Photodynamic Therapy Market Size, Share & Industry Analysis, By Product Type (Photosensitizer Drugs [Oral and Parenteral] and Photodynamic Therapy Devices [Laser and Non-Laser]), By Application (Cancer, Actinic Keratosis, Acne, Psoriasis, and Others), By End-User (Hospitals, Specialty Clinics, and Others), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

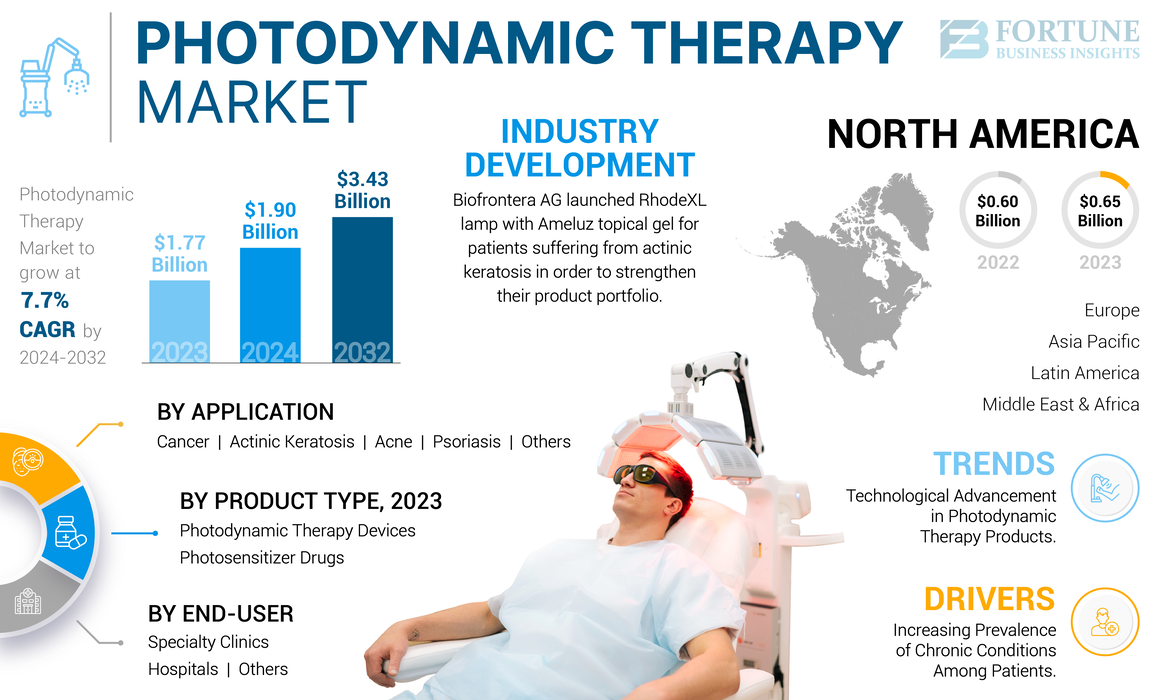

The global photodynamic therapy market size was valued at USD 1.77 billion in 2023. The market is projected to grow from USD 1.90 billion in 2024 to USD 3.43 billion by 2032, exhibiting a CAGR of 7.7% during the forecast period. North America dominated the photodynamic therapy market with a market share of 36.72% in 2023.

Photodynamic Therapy (PDT) includes the use of oxygen, light energy, and photosensitizer compounds for the treatment of various chronic conditions, including cancer, psoriasis, and others. Photosensitizing agents are natural or synthetic structures that get activated after receiving light.

The growing prevalence of various chronic conditions, including cancer, among others, is resulting in rising diagnosis and further treatment rates among patients. The rising treatment rate for these conditions is supporting the growing demand for advanced treatment procedures, such as photodynamic therapy, among patients.

- According to the 2023 data published by the National Center for Health Statistics, it was reported 1,958,310 new cancer cases are projected to occur in the U.S.

The growing focus of the prominent players operating in the market on the research and development activities to develop and introduce products among the patients is likely to boost the adoption of these products in the market. This, along with growing technological advancements such as the integration of nanotechnology, including quantum dots as innovative photosensitizers, among others, is another factor contributing to the growing global photodynamic therapy market size.

The COVID-19 pandemic’s impact on the global market was negative due to restrictions imposed, which resulted in reduced patient visits to healthcare settings. Major companies also witnessed a decline in the demand for these products and revenues due to reduced sales of the products globally.

