RFID Market Size, Share & Industry Analysis, By Product Type (Tags, Readers, and Software & Services), By Frequency (Low Frequency, High Frequency, and Ultra-High Frequency), By Industry (Agriculture & Forestry, Healthcare, Manufacturing, Retail, Transportation and Logistics, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

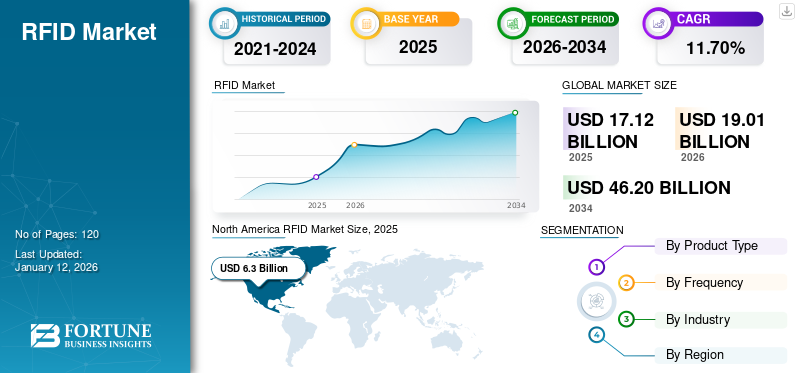

The global RFID market size was valued at USD 17.12 billion in 2025. The market is projected to grow from USD 19.01 billion in 2026 to USD 46.2 billion by 2034, exhibiting a CAGR of 11.70% during the forecast period.North America dominated the global market with a share of 36.90% in 2025.

RFID (Radio Frequency Identification) technology utilizes radio waves to identify and track objects, assets, or individuals remotely through RFID tags or labels attached to the items of interest. This automatic identification and tracking streamlines processes such as inventory management, supply chain logistics, and asset tracking, leading to increased efficiency and productivity. Moreover, this technology provides real-time visibility into items' location, status, and movement throughout the supply chain or within a facility. This enhanced visibility empowers businesses to track inventory levels, monitor stock movements, and identify operational bottlenecks or inefficiencies, enabling faster decision-making and response times.

In addition, the COVID-19 pandemic accelerated the shift toward e-commerce, as consumers increasingly turned to online shopping for safety and convenience. This surge in demand elevated the need for radio frequency identification solutions in warehouses and fulfillment centers to manage inventory, improve order accuracy, and streamline the order fulfillment process.

In the scope of work, the report includes solutions offered by companies such as Zebra Technologies Corp., GAO Group, Impinj, Inc., HID Global, NXP Semiconductor, Invengo Information Technology Co. Ltd., and others.

Download Free sample to learn more about this report.

Impact of Generative AI

Growing Demand for Enhanced Security and Fraud Detection is Expected to Boost Market Growth

Generative AI positively impacts the market by effectively analyzing RFID data and extracting valuable insights and patterns from large volumes of radio frequency identification tag readings. This enhanced data analysis capability can help businesses optimize inventory management, supply chain operations, and asset tracking processes, improving efficiency and cost savings. Moreover, generative AI algorithms can detect anomalies and identify potential security threats or fraudulent activities in radio frequency identification data streams. By analyzing patterns and deviations from normal behavior, generative AI can help businesses detect and prevent inventory shrinkage, theft, or counterfeit products, enhancing security and protecting assets. Thus, the adoption of generative AI technology in the market is expected to drive the market's growth during the forecast period.

RFID Market Trends

Increasing Adoption of RFID Technology in Retail Propel Potential Market Trend

The integration of radio frequency identification technology with the Internet of Things (IoT) and Industry 4.0 initiatives is driving innovation in the radio frequency identification market. RFID-enabled sensors and devices are deployed in various industries for real-time data collection, creating a smart, connected ecosystem that improves visibility, automation, and decision-making.

Moreover, RAIN RFID technology is gaining momentum due to its low cost, long-range capabilities, and scalability. This technology is widely adopted in retail, logistics, manufacturing, and healthcare for inventory management, asset tracking, and supply chain optimization applications.

According to industry experts, retail stores that have fully adopted radio frequency identification technology are reporting more than 10% return on investment in 2021, compared to 9.2% two years ago. As a result of these factors, adopting this technology in the retail sector is anticipated to fuel RFID market growth during the forecast period.

RFID Market Growth Factors

Increasing Demand for Regulatory Compliances among Businesses to Propel Market Growth

Increasing regulatory requirements for product traceability, safety, and security drive the adoption of radio frequency identification technology in industries such as healthcare, pharmaceuticals, food and beverage, and aerospace. Radio frequency identification enables businesses to comply with regulations by providing accurate and auditable data on product origin, handling, and distribution.

