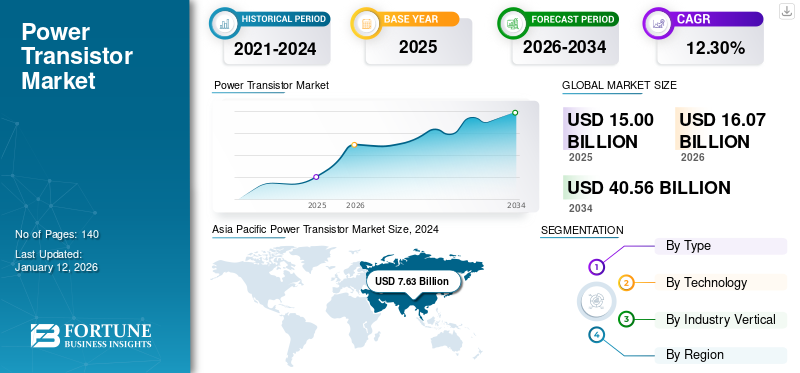

Power Transistor Market Size, Share & Industry Analysis, By Type (Bipolar Junction Transistor, Field Effect Transistor, Heterojunction Bipolar Transistor, and Others), By Technology (Low-voltage FETs, RF and Microwave Power, High-Voltage FETs, and IGBT Transistor), By Industry Vertical (Consumer Electronics, IT & Telecommunication, Automotive, Manufacturing, and Others) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global power transistor market size was valued at USD 15.00 billion in 2025. and is projected to grow from USD 16.07 billion in 2026 to USD 40.56 billion by 2034, exhibiting a CAGR of 12.30% during the forecast period. Asia Pacific dominated the global power transistor market with a share of 52.90% in 2025.

Power transistors are the three terminal semiconductor devices which include the collector, base, and emitter, which amplify and switch the electrical signal in the power suppliers and power amplifiers. It is suitable when appliances use a large amount of current and voltage. Power transistors can handle more power and load than other tiny transistors. Power transistors may have positive-negative-positive (PNP) or negative-positive-negative (NPN) polarity. These solutions are available in a variety of switching speeds and power characteristics. In the last few decades, these transistors are increasingly becoming popular throughout the globe, owing to their ability to increase electronic device switching and power efficiency. For instance, as per a report published by the Semiconductor Digest in October 2022, the average selling price of power transistors is increased by 11% in 2022 due to increasing product shipments, which is positively impacting on market share. Moreover, the increasing use of connected devices such as a modem, routers, amplifiers, smartphones, and wearables in the world is propelling the power transistor market growth for power transistors globally.

The exponential spread of the COVID-19 pandemic in 2020 has incredibly impacted the regular lifestyle of industry vertical and consumers. To prevent and limit the spread of the COVID-19 virus, government authority of various countries have globally imposed lockdown and movement restrictions. This factor has led to the shutdown of semiconductor & electronics manufacturing units. The sudden closing of production units disrupted the supply chain of electronics and semiconductor material, which slightly declined the demand for transistors, diodes, and triodes.

However, the impact of COVID-19 has significantly changed customer behaviour and business perspective. Therefore, government authorities and key market players had prepared strategies to control the COVID-19 crisis. For instance, in December 2021, the government of India allocated USD 10 billion for developing the semiconductor industry. Furthermore, Field Effect Transistor (FET) is the major component in the detection process for the protein spikes of the COVID-19 virus, increased the demand for transistors in the global market.

Power Transistor Market Trends

Increasing Use Of Transistor In Connected Devices is Driving The Market Growth

Over the last two decades, the importance of automation in the regular operation of various businesses has been proliferating. Also, the adoption of emerging technologies such as the internet of things and industrial automation are attracting end users to implement connected devices in their daily activities. For instance, in November 2022, a report published by “Automation Anyware” showed that 83% of organizations around the globe had improved their productivity by implementing the internet of things and connected devices in their organization. Power transistors help connect the device dissipate heat and prevent it from overheating. Also, these transistors reduce carbon dioxide emissions and the energy cost used by the connected device. Owing to these several benefits, the demand for the transistor is increasing during the estimated period.

Download Free sample to learn more about this report.

Power Transistor Market Growth Factors

Increasing Environment Concerns in the Electronic and Semiconductor Industry is Driving The Market Growth

The use of advanced technology in the electronics and semiconductor industry is continuously growing. Along with technological advancement, environmental concerns such as pollution and E-waste are also increasing. To control this problem, most end users prefer to use eco-friendly electronic and semiconductor components such as transistors, diodes and triodes in their end product. The increasing use of transistors such as metal-oxide-semiconductor field effect transistors (MOSFET) and Field-effect transistors (FET) are helping to solve the pollution problem. These transistors help the electronic device boost efficiency by reducing overheating and properly dissipating heat. Also, in many countries, fossil fuels are still used to produce electricity, directly increasing pollution. MOSFET and FET are reducing electronic device power consumption and preventing decay.

