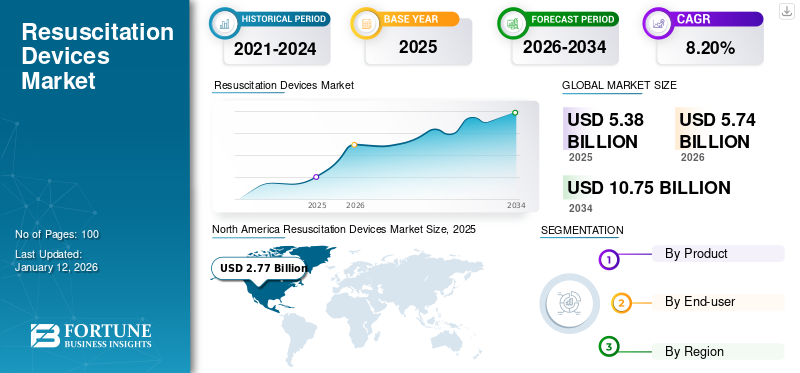

Resuscitation Devices Market Size, Share & Industry Analysis, By Product (Airway Management Devices [Infraglottic Devices, Supraglottic Devices, Laryngoscopes, and Others], Emergency Care Ventilators, and Defibrillators), By End-user (Hospitals & ASCs, Homecare, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global resuscitation devices market size was valued at USD 5.38 billion in 2025. The market is projected to grow from USD 5.74 billion in 2026 to USD 10.75 billion by 2034, exhibiting a CAGR of 8.20% during the forecast period. North america dominated the resuscitation devices market with a market share of 51.46% in 2025.

Resuscitation devices such as automated external defibrillators and manual resuscitators, are used to ventilate the lungs to initiate the breathing of an unconscious person. The increasing prevalence of obstructive pulmonary disease and cardiovascular diseases and the increasing number of road accidents have been fueling the demand for these devices globally.

- For instance, as per the data published by the Ministry of Road Transports and Highway, in 2022, around 1,130 road accidents and 422 deaths occurred daily in India.

- Moreover, as per the data published by the World Health Organization (WHO), in 2023, globally, around 92.0% of fatalities occurred on the road. Additionally, road traffic accidents are the leading cause of death in children and young adults aged 5-29 years.

Furthermore, the increasing focus of market players on new product launches and rising awareness among the population regarding the above-mentioned emergency cases has also been fueling the global resuscitation devices market growth.

The global resuscitation devices market experienced a decline during the COVID-19 outbreak in 2020 due to the reduced number of accidents, emergency cases requiring resuscitation, and hospital admissions. However, the market experienced significant growth in 2021 and 2022 due to the increase in the number of hospital visits.

Resuscitation Devices Market Overview & Key Metrics

Market Size & Forecast:

- 2025 Market Size: USD 5.38 billion

- 2026 Market Size: USD 5.74 billion

- 2034 Forecast Market Size: USD 10.75 billion

- CAGR: 8.20% from 2026–2034

Market Share:

- North America dominated the resuscitation devices market with a 51.46% share in 2025, driven by a high incidence of sudden cardiac arrest, increasing awareness about emergency care, and strong adoption of technologically advanced resuscitation devices, particularly in the U.S.

- By product, airway management devices held the largest share in 2026, attributed to the rising prevalence of chronic obstructive pulmonary disease (COPD) and the launch of advanced airway products. The ventilators segment is expected to witness the fastest growth due to increasing emergency care visits and new product innovations.

Key Country Highlights:

- Japan: The market is driven by the country’s aging population, increasing cases of respiratory diseases in neonates, and improvements in hospital infrastructure for emergency care.

- United States: The growing burden of sudden cardiac arrest, high rates of emergency department visits, and support from government initiatives—such as collaborations for ventilator production during COVID-19—are fueling market demand.

- China: The prevalence of COPD and cardiovascular diseases, particularly in urban regions, along with expanding emergency medical services, are driving the demand for resuscitation devices.

- Europe: Market growth is supported by the strong presence of key players such as Koninklijke Philips N.V. and Getinge AB, as well as ongoing efforts to upgrade hospital equipment and increase emergency care readiness.

Resuscitation Devices Market Trends

Increasing Focus of Market Players on New Product Launches

The prevalence of cardiovascular diseases, and pulmonary diseases has been increasing significantly. Moreover, the cases of respiratory diseases in newborns and emergency medical cases requiring resuscitation devices have been increasing significantly worldwide.

Such an increasing burden of cardiac arrest and respiratory problems has been increasing the demand for these devices globally. In order to fuel this increasing demand, market players have increased their focus on new product launches.

- For instance, in October 2021, Movair, a respiratory therapy company, announced the launch of Luisa, a technologically advanced ventilator that can be used for hospital and portable applications. These products can be used for invasive and non-invasive purposes.

- Similarly, in 2020, Nihon Kohden Corporation launched the NK AWS-S200 video laryngoscope to provide critical care to patients suffering from COVID-19 or respiratory diseases, even in difficult situations.

