Pink Hydrogen Market Size, Share & Industry Analysis, By Process (PEM Electrolysis, Alkaline Electrolysis, and Solid Oxide Electrolysis), and By End-User (Refinery, Ammonia, Methanol, Steel Production, Transport, and Others), and Regional Forecast, 2026-2034

Pink Hydrogen Market Size

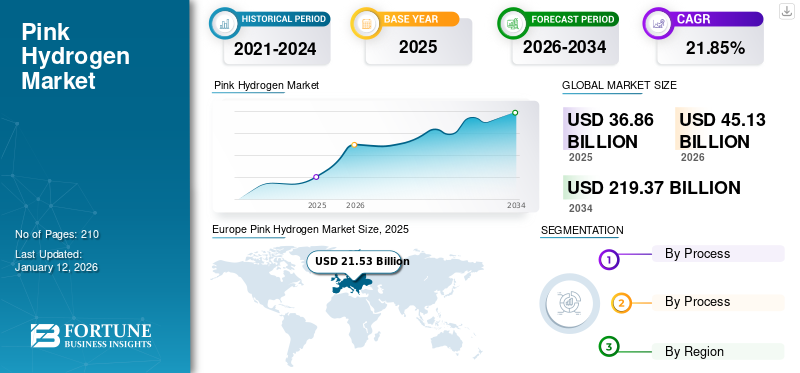

The global pink hydrogen market size was valued at USD 36.86 billion in 2025. The market is projected to grow from USD 45.13 billion in 2026 to USD 219.37 billion by 2034, exhibiting a CAGR of 21.85% during the forecast period. Europe dominated the pink hydrogen industry with a market share of 58.40% in 2025. The Pink hydrogen market in the U.S. is projected to grow significantly, reaching an estimated value of USD 54.81 billion by 2032.

Pink hydrogen is the type of hydrogen produced using nuclear energy and undergoes multiple water electrolysis processes, which is one common process. It can be used in many more public applications. Even though it accounts for a partial share of total hydrogen demand, recent developments to expand its range have been strong, mostly in the transport and refinery sectors. The rising application of hydrogen is creating demand for nuclear based hydrogen, which helps electricity generation.

The COVID-19 pandemic negatively impacted the hydrogen market, including different types of hydrogen. The pandemic affected hydrogen production due to closing of factories, production houses, and border closures. In addition, demand and supply chains were disturbed due to a pause in application operations in multiple regions.

Pink Hydrogen Market Trends

Rising Investment Toward Zero-Emission and Clean Energy Source for Sustainable Future

The global shift toward zero-emission and clean energy is a trending factor with a focus on a sustainable future. The rising government initiative in the direction of clean energy projects propelled by zero-emission regulation has created awareness. The multiple applications of hydrogen are also one of the main reasons for investing in the nuclear based projects.

- For instance, in September 2021, Exelon Generation, which is one of the leading competitive energy providers, announced that it would produce pink hydrogen, also known as purple H2, using an electrolyze process powered by nuclear electricity as it has received a US Department of Energy (DOE) green flag.

Moreover, a cumulative adaptation of the zero-emission goals by the private sector is also creating opportunities for hydrogen in the market. For example, the cost of hydrogen production can be reduced using the waste steam from the steam turbines of a nuclear power station using high-temperature steam electrolysis.

Download Free sample to learn more about this report.

Pink Hydrogen Market Growth Factors

Growing Applications of Hydrogen for Various Sectors Across the Globe

Several industries have been using hydrogen for a long time, but an upsurge has recently been observed due to emerging applications. Transport and automotive are some of the industries that are taking advantage of hydrogen. These sectors are in demand owing to the rising adaptation of hydrogen as a fuel. In addition, major auto manufacturers are evolving fuel cell vehicles (FCVs) powered by gaseous hydrogen. Hence, most of the key players, such as Walmart, FedEx, Bridgestone, Firestone, Coca-Cola, and Whole Foods, are deploying fuel cell industrial trucks.

- For instance, on February 1, 2023, Toyota’s hydrogen-powered car named “Mirai” was relaunched in California and Japan with an extended range and lower price.

Demand for hydrogen will increase in the upcoming years due to stricter environmental legislation. Another end-user that is boosting the pink hydrogen industrial growth is the refinery industry, owing to the stricter environmental legislation implemented by government bodies.

For instance, on July 3, 2023, Indian Oil’s Director - R&D SSV Ramakumar stated that 50% of its refineries’ hydrogen use should be converted to green by 2050. In addition, the country’s first green hydrogen plant working on a commercial scale will be at the Panipat refinery plant, which will have over 7,000 mtpa capacity.