RESTRAINING FACTORS

High Cost and Less Durability of Transistor Hinder the Growth of The Market

The direct cost of a power transistor is much higher than other diodes, triodes, and transistors. The higher cost of transistors ultimately increases the cost of final products such as industrial machinery, consumer electronics, and healthcare equipment in which these transistors are being used. This rising final product cost may hinder the market's growth in the forecast period. Furthermore, this transistor's major problem or technical issue is the switching frequency issue. This type of transistor cannot work appropriately above the frequency of 15KHz. When these transistors are placed above the frequency of 15KHz, they will fail or break down. Also, this transistor has a shallow capacity for reverse blocking and can easily damage due to thermal runaway. The above factors are responsible for restraining the growth of the market.

Power Transistor Market Segmentation Analysis

By Type Analysis

Bipolar Junction Transistor Segment Records Higher Revenue Owing to Its High Output Current Producing Capacity

Based on type, the market is classified into bipolar junction transistors, field effect transistors, heterojunction bipolar transistors, and others.

The bipolar junction transistor segment held a prominent revenue in the year 2026 with a share of 34.78%, due to the capacity of the bipolar junction transistor to produce a low amount of input current into a high amount of output current. Also, they are widely used to amplify switches and signals better. Field effect transistors are following the same trends soon owing to their ability to improve heat deception in consumer electronics. However, the others segment is expected to generate the highest CAGR in the forecast period owing to the ongoing technological advancements in the electronics and semiconductor industry, which is responsible for driving the market's growth.

By Technology Analysis

Low Voltage FET Records Prominent Revenue In 2024 Owing to its Lower Price

Based on technology, the market is classified into Low-voltage FETs, RF and Microwave Power, High-Voltage FETs, and IGBT transistors.

Low voltage field effect transistors generated the highest revenue in the year 2026 with a share of 35.16% in 2026, drawing to the lower retail price of low voltage field effect transistors. However, low voltage field effect transistors will have a higher CAGR in the forecast period. Furthermore, due to increasing use of radio frequency and microwave equipment in aerospace & defence industry, the RF and Microwave power segments follow the same trends and generate the second-largest market revenue. Again, insulated gate bipolar transistors and high voltage field effect transistors are experiencing moderate growth during the forecast period.

By Industry Vertical Analysis

To know how our report can help streamline your business, Speak to Analyst

Manufacturing Segment Generated Highest Revenue in the Year 2024 Due to the Heavy Use of Transistors

Based on the industry vertical, the market is classified into consumer electronics, IT & Telecommunication, automotive, manufacturing, and others.

The manufacturing segment in the market generated the highest revenue in 2026 with a share of 30.80% in 2026. It is owing to the heavy use of transistors in manufacturing machinery for better efficiency—furthermore, the automotive segment follows the same trend and shows the second-largest growth in the market. Moreover, in the consumer electronics segment, the use of transistors has been rapidly increasing in the last two decades, which is responsible for propelling the market globally. However, due to growing use of power transistor in complex switching circuit of communication and networking device, the IT and telecommunication segment shows the highest CAGR during the forecast period.

REGIONAL INSIGHTS

Asia Pacific Power Transistor Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 7.94 billion in 2025 and USD 8.35 billion in 2026. It is growing as dominating region in the market globally. It is due to the availability of modern semiconductors and electronics units and advanced research and development centers in developed countries such as South Korea, China, Japan, Taiwan, and Singapore. Also, countries such as Malaysia, India, Australia, and Vietnam are focusing on the growth of semiconductor and electronics manufacturing units, which is responsible for the development of the market in the region.

China Having Major Market Share Owing to the Heavy Presence of the Electronics Industry

China holds a prominent position in the market globally. It is due to the presence advance and modern transistor manufacturing units around the globe. Also, China's government is focusing on research and new product development of transistors in the country, which is expected to boost the market growth. Moreover, China is a significant supplier of semiconductors and electronics in the global market, which is also responsible for the market's growth.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific region generates prominent revenue. It is owing to the presence of the region's most advanced and modern transistor production units. Furthermore, developed countries such as Taiwan, China, Japan, South Korea, and Singapore are the primary providers of various transistors for small and medium-scale industries in the market, which is responsible for the market growth. The Japan market is valued at USD 0.62 billion by 2026, the China market is valued at USD 5.27 billion by 2026, and the India market is valued at USD 0.92 billion by 2026.

The U.S. will generate higher revenue in the North American region in 2024. It is due to the availability of key companies in the area. Moreover, the U.S. government has been increasing spending in the semiconductor industry for the last few years. For instance, In March 2022, As per the Bloomberg report, The America Competes Act pours USD 52 billion to promote products in the semiconductor industry. However, Canada is expected to generate the highest CAGR in the predicted period, it is due to growing investment of government of Canada in It & Telecommunication and manufacturing industry rises demand for transistor in the country. Furthermore, Mexico is strengthening its market footprint by taking up various strategies. The U.S. market is valued at USD 4.31 billion by 2026.