Moreover, market players have also been focusing on expanding their product availability across the globe. For instance, in August 2023, Medline, a medical device manufacturer and distributor, partnered with Flight Medical, an Israeli-based medical device company, to distribute the Flight 60 ventilator through Medline.

- North America witnessed a growth from USD 2.77 Billion in 2025 to USD 2.97 Billion in 2026.

Download Free sample to learn more about this report.

Resuscitation Devices Market Growth Factors

Increasing Prevalence of Diseases such as Pulmonary Diseases and Cardiac Arrest has been Fueling the Market Growth

The prevalence of cardiovascular diseases, chronic obstructive pulmonary disease (COPD), cardiac arrest, and other pulmonary diseases is increasing at a significant rate across the globe.

- For instance, as per the data published by the Centers for Disease Control and Prevention (CDC), in 2023, around 1 in every adult aged 20 and above have coronary artery disease (CAD).

- Moreover, as per the same source, around 805,000 individuals suffer from heart attacks annually in the U.S. Out of this number, around 605,000 people suffer from heart attacks for the first time.

Similarly, the prevalence of chronic obstructive pulmonary disease (COPD) has also been increasing at a significant rate worldwide. For instance, as per the data published by BioMed Central Ltd in 2022, the prevalence of COPD was 8.9% among the general population aged 35 and older in Latin America and the Caribbean. As per the same research study, the prevalence of COPD among men was 13.7%, whereas in women it was 6.7%.

Such a rising burden of these diseases has been increasing the demand for emergency care and hospital admissions. For instance, as per the report published by the Centers for Disease Control and Prevention (CDC) in 2021, there were around 139.8 million total emergency department visits in the U.S. Out of this number, around 75.6 million individuals were female, and 64.2 million were male.

The prevalence of the above-mentioned chronic diseases and the increasing number of emergency care visits have been increasing the demand for resuscitation devices for emergency treatment and providing critical care in ambulances.

Furthermore, the increasing proportion of premature births has also fueled the demand for these devices. For instance, as per the data published by the World Health Organization (WHO), in 2020, there were around 13.4 million preterm births globally. This number ranged between 4.0 and 16.0% in 2020 across countries.

The rising prevalence of chronic obstructive pulmonary disease (COPD), cardiac arrest, and the high incidence of preterm births has been fueling the demand for resuscitation devices, thereby fueling the market growth.

RESTRAINING FACTORS

Complications Associated with the Use of Airway Management Devices have been Negatively Impacting the Market

The increasing prevalence of respiratory disorders and cardiac arrest has been fueling the demand for resuscitation devices. However, certain limitations are associated with using airway management devices, which have been hampering the market growth.

- For instance, as per the data published by the Crown in 2019, tracheostomy is considered a safe medical procedure. However, it may cause early complications such as collapsed lungs, bleeding, and infection. Moreover, complications can be faced in the long-term use of these products, such as a failure in the healing of tracheostomy wounds, collapsed windpipe, and narrowed windpipe.

Moreover, other airway management devices, such as laryngeal masks, can also cause certain complications in pediatric patients, including airway restriction, vomiting, stridor, and soft tissue trauma.

- For instance, as per the research study published by Springer Nature through its journal Cureus in 2022, out of the total studied pediatric patients, around 6.6% of the patients suffered from laryngospasm. Meanwhile, 20% of them suffered from airway obstruction, 15% of the patients suffered from cough, and 10% of the patients suffered from peripheral oxygen desaturation.

Such complications associated with the use of these airway management devices have been limiting their adoption among the population, thereby hindering market growth.

Resuscitation Devices Market Segmentation Analysis

By Product Analysis

Airway Management Devices Dominated due to Increasing Prevalence of COPD

On the basis of product, the market is segmented into airway management devices, emergency care ventilators, and defibrillators.

The airway management devices are further sub-segmented into infraglottic devices, supraglottic devices, laryngoscopes, and others. The airway management devices segment dominated the market in 2024. The dominance of the segment is attributed to the rising prevalence of chronic obstructive pulmonary diseases (COPD) and increasing demand for these devices.

- For instance, in February 2020, Smith Medical, now a part of ICU Medical, launched Polyvinyl Chloride (PVC) tracheostomy tube and expanded its tracheostomy product portfolio.

Moreover, the ventilators segment is expected to grow at a significant CAGR during the forecast period. The growth of the segment is attributed to the increasing number of emergency care visits and the increasing number of new product launches.

- In July 2021, Shenzhen Mindray Bio-Medical Electronics Co., Ltd launched SV300 Pro, a turbine-based ventilator. The device consists of advanced technology that helps to address difficult challenges.

- The Airway Management Devices segment is expected to hold a 38.74% share in 2026.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Hospitals & ASCs Segment Dominated due to High Volume of Emergency Department Visits

Based on end-user, the market is segmented into hospitals & ASCs, homecare, and others.

The hospitals & ASCs segment dominated the market with a share of 79.50% in 2026. The dominance of the segment is attributed to the increasing number of emergency department visits.

- For instance, as per the data published by BioMed Central Ltd, in 2021, around 446,484 emergency department admissions were recorded in a hospital in Singapore in a time span of 10 years.

