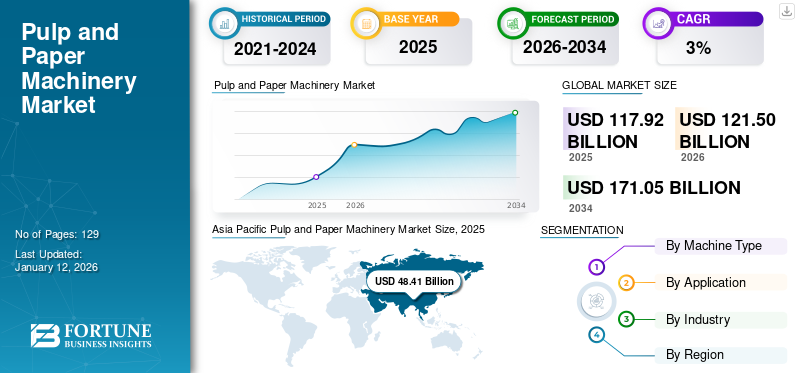

Pulp and Paper Machinery Market Size, Share & Industry Analysis, By Machine Type (Pulping Machine, Screening Machine, Refining Machine, Bleaching Machine, Forming Machine, Drying Machine, and Others (Folding)), By Application (Packaging Paper, Printing Paper, Household Paper, and Specialty Paper), By Industry (Paper Mills, Packaging, Printing facility, Household Products, and Others (Cigarettes), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

The global pulp and paper machinery market size was valued at USD 117.92 billion in 2025 and is projected to grow from USD 121.5 billion in 2026 to USD 171.05 billion by 2034, exhibiting a CAGR of 4.4% during the forecast period. The Asia Pacific dominated global market with a share of 41.1% in 2025.

The global pulp and paper machinery exhibits a complex growth structure influenced by global economic conditions, industry demand shifts, and factors such as environmental concerns and technological advancements. The market is closely tied to the overall demand for paper and packaging products. Key drivers of the demand include the growing e-commerce industry and the rise in environmental concerns about sustainable paper production. The market is characterized by significant capital investment, which influence purchasing decisions of paper mills and manufacturers. Additionally, technological advancements, especially in developing regions are shaping the industry, with automation, innovation, and sustainable machines being in high demand.

The COVID-19 pandemic has had a significant impact on the global pulp and paper machinery market. The temporary shutdown, disruptions in the supply chain, rising raw material prices, and slowdown in demand for non-essential products all contributed to market challenges. However, the surge in demand for hygiene products such as tissue paper, wipes, and other related items supported the market sustainance. The post-pandemic surge in online retail and e-commerce is expected to drive long term demand for packaging solutions.

IMPACT OF INDUSTRY 4.0

Industry 4.0 Integration Drive Improved Paper Upcycling and Enhance Sustainable Practices

Industry 4.0 technology is revolutionizing the pulp and paper industry by improving paper upcycling by optimally reducing the pulping time and reusing the water in all processes without wastage. Additionally, the integration of industry 4.0 technologies minimizes downtime for the machinery through predictive maintenance, energy optimization, and lower operating costs for paper manufacturers. Manufacturers in the paper and pulp industry are increasingly adopting these technologies to gain a competitive edge and address the demand for smarter and more sustainable production processes.

- For instance, in January 2024, Andritz AG, an international technology group, teamed up with Powerhouse Controls, a leading drive solution provider. The partnership aimed to address the needs of North American paper mills seeking to modernize their paper machine drive systems while minimizing machine downtime.

MARKET DYNAMICS

Market Trends

Shift Toward Smart Factories and Sustainable Paper Products are the Latest Market Trend

The rapid evolution of industry IoT and innovation in advanced pulp technology for sustainable paper products are shaping new industry trends. Non-wood paper solutions, such as bamboo, recycled paper, and banana fiber, are the latest sustainable alternatives that supports innovation among pulp and paper machinery manufacturers. Additionally, the increasing trend toward bio-degradable and recyclable paper products is attracting capital from major paper facilities and government organizations, which support the growth of paper roll manufacturing across packaging, printing, and other sustainable paper solutions. These trends are shaping and expanding the pulp and paper machinery market size during the forecast period.

