Power Management IC Market Size, Share & Industry Analysis, By Product Type (Voltage Regulators, Battery Management ICs, Motor Control ICs, Multi-channel ICs, and Others), By End-user (Consumer Electronics, Automotive, Industrial, Telecommunication, Healthcare, and Others), By Power Source (AC-DC and DC-DC), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

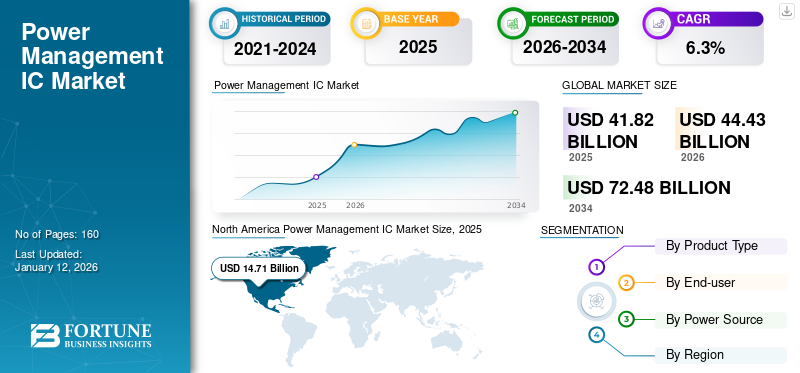

The global power management IC market size was valued at USD 41.82 billion in 2025 and is projected to grow from USD 44.43 billion in 2026 to USD 72.48 billion by 2034, exhibiting a CAGR of 6.3% during the forecast period. North America dominated the global market with a share of 35.2% in 2025.

A Power Management Integrated Circuit (PMIC) is an integrated circuit designed to manage the power requirements of a host system by controlling the flow and direction of electrical power. PMICs are used in various electronic devices to ensure efficient power distribution, minimize energy consumption, and extend battery life. They integrate multiple functions, such as voltage regulation, battery charging, power sequencing, and power monitoring, into a single chip. PMICs are crucial in portable and battery-operated devices, such as smartphones, tablets, laptops, and wearable technology, as well as in automotive and industrial applications. The key drivers of the PMIC market include the growing demand for energy-efficient electronics, the growing adoption of portable and wearable devices, the expansion of the automotive electronics sector, and the rise in industrial automation.

Global Power Management IC Market Overview

Market Size:

- 2025 Value: USD 41.82 billion

- 2026 Value: USD 44.43 billion

- 2034 Forecast Value: USD 72.48 billion

- CAGR: 6.3% (2026–2034)

Market Share:

- Regional Leader: North America held the largest market share in 2025 with 35.2%.

- Fastest-Growing Region: Asia Pacific is projected to exhibit the highest growth rate during the forecast period.

Industry Trends:

- Voltage regulators dominated the market due to their wide application in maintaining stable voltage across devices.

- Battery management ICs are expected to grow at the fastest rate, driven by rising demand in electric vehicles and portable electronics.

- Among power sources, the AC-DC segment held the largest market share, while the DC-DC segment is forecast to grow the fastest.

Driving Factors:

- Growing adoption of smartphones, tablets, wearable tech, and IoT devices is boosting the need for efficient power management.

- Increasing electrification in the automotive sector, including EVs and HEVs, is driving demand for battery management and distribution ICs.

- Rising demand for compact and energy-efficient ICs across industrial automation, consumer electronics, and renewable energy sectors.

- Post-pandemic digital transformation is accelerating investment in sustainable and low-power electronics solutions.

The COVID-19 pandemic significantly impacted the market, disrupting supply chains and reducing demand in sectors, including automotive and industrial, due to factory shutdowns and decreased consumer spending. However, the pandemic accelerated digital transformation, boosting demand for power management ICs in consumer electronics, healthcare devices, and IT infrastructure. This shift underscored the need for resilient and diversified supply chains, prompting companies to invest in regional manufacturing and alternative supply routes. Additionally, the increased focus on sustainability and energy efficiency boosted the demand for PMICs designed for low-power consumption, positioning the market for growth in a post-pandemic world.

