Proteomics Market Size, Share & Industry Analysis, By Offering (Products {Instruments and Consumables} and Services {Bioinformatics and Core Services}), By Technology (Mass Spectrometry, Chromatography, Electrophoresis, X-Ray Crystallography, Protein Microarray, and Others), By Application (Drug Discovery, Clinical Diagnostics, and Others), By End User (Pharmaceutical & Biotechnology Companies, Research & Academic Institutes, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

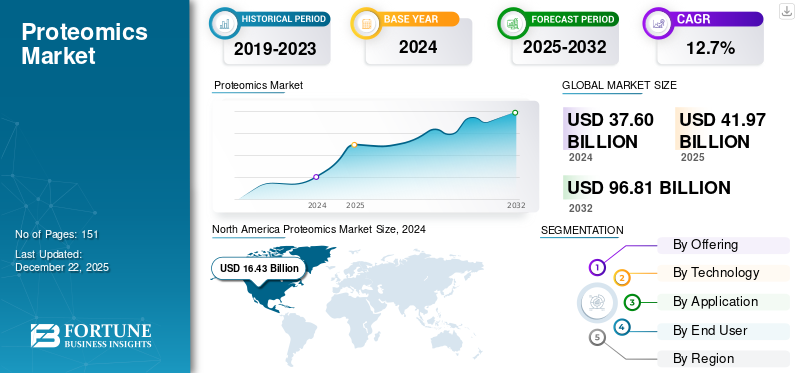

The global proteomics market size was valued at USD 41.97 billion in 2025. The market is projected to be worth USD 46.97 billion in 2026 and reach USD 125.64 billion by 2034, exhibiting a CAGR of 13.09% during the forecast period. North America dominated the proteomics market with a market share of 43.75% in 2025.

Proteomics involves a large-scale study of protein molecules which are essential in the functioning and structure of living things. The proteome is a complete set of proteins produced by a cell, tissue, or organism.

The market is witnessing robust growth over the past few years, as it has become a crucial tool in biochemistry and molecular biology. This is driven by prominent factors such as increasing demand for personalized medicine, advancements in drug discovery, and rising investments in research and development.

The market is also observing a strong growth owing to the active involvement of key players such as Agilent Technologies Inc., Thermo Fisher Scientific Inc., Illumina Inc., and others. These entities are focusing on advancements in product and services, collaboration & mergers, and other strategic initiatives to capture untapped opportunities.

MARKET DYNAMICS

MARKET DRIVERS

Strong Focus on Proteomics Research to Boost Market Growth

In recent years, the research community globally is focusing on the study of human proteome. This is aimed at understanding disease biomarkers, protein interactions and identifying potential drug targets for effective drug development. In addition, the growing trend of precision medicine also demands the extensive use of proteomics. Proteomics allows the identification of protein biomarkers that help in the prediction of individual responses to treatment leading to more effective and targeted therapies. Together, these factors significantly drive the proteomics market growth.

Moreover, with the increasing research and development activities based on protein studies, the influx of investments by both public and private operating players is also growing. This is further fostering technological advancements and expanding the applications of proteomics.

- For instance, in December 2024, Syncell received USD 15 million Series A funding with an aim to expand and enhance commercialization of its spatial proteomics and protein purification technology.

MARKET RESTRAINTS

Technical Limitations Hampers Overall Market Growth

Despite significant growth, the technological complexities and limitations restrict the market growth to a certain extent. The structure of proteome is more diverse and dynamic compared to the transcriptome or genome, with proteins existing as various isoforms and undergoing various post-translational modifications (PTMs). In addition, the high level of proteins in a biological sample can vary by orders of magnitude, making it difficult to detect and quantify both high abundant and low-abundance proteins.

Furthermore, identification of proteins from peptide fragments is also uncertain, requiring sophisticated algorithms to infer protein identity and abundance. This also results in protein quantification challenges for large numbers of samples.

MARKET OPPORTUNITIES

Shifting Focus toward Personalized Medicine to Offer Lucrative Growth Opportunities

Proteomics plays an important role in personalized medicine by studying the structure, function, and interactions of proteins within an individual's body. This allows for a deeper understanding of disease mechanisms, identification of potential biomarkers, and the development of targeted therapies tailored to an individual's unique protein profile. Thus, the growing shift toward the development of personalized medicine is likely to offer lucrative growth opportunities for the market.

Proteomics enables the identification of unique protein profiles that can be used to tailor treatments to individual patients, leading to more effective and targeted therapies. This is anticipated to further increase the investment activities, as more researchers and pharmaceutical companies are focusing on this space.

MARKET CHALLENGES

Data Complexity in Proteomics to Hinder Market Growth

The market faces challenges in both its experimental workflows and in the subsequent data analysis, requiring continuous innovation in both areas to fully realize its potential. Proteomics data is complex and thus, requires sophisticated computational tools for processing, analysis, and interpretation. This further requires installation of advanced tools, in turn increasing the overall costs.

