Plastic Antioxidants Market Size, Share & Industry Analysis, By Type (Primary, Secondary, and Blends), By Application (Polypropylene (PP), Polyethylene (PE), Polystyrene (PS), Acrylonitrile Butadiene Styrene (ABS), and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

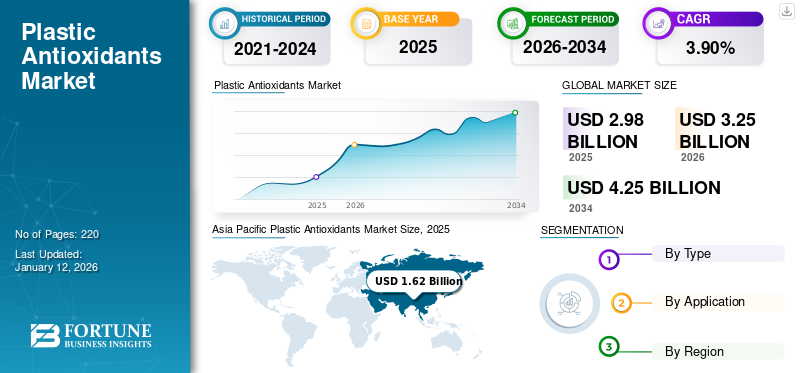

The global plastic antioxidants market is projected to grow from $3.25 billion in 2026 to $4.25 billion by 2034, at a CAGR of 3.90%. Asia Pacific leads the market with a 55% share in 2025.

Plastic antioxidants play a pivotal role in safeguarding polymers from degradation caused by oxidation, extending the lifespan of plastic products. These additives counteract the detrimental effects of oxygen exposure, UV radiation, and heat, thereby preserving the structural integrity and performance of diverse plastic materials. As the demand for durable and long-lasting plastics continues to rise across various industries, the market for global plastic antioxidants experiences steady growth. This highlights the critical function of these additives in enhancing the durability and sustainability of plastic products on a global scale. Moreover, these antioxidants act as stabilizers by inhibiting oxidation reactions that lead to the deterioration of plastics, preventing issues such as discoloration, brittleness, and loss of mechanical properties, which boosts their demand.

The COVID-19 pandemic significantly impacted the market, primarily due to disruptions in supply chains and changes in consumer behavior. Initially, there was a surge in demand for plastics in medical applications and packaging, driving a short-term increase in the need for plastic antioxidants. However, economic slowdowns and reduced manufacturing activities in several industries, including automotive and construction, led to a decline in overall demand. The pandemic also accelerated trends toward sustainability, influencing the development and use of eco-friendly and bio-based plastic antioxidants.

Global Plastic Antioxidants Market Overview

Market Size and Forecast:

- 2026 Market Size: USD 3.25 billion

- 2034 Projected Market Size: USD 4.25 billion

- CAGR (2026–2034): 3.90%

Market Share:

- Asia Pacific Market Share (2025): 55% (leading regional market)

Regional Highlights:

- Asia Pacific:2025 Market Size: USD 1.62 billion

- Europe: Growth driven by eco-friendly initiatives, circular economy adoption, and stringent plastic regulations.

- North America: Strong demand from automotive, packaging, and construction industries.

Plastic Antioxidants Market Trends

Heightened Focus on Sustainable Solutions is Likely to Create New Market Opportunities

The most notable trend in the plastic antioxidants market is a heightened focus on sustainable solutions driven by the industry’s commitment to environmental resilience. Manufacturers are increasingly prioritizing the development of eco-friendly antioxidants to address environmental concerns and align with the global shift toward sustainable practices. This trend is reshaping the market dynamics, with an emphasis on creating products that enhance the performance of plastics and contribute to a more eco-conscious and circular approach to plastic usage. In addition, the market is witnessing a transformative shift as the industry embraces sustainable innovations, redefining the landscape with a commitment to eco-conscious practices. Furthermore, the surge in demand for sustainable solutions is reshaping the landscape of plastic antioxidants, prompting innovative formulations that enhance the performance and longevity of plastic materials and align with principles of environmental responsibility.

Download Free sample to learn more about this report.

Plastic Antioxidants Market Growth Factors

Environmental Concerns and Stringent Regulations to Drive Market Growth

The increasing awareness of plastic pollution and the urgent need for sustainable practices have prompted manufacturers to invest in antioxidants that protect plastic from degradation and align with eco-friendly principles. This shift toward sustainability is evident in the rising preference for bio-based and recyclable antioxidants, reflecting the industry’s commitment to responsible and environmentally conscious solutions. Furthermore, stringent regulations imposed by governments globally are pushing manufacturers to adopt eco-friendly solutions, including antioxidants that protect from degradation. The need to reduce the environmental footprint of plastic materials has led to a surge in research and development efforts, focusing on creating antioxidants that align with sustainability objectives. In addition, bio-based antioxidants derived from renewable sources are gaining traction as they offer a greener alternative to traditional additives. This shift toward environmentally conscious practices is driven by consumer preferences and is also a strategic response to comply with evolving environmental standards. These factors are poised to increase the demand for plastic antioxidants.