Owing to the advanced manufacturing facility Germany has generated holds a prominent position in the Europe market. Also, Germany has advanced electric vehicle manufacturing units, increasing the demand for transistor in the region. However, the U.K. is expected to grow at a CAGR during the forecast period. Italy and France are following the same trend in the market respectively. However, countries such as Spain and the Rest of Europe show gradual and moderate market growth. The UK market is valued at USD 0.43 billion by 2026, while the Germany market is valued at USD 0.52 billion by 2026.

The growth in Middle East and Africa region is moderate due to the less adoption of advanced technology in the Middle East, Africa, and South America. However, countries such as U.A.E, Saudi Arabia, and Argentina are focusing on semiconductor manufacturing, which is showing significant growth in the market.

KEY INDUSTRY PLAYERS

Mitsubishi Electric Corporation Holds Major Share in the Market Owing to Advance Semiconductor Manufacturing Facility

Mitsubishi Electric Corporation holds a prominent market share it is owing to the availability of advanced semiconductor research and manufacturing units. Also, this company is the major supplier of various semiconductors and electronic devices in the market. Furthermore, Diodes Incorporated, Texas Instruments Incorporated, Microchip Technology Inc., Infineon Technologies AG, NXP Semiconductors, Vishay Intertechnology, Inc., Linear Integrated Systems, Renesas Electronics Corporation, ROHM CO., LTD., ST Microelectronics, and others have adopted various market and business growth strategies such as partnerships, collaboration, acquisition, and product launches to tackle massive competition in the market. Also, these organizations focused on expanding their business units in various countries which is helpful for diversified product development as per customer requirements. Moreover, the continuous growth in the EV charging Product is responsible for the development of the market.

List of Top Power Transistor Companies:

- Diodes Incorporated. (U.S.)

- Texas Instruments Incorporated (U.S.)

- Microchip Technology Inc. (U.S.)

- Infineon Technologies AG (Germany)

- Mitsubishi Electric Corporation (Japan)

- NXP Semiconductors (Netherlands)

- Vishay Intertechnology, Inc. (U.S.)

- Renesas Electronics Corporation (Japan)

- ROHM CO., LTD. (Japan)

- ST Microelectronics (Switzerland)

KEY INDUSTRY DEVELOPMENTS:

- March 2022_NXP semiconductor, a semiconductor and electronics solutions provider, launched its new product, RF power discrete transistor for 32T32R and 64T64R. This transistor is made of gallium nitrate and is used to improve the efficiency of urban and sub-urban antennas by increasing their massive MIMO coverage.

- March 2022_ Transphorm Inc., the provider of Gallium Nitrate based products, partnered with TDK lambda, TDK group company. Through this partnership, both organizations expanded their AC-DC Gallium Nitrate power module. Gallium Nitrate provides 38% more efficiency than the silicon-based solution.

- July 2022_Nexperia, the manufacturer of elemental semiconductors, launched new power bipolar junction transistor. This transistor is designed into an electrically and thermally advanced DPAK package to withstand voltage range from 45V to 100V and current range from 2A to 8A. This transistor is specially made to improve the effectiveness of automotive applications.

- December 2021_IBM Corporation and Samsung Electronics Corporation partnered to design and develop a new vertical transistor. This new transistor can reduce energy consumption by 85% compared to existing fin field effect transistors (finFET).

- July 2021_ST Microelectronics is a major key player in the semiconductor industry. The company had launched its new range of transistors. This new transistor series belongs to the family of LDMOS RF transistors. The newly launched LDMOS RF transistor is developed to work in a range of 8W to 300W power output, frequently used in aerospace, radar and satellite applications.

REPORT COVERAGE

The report provides a detailed analysis of the global market and focuses on critical aspects such as leading companies, applications, latest technology , and recent development in the market of transistor. Besides this, the report offers insights into the market trends and highlights the key industry developments. In addition to the abovementioned factors, the report encompasses several factors contributing to the market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.30% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Technology

|

|

|

By Industry Vertical

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market stood at USD 15 Billion in 2025.

By 2034, the global market is expected to be valued at USD 40.56 Billion.

The market is set to exhibit a CAGR of 12.30% during the forecast period (2026-2034).

Asia Pacific is anticipated to be the dominant region, which stood at USD 52.90 Billion in 2025.

In the Industry Vertical segment, the manufacturing sub-segment is expected to witness the highest CAGR during the forecast period

Increasing use of power transistors in connected devices is the key trend in the global market.

Increasing use of Eco- friendly electronic devices driving the market.

Diodes Incorporated, Electronics Industry Public Company Limited (EIC), Inchange Semiconductor Company Limited, Infineon Technologies AG, Linear Systems, Microchip Technology Inc., Mitsubishi Electric Corporation, Linear Integrated Systems NXP Semiconductors, Qualcomm Technologies, Inc. Samsung Electronics Co., Ltd. And other are the major companies in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us