This technology plays a crucial role in optimizing supply chain operations by providing real-time visibility and traceability of goods throughout the supply chain. Radio frequency identification- enabled solutions help businesses improve inventory accuracy, reduce stockouts, minimize excess inventory, and enhance overall supply chain efficiency. Moreover, the growing focus on sustainability and environmental responsibility drives the adoption of this technology for eco-friendly and recyclable applications. RFID tags made from sustainable materials, energy-efficient RFID readers, and radio frequency identification-enabled solutions for waste management and recycling are driving the market's growth.

RESTRAINING FACTORS

High Implementation Cost and Lack of Standardization to Hinder Market Growth

One of the primary barriers to radio frequency identification adoption is the initial cost of implementation, encompassing expenses related to RFID tags, readers, infrastructure setup, software integration, and training. For some businesses, especially small and medium-sized enterprises (SMEs), the upfront investment needed for radio frequency identification deployment can be prohibitive.

The absence of universal standards for this technology can hinder interoperability and compatibility between different radio frequency identification systems and components. This lack of standardization makes it challenging for businesses to integrate radio frequency identification solutions into their existing systems and collaborate with partners or suppliers using different RFID technologies.

RFID Market Segmentation Analysis

By Product Type Analysis

Tags Segment led the Market Owing to Resilience in Harsh Environments

Based on product type, the market is classified into tags, readers, and software & services.

RFID tags generated the maximum revenuewith a share of 54.19% in 2026. These tags have high data capacity, allowing them to store more information than traditional barcode labels. This capacity enables tags to carry additional data such as product details, manufacturing information, expiration dates, and maintenance records, providing valuable insights throughout the product lifecycle. The adoption of radio frequency identification tags is increasing in manufacturing facilities and warehouses owing to their ability to withstand harsh environmental conditions, including temperature extremes, moisture, vibration, and physical impact.

RFID readers are anticipated to showcase the highest CAGR over the forecast period. Their capacity to quickly and accurately capture data from multiple tags simultaneously facilitates high-speed data collection and processing. This rapid read speed improves efficiency in applications such as inventory management, asset tracking, and access control, where fast data capture is essential.

To know how our report can help streamline your business, Speak to Analyst

By Frequency Analysis

High Frequency Segment Secured the Largest Share Owing to Growing Need for High Speed Data Transfer Capability

Based on frequency, the market is divided into low frequency (30kHz - 300kHz), high frequency (3MHz - 30MHz), and ultra high frequency (300MHz - 3GHz).

High frequency captured the largest share of the market with a share of 41.56% in 2026, as it supports higher data transfer rates compared to low frequency RFID, enabling faster communication between radio frequency identification readers and tags. This high-speed data transfer capability is beneficial for applications that require rapid data exchange, such as contactless payment transactions, asset tracking, and inventory management in retail and healthcare settings.

The ultra high frequency segment is expected to dominate the market by growing at the highest CAGR in the coming years. This is due to its cost-effective solution for radio frequency identification deployments, especially in applications that require tracking large numbers of items or assets spread across wide areas.

By Industry Analysis

Surge in Demand for Optimized Supply Chain Operation Propel the Adoption of RFID Technology in Retail

Based on industry, the market is categorized into agriculture & forestry, healthcare, manufacturing, retail, transportation & logistics, and others (defense, media & entertainment).

The retail segment held the largest RFID market share contributing 49.45% globally in 2026, as radio frequency identification technology provides retailers with enhanced visibility into their supply chain, from manufacturing and distribution to store shelves. Radio frequency identification enables retailers to track shipments, monitor delivery schedules, and identify potential bottlenecks or delays in the supply chain. Additionally, it helps retailers enhance loss prevention efforts by enabling more effective inventory tracking and anti-theft measures.

Transportation & logistics is anticipated to showcase the highest CAGR during the forecast period. This technology helps transportation & logistics companies to automate the process of identifying and capturing data about shipments, reducing the need for manual intervention and improving efficiency in transportation and logistics operations.

REGIONAL INSIGHTS

By region, the market has been analyzed across five major regions, namely North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America RFID Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 6.3 billion in 2025 and USD 6.89 billion in 2026, owing to significant adoption of radio frequency identification technology in the retail and supply chain sectors. Retailers use this technology for inventory management, stock replenishment, omnichannel fulfillment, and theft prevention. Supply chain partners leverage radio frequency identification for real-time tracking and visibility of goods throughout the distribution network, enabling improved efficiency and responsiveness. Furthermore, the healthcare sector in North America has adopted radio frequency identification technology for patient tracking, asset management, medication administration, and inventory control, playing an important role in fueling the market growth in the region. The U.S. market is projected to reach USD 4.86 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific is expected to grow at the highest CAGR during the forecast period. Asia Pacific is a hub for manufacturing and logistics operations, where RFID technology is widely employed for asset tracking, production control, and supply chain optimization. Manufacturers leverage this technology to monitor work-in-progress, track components and parts, and ensure compliance with industry standards and regulations. Logistics companies use radio frequency identification for real-time tracking and visibility of goods throughout the supply chain, reducing costs and improving efficiency in the region’s dynamic manufacturing and trade environment.

