Railway Maintenance Machinery Market Size, Share & Industry Analysis, By Product Type (Tamping Machine, Ballast Maintenance Machines, Rail Grinders, Track Lifting and Handling Machines, and Others), By End-User (Government, Private Railway Operators, and Contractors), By Sales Type (New Sales and Aftermarket Sales), and Regional Forecast, 2026-2034

RAILWAY MAINTENANCE MACHINERY SIZE AND FUTURE OUTLOOK

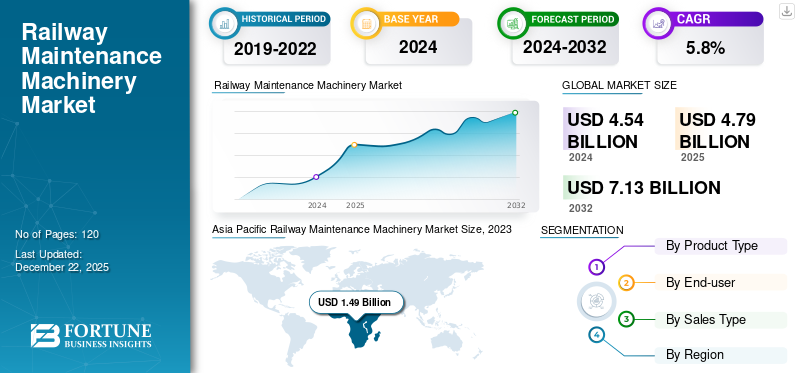

The global railway maintenance machinery market size was valued at USD 4.79 billion in 2025. The market is projected to grow from USD 5.07 billion in 2026 to USD 8.05 billion by 2034, exhibiting a CAGR of 5.90% during the forecast period. Asia Pacific dominated the railway maintenance machinery market with a market share of 35.20% in 2025.

Railway maintenance machinery involves a plethora of specialized tools and equipment used for the maintenance and repair of rail infrastructure to ensure the smooth and efficient operation of signaling systems, rail tracks, overhead lines, and other railway infrastructure. Some common types of rail maintenance machinery are tamping machines, rail grinders, ballast maintenance machines, track lifting & handling machines, and others. These machines play an important role in ensuring the safety of passengers by preventing breakdowns and delays.

Download Free sample to learn more about this report.

The rising investments in railway infrastructure, expansion of rail networks, and modernization of aging rail infrastructure majorly drive the market growth. Private players as well as governments worldwide, are increasingly investing in rail infrastructure to enhance connectivity, promote sustainable transportation options, and lower travel time. For instance,

- In September 2024, Alstom SA announced around USD 70 million in investment to improve Italy’s railway infrastructure through innovations, such as hydrogen trains, and expanded production capacities across various sites.

- In June 2024, the Spanish Government announced a nearly USD 2.4 billion investment to enhance rail infrastructure in Northern Spain.

- In September 2023, the Government of Germany announced a plan to invest more than USD 40 billion in rail infrastructure by 2027.

There is a strong push to expand the rail network in both developed as well as developing economies. This is creating a demand for high-quality rail maintenance machinery to ensure the safety of these expanding networks.

The COVID-19 pandemic had a negative impact on the rail maintenance machinery market due to the decline in rail passenger traffic and investments, reduced demand for maintenance, and supply chain disruptions. According to the International Union of Railways (UIC), in 2020, most UIC member rail companies experienced a contraction in traffic of between -40% and -60% compared to 2019. Stringent lockdowns, along with travel restrictions, led to a significant decline in rail passenger traffic. This severely affected the revenue of rail operators, which, in turn, lowered their capital expenditure on maintenance and new machinery.

IMPACT OF SUSTAINABILITY AND ENVIRONMENTAL CONCERNS ON MARKET

Rising Importance of Environmental Sustainability in Railway Industry to Drive Market Growth

Environmental sustainability has become an important factor in modern industries, including the railway industry. As climate change concerns continue to rise, businesses operating in the railway sector are increasingly adopting sustainable manufacturing practices to limit their environmental footprint. Even though rail transport is considered one of the greener modes of transport, railway operators are increasingly adopting practices that further enhance the sustainability of their operations, including the use of environmentally friendly maintenance machinery.

There is a shift toward manufacturing energy-efficient rail maintenance machinery that consumes less fuel, is quieter in operation and produces less CO2. Manufacturers are increasingly focusing on developing equipment powered by renewable energy sources to minimize environmental impact.

