Plasma Surface Treatment Equipment Market Size, Share & Industry Analysis, By Type (Low Pressure/Vacuum Plasma and Atmospheric Plasma), By Application (Manufacturing/Fabrication (Metals and Conductive Materials), Semiconductor, Automotive, Electronics, Medical, Textiles, and Others), and Regional Forecast, 2025-2032

Plasma Surface Treatment Equipment Market Size

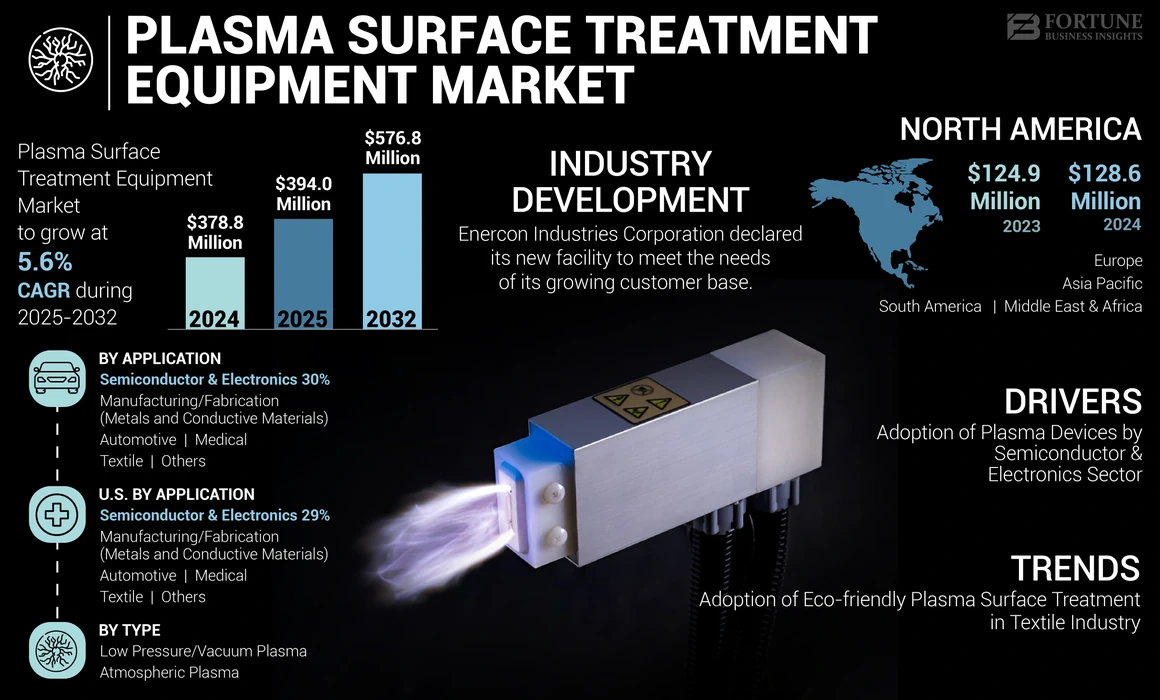

The global plasma surface treatment equipment market size was valued at USD 378.8 million in 2024. The market is projected to grow from USD 394.0 million in 2025 to USD 576.8 million by 2032, exhibiting a CAGR of 5.6% during the forecast period. North America dominated the global market with a share of 33.94% in 2024.

Plasma surface treatment equipment is used to modify the surface properties of materials for improved wettability and adhesion using plasma technology. Plasma surface treatment equipment can treat materials including metals, polymers, and ceramics. This technology is used for performing applications such as surface cleaning and activation, surface functionalization, surface etching & roughening, surface sterilization, and surface grafting. It finds applications in various industries such as aerospace, medical, automotive, semiconductor & electronics, and textiles sectors.

Rapid industrialization and increased adoption of plasma surface treatment equipment in the semiconductor and electronics sector are likely to drive the growth of the market. Moreover, growth in the semiconductor & electronics sector globally has led to an increased demand for plasma surface treatment equipment for performing surface plasma etch and surface cleaning activities, which boost the growth of the market. For instance, according to the Semiconductor Industry Association (SIA), global semiconductor sales increased by 15.8% in April 2024 compared to April 2023. Furthermore, growth in the automotive, aerospace, and semiconductor sectors in the U.S. and Canada, is uplifting the demand for plasma surface treatment equipment for surface treatment activities, surface energy enhancements, and surface modification applications. For instance, according to the report of PWC, new car sales in the U.S. are likely to increase by 30% from 2024 to 2030. Such growth in the automotive sector uplifts the demand for the product, fueling market growth.

The COVID-19 pandemic had a mixed impact on the global plasma surface treatment equipment market owing to disruption in the supply chain of raw materials, and a decrease in the demand from the aerospace, automotive, and electronic sectors, which restricted the global plasma surface treatment equipment market growth. Moreover, COVID-19 pandemic have positive impact on the market owing to increased demand in medical and healthcare sector, growth in the packaging sector, and rising investment in research and development expenditure, to fuels the market growth after COVID-19 pandemic.