Additionally, integration of proteomics data with other omics data such as transcriptomics, genomics is also a challenging process as it is crucial for a complete understanding of biological systems.

PROTEOMICS MARKET TRENDS

Advancements in Technology is a Key Market Trend

The recent trends in this marketspace are focused on technological advancements in products and services used in protein analysis. This includes increased throughput, enhanced sensitivity, and integration with other omics technologies. The key areas of technological advancements include advancements in mass spectrometry and development of single-cell proteomics among others.

- For instance, in June 2025, Thermo Fisher Scientific introduced advanced mass spectrometry solutions at the annual American Society for Mass Spectrometry (ASMS) Conference.

Download Free sample to learn more about this report.

Segmentation Analysis

By Offering

Product Offerings of Proteomics Lead Owing to Wide Adoption in R&D

On the basis of offering, the market is segmented into product and services.

The Products segment is projected to dominate the market with a share of 55.42% in 2026. the product segment held the highest proteomics market share and is anticipated to maintain its dominance throughout the study period. This segment is further divided into instruments & consumables. Different factors, such as the wide adoption of proteomics products in research & development, are driving the segment growth. Advancements in instruments coupled with introduction of new reagents and kits is another factor boosting the segment’s growth.

The services segment is projected to witness a notable growth rate during the forecast period. The growing number of service providers coupled with rising demand for services due to different applications of proteomics in various fields, has supplemented the segmental growth. Additionally, growing demand for bioinformatics tools also propels the segment.

- For instance, in January 2025, Sapient collaborated with Alamar Biosciences to extend its targeted proteomics services.

To know how our report can help streamline your business, Speak to Analyst

By Technology

Mass Spectrometry Solutions Application in Various Fields Boost its Dominance

Based on technology, the market is divided into mass spectrometry, chromatography, electrophoresis, x-ray crystallography, protein microarray, and others.

The Mass Spectrometry segment is projected to dominate the market with a share of 35.55% in 2026.The mass spectrometry segment held the leading position in 2024 driven by its increasing adoption in proteomics owing to its several advantages. This is further supplemented by advancements in technology, and rising applications of mass spectrometry in various fields such as drug development, biomarker discovery, and clinical diagnostics. Moreover, frequent new product launches and service expansion by operating players also support the segment’s growth.

- For instance, in June 2024, Agilent Technologies Inc. launched 7010D Triple Quadrupole GC/MS System at the 72nd ASMS Conference on Mass Spectrometry and Allied Topics.

On the other hand, the protein microarray segment is expected to grow at a notable rate in the coming years. The rising adoption of these microarrays by pharmaceutical companies has been a key factor driving the segment growth.

By Application

Rising Preference for Personalized Medicine Boosts Proteomics Application in Drug Discovery

On the basis of application, the market is categorized into drug discovery, clinical diagnostics, and others.

The drug discovery segment captured the leading position in the global market in 2024. Key factors such as increasing research & development activities, rising preference of personalized medicine, and advancements in technologies are driving the segment growth. Proteomics plays an important role in modern drug discovery. In recent years, this technology is extensively being used in the study of the molecular basis of various diseases. Proteomics helps identify proteins that are directly involved in disease processes or are potential targets for therapeutic intervention. By analyzing the proteome of diseased cells or tissues, researchers can identify proteins that are dysregulated and could be modulated by drugs.

On the other hand, the clinical diagnostics segment is anticipated to witness a significant growth in the coming years. Proteomics methods are being utilized more frequently to investigate the biological foundations of disease, discover new targetable proteins and pathways for therapy, estimate disease prognosis or treatment responses, and examine resistance mechanisms.

By End User

Pharmaceutical & Biotechnology Companies are Leading End Users Owing to Increasing Adoption of Protein Microarrays in R&D

Based on end user, the market is divided into pharmaceutical & biotechnology companies, research & academic institutes, and others.

The pharmaceutical & biotechnology companies segment held the largest market share 69.56% in 2026. The increasing adoption of these technologies in research & development of innovative therapies, coupled with a growing shift toward development of tailored medicines are few key driving factors for the segment growth.

- For instance, in January 2025, 14 pharmaceutical companies collaborated with the U.K. Biobank to start one of the largest proteomics studies.

The research & academic institutes segment is projected to grow at a considerable rate during the forecast period. Research institutions extensively use proteomics for various applications, including drug target identification, biomarker discovery, understanding disease mechanisms, and studying protein interactions.

PROTEOMICS MARKET REGIONAL OUTLOOK

By region, the market is divided into Europe, Asia Pacific, North America, Latin America, and the Middle East & Africa.

North America

North America Proteomics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

In 2025, North America dominated the global market with a revenue of USD 18.36 billion. This dominance can be attributed to the factors such as increasing private and government investments in proteomics research, strong focus of regional companies on the development of personalized medicine, and availability of advanced technologies.

U.S.

The U.S. captured a leading position in North America, driven by strong regulatory support, and availability of advanced product & service offerings. Additionally, increasing number of strategic initiatives by operating players, coupled with frequent innovative product launches further supported the country’s market growth. The United States market is expected to reach USD 18.76 billion by 2026.

