Regtech Market Size, Share & Industry Analysis, By Deployment (Cloud and On-premises), By Enterprise Type (Large Enterprises and Small & Medium Enterprises), By Application (Risk Management, Regulatory Compliance, and Governance), By End-user (BFSI, Manufacturing, IT & Telecom, Healthcare, Government, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

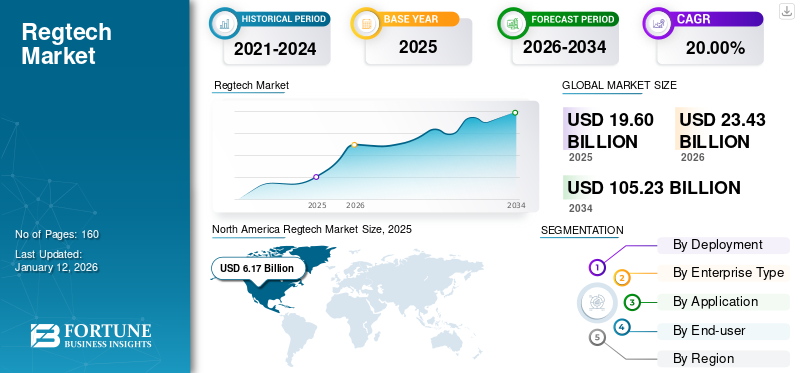

The global regtech market was valued at USD 19.06 billion in 2025. The market is projected to grow from USD 23.43 billion in 2026 and reach USD 105.23 billion by 2034, exhibiting a CAGR of 20.00% during the forecast period. North America dominated the global market with a share of 30.30% in 2025.

Several factors, including the rapid increase in the adoption of advanced technologies and the need for businesses to address increasingly complex regulatory requirements is driving the market expansion. As regulations become more complex and change frequently, traditional manual compliance management techniques are no longer viable. As a result, companies are turning to cutting-edge technologies such as artificial intelligence, big data analytics, machine learning, and blockchain to optimize compliance operations. These technologies enable the automation of daily tasks, real-time monitoring of transactions and data, predictive analysis of potential threats, and secure identity verification.

Additionally, the focus on financial regulation is driving the market growth. However, different and conflicting rules in other jurisdictions are hindering the market by increasing complexity and inconsistency, making it difficult for companies to develop unified solutions that meet disparate regulatory standards in multiple regions.

In addition, a rise in anti-money laundering and fraud is anticipated to boost market growth. The growing product application and an increase in the number of favourable regulations across various countries are driving the market growth. For instance,

- In April 2022, the Hong Kong Monetary Authority introduced the Regtech Knowledge Hub to encourage enterprises to adopt solutions to support business growth.

The COVID-19 pandemic pushed the adoption of regulatory technology solutions across various industries owing to the rise in work-from-home policy. As the employees were highly relying on chat and collaboration tools, the need for governance increased. Moreover, the confidential data handling industries, such as BFSI, healthcare, and retail, highly relied on remote working, increasing the risk of data theft. Cyber threats and privacy risks were the major concerns for the enterprises. This surged the demand for the solution during the COVID-19 crisis.

Regtech Market Trends

Government Encouragement for Implementing Regulatory Tech Solutions

Governments across the globe are encouraging enterprises to implement regulatory technology solutions. Rapid digitalization is creating challenges for government agencies in securing data and contributing to helping businesses comply with regulations efficiently. For instance,

- In May 2023, the government of Australia, under the Business Research and Innovation Initiative (BRII), granted USD 5 million to small and medium enterprises to support regulation technology.

- In May 2021, the Monetary Authority of Singapore (MAS) announced a grant of USD 35 million to improve regulatory technology and the accuracy of its reporting.

- In November 2020, the government of Hong Kong introduced a two-year roadmap to accelerate technology adoption. The external challenges and evolving models in the banking sector are gaining the government’s focus toward governance.

The increasing government support is slated to boost the regtech market growth.

Download Free sample to learn more about this report.