- For instance, in May 2024, Voith, in partnership with Essity, received funding from the German Federal Ministry for Economic Affairs and Climate Action to conduct research into CO2-neutral paper manufacturing at its Heidenheim site. The new facility would reduce water consumption by 95% and energy consumption by 40%.

Download Free sample to learn more about this report.

Market Drivers

Rapid Penetration of E-Commerce and Efficient Production Needs to Fuel Product Demand

As urbanization increases and disposable income rises, the e-commerce industry is expanding across developing countries such as China, India, ASEAN, and other developing economies. This rapid penetration of e-commerce or online retail has boosted the demand for packaging paper, hygiene paper products, and other paper products. Additionally, paper manufacturers are increasingly demanding more energy-efficient and sustainable production machines that ensure maximum Overall Equipment Effectiveness (OEE). These factors are driving pulp and paper machinery market growth and demand in the long term.

- For instance, in July 2023, Pakka, a prominent regenerative packaging solution firm, set up a 400-tonne-per-day packaging plant. The company invested USD 250 million in sugarcane-rich Guatemala, South America, for the production of compostable flexible packaging and molded fiber facility.

Market Restraints

High Capital Expense and Environmental Concerns to Hinder New Investment

Despite the increasing demand for sustainable paper products, the production of pulp and paper machinery remains resource-and price-intensive, raising concerns about deforestation, water usage, and strict regulatory constraints. Additionally, the high initial setup cost for paper manufacturing units is impacting the business's cash flow and profit margins in the long term. These challenges need to be identified and resolved, as they may deter profitability and restrain new investment in the paper business during the forecast period.

Market Opportunities

Increasing Paper Products and Rapid Industrialization Across Various Countries Create Ample Opportunities

Pulp and paper machinery is a major sector that supports rapid industrialization in countries such as China, India, Brazil, and South Africa. Additionally, the growing demand for hygiene and sanitary products in developed and developing countries presents significant opportunities for medium and small manufacturing enterprises (MSME) to support industrialization. This development across different regions shows an increasing demand for paper products, which will significantly help acquire sustainable pulp and paper machinery market share during the forecast period.

- For instance, in August 2024, Valmet Corporation, a prominent paper machinery provider, completed the acquisition of Demuth, a prominent wood handling technology services provider in Brazil South America. The acquisition is aligned with the Valmet strategy to develop and supply reliable process technologies to pulp & paper and energy businesses.

SEGMENTATION ANALYSIS

By Machine Type

Screening Machines Dominate due to Increased Emphasis on Improving Product Quality

By machine type, the market is classified into a pulping machine, screening machine, refining machine, bleaching machine, forming machine, drying machine, and others (folding).

Across the machine type segment, screening machines are dominating the category with the highest market share and CAGR owing to increasing demand for high-quality paper products across end users. Additionally, manufacturers are focusing on integrating smart screeners for smooth paper-quality manufacturing, which is supporting the long-term growth of paper screeners. This segment is poised to grow with a considerable CAGR of 4.77% during the forecast period (2026-2034).

Bleaching and forming machines are experincing progressive market growth due to rapid industrialization across developing countries. Additionally, supportive government policies for the easy establishment of small and medium paper businesses are further driving growth in the paper sector. Furthermore, stable demand for refining, pulping, drying, and other machinery in paper recycling units is supporting the the long term growth of the industry's.

The bleaching machine segment is likely to capture 22.92% of the market share in 2026.

By Application

Packaging Paper Led Due to Growing Demand for Paper Packaging in Last Mile Shipping

By application, the market is classified into packaging paper, printing paper, household paper, and specialty paper.

The packaging paper segment is dominating the market owing to the growing investments by established paper business owners to upgrade with modern machinery. The growth of business is supported by the growing global demand for a variety of paper packaging solutions across the last mile shipping businesses. The segment held 34.05% of the market share in 2026.

The increasing demand for hygienic products has boosted the demand for household paper category.

The stagnant demand for printing paper due to the shift from offline media to digital platforms has impacted the print paper category.

The limited demand for specialty paper due to minimizing demand and quenching of speciality paper customer businesses due to digitization has impacted segmental growth.

