.84 billion in 2026 to USD 9 billion by 2034.

Registering a CAGR of 11.08%, the market will exhibit steady growth over the forecast period (2026-2034).

The automated medication dispensing systems segment led the market in 2026.

The rising prevalence of medical errors in pharmacies and the increasing product launches by industry players across the globe are the key factors driving the market growth.

Omnicell Inc., BD, and Yuyama Ltd. are major players in the global market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us