Plasma Surface Treatment Equipment Market Trends

Adoption of Eco-friendly Plasma Surface Treatment in Textile Industry to Boost the Market Demand

Surface modification of textiles is becoming increasingly popular across various geographies. New finishing techniques are being developed in the textile industry to improve product quality. The additional constraint of developing fabrics under environmentally friendly conditions is also a significant challenge for many manufacturers. A unique property that makes plasma a versatile alternative is that it can exist over an extensive range of temperatures and pressures. Through different types of treatments, plasma can impart unique surface properties to fibers, enabling a variety of textile finishes, which include improved printability, dye ability, and removal of dirtiness, hydrophobicity, adhesion, and color fastness. These advancements represent the latest trends in the market.

Download Free sample to learn more about this report.

Plasma Surface Treatment Equipment Market Growth Factors

Rising Adoption of Plasma Devices by Semiconductor & Electronics Sector to Fuels the Market Growth

Plasma is an innovative product in the semiconductor industry as it guarantees a clean surface and accurate patterning. By effectively removing oxide, plasma addresses problems such as the NSOP (Non-Stick on Pad) and increases the reliability of semiconductor devices. Plasma processing is widely used for an extensive range of applications, such as etching, cleaning, and deposition processes. These manufacturing processes are essential for the development of semiconductor devices such as integrated circuits, growing demand for consumer electronics, automotive electronics, microelectromechanical systems, and other nanoscale devices. Leading companies offer these devices to stay competitive in the market. For instance, in March 2024, Nordson introduced FlexTRAK plasma processing solutions specifically tailored to the needs of advanced semiconductor packaging and assembly, wafer-level packaging, and microelectromechanical assembly. These plasma applications include cleaning, bump adhesion, wire bond improvement, sludge removal, and stripping. All these factors are anticipated to show a positive impact on the plasma surface treatment equipment market.

RESTRAINING FACTORS

High Capital Initial Investment to Hinder the Market Growth

The plasma surface treatment systems market faces significant challenges due to the high initial investment and maintenance costs associated with these systems. The substantial investment required to purchase and install plasma surface equipment presents a financial hurdle for small businesses and companies with limited budgets. Additionally, ongoing maintenance costs such as servicing, calibration, and replacement of consumables can increase overall costs and deter potential buyers. Uncertainty regarding the return on investment further complicates the decision-making process for companies considering these systems. On average, this machine cost between USD 5,000 – USD 8,000 per unit. All such factor restricts the growth of the market.

Plasma Surface Treatment Equipment Market Segmentation Analysis

By Type Analysis

Atmospheric Plasma Segment to Dominate the Market Due to Increasing Demand from Automotive and Electronics Sector

Based on type, the market is segmented into low pressure/vacuum plasma and atmospheric plasma.

The atmospheric plasma dominated the market in terms of revenue in 2023, and growing at substantial growth owing to factors such as cost-effective solutions, and it is used to treat a wide range of materials, including polymers, metals, ceramics, and composites. These machines found applications in the automotive, electronics, packaging, and textiles sectors.

Low pressure/vacuum plasma is projected to grow moderately owing to increasing demand for surface modification in emerging applications, such as biomedical devices, flexible electronics, and energy storage devices. In addition, it requires huge cost compared to other models as it requires a vacuum chamber to perform surface modification activities. This factor is driving the growth of the pressure vacuum plasma surface treatment equipment segment. All such factors contributed positively in the global plasma surface treatment equipment market share.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Semiconductor & Electronics Sector Dominate the Market Owing to Rising Demand for Printing Circuit Boards, and ICs to Drive the Market Growth

Based on application, the market segmentation into manufacturing/fabrication, semiconductor & electronics, automotive, medical, textile, and others.

The semiconductor & electronics segment captures the key market share, and is projected to grow at significant growth rate during the forecast period. These machines are largely adopted in the semiconductor sector for painting and marking printed circuit boards (PCBs), integrated circuits (ICs), and semiconductor chips. Additionally, these type of systems are used for performing various applications such as cleaning, etching, deposition, surface modification, and enhancing reliability, to drive the market growth.

The manufacturing/fabrication (metal and conductive materials) segment is anticipated to grow steadily owing to rising demand from the electronics sectors. This treatment equipment is used for etching, surface modification, and cleaning applications.

The automotive, medical, and textiles sectors are projected to grow moderately, owing to rising demand for performing cleaning, painting, and etching applications.

The others segment includes the aerospace sector. Rising demand for equipment in the aerospace sector for etching, cleaning, and surface modification activities, fuels the growth of the market. All such factors drive the market growth.

REGIONAL INSIGHTS

The market covers five major regions mainly as North America, Europe, Asia Pacific, Middle East and Africa, and South America.

North America Plasma Surface Treatment Equipment Market Size, 2024

To get more information on the regional analysis of this market, Download Free sample

North America is set to dominate the market during the forecast period owing to the strong presence of well-established industries such as aerospace, electronics, medical devices, and automotive. In addition, strong growth observed from semiconductor and electronics and automotive sector creates demand for plasma surface treatment equipment, fueling market growth. For instance, according to the International Organization of Motor Vehicle Manufacturers (OICA), the automotive sector growth in North America increased by 8.5% in 2023 as compared to 2022.