Power Management IC Market Trends

Incorporation of Advanced Features in PMICs to Fuel the Market Growth

Integrating advanced features in power management ICs is poised to drive the market significantly during the forecast period. Modern electronic devices require increasingly complex power management ICs that can handle multiple functions efficiently within a compact space. For instance, the trend is using fast charging capabilities in PMICs to support smartphones and other portable electronics.

Companies, such as Qualcomm and MediaTek are developing PMICs that enable fast charging technologies, including Qualcomm Quick Charge and MediaTek Pump Express. Moreover, power management ICs are evolving to include features, such as power optimization for IoT devices, battery management systems (BMS) for electric vehicles, and energy harvesting capabilities for sustainable applications. This integration enhances device performance and efficiency, reducing overall system costs and footprint and catering to the growing needs of diverse industries. For instance,

- In September 2023, Infineon Technologies AG partnered with Infypower, a prominent player in China's new energy vehicle charging sector. The collaboration aims to enhance electric vehicle charging station efficiency using Infineon's high-performance 1200 V CoolSIC MOSFET power semiconductor devices, known for their superior efficiency, power density, and reliability based on silicon carbide (SiC) technology.

Download Free sample to learn more about this report.

Power Management IC Market Growth Factors

Increased Demand for Portable Devices to Propel Market Expansion

The widespread adoption of smartphones, tablets, wearables, and IoT devices has raised the necessity for efficient power management solutions. Power management ICs are indispensable in optimizing battery life, enhancing charging efficiency, and regulating power consumption across diverse electronic devices. For instance, modern smartphones with advanced processors and high-resolution displays require sophisticated PMICs to ensure precise voltage regulation and effective power delivery to various components. Similarly, the proliferation of IoT devices spanning smart home appliances, wearable health monitors, and industrial sensors relies heavily on PMICs to manage power consumption effectively.

Leading semiconductor companies, such as Texas Instruments, Analog Devices, and Maxim Integrated, drive innovation in PMIC technology. They are developing solutions with advanced features, such as adaptive voltage scaling, integrated power management algorithms, and enhanced thermal management capabilities. These advancements cater to the increasing demand for energy-efficient electronics and support the trend towards compact and powerful devices with extended battery life. Consequently, the rise in the adoption of consumer electronics is driving the global power management IC market share.

RESTRAINING FACTORS

Complexity of Integrating Advanced Features to Impede Market Growth

The market faces several restraining factors, including stringent regulations related to energy efficiency and environmental standards. Additionally, the complexity of integrating advanced features into ICs and the high costs associated with research and development pose challenges. Market saturation in certain segments and the commoditization of basic ICs also limit growth opportunities. Moreover, economic uncertainties, particularly in emerging markets, and fluctuating raw material prices further contribute to the market's constraints, influencing investment decisions and overall market dynamics.

Power Management IC Market Segmentation Analysis

By Product Type Analysis

Need for Maintaining Stable Voltage Levels Boosts the Voltage Regulators Segment Growth

Based on product type, the market is segmented into voltage regulators, battery management ICs, motor control ICs, multi-channel ICs, and others.

Voltage regulators hold the highest share of 32.79% in 2026, due to their critical role in maintaining stable voltage levels required for electronic devices, ensuring reliable performance, and preventing damage from voltage fluctuations. Their ubiquitous use across diverse applications, from consumer electronics to industrial equipment, contributes to their dominance in the market.

Battery management ICs are anticipated to grow at the highest CAGR in the market due to increasing demand for electric vehicles (EVs), including advanced driver assistance systems, portable electronics, and renewable energy storage solutions. These ICs are critical for managing battery performance, ensuring safety, optimizing efficiency, and aligning with the global trend toward sustainable energy practices and the proliferation of battery-powered devices.