Global Photodynamic Therapy Market Snapshot & Highlights

Market Size & Forecast:

- 2023 Market Size: USD 1.77 billion

- 2024 Market Size: USD 1.90 billion

- 2032 Forecast Market Size: USD 3.43 billion

- CAGR: 7.7% from 2024–2032

Market Share:

- Region: North America dominated the market with a 36.72% share in 2023. This is driven by the increasing prevalence of chronic disorders, a growing number of inpatient and outpatient admissions, and a strong focus from key players on acquisitions and mergers to strengthen their market presence.

- By Application: The Cancer segment held the largest market share in 2023. The segment's dominance is attributed to the growing prevalence of cancer, which is increasing the demand for innovative therapies, and the numerous benefits of photodynamic therapy, such as improved patient outcomes and limited damage to healthy cells.

Key Country Highlights:

- Japan: As part of the fastest-growing Asia Pacific region, Japan's market is driven by a rising geriatric population, an increasing focus on skin disorders, and growing demand for innovative treatment procedures from a large and aging patient base.

- United States: Market growth is fueled by a high prevalence of chronic conditions, with an estimated 1.9 million new cancer cases projected to be diagnosed. The market is also supported by a significant number of people with skin conditions such as psoriasis, which affects more than 8 million people in the U.S.

- China: Growth is supported by a rapidly aging population, with about 297 million people aged 60 and above, who are more prone to chronic disorders. This, coupled with rising strategic initiatives from key players, is driving the adoption of advanced therapies in the Asia Pacific region.

- Europe: The market is advanced by a high prevalence of skin conditions, with an estimated 13.3% of the population suffering from actinic keratosis. Strategic collaborations, such as the one between Biofrontera AG and German Medical Engineering GmbH to promote a new daylight lamp for photodynamic therapy, are also key growth drivers.

Photodynamic Therapy Market Trends

Technological Advancement in Photodynamic Therapy Products

The prominent players operating in the market are focusing on technological advancements in photodynamic products, such as the use of organoids for photodynamic applications, among others. There are growing research and development activities to integrate nanotechnology for the development of biocompatible and non-toxic molecules for this therapy. Quantum dots, such as those created from silicone and carbon, have electronic and optical properties that differ from larger particles, thereby delivering improved and faster results among patients.

- In February 2023, Photonamic GmbH & Co KG collaborated with Lumeda, Inc., for a clinical study where Photonamic’s photosensitizing drug Gleolan was used in combination with Lumeda’s DigiLum PDT technology, a light delivery and dosimetry system. This collaboration aimed to cater to the growing demand for patients who have non-small cell lung cancer.

Additionally, the integration of technology with these systems also provides high photodynamic activity, which enables the drug to target cancer cells with unparalleled precision, minimizing damage to surrounding health tissues among patients. The increasing number of clinical trials, along with technological advancements associated with these systems, have shifted the focus of key players to introduce advanced products in the global market.

Download Free sample to learn more about this report.

Photodynamic Therapy Market Growth Factors

Increasing Prevalence of Chronic Conditions Among Patients to Support Market Growth

The increasing prevalence of chronic conditions, including various types of cancers, psoriasis, and others, is resulting in rising patient admissions and treatment to healthcare settings for these conditions. The increasing number of patient admissions is further resulting in the growing demand for these systems among patients.

- For instance, according to the 2023 data published by the National Center for Biotechnology Information (NCBI), it was reported that approximately 2% of the population is affected by psoriasis in the U.S.

The growing demand for minimally invasive procedures is further driving the focus of key players to develop and introduce innovative products, thereby likely boosting the adoption of these products among patients. Improving healthcare infrastructure in emerging countries such as India, China, Mexico, and others, growing geographical expansion, collaborations, and mergers among the key players to strengthen their presence are some of the other major factors expected to favor the adoption of these devices in the market.

The increasing adoption, along with the benefits of this therapy over other therapies, is expected to boost the global photodynamic therapy market growth during the forecast period.

RESTRAINING FACTORS

Lack of Awareness About Benefits of These Systems to Hamper Market Growth

There are various advantages of this therapy over other therapies for the patient population suffering from various chronic conditions. However, limited awareness about the benefits of this therapy among patients, especially in emerging countries, is a major limitation of the market. There is much resistance among patients to adopt this new therapy owing to the limited awareness about this therapy.

The availability of other alternative therapies for the treatment of chronic conditions, including cancer and others, is also limiting the spread of awareness among patients. Thus, the limited awareness about the benefits of this therapy, along with the high cost of PDT among patients, is also likely to hinder the adoption of this therapy among patients.

