Product Engineering Services Market Size, Share & Industry Analysis, By Service (Design, Development, Testing, Support & Maintenance, Redesigning & Re-engineering, Deployment, and Others), By Enterprise Type (Large Enterprises and Small & Medium Enterprises), By Industry (Automotive, Healthcare & Life Science, Manufacturing, BFSI, Retail & Consumer Goods, Aerospace & Defense, IT & Telecom, and Others), and Regional Forecast, 2026– 2034

KEY MARKET INSIGHTS

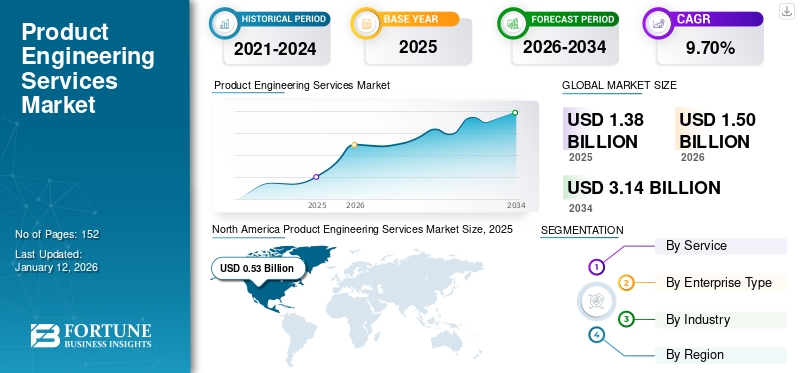

The global product engineering services market size was valued at USD 1.38 billion in 2025. The market is projected to grow from USD 1.5 billion in 2026 to USD 3.14 billion by 2034, exhibiting a CAGR of 9.70% during the forecast period. North America dominated the global market with a share of 38.50% in 2025.

Product engineering services offer various solutions at different phases of the product engineering lifecycle. It monitors and controls solution and service operations from the beginning of the lifecycle of design to re-engineering and deliveries. The growing focus on lowering production costs is expected to propel the demand for advanced engineering services. The assurance of better output with reduced operation time and cost is expected to boost market growth. Enterprises’ increasing focus on Time-to-Market (TTM) systems is slated to boost the demand for these services.

The COVID-19 pandemic severely hampered the production and operation of industries across the world. Manufacturing shutdowns, supply chain limitations, and closure of global borders significantly impacted markets across countries, hindering the production and development of products across industries such as BFSI, manufacturing, retail, healthcare, automotive, and more. To tackle the situation, various companies invested in launching innovative solutions. For instance,

- In September 2021, product engineering and lifecycle service provider Quest Global launched a COVID-19 vaccine awareness program across the cities of India.

Thus, to ensure business continuity, engineering service providers collaborated and introduced innovative products. These services supported industries in offering quick and cost-effective solutions, resulting in post-pandemic market growth. This is expected to boost the product engineering services market share.

Impact of Generative AI

Integration of Enhanced Capabilities of Generative AI to Propel Market Growth

In the dynamically changing landscape of modernized industries, how products are comprehended, designed, developed and handled has undergone an insightful transformation owing to the emerging progression of technology. Generative AI is an innovative paradigm that embraces the potential to transform product engineering services entirely. It streamlines the product development process and helps improve time-to-market, customer experience, and employee productivity.

The several applications of generative AI can help resolve such challenges and enhance productivity and efficiency across various industries. Following are the various applications of Generative AI in product engineering services:

- User Interface Design: GenAI is modernizing UI design by generating alternative styles and layouts that help engineers quickly explore various design choices and deliver a visually stunning user experience.

- Automated Testing: Using GenAI, software engineers can create synthetic test data, enabling automated testing that thoroughly examines different scenarios, enhancing the efficiency and accuracy of the testing process.

- Code Generation: Generative AI helps automate repetitive code-writing tasks and aids the team to focus on higher-level problem-solving and speeding up the development process.

Thus, the incorporation of generative AI capabilities is anticipated to upsurge the product engineering services market growth.

Product Engineering Services Market Trends

Artificial Intelligence Integration with Engineering Services to Escalate Market Growth

Artificial Intelligence (AI) is offering revolutionary solutions across industry applications. Product engineering services integrate artificial intelligence to enhance output through innovative solutions. Together, these technologies have elevated the expertise and experience in product design and development. It helps mitigate the risk of development and deployment in advance, thus enhancing time management.

Similarly, artificial intelligence identifies the areas that can support lowering expenses; thus, major enterprises in engineering services are investing in the technology. This collaborative integration fosters improved customer satisfaction, scalability, efficiency, and competitiveness. The integration of artificial intelligence with engineering services is expected to unlock significant growth opportunities.