RESTRAINING FACTORS

Volatility in Raw Material Prices May Hinder Market Growth

The plastic antioxidant market is intricately tied to the dynamics of raw material prices, and the volatility in these prices has a profound impact on the industry. Antioxidants, being a derivative of petrochemical feedstock, are particularly susceptible to fluctuations in oil prices. The production process involves the use of key raw materials derived from crude oil, such as phenols and aromatic amines. Therefore, any shifts in the global oil market directly influence the cost structure of producing antioxidants. In addition, the unpredictability of raw materials prices hinders manufacturers' long-term planning. Strategic decision-making, investment planning, and budgeting become more challenging when faced with frequent and significant fluctuations. As a result, it may impede the market growth in the long-term forecast.

Plastic Antioxidants Market Segmentation Analysis

By Type Analysis

Primary Segment Accounted for the Major Share Due to its Durability Across Diverse Plastic Products

By type, the market is segregated into primary, secondary, and blends.

The primary segment held a major global plastic antioxidants market share of 49.54% in 2026. This segment includes phenolic antioxidants and its growth in the market is propelled by several driving factors that contribute to its sustained growth and widespread adoption across various industries. One key factor is the exceptional effectiveness of phenolic-based products in inhibiting oxidation, making them a preferred choice for enhancing the durability and performance of plastic materials. This efficacy is particularly crucial in demanding applications where exposure to environmental stressors, such as UV radiation and heat, can lead to degradation, which makes it a primary choice among consumers. Furthermore, the primary segment plays a pivotal role in the market, primarily due to its exceptional ability to prevent oxidative degradation of plastics. These antioxidants are crucial for enhancing the longevity, durability, and performance of plastic products across various industries. By scavenging free radicals, phenolic-based antioxidants inhibit the chain reaction of oxidation, a common challenge in the lifecycle of plastic materials. This capability makes them indispensable in applications ranging from packaging, automotive, and construction to consumer goods, where the integrity and longevity of plastic components are paramount.

In addition, the use of the secondary segment in the market is notably significant. These antioxidants play a crucial role in enhancing the polymers' resistance to oxidation, thereby extending their lifespan and maintaining their physical properties over time. They are particularly valued for their synergistic effects when used in conjunction with primary antioxidants, effectively stabilizing plastics against thermal degradation and processing. This makes them indispensable in the manufacturing of various plastic products, ranging from packaging materials to automotive components, where durability and longevity are paramount, boosting the demand for secondary antioxidants.

Furthermore, blends - primary & secondary combination approach provides a more comprehensive and extended protection against the diverse mechanisms of polymer degradation, resulting in enhanced overall performance and longevity of plastic products. This factor is poised to expand its demand from 2024-2032.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Polyethylene (PE) Segment Accounted for the Largest Share Due to Surging Demand from Packaging Industry

Based on application, the market for plastic antioxidants is segmented into Polypropylene (PP), Polyethylene (PE), Polystyrene (PS), Acrylonitrile Butadiene Styrene (ABS), and others.

The Polyethylene (PE) segment held the largest market share 36.92% globally in 2026. Polyethylene (PE) has widespread applications in the packaging industry. As a preferred material for packaging films, bottles, and containers, it plays a pivotal role in the packaging industry. The need to protect these packaging materials from degradation due to exposure to environmental stressors, such as UV radiation and heat, fuels the demand for antioxidants. Furthermore, the use of polyethylene antioxidants in packaging contributes to sustainability efforts by improving the recyclability and reducing the environmental footprint of packaging materials.

In addition, the Polypropylene (PP) segment in the market is influenced by several factors that contribute to its sustained growth and widespread adoption. The polypropylene segment within the market is experiencing robust growth, driven by its extensive application across multiple industries including automotive, packaging, and consumer goods. Polypropylene's inherent characteristics such as lightweight, resistance to chemicals, and versatility make it an ideal choice for manufacturing a wide range of products. The incorporation of antioxidants in polypropylene resin not only enhances its resistance to thermal degradation and oxidation but also substantially extends the material's service life and performance.

Furthermore, the robust growth in the consumer electronics sector is a significant driver for the Polystyrene (PS) segment expansion. PS is a preferred choice for electronic casing and components due to its lightweight nature and moldability, boosting the demand for antioxidants.

REGIONAL INSIGHTS

Based on region, the market is segmented into Europe, Asia Pacific, Latin America, North America, and the Middle East & Africa.

Asia Pacific Plastic Antioxidants Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

The global plastic antioxidants market size in Asia Pacific stood at USD 1.62 billion in 2025. The region has been identified as the largest consumer due to the presence of leading economies such as China and India. In addition, Asia Pacific is the global automotive manufacturing hub, and according to the International Organization of Motor Vehicle Manufacturers, the region accounted for nearly 70% of the global automotive production in 2022, with China accounting for one-third of the global production alone. With such a vast production base and the usage of plastic antioxidants in automotive components, this region dominates global consumption. The Japan market is projected to reach USD 0.18 billion by 2026, the China market is projected to reach USD 0.95 billion by 2026, and the India market is projected to reach USD 0.22 billion by 2026.