Regtech Market Growth Factors

Integration of Emerging Technologies to Drive Market Growth

Industry players are investing in implementing advanced technologies to boost operational efficiency and global business growth. However, to deal across multiple countries, enterprises are required to follow various country-specific regulations. Thus, the solution providers are investing in providing innovative and efficient applications of integration technologies. For instance, blockchain technology is gaining popularity in the industry as it offers transparent and secure record-keeping capabilities. Similarly, artificial intelligence is providing various use-case applications that are helping the market players offer condition-specific solutions. For instance,

- In May 2023, regulatory solution provider ComplyAdvantage launched an anti-fraud tool by integrating artificial intelligence and its regulatory solution. The new solution flags suspicious activity and fraud typologies to ensure safe transactions.

Furthermore, the natural language processing subfield of AI is gaining traction by offering ease of interpreting human language across legal documents, regulatory texts, social media, news articles, and others. The rise in product efficiency with the integration of advanced technologies is expected to drive market growth.

RESTRAINING FACTORS

Lack of Industry Standards to Hamper Market Growth

The solution is gaining traction with the rise in regulations. However, currently, there is no firm to standardize the regtech tools and services. As the industry-specific needs are different, it is essential to set a benchmark for market players for due diligence. The lack of transparent operation and capabilities is limiting the establishment of standards. These factors may hinder the adoption of the solutions to some extent.

Regtech Market Segmentation Analysis

By Deployment Analysis

Rising Data Security Concerns to Propel the Adoption of On-premises Solutions

On the basis of deployment, the market is segmented into on-premises and cloud.

The on-premises segment is set to dominate the market during the forecast period. The growing concern of data security is set to boost the demand for on-premises solutions.

The cloud-based solution segment is estimated to register a rapid growth rate over the forecast period. The cloud-based solution segment is anticipated to hold a dominant market share of 53.35% in 2026. This is owing to the rise in demand for digital transformation and cloud computing. The cloud deployment of the technology offers easy accessibility and integration with artificial intelligence and other technologies.

By Enterprise Type Analysis

Ease of Business Management to Fuel Product Demand across Large Enterprises

Based on enterprise type, the market is categorized into small & medium enterprises and large enterprises.

The large enterprises segment is expected to gain maximum revenue share during the forecast period. The large enterprises segment is anticipated to hold a dominant market share of 66.71% in 2026. Enterprises with a presence in multiple countries are likely to invest in these solutions for the easy management of country-specific compliance.

The small & medium enterprises segment is set to witness a rapid growth rate over the analysis period. The adoption of digital solutions is likely to propel the need for technical, and regulatory management.

By Application Analysis

Focus on Compliance Friendly Business to Boost Regulatory Compliance Segment Growth

Based on application, the market is segmented into risk management, regulatory compliance, and governance.

The regulatory compliance segment is poised to register the highest share in the market during the forecast period. The regulatory compliance segment is anticipated to hold a dominant market share of 39.91% in 2026. Companies are investing in the solution to improve business and manage rapidly maturing regulatory compliances.

The risk management segment is set to witness a rapid growth rate over the forecast period. This is owing to the rise in number of cyber-attacks across various industries. Enterprises with a huge set of sensitive customer information are likely to invest in the solution.

The governance segment is set to showcase a steady growth rate during the forecast period. The introduction to the new technical governance is likely to fuel the market growth. For instance, the launch of AI governance owing to its risk in sensitive areas such as law enforcement, healthcare, and finance is growing.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

Rising Cyber Attacks to Boost Demand for Standardized Compliance in the BFSI Sector

By end-user, the market is classified into BFSI, manufacturing, healthcare, IT & telecom, government, and others (retail).

The BFSI segment is slated to gain a dominant market share over the study period. The BFSI segment is anticipated to hold a dominant market share of 25.61% in 2026. The high risk and stringent governance in the BFSI sector is expected to boost the adoption of the solution. The sector needs to address various compliance challenges, which is likely to fuel the market growth.

The healthcare segment is set to showcase a rapid growth rate over the analysis period owing to the rapidly changing regulations. The industry has witnessed exponential growth in cyber-attacks over the last few years. According to a study by Bitglass, the Protected Health Information (PHI) of 26 million U.S. citizens was impacted with such cyber-attacks.

The manufacturing segment is set to gain significant share over the forecast period. This is owing to the growing number of regulatory specifications to standardize product quality and to comply with environmental policies.