Download Free sample to learn more about this report.

Product Engineering Services Market Growth Factors

Growing Focus on Product Design and Enhancement of Customer Engagement Services to Drive Market Growth

Engineering services support all activities in the lifecycle of product design, development, testing, re-engineering, and more. It uses sophisticated methodologies to understand production and offer comprehensive support across the product lifecycle. In recent times, companies have majorly focused on offering quicker and faster deliveries to enhance customer engagement. Thus, the rise in focus on customer satisfaction has led companies to increase production efficiency and product quality.

Product customization is also gaining traction, and customers are experimenting with their needs and requirements. This has fueled the need for monitoring and analyzing the development process through this type of engineering service. Moreover, technology plays a crucial role in quality assurance, along with cost-effective methods. Thus, the growing prevalence of customized development and the heightened focus on product designing is likely to propel the market growth.

RESTRAINING FACTORS

Additional Cost of Designing Services May Hamper Market Growth

Product engineering services are gaining significant demand across industry applications. However, for growing businesses, the installation of such services entails additional costs. Moreover, not all enterprises find it comfortable to utilize designing and developing services during the initial product conceptualization process. Limited innovation funds and high cost of investment are expected to hamper market growth.

Product Engineering Services Market Segmentation Analysis

By Service Analysis

Efficiency of Product Development to Expedite Segment Growth

On the basis of service, the market is segmented into design, development, testing, support & maintenance, redesigning & re-engineering, deployment, and others.

The development segment dominated the market with a share of 20.76% in 2026. The efficiency of product development empowers enterprises to offer innovative and emerging solutions. The product development engineer manages the process from benchmarking to delivery, boosting time management and customer service. The surge in demand for product development services is a direct reflection of the worldwide digital transformation initiative. According to Fortune Business Insights, the digital transformation market size is expected to grow from 2.71 trillion in 2024 to 12.35 trillion by 2032. This rapid growth reflects the urgent necessity of business in innovative solutions.

The deployment segment is expected to showcase the highest CAGR during the forecast period. Product deployment services enhance the multiple site integration along with data protestation. This is expected to boost product engineering service market share.

Similarly, the design segment is poised to gain a prominent market share during the forecast period. The service helps enterprises conceptualize products and offers a window for rectifying or modifying designs.

By Enterprise Type Analysis

Capability to Support Production Lifecycle is Likely to Propel Large Enterprises Expansion

Based on enterprise type, the market is segmented into large enterprises and small & medium enterprises.

The large enterprises segment dominated the market with a share of 65.36% in 2026. The rise in competition is driving companies to invest in services that can help enhance product development and production time. Furthermore, these services help cover a wide range of activities across the production lifecycle to boost market growth.

The small & medium enterprises segment is expected to grow with the highest CAGR during the forecast period. The growing digitalization across small enterprises is expected to propel the demand for this type of engineering services.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Demand for Quick Production to Fuel Engineering Services Adoption in Manufacturing

By industry, the market is categorized into automotive, healthcare & life science, manufacturing, BFSI, retail & consumer goods, aerospace & defense, IT & telecom, and others.

The manufacturing segment captured the maximum revenue with a share of 19.16% in 2026. The increasing demand for faster production with higher quality and lesser cost is likely to boost the demand for this type of engineering services in manufacturing industries globally. These services monitor the product throughout the entire production lifecycle and offer effective ways to reduce the time and cost further.

The healthcare & life science segment is expected to grow with the highest CAGR during the forecast period. These services help design and manufacture medical devices within a cost-competitive range.

Similarly, the automotive segment is projected to gain a significant share during the forecast period. Its growing application in car concept development, designing, and more is expected to boost segmental share.

REGIONAL INSIGHTS

Based on region, the market has been studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America

North America Product Engineering Services Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is expected to gain a dominant revenue share during the forecast period with increased demand for services supporting production time and cost. The growing focus on faster product deliveries is likely to fuel market growth in the region. Industries such as manufacturing, aerospace & defense, BFSI, retail, and more are investing in time-efficient product development solutions to enhance customer satisfaction. The U.S. market is projected to reach USD 0.42 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is likely to witness the highest CAGR during the forecast period, owing to growing demand for customized products and increasing investment in technology. As per industry experts, in 2023, technology spending in the region reached USD 732 billion. Governments in China, Japan, India, and others are implementing various policies and initiatives to promote technological innovation, and investments in R&D are also increasing to foster innovation and the creation of high-quality products, ensuring that the region remains at the forefront of technological advancements. India is expected to grow with the highest CAGR during the forecast period as the country has a large pool of highly skilled engineers and is also at the forefront of developing emerging technologies, including Machine Learning (ML), AI, and IoT. India has emerged as a leading destination for technology and product engineering services, with around 1,300 global organizations becoming part of India’s global capability center sector. The Japan market is projected to reach USD 0.05 billion by 2026, the China market is projected to reach USD 0.08 billion by 2026, and the India market is projected to reach USD 0.04 billion by 2026.