Europe

As Europe intensifies its efforts to combat plastic pollution and reduce its environmental footprint, there is an increased demand for antioxidants that contribute to the longevity and recyclability of plastic materials. Manufacturers are responding by developing eco-friendly solutions, aligning with the circular economy principles advocated by European sustainability initiatives. Stringent regulations further propel the plastic antioxidants market growth in Europe. The UK market is projected to reach USD 0.06 billion by 2026, while the Germany market is projected to reach USD 0.19 billion by 2026.

North America

As industries such as automotive, packaging, and construction continue to expand in North America, there is a parallel surge in the need for antioxidants to protect plastic materials from degradation, ensuring durability and reliability. Ongoing research and development efforts lead to the creation of more effective and multifunctional antioxidant formulations. This fosters innovation in this region, with manufacturers striving to provide solutions that meet the current demands and anticipate future challenges in the dynamic landscape of plastic applications. The U.S. market is projected to reach USD 0.47 billion by 2026.

List of Key Companies in Plastic Antioxidants Market

Companies Focus on Collaborations to Enhance R&D Efforts and Strengthen Position

Leading manufacturers in North America and Europe are expanding their reach in various countries to strengthen their position in the market. The key players in the market have, therefore, developed strong regional presence, distribution channels, and product offerings.

Major market players are engaged in research and development to produce a superior quality product. Furthermore, the companies are now promoting strategic partnerships and collaboration with other leading manufacturers to improve their R&D efforts. Moreover, the businesses greatly emphasize increasing the service area to increase the market share and boost the company's revenues.

LIST OF KEY COMPANIES PROFILED:

- BASF SE (Germany)

- Clariant (Switzerland)

- ADEKA (Japan)

- Solvay (Belgium)

- Tosaf (Israel)

- Songwon (South Korea)

- Sumitomo (Japan)

- Evonik (Germany)

- Lanxess (Germany)

KEY INDUSTRY DEVELOPMENTS:

- December 2023: BASF launched Irgastab PUR 71, a cutting-edge antioxidant with an advanced anti-scorch solution that offers exceptional performance for polyurethane foams.

- July 2023: Lanxess revealed the release of a new range of Hindered Phenol Stabilizers (HPS) for plastics. These HPS aim to offer better protection against thermal oxidation, which makes them perfect for high-temperature applications such as automotive components and electrical insulation.

- October 2022: SONGWON launched its new products, SONGNOX 9228 antioxidant and SONGSORB 1164 UV absorber, which are suitable for packaging, agriculture, building & construction, and home & personal care applications.

- May 2021: Wells Plastics announced a high-performance antioxidant master batch system for recycled polypropylene and polyethylene.

- December 2019: BASF announced the opening of a second phase of a new antioxidant manufacturing plant in Shanghai, China. This new plant supports the fast-growing antioxidants market in the country.

REPORT COVERAGE

The research report provides both qualitative & quantitative insights on global market. The quantitative insights include market sizing in terms of value (USD Billion) and volume (Kilo tons) across each segment and region profiled in the scope of the study. In addition, it provides market share analysis and growth rates of segments and key countries in each region. The qualitative insight covers the elaborative analysis of key market drivers, restraints, growth opportunities, and industry trends related to the market. The competitive landscape section covers detailed company profiling of the key players operating in the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR 3.90% from 2026-2034 |

|

Unit |

Volume (Kilo Tons) and Value (USD Billion) |

|

Segmentation

|

By Type

|

|

By Application

|

|

|

By Country

|

Frequently Asked Questions

According to Fortune Business Insights, the global plastic antioxidants market is projected to grow from USD 3.25 billion in 2026 to USD 4.25 billion by 2034, exhibiting a CAGR of 3.90% during the forecast period.

The market is expected to exhibit a CAGR of 3.90% during the forecast period.

The market is driven by the rising demand for long-lasting plastic products across packaging, automotive, and construction industries. Growing environmental awareness and regulations are also pushing manufacturers to develop eco-friendly and bio-based antioxidants.

Asia Pacific leads the global market, accounting for over 53.74% share in 2024. This is due to massive plastic and automotive production, especially in China and India, along with increasing industrialization in Southeast Asia.

The market is categorized into primary antioxidants (like phenolic antioxidants), secondary antioxidants (such as phosphites), and blends. Primary antioxidants are most dominant due to their high efficiency in protecting plastics from oxidation.

Sustainability is a major trend reshaping the market. Companies are investing in bio-based and recyclable antioxidants to align with global regulations and circular economy initiatives, especially in Europe and North America.

Polyethylene (PE) holds the largest share due to its extensive use in packaging applications. PE antioxidants help protect packaging materials from UV exposure and heat, enhancing durability and recyclability.

A major challenge is the volatility of raw material prices, especially petrochemical derivatives like phenols and amines. This affects manufacturing costs and long-term business planning for key industry players.

Major companies include BASF SE, Clariant, ADEKA, Solvay, Songwon, Lanxess, Sumitomo, and Evonik. These players focus on R&D, collaborations, and sustainable product innovations to strengthen their market position.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us