Polyoxymethylene Market Size, Share & Industry Analysis, By Application (Automotive, Electrical & Electronics, Industrial Machinery, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

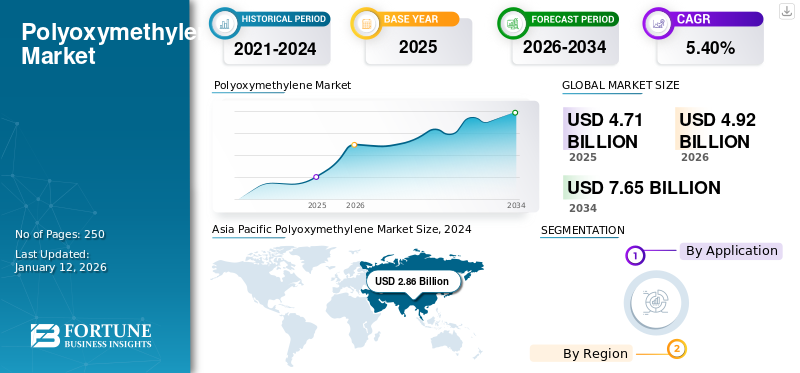

The global polyoxymethylene market size was valued at USD 4.71 billion in 2025. It is projected to grow from USD 4.92 billion in 2026 to USD 7.65 billion by 2034 at a CAGR of 5.40% during the forecast period. Asia Pacific dominated the polyoxymethylene market with a market share of 63% in 2025.

Polyoxymethylene (POM) is an engineering thermoplastic also called Delrin, acetal, polyformaldehyde, and polyacetal. It is mainly utilized in precision parts that require excellent dimensional stability, low friction, and high stiffness. POM is available in different grades such as standard/unreinforced, reinforced, high-impact/toughened, grades with high slip/wear properties, UV stabilized, and nanocomposites. The typical application of POM includes high-performance engineering components, such as eyeglass frames, small gear wheels, ski bindings, ball bearings, gun parts, fasteners, lock systems, and knife handles. The growing automotive industry expansion in developed and developing countries, along with the rising demand for polyoxymethylene from the electrical & electronics industry is expected to augment the market growth.

Disruptions in the automotive and electronics industries due to the spread of the COVID-19 pandemic brought polyoxymethylene production to a halt. On the contrary, rapid growth in the medical industry during the pandemic somewhat offset the market decline, as POM is utilized in several medical applications such as surgical instruments, medical devices, orthopedic implants, and drug delivery systems.

Global Polyoxymethylene Market Overview

Market Size:

- 2025 Value: USD 4.71 billion

- 2026 Value: USD 4.92 billion

- 2034 Forecast Value: USD 7.65 billion, with a CAGR of 5.40% from 2026–2034

Market Share:

- Asia Pacific held the largest share at 63% in 2025.

- By application, the automotive segment is projected to generate USD 2,169.1 million in revenue by 2025.

- The industrial machinery segment is expected to hold a 14.5% share in 2025.

Key Country Highlights:

- China: Expected to witness a strong CAGR of 6.60% during the forecast period.

- Japan: Market expected to reach USD 344.0 million by 2025.

- Europe: Anticipated to grow at a CAGR of 4.5%, driven by rising electrification and automation in the automotive sector.

Polyoxymethylene Market Trends

Growing Healthcare Industry to Create Market Opportunities for the Market

The healthcare industry expansion is expected to influence the demand for polyoxymethylene. The growth is mainly driven by its exceptional characteristics such as strong mechanical strength, low moisture absorption, hardness and spring stiffness, good dimensional stability, and high chemical resistance, especially to solvents, alkalis, and fuels. Such properties make POM ideal for manufacturing precision medical devices such as inhalers and surgical instruments.

Furthermore, in medical or healthcare applications, POM is used in traumatology, joint reconstruction, and spinal procedures. Moreover, the growing adoption of durable medical devices and rising medical technological innovation, which necessitates materials that could withstand rigorous operational conditions while maintaining patient safety is expected to flourish market growth in the upcoming years. Asia Pacific witnessed a polyoxymethylene market growth from USD 2.71 Bollion in 2023 to USD 2.86 billion in 2024.

Download Free sample to learn more about this report.

Polyoxymethylene Market Growth Factors

Expansion of Automotive Industry to drive Product Demand due to its Exceptional Characteristics

The automotive industry expansion is a significant driving force for the rising adoption of polyoxymethylene. The growth is associated with its excellent versatility and mechanical properties that upsurge its adoption in several automotive applications such as seatbelt adjusters, car locks, HVAC control panel knobs, automotive clips, and speaker grilles.

Furthermore, increasing advancement in the POM to provide low VOC performance is expected to upsurge market growth. This is due to the reduction of VOCs that contributes to the improvement of cabin air quality. Nowadays, in the automotive industry, the issue of in-vehicle air quality is becoming critical due to its direct impact on passenger comfort and safety. As a result, many companies are working on the development of POM engineering plastics to meet the growing trend. For instance, DuPont and Polyplastics have developed Delrin 300TE and DURACON acetal, respectively, to provide impact-modified and low-emission. Hence, such developments and rapid advancement in the automotive industry are expected to boost the polyoxymethylene market growth during the forecast period. Asia Pacific witnessed a polyoxymethylene market growth from USD 2.71 billion in 2023 to USD 2.86 billion in 2024.

RESTRAINING FACTORS

Fluctuating Raw Material Prices Used in Product Manufacturing to Hinder Market Growth

The fluctuation in raw material prices is impacting the overall cost of polyoxymethylene. The major raw materials such as acetic acid and formaldehyde, are used in the production of POM. The fluctuation occurs due to several major factors such as geopolitical tension, demand dynamics, currency fluctuation, and disruption in manufacturing. As a result, the sudden spike in the price leads to an increase in the overall cost and impacts product demand.