MARKET TRENDS

Urbanization and Expansion of Metro Rail Networks to Fuel Market Growth

Ongoing rapid urbanization across the world is resulting in the expansion of metro and suburban rail networks. Developing countries, such as China, Brazil, and India, are investing substantially in expanding their rail infrastructure to accommodate the rising urban population.

For instance,

- In August 2024, the Government of Brazil announced the plans to acquire 33 new metro trains to update the aging rolling stock infrastructure and enhance metro accessibility.

- In June 2024, the Government of India finalized a series of targets, including starting metro rail in 31 cities, up from the present 21.

Metro trains need routine and accurate maintenance due to the high volume of traffic they handle, leading to increased demand for maintenance machinery. Additionally, commuter railway systems are also experiencing increased demand in metro cities. These systems demand regular track and infrastructure maintenance to ensure smooth operations and reduce delays, which, in turn, drives the global railway maintenance machinery market size.

MARKET DYNAMICS

Market Drivers

Growing Focus on Railway Safety and Accident Prevention to Augment Market Growth

In recent years, railway accidents have increased significantly, especially in developing countries, owing to the poor maintenance of tracks and infrastructure. For instance, in September 2024, a coal-loaded train near Uttar Pradesh, India, derailed due to poor maintenance, according to the initial probe. Such incidents have led to a growing focus on enhancing security standards across all rail networks. As private railway operators and governments give more importance to safety, the need for regular maintenance and the use of advanced machinery to detect and repair faults is expected to increase during the forecast period.

The shift from reactive to predictive and preventive maintenance is further expanding the rail maintenance machinery market. Maintenance machinery, such as tamping machines, stabilizing machinery, ballast maintenance machines, and rail grinders, are essential for executing preventive maintenance practices. Moreover, rail operators are adopting cutting-edge monitoring technologies that detect railway component failures before they occur.

Market Restraints

High Initial Investment Cost Coupled with Supply Chain Disruptions to Hinder Market Growth

One of the major challenges in the railway maintenance machinery market is the high initial cost of acquiring these advanced machines and tools. Tamping machines, rail grinders, ballast cleaners, and track inspection vehicles require significant capital investment. Automated machinery that integrates cutting-edge technologies, such as robotics and sensor systems, is comparatively expensive. The high cost of this machinery makes it difficult for smaller or budget-sensitive rail operators to invest in them.

In addition, the shortage of raw materials, such as steel and electronic components, is expected to hamper the railway maintenance machinery market growth. Raw material shortages inflate the cost of manufacturing rail maintenance machinery and cause longer lead times for delivery.

Market Opportunities

Increased Freight Transportation to Offer Lucrative Opportunities

The global trade expansion, e-commerce growth, and robust industrial production in developing as well as developed regions have led to increased rail freight transportation. In the U.S., freight railroads account for around 40% of long-distance freight volume. Freight railroads deliver commodities and goods to industrial, wholesale, and retail segments of the economy. Rail freight transport has several advantages, including accessibility, lower costs, and efficiency. Rail freight is usually utilized for transporting large volumes of goods and commodities over long distances, making them a crucial part of the supply chain.

The growth in rail freight traffic is expected to increase the need for reliable railway infrastructure that can support increased loads without failures. This, in turn, is expected to offer ample growth opportunities to railway maintenance machinery during the forecast period.

Market Challenges

Skilled Workforce Shortages and Economic Uncertainity to Limit the Market Growth

The rail industry is essential to modern transportation networks and infrastructure and is responsible for efficiently transporting goods and individuals over long distances. However, the sector grapples with a major issue in cultivating and sustaining a skilled workforce capable of adapting to new developments, technological advancements, and shifting market needs. As the industry grows, it is important to emphasize the recruitment and retention of skilled personnel.

In addition, numerous rail companies have faced significant challenges due to the economic downturn caused by the pandemic, and it is anticipated that their recovery will take more time compared to other transportation methods. This, in turn, is expected to reduce the investment in railway maintenance machinery during the forecast period.

SEGMENTATION ANALYSIS

By Product Type

Tamping Machine to Dominate Market Due to Increased Importance of Safety of Railway Operations

Based on product type, the market is classified into tamping machines, ballast maintenance machines, rail grinders, track lifting and handling machines, and others.

The tamping machine is expected to dominate the market and grow with the highest CAGR during the forecast period, as it is extremely important in enhancing safety and ride quality. The segment acquired 37.36% of the market share in 2026. Poorly maintained railway tracks often lead to derailments, making tamping a crucial safety function. Tamping improves the smoothness of train rides by minimizing wear and vibrations on the track. This, in turn, enhances passenger comfort and reduces maintenance costs for rail operators.