REGIONAL INSIGHTS

North America Regtech Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America market is set to register the highest revenue share during the forecast period. The rise in digital adoption is expected to fuel the demand for regularized technology. The strong growth in technology is likely to fuel the product demand.

The U.S. is expected to showcase rapid growth over the study period. This is due to the rising adoption of artificial intelligence, machine learning, data mining, and other technologies in the country. The rising digitalization is expected to boost the product demand.

To know how our report can help streamline your business, Speak to Analyst

The Asia Pacific regtech market share is expected to register rapid growth during the forecast period. The rising demand for regulations from various industries is expected to boost the market growth in the region. The governments of countries such as China, India, South Korea and Japan are keen in implementing stringent regulations on technology. As per the Future-proofing Fraud Prevention in Digital Channels report, the region has invested USD 83 million in new fraud prevention technology.

Europe is expected to exhibit strong growth during the forecast period. The European banking sector has significantly invested in complying with evolving regulations of GDPR, MiFID, PSD2, and others. As per the survey, 140 regtech companies have headquartered in Europe.

The Middle East & Africa market is estimated to showcase a steady growth rate over the study period. The adoption of the solution is very low in countries such as Turkey. However, Israel and the GCC to showcase strong growth during the forecast period. With the increase in opportunities, various key market players are investing in business opportunities in the region. For instance,

- In April 2023, Clausematch Inc. announced the first Middle East partnership with Várri Consultancy to provide expertise in governance, risk, and compliance management.

Similarly, South America is set to showcase promising growth rates during the forecast period. As per the Fenergo survey, Comisión Nacional Bancaria de Valores (CNBV) regulation decreased by 11% with the adoption of the solutions.

Key Industry Players

Companies’ Revenue to Rise with Growing Strategic Partnerships for Customer Expansion

Key players in the market are keen in offering innovative solutions for industry specific needs. These players are strategically collaborating and entering partnerships to expand the market knowledge and countries specifications in obligation. The players are strengthening the market position using strategic acquisition of small players.

List of Top Regtech Companies

- ACTICO GmbH (Germany)

- Ascent Technologies, Inc. (U.S.)

- Deloitte Touche Tohmatsu Limited (London)

- IBM Corporation (U.S.)

- Jumio Corporation (U.S.)

- Chainalysis Inc. (U.S.)

- MetricStream Inc. (U.S.)

- Thomson Reuters (Canada)

- Broadridge Financial Solutions, Inc. (U.S.)

- Accuity Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- June 2023: Dassault Systèmes announced that it strengthened the financial services business experience of OUTSCALE, its cloud brand and sovereign and sustainable operator of experiences as a service, through the acquisition and integration of Innova Regtech solutions. With this, Dassault Systèmes reaffirmed its claim to make OUTSCALE a reliable partner for financial institutions.

- April 2023: Hummingbird RegTech launched its app for professionals in the compliance sector to fight financial crime with its custom tech stack. The app offered tools for compliance professionals' everyday work and would help align with current regulations.

- March 2023: Ascent Technologies, Inc. introduced an additional new offering, the Compliance Confidence Scorecard, which offers regulatory changes, analysis, and monitoring. It would help businesses in mapping solutions and services in regulatory compliance.

- June 2023: Dassault Systems announced the integration of Innova RegTech solution to automate compliance control for financial institutions. The new integration is providing the organization with the capability to partner with other financial organizations such as BNP Paribas Securities Services and others.

- June 2023: Corlytics Group acquired Clausematch Limited and introduced intelligent regulatory document maintenance and creation capabilities for the industry client. The company aimed to provide solutions for handling regulation issues.

REPORT COVERAGE

The research report provides a detailed analysis of the industry and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 20.00% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Enterprise Type

By Application

By End-user

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 105.23 billion by 2034.

In 2025, the market was valued at USD 19.06 billion.

The market is projected to grow at a CAGR of 20.00% during the forecast period.

Based on end-user, the BFSI segment is expected to lead the market.

The rising integration of emerging technologies is a key factor driving the market growth.

ACTICO GmbH, Ascent Technologies, Inc., Deloitte Touche Tohmatsu Limited, IBM Corporation, Jumio Corporation, Chainalysis Inc., and MetricStream Inc. are the top players in the market.

North America is expected to hold the highest market share.

By deployment, the cloud segment is expected to grow with a remarkable CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us