Polyhydroxyalkanoate Market Size, Share & Industry Analysis, By Type (Short Chain, Medium Chain, and Long Chain), By Application (Packaging & Food Services, Biomedical, Agriculture, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

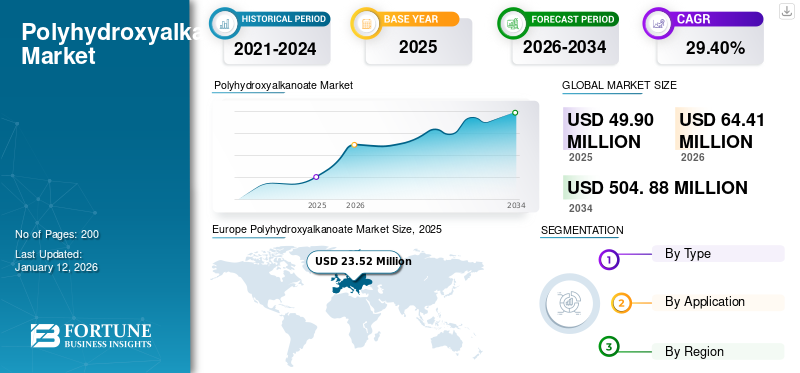

The global polyhydroxyalkanoate market size was USD 49.9 million in 2025 and is projected to grow from USD 64.41 million in 2026 to USD 504. 88 million in 2034 at a CAGR of 29.40% during the forecast period. Europe dominated the polyhydroxyalkanoate market with a market share of 47.00% in 2025.

Polyhydroxyalkanoates (PHA) are a class of biodegradable polymers synthesized by numerous microorganisms as a carbon and energy storage material. These biopolymers exhibit properties similar to conventional plastics while being environmentally friendly, making them increasingly vital in addressing plastic pollution. PHAs are composed of hydroxyalkanoate monomers, with their properties varying based on the monomer composition and structure. PHA's versatility spans diverse applications, including packaging, biomedical devices, agricultural materials, and even 3D printing. Their biocompatibility makes them suitable for medical applications such as sutures, implants, and drug delivery systems, reducing the risk of adverse reactions.

The COVID-19 pandemic had both positive and negative impacts on the market. PHA production faced challenges due to disrupted supply chains. Restrictions on movement and shipping delays affected the availability of raw materials and transportation of finished products. However, heightened awareness of environmental sustainability and the urgent need to address plastic pollution boosted interest in bio-based biodegradable alternatives such as PHA. This increased demand is particularly evident in sectors such as packaging, where there is a growing preference for eco-friendly materials over conventional plastics.

Global Polyhydroxyalkanoate (PHA) Market Key Takeaways

Market Size:

- 2025 Value: USD 49.9 million

- 2026 Value: USD 64.41 million

- 2034 Forecast Value: USD 504. 88 million, with a CAGR of 29.40% from 2026–2034

Market Share:

- Europe dominated the polyhydroxyalkanoate market with a 47.00% share in 2025, driven by a strong bioplastics manufacturing base and stringent plastic disposal regulations.

Key Country Highlights:

- The polyhydroxyalkanoate market in Japan is expected to reach USD 1.79 million by 2025.

- China is projected to witness a strong CAGR of 29.90%, while Europe is anticipated to grow at a CAGR of 29.2% during the forecast period.

- By application, the agriculture segment is projected to generate USD 5.49 million in revenue by 2025.

Polyhydroxyalkanoate Market Trends

Increasing R&D to Develop Advanced PHA Production Technologies is the Latest Market Trend

Ongoing research and development efforts have led to advancements in PHA production technologies, including fermentation processes and genetically engineered microorganisms. These advancements have resulted in improved production efficiency, higher PHA yields, and reduced production costs, making PHA more competitive with conventional plastics. Researchers have genetically engineered microorganisms such as bacteria and algae to produce PHA more efficiently. By optimizing metabolic pathways and enzyme activities, these engineered strains can achieve higher PHA yields and productivity rates. Additionally, advancements in strain development have yielded microbes capable of utilizing a wider range of feedstocks, including industrial waste streams and lignocellulosic biomass. Europe witnessed a growth from USD 14.6 million in 2023 to USD 18.3 million in 2024.

Traditional PHA production relies on sugars derived from crops such as corn and sugarcane as feedstock. However, researchers are exploring alternative feedstocks to reduce dependence on food crops and mitigate competition with food production. These alternative feedstocks include lignocellulosic biomass, organic waste, industrial by-products, and carbon dioxide (CO2) captured from industrial emissions. The diversification of feedstocks presents an opportunity to improve the sustainability and cost-effectiveness of PHA production. These developments underscore the latest trends in the market.

Download Free sample to learn more about this report.