Ballast maintenance machines to hold the second largest market share during the forecast period. The most commonly used ballast maintenance machines include ballast regulators and ballast cleaners. Ballast cleaners play an extremely important role in railway operation by cleaning and recycling ballast by removing debris and dirt that accumulates over the period.

By End-user

Increasing Focus by Government on Enhancing Reliability and Efficiency of Railway Networks to Augment Market Growth

Based on end-user, the market is segmented into government, private railway operators, and contractors.

The government end-user segment accounted for the largest market share in 2026, as railway infrastructure in many countries is owned and managed by the government authorities. The government in many countries is responsible for maintaining railway infrastructure. This leads to significant investments in rail maintenance machinery to minimize accidents, maintain track quality, and prevent service downtime. The government segment is expected to hold 52.39% of the market share in 2025.

To know how our report can help streamline your business, Speak to Analyst

The contractors are anticipated to grow at the highest CAGR of 6.6% during the forecast period. Contractors bring specialized expertise in railway maintenance operations. They often have advanced knowledge of track laying, tamping, and ballast cleaning, enabling governments to leverage external expertise for better maintenance of rail infrastructure.

By Sales Type

Machine Upgrades and Retrofits to Boost Aftermarket Sales

Based on sales type, the market is segmented into new sales and aftermarket sales.

The aftermarket sales are anticipated to grow at the highest CAGR of 6.1% during the forecast period. The rapid technological advances in rail maintenance machinery are expected to increase demand for aftermarket sales for machine upgrades and retrofits. These improvements enable older machinery to stay competitive by enhancing efficiency and precision as well as compliance with new regulations.

The new sales segment accounted for the largest market share in 2023 due to the expansion of railway networks globally. There has been a significant demand for new maintenance machinery to support new track installations and maintenance. The segment is likely to hold 63.18% of the market share in 2026.

RAILWAY MAINTENANCE MACHINERY MARKET REGIONAL OUTLOOK

The market covers five major regions, mainly North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

ASIA PACIFIC

Asia Pacific Railway Maintenance Machinery Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific accounted for the largest railway maintenance machinery market share in 2023 owing to the increasing investments in railway infrastructure, rapid urbanization and population growth, rising number of railway electrification projects, and expansion of freight rail networks. The government authorities in this region are making significant investments in expanding as well as modernizing railway infrastructure. The regional market value in 2025 was USD 1.69 billion, and in 2026, the market value led the region by USD 1.8 billion. According to the United Nations (UN), the Asia Pacific region is home to around 60% of the world's population. This has led to the increased urbanization of cities and a strong demand for public transportation. This, in turn, augmented the need for regular maintenance of railway tracks to address the increased demand. India is likely to reach USD 0.42 billion and Japan is projected to hit USD 0.24 billion in 2026.

China Set to Dominate Market Due to Robust Investments in Railway Infrastructure

According to the China State Railway Group, during the January-April 2024 period, fixed-asset investment in China’s railway sector reached around USD 26 billion, a substantial 10.5% increase from the same period a year ago. The market in China is expected to hit USD 0.49 billion in 2025. China’s high-speed rail network is the largest in the world. Such a high-speed rail network demands regular maintenance, augmenting the demand for rail maintenance machinery to ensure reliability and safety.

To know how our report can help streamline your business, Speak to Analyst

North America

The North America region’s growth is largely attributed to the expansion of freight rail and stringent regulatory requirements. The region is to be anticipated as the third-largest market with USD 1.23 billion in 2026. Freight rail is a major part of the region’s logistics network. The increasing freight volumes due to robust international trade have expanded the freight rail network in North America. This, in turn, fueled the demand for rail maintenance machinery to maintain tracks that transport heavy loads consistently. The U.S. market size is expected to hit USD 0.84 billion in 2026.

Europe

The region is anticipated to account for the second-highest market size of USD 1.47 billion in 2026, exhibiting the second-fastest growing CAGR of 4.1% during the forecast period. The European region is projected to grow stagnantly during the forecast period. Europe has a well-developed railway network, unlike emerging regions, such as the Asia Pacific, the Middle East, and South America, where rail infrastructure is rapidly advancing. This limits the demand for new machinery as existing systems are often maintained rather than expanded. The market value in U.K. is expected to be USD 0.18 billion in 2026.