- For instance, according to 2021 statistics published by Medica Tour, it was reported that the cost of photodynamic therapy is approximately USD 8,500. Thus, high costs for PDT among patients are likely to hinder the growing adoption of this therapy, thereby limiting the growth of the market.

Photodynamic Therapy Market Segmentation Analysis

By Product Type Analysis

Increasing Number of Product Launches for Photodynamic Drugs Led to Dominance of Segment

Based on product type, the market is segmented into photosensitizer drugs and photodynamic therapy devices. The photosensitizer drugs segment is further segmented into oral and parenteral. The photodynamic therapy devices segment is further bifurcated into laser and non-laser.

The photosensitizer drugs segment dominated the market in 2023. The dominance is due to the growing benefits of these drugs among patients, such as improved efficacy, minimal invasiveness, and others, resulting in the rising demand for these products in the market. The growing demand is further driving the focus of key players on launching novel photosensitizers in the market.

- In February 2023, Bausch + Lomb with Modulight Corporation, one of the players dedicated to biomedical laser devices, received the approval for photosensitizer drugs VISUDYNE (verteporfin for injection) for the treatment of patients suffering from predominantly classic subfoveal choroidal neovascularization.

The photodynamic therapy devices segment is expected to grow during the forecast period. The growth is due to increasing technological advancements in these devices, such as the integration of artificial intelligence and the adoption of advanced light sources, among others. The growing advancements in these devices are supporting the increasing demand and further adoption of these devices in the market.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Growing Prevalence for Cancer Among Population Led to Dominance of Cancer Segment

Based on application, the market is segmented into cancer, acne, psoriasis, actinic keratosis, and others.

The cancer segment dominated the market in 2023. The dominance of the segment is due to the growing prevalence of cancer, resulting in a rising demand for innovative therapies among the patient population. The increasing demand, along with several benefits of this therapy, including improved patient outcomes and limited damage to health cells, among others, is further resulting in the focus of key players toward R&D activities to develop and introduce novel products in the market.

- For instance, according to the 2023 statistics published by the American Association for Cancer Research (AACR), it was reported that an estimated 1.9 million new cancer cases are expected to be diagnosed with cancer in the U.S.

The actinic keratosis segment is also expected to grow during the forecast period. The growth is due to the rising prevalence of actinic keratosis, resulting in a growing number of patient admissions in these healthcare settings. The increasing number of patient admissions, coupled with a growing focus on novel drugs, is likely to support the rising adoption of these products in the market.

Additionally, the psoriasis and acne segments are also expected to grow during the forecast period. The growth is due to an increasing focus on skin disorders, including psoriasis, acne, and others, resulting in the rising demand for innovative treatment procedures in the market. Growing awareness about the benefits of this therapy among the patient population is further likely to drive the focus of key players toward inorganic growth strategies to strengthen their market presence.

By End-user Analysis

Increasing Number of Hospitals Globally Led to Dominance of Segment

On the basis of end-user, the market is segmented into hospitals, specialty clinics, and others.

The hospitals segment accounted for the largest market share in 2023. The growth is due to the growing demand for PDT, which has resulted in the rising number of hospitals offering this therapy among patients in the market. The increasing prevalence of chronic diseases such as cancer, actinic keratosis, and others, coupled with reimbursement coverage policies, is likely to augment the adoption of this therapy in the market.

- For instance, according to the 2023 data published by Above & Beyond ABA Therapy, there are approximately 7,335 active hospitals in the U.S.

Specialty clinics and other segments are expected to grow during the forecast period. The growth is due to increasing demand for novel drugs and devices, resulting in the rising number of patient admissions for the treatment of these disorders. This, along with the increasing availability of technologically advanced devices and novel drugs in these healthcare settings, is likely to boost the adoption of these products in the market.

REGIONAL INSIGHTS

Based on geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Photodynamic Therapy Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America was valued at USD 0.65 billion in 2023 and dominated the market. The dominance of the region is due to the increasing prevalence of chronic disorders such as cancer, acne, actinic keratosis, and others, resulting in the growing number of inpatient and outpatient admissions in healthcare settings. The rising number of key players focusing on acquisitions and mergers to strengthen their market presence is likely to support the growing adoption of the products in the market.

- For instance, in March 2024, according to the 2022 data published by the National Psoriasis Foundation, it was reported that more than 8 million people in the U.S. have psoriasis.

Europe is also expected to grow during the forecast period. The growth is due to the growing prevalence of chronic disorders such as cancer, psoriasis, and others, resulting in the rising adoption of these products among patients in the market. The increasing number of cases suffering from these disorders is resulting in the rising focus of key players on R&D activities to launch novel products, further increasing the adoption of these products in the market.