The Japan market is projected to reach USD 1.01 billion by 2026, the China market is projected to reach USD 1.13 billion by 2026, and the India market is projected to reach USD 0.57 billion by 2026.

Europe is anticipated to hold a prominent position in the market. European retailers and fashion brands have embraced RFID technology for inventory management, stock visibility, and omnichannel retailing. Radio frequency identification enables retailers to improve inventory accuracy, prevent stockouts, enhance the customer shopping experience, and enable seamless checkout processes, driving operational efficiency and sales growth. European companies use this technology in the automotive and manufacturing sectors for asset tracking, production control, and quality management. Radio frequency identification enables manufacturers to monitor work-in-progress, track components and parts, and ensure compliance with industry standards and regulations, enhancing productivity and competitiveness. The UK market is projected to reach USD 0.90 billion by 2026, while the Germany market is projected to reach USD 0.82 billion by 2026.

The Middle East & Africa is expected to showcase noteworthy growth owing to the increasing adoption of RFID technology in the logistics and transportation industry for asset tracking, cargo monitoring, and supply chain visibility. Radio frequency identification enabled solutions to help logistics companies optimize operations, improve security, and enhance customer service through real-time tracking and monitoring of assets and shipments. With the region experiencing growing trade volumes and infrastructure investments, this technology plays a crucial role in managing the complexities of the MEA logistics network.

Moreover, South American farmers, food producers, and retailers use radio frequency identification technology for product traceability, quality control, and supply chain transparency in the agriculture and food industry. RFID-enabled solutions help ensure food safety, prevent counterfeiting, and enable quick and accurate recalls in case of contamination or foodborne illness outbreaks, thereby safeguarding consumer health and trust.

Key Industry Players

Focus on Research and Development Drives Product Innovation and Sustains Market Dominance

Established companies are increasing their geographical presence globally by offering industry-specific services. Industry leaders are strategically focusing on partnerships and acquisitions with regional companies to sustain their dominance. Top market participants are increasing research and development investments for product innovations to augment market growth. Moreover, major players are implementing strategic initiatives at a rapid pace to sustain their competitiveness in the market.

List of Top RFID Companies

- Zebra Technologies Corp. (U.S.)

- GAO Group (Canada)

- Impinj, Inc. (U.S.)

- Dipole RFID (Spain)

- HID Global (U.S.)

- Laird Technologies (U.S.)

- Allflex (Australia)

- Invengo Information Technology Co. Ltd. (China)

- NXP Semiconductor (Netherlands)

- Avery Dennison Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS

- March 2024: Galaxy Entertainment Group and Melco Resorts are planning to roll out radio frequency identification technology enabled tablets for casinos to curb fraud, manage inventory, and keep tabs on players.

- January 2024: HID Global collaborated with Olea Kiosk to enhance the user check-in/authentication experience by using radio frequency identification technology in access control applications.

- January 2024: Newland AIDC engaged in a partnership with Impinj. Through this partnership, Newland AIDC aims to expand its product portfolio with Impinj's cutting-edge technology.

- November 2023: Metalcraft launched the Universal Eco Mini RFID Tag. This novel tag is designed to track items on metal surfaces in retail stores. It has a detection range of up to 25 feet on metal surfaces. The solution is cost-effective for retailers of all sizes.

- August 2023: Tata Power has an innovative idea of launching radio-frequency identification cards for charging electric vehicles (EV) to promote EV adoption in India. With the launch of this card, Tata Power aims to expand its EV charging infrastructure across the country.

- July 2023: Beontag unveiled a range of tags enabled with radio frequency identification functionality using Impinj M800 series RAIN RFID tag chips. These chips are designed with specialized antennas to meet retail applications.

- April 2023: Checkpoint Systems collaborated with Partner Tech Europe to develop the next-gen Self-Service Checkouts (SCOs) system enabled with radio frequency identification technology to improve in-store security and customer convenience.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.70% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

By Frequency

By Industry

By Region

|

Frequently Asked Questions

According to Fortune Business insights, the market is projected to reach USD 46.2 billion by 2034.

In 2025, the market was valued at USD 17.12 billion.

The market is projected to grow at a CAGR of 11.70% during the forecast period.

The retail sector leads the market by industry and captured the largest market share in 2025.

Increasing demand for regulatory compliance among businesses is key to market growth.

The top players are Zebra Technologies Corp., GAO Group, Impinj, Inc., HID Global, NXP Semiconductor, and Invengo Information Technology Co. Ltd.

North America is expected to hold the highest market share.

By industry, the transportation & logistics is expected to show the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us