To know how our report can help streamline your business, Speak to Analyst

By Industry

Increased Demand for Sustainable Packaging Solutions Support Packaging Industry Growth

As per industry, the market is classified as paper mills, packaging, printing facility household products, and others (cigarettes).

The packaging segment is dominating the market owing to the rising preference for paper over plastic packaging due to its easy-to-decompose capability and sustainability. These factors have supported the segment's growth with the highest share. This segment is expected to hold 32.30% of the market share in 2026.

The printing facility segment is witnessing progressive growth owing to high investment and frequent replacement of machines due to reduced life expectancy caused by heavy usage. Additionally, the prominent adoption of paper-converting machines in print facilities supports long-term growth in the segment. This segment is likely to register a substantial CAGR of 3.80% during the forecast period (2026-2034).

Household products are witnessing stable growth due to the heavy usage of products by end users and increasing consumer demand across various sectors.

Paper mills and other industries are observing slow and stagnant growth due to changes in reading habits and preferences of consumers from offline media to digital platforms.

PULP AND PAPER MACHINERY MARKET REGIONAL OUTLOOK

Asia Pacific

Asia Pacific Pulp and Paper Machinery Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is dominating the global market in terms of share owing to the predominant presence of established paper manufacturers who are upgrading their existing facilities to modern paper manufacturing equipment. This improvement improves productivity while maintaining sustainability. Furthermore, the growing emphasis of government to improve the significance of print media and sustainable packaging solutions is bolstering demand for machines in major countries such as China, Japan, and developing nations, notably India, South Korea, and other ASEAN countries. India is estimated to hold USD 7.70 billion in 2026, while Japan is set to gain USD 11.23 billion in the same year.

China is dominating the Asia Pacific market with its strong industrial base and the wide use of easy-to-operate, fully automated paper machinery that is available at affordable prices. Additionally, the high domestic demand for paper manufacturing machinery in the paper recycling business and growing capital investment by manufacturers in production facilities to improve productivity and product quality are driving long term demand. Chinese market is forecasted to be worth USD 18.02 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is expected to acquire USD 32.10 billion in 2026, registering a CAGR of 3.17% during the forecast period (2026-2034). North America pulp and paper industry is a mature market, with progressive demand for pulp and paper machinery. The U.S. and Canada are leading the regional market driven by demand for packaging and recycled paper. Increasing automation and a shift toward environment-friendly production methods are key drivers in this region. The U.S. market is set to be valued at USD 20.09 billion in 2026.

South America

South America is foreseen to grow with a value of USD 8.03 billion in 2026. The South America market is showcasing moderate growth with increasing investment by manufacturers in new production facilities for paper packaging and tissue products. Countries such as Brazil and Argentina are playing critical roles, benefiting from Foreign Direct Investment (FDI) policies and tax benefits that support establishments in this region.

Europe

Europe is set to be worth USD 24.92 billion in 2026. The region is witnessing significant steady growth due to the presence of paper manufacturers in countries such as Germany, Spain, and the Rest of Europe. The U.K. market is predicted to reach USD 5.36 billion in 2025. Additionally, companies in the region are focusing on reducing environmental impact with stringent regulations are driving the demand for energy-efficient and sustainable machinery. Germany is projected to reach a market value of USD 4.76 billion in 2026, while France is poised to be valued at USD 3.76 billion in the same year.

Middle East & Africa

The Middle East & Africa region is growing slowly owing to expanding urbanization and growing demand for hygienic paper products in GCC Countries such as Saudi Arabia, UAE, and other countries. Additionally, South Africa's increasing focus on sustainable development and eco-friendly paper production machinery to support industrialization is contributing to market growth. The GCC market is likely to stand at USD 2.46 billion in 2026.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Emphasis on Developing Automated Machines to Extent their Market Potential

Key players operating in the pulp and paper machinery segment have shifted their focus to developing more advanced automated machines that are capable of handling different paper sizes and materials. These capabilities help key market players to extend their market potential through a broader portfolio of machines, which can improve production efficiency and revenue with automation capabilities.

- For instance, in October 2023, Andritz AG, an international technology group, signed an agreement with Texas based Flowserve corporation to take over its NAF AB engineers firm, which has been providing process control valves for pulp and paper and other related industries. The agreement strengthens Andritz’s product and service portfolio in the field of process control.