Polyhydroxyalkanoate Market Growth Factors

Increasing Demand for Sustainable Plastic Alternatives to Propel Market Growth

The market is experiencing a surge in demand driven by several key factors, shaping its growth trajectory and market dynamics. Polyhydroxyalkanoates, biodegradable polymers derived from renewable resources, are gaining attention as sustainable alternatives to traditional petroleum-based plastics. As awareness of environmental issues and the need for eco-friendly solutions grows, the market is poised for significant expansion.

The escalating global concern over plastic pollution is a primary driver of the polyhydroxyalkanoate market growth. Traditional plastics, derived from fossil fuels, pose a severe threat to the environment due to their non-biodegradable nature. PHAs offer a sustainable solution as they are biodegradable under various environmental conditions, including soil, marine, and composting environments. As governments, businesses, and consumers prioritize sustainability initiatives, the demand for PHAs as a biodegradable plastic alternative is rapidly increasing. Heightened awareness of plastic pollution and its detrimental impact on ecosystems, marine life, and human health has spurred demand for biodegradable and eco-friendly alternatives. PHA, being biodegradable and derived from renewable resources, presents a viable solution to mitigate plastic waste accumulation in landfills and oceans.

Secondly, regulatory initiatives aimed at reducing plastic waste are fueling the adoption of PHAs. Governments worldwide are implementing stringent regulations and policies to curb plastic pollution and promote the use of biodegradable materials. This includes bans on single-use plastics, mandates for biodegradable packaging, and incentives for sustainable product development. As regulatory pressure mounts, industries are seeking viable alternatives, driving the demand for PHAs across various sectors such as packaging, agriculture, textiles, and biomedical applications. These factors are expected to drive demand for polyhydroxyalkanoate.

RESTRAINING FACTORS

Limited Scalability of Polyhydroxyalkanoate Production May Hamper Market Growth

Microbial fermentation processes are the primary method for PHA production, but scalability remains a challenge. Scaling up production to meet commercial demands often involves significant capital investment and technical challenges, including optimizing fermentation conditions, ensuring product purity, and maintaining consistent product quality at larger scales. As a result, achieving cost-effective large-scale production of PHAs is hindered by these scalability limitations. Additionally, the performance characteristics of PHAs may not always meet the requirements of specific applications. While PHAs offer biodegradability and environmental benefits, their mechanical properties, such as strength, flexibility, and heat resistance, may not match those of conventional plastics in some applications. This limitation restricts the range of industries and applications where PHAs can be effectively utilized, particularly in applications requiring high-performance materials.

Polyhydroxyalkanoate Market Segmentation Analysis

By Type Analysis

Short Chain Segment Held the Largest Share Attributed to Superior Properties

By type, the market is segmented into short chain, medium chain, and long chain.

The short-chain segment accounted for 30.56 and is expected to represent 47.45% of the market share due to easy availability, lower cost, and superior properties. Furthermore, the growing expansion of the packaging industry will further boost the demand for short-chain-length polyhydroxyalkanoates. By type, the long chain segment is expected to hold a 20.7% share in 2025.

The medium and long-chain segments are expected to show significant growth by the end of the prediction period. Medium-chain PHA exhibits unique properties that make them suitable for various applications. They are known for their rapid degradation in natural environments, making them ideal for single-use disposable products and compostable packaging materials. Rising demand in the manufacturing of water bottles and shopping bags will boost the segment growth.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Packaging & Food Segment Dominanted Due to Exceptional Barrier Properties

Based on application, the market is segmented into packaging & food services, biomedical, agriculture, and others.

The packaging and food service segment is represent 52.79% of the market share in 2026. PHA packaging demonstrates excellent barrier properties, protecting food products from moisture, oxygen, and other external contaminants. This helps extend the shelf life of perishable goods, reducing food waste, and improving product quality. By application, the agriculture segment is projected to generate USD 5.49 million in revenue by 2025.

Polyhydroxyalkanoates are revolutionizing the biomedical field, offering versatile and sustainable solutions for various medical applications. As a biodegradable and biocompatible polymer, PHA holds immense potential in tissue engineering, drug delivery, medical implants, and regenerative medicine, among other areas.

REGIONAL INSIGHTS

Based on region, the market is categorized into Europe, North America, the Asia Pacific, Latin America, and the Middle East & Africa.

Europe Polyhydroxyalkanoate Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Europe

Europe region accounted for a value of USD 18.3 million in 2024 and is expected to show significant growth. The region was also the dominated the polyhydroxyalkanoate market in the year 2023. The growth is attributed to the large manufacturing base for bioplastics in countries such as Germany, France, and the U.K. The availability of raw materials and stringent regulations for plastic disposal are the primary factors expected to drive market growth by the end of the forecast period. Moreover, initiatives such as bans on single-use plastics and incentives for biodegradable materials create a favorable environment for polyhydroxyalkanoate adoption and production. In Germany, the biomedical segment is estimated to hold a 9.7% market share in 2024. The UK market is projected to reach USD 4.51 billion by 2026, while the Germany market is projected to reach USD 10.17 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

The Asia Pacific region is one of the key markets for polyhydroxyalkanoate and is expected to witness significant growth. Rapid industrialization and urbanization in countries such as China, India, and Southeast Asian nations have encouraged demand for eco-friendly materials across various sectors, including packaging, agriculture, and biomedical applications. The Japan market is projected to reach USD 2.3 billion by 2026, the China market is projected to reach USD 9.14 billion by 2026, and the India market is projected to reach USD 2.03 billion by 2026.