The U.S. is Set to Observe Significant Growth Due to Owing to Rising Demand from Automotive and Electronics Sectors

The country is set to grow at a significant rate owing to rising demand from the electronics and semiconductor sectors, driving market growth. These industries adopted high-quality surface treatment equipment for improved adhesion, biocompatibility, and corrosion resistance. In addition, the North American region has stringent regulations and quality standards, particularly in the medical device and food packaging industries, which necessitate the use of advanced surface treatment technologies such as plasma treatment.

To know how our report can help streamline your business, Speak to Analyst

Europe is projected to grow steadily during the forecast period, due to rising growth in the automotive, medical, and electronics sectors across countries such as Germany, France, and Italy. This growth creates demand for plasma surface treatment equipment, thereby driving the growth of the market. For instance, according to Germany Trade & Invest (GTAI), the automotive sector in Germany increased by 24% in 2023 compared to 2022.

Asia Pacific is anticipated to grow moderately during the forecast period, owing to growing industrialization, growth in industrial sectors, infrastructure investment, and rising demand from various industry verticals such as automotive, electronics, and medical sectors. These factors contribute to market growth in the Asia Pacific region.

The Middle East & Africa and South America are projected to grow with decent growth owing to growing demand in the consumer electronics and automotive sectors. In addition, growth in the oil and gas industry in the Middle East & Africa region drives demand for plasma surface treatment equipment for applications such as corrosion resistance, functional coatings, and surface activation on components and equipment. All factors collectively enhance the market growth in these regions.

KEY INDUSTRY PLAYERS

Key Players are Adopting Product Launch and Acquisition Strategic to Intensify the Market Competition

Major players such as 3DT LLC, Pink GmbH Thermosysteme, Plasmatreat, Diener Electronics GmbH & Co. KG, and Tantec A/S and among others, are actively engaged in adoption strategies such as product launch, acquisition, and business expansion to strengthen their competitive landscape. For instance, in January 2023, Europlasma partnered with Specialty Coating Systems, a technology company to develop, fine-tune, and deliver coating and plasma surface treatment solutions.

List of Top Plasma Surface Treatment Equipment Companies:

- 3DT LLC (U.S)

- Plasmatreat (Germany)

- Diener Electronics GmbH & Co. KG (Germany)

- Tantec A/S (Denmark)

- Fari Plasma (China)

- Nordson Corporation (U.S.)

- Henniker (U.K.)

- Enercon Industrie Corporation (U.S.)

- Eltech Engineers Pvt Ltd (U.S.)

- Tri-Star Technologies Inc (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- December 2023: Plasmatreat launched new plasma nozzles to extend its large product portfolio, targeting specific applications. Plasma technology allows the modification of surface properties in various materials in order to optimally prepare them for subsequent processing.

- September 2023: Tantec UK & Ireland displayed its atmospheric plasma and vacuum plasma on a robot system, discussing various aspects of plasma treatment.

- July 2023: Enercon Industries Corporation announced that it is building a new facility to meet the needs of its growing customer base. This facility would improve customer service delivery, create additional production capacity and enable the development of innovative products.

- March 2023: Ebble Group, which includes Tantec-UK and Ebble Manufacturing, moved to new premises as part of their expansion strategy to improve the product portfolio of plasma treatment devices for U.K. customers.

- June 2022: Intertronics launched the Relyon Plasma Piezobrush PZ3-i aimed at automating plasma surface treatment for manufacturers in the medical and life sciences industry.

REPORT COVERAGE

The report provides an in-depth analysis of the plasma surface treatment equipment industry dynamics and competitive landscape. The report also provides market estimation and forecast based on type, application, and regions. It provides various key insights, recent industry developments in the market such as mergers & acquisitions, macro, and microeconomic factors, SWOT analysis, and company profiles.

To gain extensive insights into the market, Download for Customization

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.6% from 2024 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

By Application

By Region

|

Frequently Asked Questions

As per Fortune Business Insights study, the market was valued at USD 378.8 million in 2024.

The market is expected to reach USD 576.8 million by 2032.

The market is projected to grow at a CAGR of 5.6% during the forecast period (2025-2032).

Based on type segment, low pressure/vacuum plasma segment to dominate the market over the forecast period.

Increasing demand from semiconductor & electronics and medical sector are the key factor driving the growth of market.

3DT LLC, Plasmatreat, Diener Electronics GmbH & Co. KG, Tantec A/S, Fari Plasma, Nordson Corporation, Henniker, Enercon Industrie Corporation, Eltech Engineers Pvt Ltd, and Tri-Star Technologies Inc are the leading companies in this market.

North America region is likely to hold the major share of the market, owing to strong growth in the automotive and electronics sector, fueling market growth.

Rising acceptance of eco-friendly plasma surface treatment in textile industry are latest trends in the market.

The semiconductor & electronics industry is expected to lead the market over the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us