By End-user Analysis

Burgeoning Growth in Portable Devices Boosts the Consumer Electronics Segment Growth

Based on end-user, the market is segmented into consumer electronics, automotive, industrial, telecommunication, healthcare, and others.

The consumer electronics segment holds the largest market share of 32.54% in 2026, due to the widespread adoption of smartphones, tablets, wearables, and other portable devices requiring efficient power management solutions. These devices rely on power management ICs to optimize battery life, enhance performance, and manage power consumption effectively, driving the demand for these components across the consumer electronics sector.

The automotive industry is expected to grow at the highest CAGR in the market due to increasing electrification and integration of advanced electronics in vehicles. This growth is driven by the rising adoption of electric vehicles (EVs), hybrid electric vehicles (HEVs), and autonomous driving technologies. These technologies require sophisticated power management solutions to optimize battery efficiency, manage power distribution, and ensure the reliable operation of electronic systems within vehicles.

To know how our report can help streamline your business, Speak to Analyst

By Power Source Analysis

Rising Need to Power Electronic Devices Boosts the AC-DC Segment Growth

Based on power source, the market is segmented into AC-DC and DC-DC.

AC-DC power sources hold the highest share of 55.46% in 2026, due to their essential role in converting alternating current (AC) from the main supply into direct current (DC) suitable for powering electronic devices. They are crucial in various applications, including consumer electronics, industrial equipment, and telecommunications infrastructure, driving widespread adoption and market dominance.

DC-DC power sources are anticipated to grow at the highest CAGR in the market due to their increasing use in portable electronic devices, electric vehicles, renewable energy systems, and telecommunications equipment. These converters offer efficient voltage regulation and power conversion capabilities, catering to the rising demand for compact, energy-efficient solutions across various industries.

REGIONAL INSIGHTS

The global market scope is classified across five regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America

North America Power Management IC Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 14.71 billion in 2025 and USD 15.52 billion in 2026. North America leads the market due to its robust semiconductor industry, technological innovations, and strong presence of major manufacturers. These factors support the region's dominance across consumer electronics, automotive, industrial automation, and telecommunications sectors. Additionally, initiatives in renewable energy and smart grid technologies contribute to the high demand for efficient power management solutions. This supports regulatory frameworks and significant R&D investments, fueling the region's power management IC market growth. The U.S. market is projected to reach USD 9.06 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is expected to grow with the highest CAGR over the forecast period due to rapid industrialization and urbanization, driving increased demand for consumer electronics, automotive electronics, and industrial automation. Additionally, government initiatives promoting energy efficiency and sustainable practices are accelerating the demand for power management ICs. Moreover, the presence of leading semiconductor manufacturers and expanding investments in technological advancements further bolster the region's market growth. The Japan market is projected to reach USD 2.25 billion by 2026, the China market is projected to reach USD 2.84 billion by 2026, and the India market is projected to reach USD 1.81 billion by 2026.

For instance,

- In July 2023, Microchip Technology Inc. planned to invest approximately USD 300 million over several years to expand its operations in India, a key semiconductor industry hub. This initiative underscores Microchip's effort to strengthen its footprint in India and leverage its growing importance in the global semiconductor landscape.

Europe

Europe holds the second-highest share of the market. The region benefits from a strong automotive industry that increasingly integrates advanced electronic systems requiring efficient power management solutions. Additionally, the region's focus on renewable energy and stringent regulations promoting energy efficiency in consumer electronics contribute to the market growth. Moreover, investments in smart grid technologies and the presence of key semiconductor manufacturers further strengthen its position in adopting and advancing power management IC technologies. The UK market is projected to reach USD 2.73 billion by 2026, while the Germany market is projected to reach USD 2.35 billion by 2026.