- For instance, according to the 2023 statistics published by Almirall, S.A., an estimated 13.3% of the European population is suffering from actinic keratosis.

Asia Pacific is also expected to grow during the forecast period. The growth is due to the rising geriatric population in the region. The geriatric population is more prone to chronic disorders such as cancer, acne, and others. The increasing prevalence of these disorders, along with growing strategic initiatives among the key players to expand their geographical reach in emerging countries such as India, China, and others, is further likely to support the growth of the market.

- According to the 2023 statistics published by China’s government, it was reported that there are about 297 million people aged 60 and above in China.

Additionally, Latin America and the Middle East & Africa are also expected to grow during the forecast period. The growth is due to increasing awareness among the patient population regarding this therapy, which has resulted in rising demand for these procedures in the market. Also, an increasing focus of the key players toward launching novel drugs and devices is likely to boost the adoption of these products in the market.

KEY INDUSTRY PLAYERS

Significant Focus of Key Players to Strengthen their Product Portfolio to Support Market Growth

The market is consolidated with a few players operating in the market with a robust and diversified product portfolio.

Biofrontera AG and Galderma are the prominent players, accounting for a majority of the market share. The increasing focus of these companies on research and development activities to launch innovative drugs and device products to strengthen their product portfolio is likely to support the growing share of these companies in the market.

- For instance, in June 2022, Biofrontera AG, a biopharmaceutical company, launched Ameluz and BF-RhodoLED with the aim of strengthening its product portfolio in Finland.

Additionally, Sun Pharmaceutical Industries Ltd. and Luzitin S.A. are focusing on inorganic growth strategies such as acquisitions and mergers to increase their brand presence, which is also contributing to the global photodynamic therapy market share.

Novartis AG Bausch + Lomb is also growing in the market. The rising focus of these key players on strategic initiatives to expand their geographical presence is likely to support the growth of these companies in the market.

List of Top Photodynamic Therapy Companies:

- BIOFRONTERA AG (Germany)

- LUMIBIRD (France)

- Sun Pharmaceutical Industries Ltd. (India)

- GALDERMA (Switzerland)

- Bausch + Lomb (Canada)

- Luzitin, S.A. (Portugal)

- Novartis AG (Switzerland)

- Modulight Corporation (Finland)

- Theralase Technologies Inc. (Canada)

KEY INDUSTRY DEVELOPMENTS:

- June 2024 – Biofrontera AG launched RhodeXL lamp with Ameluz (aminolevulinic acid hydrochloride) topical gel for patients suffering from actinic keratosis in order to strengthen their product portfolio.

- February 2024 – Biofrontera AG collaborated with GME - German Medical Engineering GmbH in order to promote the Multilite daylight lamp for the photodynamic therapy for actinic keratosis in Germany and the U.K.

- July 2023 – Better Therapeutics received the U.S. FDA authorization for AspyreRx (formerly BT-001), a PDT treatment to provide behavioral therapy to patients or older with type 2 diabetes.

- February 2023 – Galderma collaborated with German Medical Engineering (GME) with the aim of promoting their photosensitizer drug, Metvix. This helped the company to strengthen its brand presence globally.

- June 2020 – Sun Pharmaceutical Industries Ltd. Presented data insights about ODOMZO and LEVULAN KERASTICK for treating patients who have skin cancer. This helped the company to increase its brand presence.

REPORT COVERAGE

The report provides a detailed market analysis. It focuses on key aspects, such as market size & market forecast, market segmentation based on product type, application, end-user, region, and competitive landscape. It also gives an overview of technological developments and the prevalence of chronic disorders. Besides, it offers insights into the latest market trends, market statistics, and key industry developments. In addition to the factors mentioned above, it encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 7.7% from 2024-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

|

|

By Application

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market was valued at USD 1.77 billion in 2023 and is projected to record a valuation of USD 3.43 billion by 2032.

In 2023, the North America market value stood at USD 0.65 billion.

The market will exhibit a steady CAGR of 7.7% during the forecast period of 2024-2032.

The photosensitizer drugs segment is the leading segment based on the product type in this market during the forecast period.

The key driving factors of the market include the rising prevalence of chronic diseases, increasing demand for advanced drugs and devices, favorable health reimbursement policies, and the launch of technologically advanced products.

Biofrontera AG, Novartis AG, and Sun Pharmaceutical Industries Ltd. are the leading players in the global market.

North America dominated the market share in 2023.

Launch of technologically advanced products addressing the critical unmet needs of the market are driving the product’s adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us