- The polyhydroxyalkanoate market in Japan is expected to reach USD 1.79 million by 2025.

- China is projected to witness a strong CAGR of 29.90% during the forecast period.

North America

The North America region has a robust R&D ecosystem, with academia, research institutes, and companies actively involved in developing innovative PHA formulations, production processes, and applications. This is expected to boost the regional market growth significantly. The U.S. market is projected to reach USD 12.82 billion by 2026.

In Latin America, home to some of the world's most biodiverse ecosystems, there are increasing environmental concerns, including plastic pollution. As awareness grows, there's a rising demand for eco-friendly alternatives such as polyhydroxyalkanoates. Governments across Latin America are implementing regulations to mitigate plastic pollution, promoting the use of biodegradable materials. Hence, Latin America is anticipated to register considerable growth during the forecast period.

The Middle East & Africa region faces environmental challenges, including plastic pollution, desertification, and water scarcity. With a growing emphasis on economic diversification beyond oil and gas, countries in this region are exploring opportunities in renewable energy and sustainable industries. PHA production presents a viable avenue for diversification, leveraging the region's abundant feedstock resources and research capabilities.

List of Key Companies in Polyhydroxyalkanoate Market

Key Companies Adopt Pricing Strategies to Broaden Their Market Presence

Bio-on SpA Source, PolyFerm Canada, Kaneka Corporation, and Danimer Scientific are the key players in the market. Industry players mainly focus on product development, pricing strategies, and applications. These strategies can help companies expand their market presence by attracting different customer segments, responding to competitive pressures, leveraging perceived value, and adapting to changing market conditions. To boost their market share and achieve a competitive advantage, several major players are engaged in numerous strategic agreements to promote brand and sales.

LIST OF KEY COMPANIES PROFILED:

- Bio-on SpA Source (Italy)

- PolyFerm Canada (Canada)

- Tianjin GreenBio Materials Co., Ltd. (China)

- Kaneka Corporation (Japan)

- Danimer Scientific (U.S.)

- Newlight Technologies (U.S.)

- RWDC (U.S.)

- Tianan Enmat (China)

- Paques Biomaterials (The Netherlands)

- CjBio (South Korea)

- Bluepha (China)

- Full Cycle Bioplastics (U.S.)

- Yield10 Bioscience, Inc. (U.S.)

- TerraVerdae Bioworks (Canada)

KEY INDUSTRY DEVELOPMENTS:

- September 2023- Lummus Technology, a global provider of process technologies and value-driven energy solutions, and RWDC Industries, a biotechnology company developing biopolymer material solutions, announced a binding Joint Development and Commercial Cooperation Agreement (JDCCA) to expand manufacturing and global licensing of polyhydroxyalkanoates.

- May 2023- Bluepha Co. Ltd, the leading synthetic biology company in China, and TotalEnergies Corbion, a global leader in PLA technology, have signed a memorandum of understanding (MOU) to accelerate the market adoption of PLA/PHA-based solutions in China. The collaboration aims to bring together the expertise and resources of both companies to further advance the development of high-performance biopolymer solutions, combining Bluepha Polyhydroxyalkanoates with Luminy Polylactic Acid (PLA) technology.

- March 2023- Bluepha, launched its first portfolio of marine degradable biopolymers, Bluepha PHA, on March 1st, 2023

- January 2022 – TerraVerdae Bioworks announced the signing of a binding letter of intent to acquire 100% of the equity of PolyFerm Canada. TerraVerdae is one of the leading performance biopolymer companies dedicated to developing sustainable alternatives to petroleum-based plastics in order to reduce climate impacts and the growing build-up of plastic trash on land and in water.

REPORT COVERAGE

The global market report provides a detailed analysis of the market and focuses on crucial aspects such as leading companies, applications, and types. Additionally, the report offers insights into market trends and highlights vital industry developments. In addition to the factors mentioned above, the report encompasses various factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 29.40% from 2026-2034 |

|

Unit |

Value (USD Million) and Volume (Tons) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 38.8 million in 2024 and is projected to reach USD 301.7 million by 2032.

In 2024, the Europe market size stood at USD 18.3 million.

Growing at a CAGR of 29.3%, the market will exhibit steady growth during the forecast period.

Based on application, packaging & food services segment led the market in 2023.

Increasing demand for sustainable plastic alternatives is a key factor driving market growth.

Bio-on SpA Source, PolyFerm Canada, Kaneka Corporation, and Danimer Scientific are a few leading market players.

Europe held the highest market share in 2024.

Growing packaging and biomedical industries and increasing demand for bio-based products are expected to drive product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us