South America and the Middle East & Africa are projected to grow at an average growth rate in the market primarily due to increasing urbanization, industrialization, and infrastructure development. While these regions are expanding their telecommunications and automotive sectors, the growth is tempered due to economic challenges, political instability, and varying levels of technological adoption. However, advancements in renewable energy projects and efforts to modernize infrastructure are creating demands for power management ICs, albeit at a more moderate pace than in other regions.

KEY INDUSTRY PLAYERS

Key Players Launch New Products to Strengthen Market Positions

Players in the global power management IC market are launching new products to enhance their market positioning by leveraging the latest technological advancements and addressing diverse consumer needs to stay ahead of competitors. They prioritize portfolio enhancement and strategic collaborations, acquisitions, and partnerships to strengthen their product offerings. Such strategic product launches help companies maintain and grow their market share in a rapidly evolving industry.

List of Top Power Management IC Companies

- Texas Instruments Incorporated (U.S.)

- Analog Devices, Inc. (U.S.)

- Infineon Technologies AG (Germany)

- STMicroelectronics (Switzerland)

- Semiconductor Components Industries, LLC (U.S.)

- Evelta Electronics (India)

- Renesas Electronics Corporation (Japan)

- NXP Semiconductors (Netherlands)

- Microchip Technology Inc. (U.S.)

- ROHM CO., LTD. (Japan)

KEY INDUSTRY DEVELOPMENTS

- In May 2024, Nanjing SemiDrive Technology Ltd., China's leading SoC manufacturer of smart vehicle interiors, and ROHM collaborated on a smart cockpit reference design. This design features SemiDrive's X9E and X9M automotive SoCs and PMICs, LED driver ICs, SerDes ICs, and other ROHM components. A corresponding reference board includes three main boards: the CoreBoard, the SerDes Board, and the Display Board.

- In May 2024, Infineon Technologies AG introduced the PSoC 4 HVPA-144K microcontroller, which targets automotive battery management, integrating high-voltage subsystems and high-precision analog on a single chip. It meets ISO26262 compliance for safe and compact battery sensing in vehicles. The device includes programmable gain amplifiers with automatic control for precise analog front-end operation, surpassing Hall sensors' current battery accuracy.

- In April 2024, Infineon Technologies AG introduced the PSoCT 4 HVMS automotive microcontrollers, integrating high-voltage features, such as a LIN/CXPI transceiver and 12V regulator with advanced analog capabilities, such as CAPSENSE and inductive sensing. These microcontrollers meet stringent automotive safety standards, including ISO26262 compliance, and are designed for modern vehicles where space constraints require compact, highly integrated ICs.

- In December 2023, Infineon Technologies AG expanded its MOTIX automotive and industrial motor control product line. This includes the introduction of 2-channel MOTIX gate driver ICs: 2ED2748S01G, 2ED2732S01G, 2ED2742S01G, and 2ED2738S01G. They are specifically designed for battery-operated devices such as drones, cordless power tools, and light electric vehicles using up to 120 V batteries.

- In August 2023, ROHM developed the BM3G0xXMUV-LB series, featuring power stage ICs with combined 650V GaN HEMTs and gate drivers. These ICs are tailored for primary power applications in industrial and consumer sectors, such as AC adapters and data servers. They utilize advanced power and analog technologies to achieve enhanced miniaturization and superior power conversion efficiency over conventional silicon MOSFETs.

REPORT COVERAGE

The market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.3% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

By End-user

By Power Source

By Region

|

Frequently Asked Questions

The market is projected to reach USD 72.48billion by 2034.

In 2025, the market was valued at USD 41.82 billion.

The market is projected to grow at a CAGR of 6.3% during the forecast period.

The voltage regulators segment leads the market.

The increased demand for portable devices drives the adoption of PMICs.

Texas Instruments Incorporated, Analog Devices, Inc., Infineon Technologies AG, and STMicroelectronics are the top players in the market.

North America is expected to hold the highest market share.

By power source, DC-DC is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us