Adaptation of the Hydrogen over Fossil Fuel is Boosting Industrial Growth

Hydrogen has been used widely in recent years due to its advantageous factors. One of the major reasons is that technological development leads to positive climate change. In addition, the global primary energy demand has increased due to the shift from fossil fuel to hydrogen. Most of the energy is supplied by fossil fuels, but many companies are shifting toward hydrogen-based applications due to the energy transition.

For instance, on January 12, 2023, Considering hydrogen applications and climate change, the UAE is about to produce nuclear energy for power generation, which is currently operating two out of four units at the Barakah nuclear power plant. Each plant has a capacity of over 1.4 GW. Once all four units are active, the plants will deliver up to 25% of the UAE's energy needs.

RESTRAINING FACTORS

Unavailability of the Nuclear Power Plants is Restricting the Production of nuclear based Hydrogen

Pink hydrogen is booming in several regions owing to the rise in applications. Despite the demand in multiple sectors, only a few countries can produce pink hydrogen. This is due to the unavailability of the nuclear power plant, as it requires nuclear plants for production.

Brazil and Mexico are not active in producing pink hydrogen despite having nuclear power plants for hydrogen production. Lack of awareness, high project investments, and high initial capital to produce the pink hydrogen are major factors restraining growth.

Pink Hydrogen Market Segmentation Analysis

By Process Analysis

PEM Electrolysis Segment Dominates Driven by its Advantages Over Other Processes

Based on process, the market is segmented into PEM Electrolysis (Polymer Electrolyte Membrane), alkaline electrolysis, and solid oxide electrolysis processes.

Globally, PEM Electrolysis (Polymer Electrolyte Membrane) is one of the common processes used in electrolysis to produce hydrogen and is the market’s dominant segment. Greater energy efficiency, high current density, low gas permeability, wider operating temperatures, and easy handling & maintenance are some of its superior properties. The PEM Electrolysis segment also held the larger share of 49.27% of pink hydrogen market in 2026. The demand for the PEM process is rapidly increasing across the globe owing to its high efficiency and low maintenance. Hence, the number of projects for PEM electrolysis is increasing daily.

For instance, in July 2023, a Chinese public-private consortium invested 33 Billion Yuan (approx. USD 4.5 billion) into the largest green hydrogen project using PEM (proton exchange membrane electrolysis). The project will be located near the city of Fengzhen in Mongolia and produce over 50,000 tons of green hydrogen per year from 3GW of wind and solar power.

By End-User Analysis

Increasing Role of Hydrogen in Desulfurization in Refineries Leads Segment Growth

Based on end-user, the market is segmented into refinery, ammonia, methanol, steel production, transport, and others.

In this particular segment, the refinery is dominating the market share of 39.09% in 2026. Refineries use hydrogen to remove sulfur from the fuels they produce in a chemical separation process called hydrodesulfurization. Furthermore, hydrogen is also important in ammonia plants as it is the crucial raw material for ammonia.

Moreover, steelmaking is an energy-intensive sector, which is hard to decarbonize due to the heat needed for the reduction of iron ore in steel production. This process has historically depended on coal for the necessary heat, which releases carbon dioxide and monoxide. Hydrogen provides an option to greatly decrease carbon emissions from this process, largely replacing coal for direct reactions and combustion.

REGIONAL INSIGHTS

The market is studied geographically across North America, Europe, Asia Pacific, and the rest of the world.

Europe

Europe dominated the market with a valuation of USD 21.53 billion in 2025 and USD 26.61 billion in 2026. Europe accounts for a majority of the global pink hydrogen market share, with the growing demand for several applications and rising production of hydrogen. Applications include petrochemical, steel, cement, aviation, and heavy transportation.

Europe Pink Hydrogen Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

The U.K. is one of the dominating countries producing pink hydrogen and contributing most of the share in the European region. Along with the U.K., Russia and Sweden dominates the share of nuclear based hydrogen. The major reasons driving the country's domination are goals toward zero carbon emission and a sustainable future backed by government appreciation. For instance, on September 14th, 2023, The Bay Hydrogen Hub project is about to produce nuclear based hydrogen by running power and steam from the utility's 1.25GW Heysham 2 plant via a solid-oxide electrolyzer process. The UK market is projected to reach USD 16.47 billion by 2026.

