RSV Vaccines Market Size, Share & Industry Analysis, By Product (Abrysvo, Arexvy, mRESVIA, and Others), By Type (Inactivated, Recombinant/Conjugate/Subunit, mRNA Vaccine, and Others), By Age Group (Pediatric and Adults), By Distribution Channel (Hospital & Retail Pharmacies, Government Suppliers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

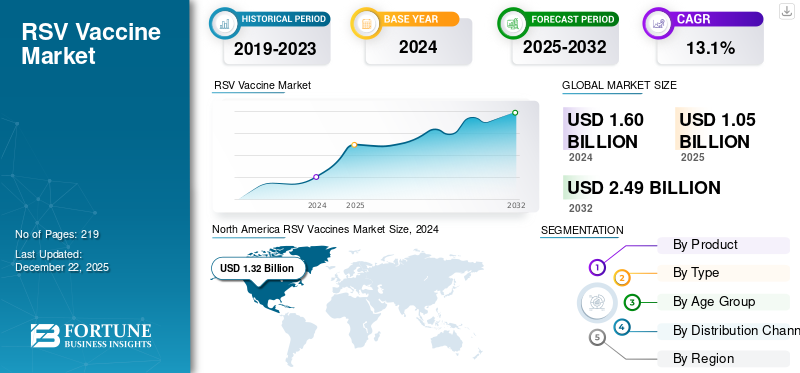

The global RSV vaccines market size was valued at USD 1.05 billion in 2025. The market is projected to grow from USD 1.1 billion in 2026 to USD 3.4 billion by 2034, exhibiting a CAGR of 15.21% during the forecast period. North America dominated the RSV vaccines market with a market share of 58.52% in 2025.

Respiratory Syncytial Virus (RSV) is a common respiratory virus that typically causes mild, cold-like symptoms, but can be severe, especially in infants and older adults. RSV infections are highly contagious and spread through droplets from coughing and sneezing, or contact with contaminated surfaces, which increases the need for effective vaccines to prevent the infection and its spread. The market is experiencing substantial growth, driven by increasing awareness of RSV's impact on public health, particularly among vulnerable populations such as infants and the elderly. Additionally, efforts undertaken by governments and affiliated bodies to raise the awareness among the general population further supported the market growth.

- For instance, in September 2024, the American Lung Association launched an educational campaign aimed at increasing awareness about RSV infection and steps to help prevent the same.

Moreover, Pfizer Inc., GSK plc, and Moderna Inc. are some of the foremost companies involved in the market with approved products and strong research capabilities, which is also boosting the market growth.

MARKET DYNAMICS

MARKET DRIVERS

High Disease Burden across the Globe to Drive Market Growth

Respiratory syncytial virus (RSV) is a leading cause of respiratory infections, especially in young children and older adults, leading to hospitalizations and even deaths, which fuels the demand for vaccines.

- For instance, as per the data published by the Centers for Disease Control and Prevention in March 2025, from October 1, 2024 to May 3, 2025, the number of outpatient visits due to RSV in the U.S. is estimated to be around 3.6 million to 6.5 million.

Moreover, the burden of RSV in older adults is often underestimated, as it can be easily confused with influenza and other respiratory illnesses. In addition, adults with comorbidities such as chronic obstructive pulmonary disease (COPD), congestive heart failure, or diabetes are at higher risk of severe RSV illness. All these factors are anticipated to increase the demand for efficient vaccines to contain the increasing number of RSV cases around the globe.

MARKET RESTRAINTS

High Development and Manufacturing Costs to Limit Market Growth

Despite the growing demand for RSV vaccines, the RSV vaccines market growth is negatively impacted by several factors, including high costs associated with development and manufacturing of these products. The development and manufacturing of RSV vaccines require significant investment in research, clinical trials, and large-scale production, which might create a financial burden on the emerging players. These high costs can translate to higher prices for the vaccine, potentially limiting access, especially in low- and middle-income countries. Additionally, limited local manufacturing capabilities also hamper the market growth in these countries.

- For instance, the list price of Arexvy is USD 280 per dose, which is relatively higher.

MARKET OPPORTUNITIES

Development of Pediatric Vaccines to Create Growth Opportunities

The rising number of RSV infection cases in the pediatrics group is a concerning factor for the healthcare professionals. According to the data from CDC of August 2024, RSV results in an estimated 58,000-80,000 hospitalizations among children under 5 years of age. Thus, there is an unmet need for pediatric patients, which has created lucrative opportunities for the market growth. Currently approved products are for older adults.

To capture this, operating players are shifting their focus to the development of RSV vaccines for pediatric patients.

- For instance, Blue Lake Biotechnology is actively involved in the development of the RSV vaccines for children. The company’s candidate is in Phase 1/2 study in children.

MARKET CHALLENGES

Regulatory Hurdles and Safety Concerns Challenge Market Growth

Potential side effects, both mild and severe, can deter uptake of the vaccine among healthcare providers and the public. Additionally, public perception and misinformation about vaccine safety and efficacy can lead to hesitancy, particularly among parents of young children and older adults.