Major Players in the Pulp and Paper Machinery Market

Andritz AG, Voith Group, Parason Machinery, Valmet Corporation, Bellmer GmBH, IHI Corporation, A. Celli Paper S.p.A, Kadant Inc., Mitsubishi Heavy Industries, and Toscotec SPA are the largest players in the market. The global pulp and paper machinery market is moderately consolidated.

List of Key Companies Profiled:

- Andritz AG (Austria)

- Voith Group (Germany)

- Parason Machinery (India)

- Valmet Corporation (Finland)

- Kadant Inc. (U.S.)

- Bellmer GmBH (Germany)

- Construcciones Papeleras S.L. (Spain)

- Henan Zhejiang Paper Machinery (China)

- JMC Paper Tech Pvt. Ltd. (India)

- A.Celli Paper S.p.A (Italy)

- Walmsleys Limited (U.K.)

- Yokogawa Electric Corporation (Japan)

- Allimand (France)

- Overmade SRL (Italy)

- Qinyang Shunfu Paper Machinery Co., Ltd. (China)

- Mitsubishi Heavy Industries (Japan)

- Levstal Group (Estonia)

- Toscotec SPA (Italy)

- IHI Corporation (Japan)

- Shin Yin Machinery Co., Ltd. (China)

KEY INDUSTRY DEVELOPMENTS:

- September 2024: Andritz AG, an international technology group, initiated a project to set up a service center in Mato Grosso do Sul, Brazil, for pulp and paper mill equipment. The strategic investment would strengthen its presence in Brazil and provide local support for the paper and pulp industry. The center would primarily serve neighboring regions of Mato Grosso do Sul and would also function as a manufacturing and distribution hub for strategic parts.

- September 2024: Andritz AG, an international technology group acquired the Swedish analyzer and measurement technology firm PulpEye. The acquisition complements Andritz’s portfolio by adding the core pulp quality analyzers and measurements into the group’s automation and digitalization portfolio. Andritz will continue to develop the Pulpeye product line further and establish a dedicated service network.

- August 2024: Valmet and Korber closed the agreement to acquire a majority shares in FactoryPal, a subsidiary unit of Korber. The agreement would strengthen the digital solution of FactoryPal. The company provides unique software that improves shopfloor manufacturing performance and productivity.

- June 2024: Valmet and Flootech entered into a partnership to enhance collaboration to provide water treatment solutions and offer profound technical and commercial expertise to Valmet’s customers globally. The offerings include water treatment and recycling solutions, effluent treatment, process water treatment, and sludge dewatering.

- October 2023: Valmet Corporation, a prominent paper technology manufacturer, introduced a new rotating consistency measurement (Valmet Roatry) for pulp and paper producers. The latest technology offers a new user interface and easier maintenance, While the transmitter continues to offer highly secure and accurate fiber consistency measurement for critical applications.

REPORT COVERAGE

The report provides a detailed market analysis and focuses on key aspects such as leading companies, company profiles, machine types, and leading applications of the product. Besides, the report offers insights into the market trends, competitive landscape, and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.4% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Machine Type

By Application

By Industry

By Region

|

|

Key Market Players Profiled in the Report |

Andritz AG (Austria), Voith Group (Germany), Parason Machinery (India), Valmet Corporation (Finland), Kadant Inc.(U.S.), Mitsubishi Heavy Industries (Japan), Toscotec SPA (Italy), Levstal Group (Estonia), IHI Corporation (Japan), and Bellmer GmBH (China) |

Frequently Asked Questions

As per the Fortune Business Insights, the market is projected to reach USD 171.05 billion by 2034.

In 2024, the market was valued at USD 117.92 billion.

The market is projected to grow at a CAGR of 4.4% during the forecast period.

By application, the packaging paper segment leads the market.

Rapid penetration of e-commerce and efficient production needs are key factors driving market growth.

Andritz AG, Voith Group, Parason Machinery, Valmet Corporation, Kadant Inc., Mitsubishi Heavy Industries, Toscotec SPA, Levstal Group, Toscotec SpA, IHI Corporation, and Bellmer GmBH are the top players in the market.

Asia Pacific dominates the market in terms of share.

By application, packaging paper is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us