Moreover, the homecare segment is expected to grow at a significant CAGR during the forecast period. The growth of the segment is attributed to the increasing cases of sudden cardiac arrest, rising geriatric population, and rising awareness regarding emergency resuscitation devices.

REGIONAL INSIGHTS

By geography, the market is studied across Europe, North America, the Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Resuscitation Devices Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market in 2025 by accounting for major market share of USD 2.77 billion. The increasing number of cases of sudden cardiac arrests in the U.S. has been creating awareness regarding these devices for the emergency first line of treatment. This factor has been fueling the market growth in the region. The U.S. market is projected to reach USD 2.38 billion by 2026.

- For instance, as per the data published by the Sudden Cardiac Arrest Foundation, 2021, 73.4% of out-of-hospital cardiac arrests (OHCA) occurred at residence, 16.3% occurred at public settings, and 10.3% at nursing homes.

Europe

The market in Europe accounted for a substantial market share in 2025, attributed to the strong presence of market players such as Koninklijke Philips N.V., Hamilton Medical, and Convatec Group PLC, among others. The UK market is projected to reach USD 0.1 billion by 2026, while the Germany market is projected to reach USD 0.4 billion by 2026.

Asia Pacific

The Asia Pacific market is anticipated to grow at a significant CAGR during the forecast period. The growth of the market in Asia Pacific is attributed to the rising prevalence of chronic obstructive pulmonary disease and cardiovascular diseases, which can lead to sudden cardiac arrests in the region. This factor has been fueling the demand for emergency resuscitation in the region. The Japan market is projected to reach USD 0.02 billion by 2026, the China market is projected to reach USD 0.19 billion by 2026, and the India market is projected to reach USD 0.13 billion by 2026.

- For instance, as per the data published by Lung India in 2021, out of the total studied population in India, the prevalence of COPD was 7.4%. Moreover, it was also observed that COPD was more common in males as compared to females, and it was higher in urban areas.

Latin America and Middle East & Africa

The markets in Latin America and the Middle East & Africa are expected to grow at a substantial CAGR during the forecast period. The increasing geriatric population and rising burden of chronic diseases are anticipated to drive the growth in these regions.

Key Industry Players

Increasing Focus of Market Players on Introducing Technologically Advanced Resuscitation Devices is Responsible for their Growth in the Market

Getinge AB, Ambu A/S, and Teleflex Incorporated are the key players that accounted for a significant portion of the global resuscitation devices market share in 2024. The growth of these players in the market is attributed to their focus on the launch of technologically advanced resuscitation devices.

- For instance, in March 2023, Ambu A/S relaunched the second generation of its VivaSightTM 2 DLT for monitoring patients during one-lung ventilation procedures.

Moreover, other players in the market, such as Koninklijke Philips N.V., Hamilton Medical, and Getinge AB, among others, have been focusing on the expansion of their production capacity to fuel their revenue growth.

- For instance, in April 2020, Koninklijke Philips N.V. and the U.S. government collaborated to expand ventilator production capacity to fight against the COVID-19 pandemic.

LIST OF TOP RESUSCITATION DEVICES COMPANIES:

- Koninklijke Philips N.V. (Netherlands)

- Hamilton Medical (Switzerland)

- Getinge AB (Sweden)

- Medtronic (Ireland)

- Teleflex Incorporated (U.S.)

- Convatec Group PLC (U.K.)

- Ambu A/S (Denmark)

- Flexicare Medical Limited (U.K.)

- ICU Medical (U.S.)

- ZOLL Medical Corporation (Asahi Kasei) (U.S.)

- Stryker (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- July 2023 – Ambu A/S announced that its product VivaSigh 2 SLT, a lung ventilation device, is ready for European commercialization.

- March 2022 – ZOLL Medical Corporation (Asahi Kasei) launched Arrhythmia Management System (AMS). The product adds biometric data, such as heart rate, and respiratory rate, to the ECG information given by traditional MCT devices.

- May 2021 – Medtronic commercialized the SonarMed airway monitoring system in the U.S. This expanded the company's product portfolio for airway management devices.

- May 2020 – Hamilton Medical partnered with Raumedic, a pharmaceutical and medical device solution provider, to expand the production of ventilators.

- April 2020 – Koninklijke Philips N.V. announced plans to increase the production of ICU ventilators to fulfill the increasing demand for ventilators during the pandemic.

REPORT COVERAGE

The global resuscitation devices market report provides a detailed competitive landscape. It also includes key insights, such as top industry developments covering partnerships, mergers, and acquisitions. Additionally, it focuses on key points, such as new product launches in the market. Furthermore, the report covers regional analysis of different segments, profiles of key market players, market trends, and the impact of COVID-19 on the market. The report consists of quantitative and qualitative insights that have contributed to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.20% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 5.38 billion in 2025 and is projected to reach USD 10.75 billion by 2034.

In 2025, the market value stood at USD 2.77 billion.

The market is predicted to exhibit a CAGR of 8.20% during the forecast period of 2026-2034.

The airway management devices segment led the market by product in 2026.

The increasing prevalence of COPD and cardiovascular diseases are the key factors fueling the market growth.

Getinge AB, Ambu A/S, and Teleflex Incorporated are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us