Polyoxymethylene Market Segmentation Analysis

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Automotive Segment Dominated Due to Increased Demand from Various Applications

Based on application, this market is segmented into automotive, electrical & electronics, industrial machinery, and others. The automotive segment accounted for the dominant polyoxymethylene market share 46.14% in 2026. The growing electric vehicle charging infrastructure, rising consumer expenditure, and increasing technological innovation augment the automotive industry. This is fueling the adoption of polyoxymethylene in demanding applications such as bearings, gears, door handles, fuel system components, interior trim parts, and seat belt components.

- By application, the industrial machinery segment is expected to hold a 14.5% share in 2025.

- The automotive segment is projected to generate USD 2,169.1 million in revenue by 2025.

The rising demand for POM from electrical & electronic industries will propel market growth. The growth is attributed to the increasing demand for switches, connectors, circuit breakers, relays, coil forms, and insulating bushings. POM's wear resistance and high mechanical strength make it suitable for several industrial machinery applications such as bearings, gears, valve parts, and conveyor system components.

REGIONAL INSIGHTS

By region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific Polyoxymethylene Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific’s market size stood at USD 2.86 billion in 2024, where China holds the largest market share due to the strong expansion of the automotive and electronics industries. Additionally, rapid urbanization, robust industrialization, and economic development will further drive market growth, particularly in applications requiring high-performance and durable materials. Furthermore, the growing healthcare and medical industry will surge the product demand due to its stabilizability, biocompatibility, and chemical-resistant characteristics. The Japan market is projected to reach USD 0.36 billion by 2026, the China market is projected to reach USD 1.68 billion by 2026, and the India market is projected to reach USD 0.56 billion by 2026.

- The polyoxymethylene market in Japan is expected to reach USD 344.0 million by 2025.

- China is projected to witness a strong CAGR of 6.60% during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

North America

North America’s market growth is driven by the rapid progress of the electrical & electronics industry. This, in turn, surges the product adoption in the manufacturing of insulating components, switches, connectors, and housing for electrical equipment and devices. Moreover, the growing consumer goods industry in the region will also influence market growth. The U.S. market is projected to reach USD 0.5 billion by 2026.

Europe

In Europe, the market is expected to grow positively due to the development of charging infrastructure and the growing automotive industry. In the automotive industry, where lightweight components have historically driven the replacement of metals, the shift toward electrification and increased automation is broadening product use due to the growing demand for small electric motors and gearwheels. The Germany market is projected to reach USD 0.36 billion by 2026.

- Europe is anticipated to grow at a CAGR of 4.5% during the forecast period.

Latin America and the Middle East & Africa

In Latin America and the Middle East & Africa, the market is growing due to increased product demand from industrial machinery. The characteristics of polyoxymethylene such as high strength, dimensional stability, low friction, strong wear resistance, and mechanical strength, surge its adoption in several applications such as precision mechanical parts and conveyor system components.

KEY INDUSTRY PLAYERS

Key Players Adopted Product Advancement Strategy to Reduce Volatile Organic Compounds

The competitive landscape of the polyoxymethylene market is fragmented. Key players such as DuPont and Polyplastics Co., Ltd. are involved in product advancement and offering grades to reduce Volatile Organic Compounds (VOCs). The growing trend toward the elimination of unpleasant odors from plastic materials and the reduction of VOC generation are leading many companies to come up with sustainable solutions. For instance, Polyplastics Co., Ltd. has added DURACON POM LV Series to its portfolio to reduce VOC. Furthermore, major players are adopting strategies such as expansion, acquisitions, capacity improvements, mergers, and collaborations to increase their presence in the market.

List of Top Polyoxymethylene Companies:

- Celanese Corporation (U.S.)

- LG Chem (South Korea)

- Mitsubishi Chemical (Japan)

- Dupont (U.S.)

- Sparsh Polychem Private Limited (India)

- SABIC (Saudi Arabia)

- Polyplastics Co., Ltd. (Japan)

- Guangzhou Ning E-plastics Co., Ltd (China)

- Retlaw Industries (U.S.)

- Urvi Plastic Industries (India)

- POLYESTER POLYMERS INDIA PVT. LTD. (India)

- S.S.B. POLYMERS & S.S.B. ENTERPRISES (India)

KEY INDUSTRY DEVELOPMENTS:

- June 2023: Polyplastics Group announced the commercial availability of its DURACON POM (Polyoxymethylene/Acetal) PM Series for medical applications. With this initiation, the company would supply its materials to the U.S., China, Europe, and India. Additionally, with this development, the company would expand its business into the medical and healthcare industries.

REPORT COVERAGE

The market research report offers a detailed market study and emphasizes crucial factors such as applications and leading companies. Additionally, the report gives quantitative data in terms of volume and value, research methodology of qualitative data, insights into market trends, and highlights vital industry developments. In addition, the report covers various factors that contribute to the market's progress over the coming years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.40% from 2026 to 2034 |

|

Unit |

Value (USD Billion), Volume (Million Ton) |

|

Segmentation |

By Application

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 4.71 billion in 2025 and is projected to reach USD 7.65 billion by 2034.

The market will exhibit a CAGR of 5.40% during the forecast period (2026-2034).

In 2025, Asia Pacific’s market value stood at USD 3.01 billion.

By application, the automotive segment led the market in 2026.

The increasing product demand from several industries such as medical, automotive, and electronics is the key factor driving market growth.

Celanese Corporation, LG Chem, Mitsubishi Chemical, and Dupont are the leading players in this market.

China holds the largest share of the global market in 2026.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us