- For instance, in July 2024, Thermo Fisher Scientific completed the acquisition of Olink Holding to enhance its capabilities in proteomics. The acquired company was a provider of next-generation proteomics solutions.

Europe

Europe is anticipated to exhibit a considerable growth rate in the coming years. Growing focus on research & development activities, active biobanks, personalized medicine initiatives, and investment in proteomics research platforms are some of the prominent factors driving the regional market growth. Additionally, increasing funding initiatives and policies supporting translational proteomics, enhances the adoption of these technologies. The United Kingdom market is expected to reach USD 1.84 billion by 2026, while the Germany market is expected to reach USD 3.14 billion by 2026.

- For instance, the European Proteomics Association (EuPA) held its yearly conference in June 2025. This conference aimed at gathering experts from mass spectrometry and proteomics fields to share knowledge.

Asia Pacific

Asia Pacific is likely to witness the fastest growth rate over the study period. This can be attributed to factors such as growing investments in advanced drug development, infrastructure improvements, and rising demand in emerging countries such as China, India, and South Korea. Moreover, rising industrial and academic collaborations, and government initiative to advance proteomics research are few other key factors propelling the regional market growth. The Japan market is expected to reach USD 1.98 billion by 2026, the China market is expected to reach USD 2.61 billion by 2026, and the India market is expected to reach USD 1.37 billion by 2026.

- For instance, in October 2023, the Chinese government introduced a 30-year, multibillion RMB proteomics project to focus on the mapping of human proteomes.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa have a smaller share of the market. However, due to gradual adoption of the product in clinical diagnostics, supported by donor funding and academic collaborations is anticipated to witness a considerable growth in the coming years.

COMPETITIVE LANDSCAPE

Key Market Players

Leading Companies Focus on Collaborations to Boost Their Market Presence

Several companies are at the forefront of the market, including Agilent Technologies Inc., Thermo Fisher Scientific Inc., Danaher Corporation, Illumina Inc., and others. Along with these well-established players, several emerging players such as Alamar Biosciences, Syncell Inc., Pixelgen Technologies are also expanding their presence in this market.

Increasing number of collaborations between companies, rising investment in emerging players, and emphasis on new product launches are some of the strategies undertaken. Through these initiatives, the companies aim to strengthen their market presence.

- For instance, in January 2022, an Israeli startup named Protai raised a seed funding of USD 8 million to support its drug discovery with proteomics and artificial intelligence.

Some other key players in the market include Bio Rad Laboratories Inc., Waters Corporation, Bruker, Shimadzu Corporation, QIAGEN, and others.

LIST OF KEY PROTEOMICS COMPANIES PROFILED

- Agilent Technologies Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Bio Rad Laboratories Inc. (U.S.)

- Illumina Inc. (U.S.)

- QIAGEN (Germany)

- Shimadzu Corporation (Japan)

- Promega Corporation (U.S.)

- Danaher (U.S.)

- Waters Corporation (U.S.)

- Bruker (U.S.)

KEY INDUSTRY DEVELOPMENTS

- June 2025: Illumina Inc. announced the acquisition of SomaLogic through a definitive agreement with Standard BioTools. This acquisition is anticipated to accelerate Illumina’s proteomics business.

- June 2025: Brucker Corporation launched new timsUltra AIP system at the 73rd Conference on Mass Spectrometry and Allied Topics (ASMS). This ultra-high sensitive 4D-Proteomics solution enhances the single-cell proteomics.

- May 2025: Seer, Inc. introduced Proteograph Product Suite that features SP200 automation instrument and Proteograph ONE Assay. This is a high-resolution, scalable mass spec-based proteomics solution.

- January 2025: Illumina, Inc. in collaboration with Standard BioTools, deCODE Genetics, GSK plc., Tecan, Novartis AG, and Johnson & Johnson Services Inc. launched a pilot proteomics program. This program is aimed at analyzing 50,000 U.K. Biobank samples.

- November 2023: Momentum Biotechnologies added proteomics services in their service offerings.

REPORT COVERAGE

The global proteomics market report provides a detailed analysis of the industry using various parameters. It emphasizes key aspects, such as profiles of major companies, segmental analysis, and a few others. In addition, the market report also includes detailed insights into market dynamics, new products & services launches, and key industry developments such as mergers, partnerships, & acquisitions.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.09% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Offering

|

|

By Technology

|

|

|

By Application

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 41.97 billion in 2025 and is projected to reach USD 125.64 billion by 2034.

In 2025, North Americas market value stood at USD 18.36 billion.

The market is expected to exhibit steady growth at a CAGR of 13.09% during the forecast period.

In terms of offering, the products segment led the market in 2025.

The growing usage of proteomics in drug discovery is a key factor driving market growth.

Agilent Technologies Inc., Thermo Fisher Scientific Inc., and Illumina Inc. are some of the major players in the market.

North America dominated the market in 2025 by holding the largest share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us