Europe

Europe is expected to grow rapidly during the forecast period. With the rise in digitalization and automation in the region, various key players are expanding into European countries. The enterprises are keen on enhancing operations to boost market growth. The UK market is projected to reach USD 0.08 billion by 2026, while the Germany market is projected to reach USD 0.06 billion by 2026.

Middle East & Africa

The Middle East & Africa is estimated to showcase a significant growth rate during the forecast period. Rapidly growing industries such as aerospace & defense, automotive, BFSI, and others are slated to boost the market growth in the region.

South America

South America is set to showcase steady growth during the forecast period with the rise in digitalization and production services.

KEY INDUSTRY PLAYERS

Key Players Are Adopting Acquisition Strategies to Expand their Market Reach

Key players in the market are significantly strengthening their market position through the strategic acquisition of small and niche local players. Through this, these players are gaining expertise, a new client base, and global expansion. Similarly, with the rise in advanced technologies, the key players are integrating generative AI capabilities to offer higher-end capabilities.

- May 2023: Encora, a generation product engineering provider, launched generative AI-powered digital engineering services to offer higher quality and productivity to its clients. The advanced services offered support across the software development lifecycle.

List of Top Product Engineering Services Companies

- HCL Technologies (India)

- Capgemini SE (France)

- IBM Corporation (U.S.)

- Accenture plc (Ireland)

- Bertrandt AG (Germany)

- Wipro (India)

- TATA Consultancy Services Limited (India)

- AVL List GmbH (Austria)

- Alten Group (France)

- AKKA Technologies (Belgium)

KEY INDUSTRY DEVELOPMENTS

- June 2024: Cognizant entered a partnership with Gentherm, a medical patient temperature management system company for providing product engineering services. Cognizant is providing system engineering, model-based development, and validation and has created a test facility to conduct research and development for Gentherm products.

- June 2024: Capgemini signed a collaboration agreement with D+I, an Australia-based product development and design consultancy, to enhance its engineering capabilities by delivering innovative products to the Australian industrial and consumer sectors.

- May 2024: Quest Global acquired a majority stake in People Tech Group, a next-generation digital transformation and digital innovation company. The acquisition marks a significant milestone in Quest Global’s growth journey by expanding its footprint in North America and India within Hi-Tech industries. The acquisition aims to better serve customers by providing expanded expertise in digital transformation.

- March 2024: Jaguar Land Rover entered a partnership with Tata Technologies, a product development, engineering, and digital services provider company, to bring digital transformation across Jaguar’s logistics, manufacturing, finance, purchasing, and supply chain modules. Tata’s integrated Enterprise Resource Planning (ERP) platform helps revolutionize the performance of modern luxury vehicles and deliver a faster customer experience.

- October 2023: Happiest Minds Technologies Limited introduced product and digital engineering services, offering focused, cutting-edge technologies and engineering skills. With this strategic move, the company focused on building deep domain expertise.

- June 2023: FPT Corporation, a Vietnam-based IT service provider, acquired U.S.-based Cardinal Peak, offering product type of engineering services to strengthen its market position. The company aims to deliver end-to-end product engineering services such as Internet of Things (IoT), cloud, hardware, mobile product development, and more.

- May 2023: Next-generation product engineering service provider Encora introduced generative AI-powered digital engineering services to offer higher quality and productivity to its clients. The advanced services offered support across the software development lifecycle.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, product/service types, and leading applications of the product. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.70% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Service

By Enterprise Type

By Industry

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 3.14 billion by 2034.

In 2025, the market was valued at USD 1.38 billion.

The market is projected to grow at a CAGR of 9.70% during the forecast period.

By industry, the manufacturing segment held the maximum share in 2026.

The growing focus on product design and enhancement of customer engagement services are the key factors driving the market growth.

HCL Technologies, Capgemini SE, IBM Corporation, Accenture plc, AVL, Wipro, TATA Consultancy Services Limited, and Alten are the top players in the market.

North America dominated the global market with a share of 38.50% in 2025.

By service, the deployment segment is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us