North America

North America is one of the fastest-growing regions owing to the advancement in hydrogen production operations. North America also has major active nuclear plants producing pink hydrogen and contributing to the global share. For instance, in 2022, DOE's Office of Energy Efficiency & Renewable Energy and the Office of Nuclear Energy collaborated with utilities to back three hydrogen demonstration projects at nuclear power plants. The U.S. market is projected to reach USD 12.52 billion by 2026.

Asia Pacific

Asia Pacific is also one of the fastest-growing regions, driven by the emerging adaptation of hydrogen use. The region has a wide population, which is driving the economy very well. People's financial spending power is drastically increasing due to developing industries and stable government activities. China leads Asia Pacific, driven by several advancements in hydrogen production activities, and dominates the hydrogen market.

In addition, other factors are a large part of the global chemical market, and its substantial oil refining capacity is the primary source of hydrogen demand. The Japan market is projected to reach USD 1.56 billion by 2026, and the China market is projected to reach USD 3.96 billion by 2026.

Latin America and Middle East & Africa

The rest of the world, which includes Latin America and the Middle East & Africa, are also trying to get into the race for pink hydrogen production. Many countries are developing hydrogen due to its growing global demand. Gulf countries are initiating hydrogen production plants to switch from fossil fuels to clean energy. For instance, on October 12th, 2023, The UAE investigated the production of nuclear based hydrogen generated through electrolysis powered by nuclear energy. There are seven different projects with dissimilar maturity levels across the country as they try to meet demand for domestic use and exports.

Key Industry Players

Players Align their Sustainability Collaborate with Government Initiatives to Solidify Market Position

The pink hydrogen market growth is focused on investments by0020leading market players: Air Products and Chemicals, OKG Aktiebolag, Linde Plc., and others. Leading Plc. is a global player in industrial gases and engineering solutions. Linde has been producing hydrogen for more than an era and is an inventor of new hydrogen production technologies.

- For Instance, in September 2022, Linde Plc. announced that it would build a 35 MW PEM (Proton Exchange Membrane) electrolyzer to produce green hydrogen in New York. The plant will be one of the largest electrolyzers installed by Linde globally and will double Linde’s green liquid hydrogen production capacity in the U.S.

LIST OF TOP PINK HYDROGEN COMPANIES:

- Siemens Energy (Germany)

- Air Products and Chemicals (U.S.)

- OKG Aktiebolag (Sweden)

- Linde Plc (Ireland)

- Exelon Corporation (U.S.)

- Air Liquid (France)

- Nel ASA (Norway)

- Hydrogen Systems (Denmark)

- Iberdrola SA (Spain)

- SGH2Energy (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- April 2024, India is in discussion with large domestic businesses to invest in the regulated nuclear sector, including focus on clean power. This discussion also includes the production if the pink hydrogen in the country.

- October 2023: The U.S. government announced USD 7 billion in funds for seven regional “hubs” to produce hydrogen. If produced cleanly, hydrogen could help fight global warming by swapping fossil fuels in the fertilizer and steel industries and tricky-to-electrify vehicles such as industrial trucks.

- October 2023: China's home-based nuclear power facilities with advanced technology have rolled off the production line, with over 20 third-generation nuclear reactors in the pipeline, established to generate more clean energy to push the country's growth.

- April 2022: DOE’s Office of Energy Efficiency & Renewable Energy and the Office of Nuclear Energy have already started collaborating with utilities to back three hydrogen demonstration projects at nuclear power plants.

- February 2021: Nuclear power may produce one-third of the UK’s clean hydrogen by 2050, as per the Hydrogen Roadmap developed by the Nuclear Industry Council (NIC). The NIC, co-chaired by the Minister for Business, Energy and Clean Growth and Nuclear Industry Association (NIA), sets strategies for government-industry teamwork to promote nuclear power in the U.K.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 21.85% from 2026 to 2034 |

|

Unit |

Value (USD Billion) and Volume (Thousand Tons) |

|

Segmentation |

By Process

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

A study by Fortune Business Insights states that the global market was USD 45.13 billion in 2026.

The global market is projected to grow at a CAGR of 21.85% over the forecast period.

The Europe pink hydrogen market size stood at USD 26.61 billion in 2026.

Based on process, the PEM Electrolysis (Polymer Electrolyte Membrane) segment holds a dominating global market share.

The global market size is expected to reach USD 219.37 billion by 2034.

Rising demand for refinery systems is a key factor propelling market growth.

Siemens Energy, Linde Plc, and Air Liquid are some of the top players actively operating across the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us