On the other hand, Germany is projecting to hit USD 0.28 billion in 2026 and France is likely to hold USD 0.25 billion in 2025.

Middle East & Africa

The Middle East & Africa region is projected to show significant growth during the forecast period due to the rapid urbanization and population growth across GCC Countries, Turkey, and Africa. This, in turn, augments the development of new railway tracks, boosting demand for rail maintenance machinery. Several countries in the Middle East region are increasingly investing in railway infrastructure development projects to improve trade and connectivity. All these factors are expected to increase the demand for rail maintenance machinery during the forecast period. The GCC market size is estimated to be USD 0.07 billion in 2025.

South America

South America is anticipated to grow moderately during the forecast period on account of the economic growth in trade activities that are pushing governments to improve logistics capabilities. Several economies in this region are expanding their rail networks, which ultimately boosts demand for advanced rail maintenance machinery. The region is to be anticipated as the fourth-largest market with USD 0.32 billion in 2026.

KEY INDUSTRY PLAYERS

Key Players Focused on Strengthening their Market Position with Continuous Developments

The global market for railway maintenance machinery is consolidated by leading players such as ENVIRI CORPORATION (Harsco Rail), Nordco, Inc., Loram, Plasser & Theurer, China Railway Construction Corp., Speno International SA, and Rhomberg Sersa Rail Holding GmbH among others. These companies are expanding their operations by adopting strategies such as mergers, acquisitions, product launches, collaborations, and partnerships.

List of Key Companies Profiled

- ENVIRI CORPORATION (Harsco Rail) (U.S.)

- Nordco, Inc. (U.S.)

- Loram (U.S.)

- Plasser & Theurer (Austria)

- Gamzen (India)

- Speno International SA (Switzerland)

- China Railway Construction Corp. (China)

- Geismar (France)

- Rhomberg Sersa Rail Holding GmbH (Austria)

- ROBEL Bahnbaumaschinen GmbH (Germany)

- RAILQUIP (U.S.)

- BBM Railway Solutions (U.S.)

- ISHIDA SEISAKUSYO (Japan)

- Quanzhou Jingli Engineering & Machinery Co.,Ltd. (China)

- Salcef Group S.p.A. (Italy)

- STRABAG Rail GmbH (Germany)

- Swietelsky Rail (Australia)

KEY INDUSTRY DEVELOPMENTS:

- September 2024: Harsco Rail to showcase its advanced solutions, such as railway surfacing solutions, rail treatment solutions, specialty machinery, m protran technology, and track construction and renewal solutions at the InnoTrans 2024 exhibition in Berlin, Germany.

- October 2022: Plasser & Theurer wins a contract for the supply of eight railway track machinery for the maintenance and construction of new rail infrastructure of Poland Railway Lines.

- October 2021: SINARA Transport Machine assembled two tamping machines at San Engineering and Locomotives in Bangalore, India, to address the 51% localization requirements of the contract that was ordered by Indian Railways (IR) in 2020.

- April 2021: Loram announced the development of a Research & Development (R&D) center in Texas, U.S., with an investment of USD 17 million. Through this development, the company planned to accelerate product development for railroad customers.

- February 2021: Plasser & Theurer announced the launch of the latest rail grinding machines for light rail and trams. This machine integrates the conventional whetstone grinding method with oscillating grinding.

REPORT COVERAGE

The railway maintenance machinery market analysis report provides an in-depth analysis of the market industry dynamics and competitive landscape. The report also provides market estimation and forecast based on technology, end-user, and regions. It provides various key insights into recent industry developments in the market, such as mergers & acquisitions, macro and microeconomic factors, SWOT analysis, and company profiles.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.90% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

By End-user

By Sales Type

By Region

|

Frequently Asked Questions

As per a Fortune Business Insights study, the market was valued at USD 4.80 billion in 2025.

In 2034, the market is expected to record a valuation of USD 8.05 billion.

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.90% during the forecast period.

The tamping machine segment is expected to lead the market over the forecast period.

Rising investments in railway infrastructure, expansion of rail networks, and modernization of aging rail infrastructure drive the market.

ENVIRI CORPORATION (Harsco Rail), Nordco, Inc., Loram, Plasser & Theurer, China Railway Construction Corp., Speno International SA, and Rhomberg Sersa Rail Holding GmbH are the leading companies in this market.

Asia Pacific dominated the railway maintenance machinery market with a market share of 35.20% in 2025.

Urbanization and expansion of metro rail networks are the key trends that fuel the market growth.

Based on end-user, the government sector is projected to lead the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us