Furthermore, obtaining regulatory approval for new vaccines is a lengthy and expensive process, potentially delaying market entry. In addition, the instances, such as pause on some RSV vaccine trials in infants due to safety concerns, further highlighting the stringent regulatory requirements.

- For instance, in December 2024, the U.S. FDA has paused all RSV vaccine trials involving infants (aged under 2 years) or RSV naive children aged 2-5 years. This was due to the increase in severe illness.

Additionally, increasing usage of monoclonal antibodies (e.g., Nirsevimab) in infant immunization also pose a threat to the market growth in the near future.

RSV VACCINES MARKET TRENDS

Technological Advancements to Determine Future Market Growth

The rising demand for vaccines has shifted the focus of market players to develop innovative products based on advanced technologies. New vaccine technology, such as mRNA-based and vector-based vaccines, is being developed and gaining traction, promising more effective and accessible options.

- For instance, as per the article published in October 2024, a group of researchers has discovered the potential application of vector-based RSV vaccines.

Furthermore, many key pharma companies are receiving marketing approvals for their innovative products, leading toward market growth.

Other Trends

Development of Pre-filled Syringes

In the near future, pre-filled syringes and simplified dosing for these vaccines are expected to drive adoption in emerging regions. Moderna Inc.’s mRESVIA vaccine is available in a prefilled syringe for easy administration.

Download Free sample to learn more about this report.

Segmentation Analysis

By Product

Arexvy is the Leading Product Due to Its Higher Adoption

Based on product, the market is divided into Abrysvo, Arexvy, mRESVIA, and others.

The Arexvy vaccine segment dominated the market in 2024. The product is currently approved by 66 markets globally. Also, it has national RSV vaccination recommendations for older adults in 18 countries. All these factors support the dominating position of the product in the global market.

The mRESVIA segment is expected to grow with the highest CAGR during the forecast period. The product was approved by the U.S. FDA in May 2024. This vaccine is based on the mRNA technology and has high growth potential in the near future. The vaccine is currently approved in several countries, including the U.S., European Union, and others.

By Type

Recombinant/Conjugate/Subunit Segment Lead the Market Due to Its Effectiveness

Based on type, the market is divided into inactivated, recombinant/conjugate/subunit, mRNA vaccine, and others.

The recombinant/conjugate/subunit segment held the leading RSV vaccines market share in 2024. Advantages offered by this type of vaccine include long-term protection, appropriate immune response, and others. Additionally, the rising number of product launches and robust pipeline for recombinant vaccines also propel the segment’s growth in the market.

- For instance, currently only one recombinant vaccine manufactured by GSK plc is approved and commercialized, however there are several candidates advancing in the clinical pipeline.

The mRNA vaccine segment is anticipated to witness a significant growth in the near future. Increasing technological advancements and strong growth of pipeline candidates have supplemented the market growth. Currently, companies such as Moderna Inc. are focusing on expanding the application areas for these vaccines.

By Age Group

Increasing Availability of Approved Products Fueled Adults Segment Dominance

Based on age group, the market is fragmented into pediatric and adults.

The adult segment captured the dominating share of the market in 2024. Increasing cases of RSV in adults, availability of approved products, and the rise in research & development and product launches targeted at adults are some of the factors driving the segment growth.

- For instance, as per the data from CDC, RSV results in an estimated 100,000-150,000 hospitalizations among adults 60 and older.

On the other hand, the pediatric segment is anticipated to witness considerable growth in the coming year. Advancing the clinical pipeline of candidates focusing on the pediatric age group is likely to boost the segment growth.

By Distribution Channel

Government Suppliers Led in 2024 with Growing Vaccination Programs

Based on distribution channel, the market is segmented into hospital & retail pharmacies, government suppliers, and others.

The government suppliers held a dominant global vaccine market share in 2024. Suppliers such as the United Nations Children's Fund (UNICEF), Global Alliance for Vaccines and Immunization (GAVI), the Pan American Health Organization (PAHO), and others are actively engaged in achieving a sustainable supply of products across the globe. Moreover, increasing distribution by government suppliers boost the segment growth.

The hospital & retail pharmacies segment is anticipated to grow with a notable CAGR during the forecast period. Owing to the easy availability of vaccines and convenience of these distribution channels, consumers prefer these settings.

- For instance, in August 2023, Arexvy, the vaccine manufactured by GSK plc, was made available through all major retail pharmacies in the U.S.

RSV Vaccines Market Regional Outlook

Based on region, the market is analyzed across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America RSV Vaccines Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America generated revenue of USD 0.61 billion in 2025 and dominated the global market. The dominant share of the region is due to adequate vaccination awareness, presence of key manufacturers, and secure government policy regarding health welfare.

U.S.

The U.S. dominated the North American region, owing to significant investments in public health funding for adequate vaccination in the population. Along with this, a strong research community in the country for the development and launch of new products further supports the market growth.

- In April 2025, the U.S. Centers for Disease Control and Prevention's (CDC) Advisory Committee on Immunization Practices (ACIP) expanded the recommended use of RSV vaccines manufactured by Pfizer Inc.

Europe

Europe is expected to register a strong growth in the coming years, with high-growth in Germany and France. Furthermore, the region’s rising regulatory approvals for new vaccines and strong healthcare infrastructure enhance the market growth in the region.

- For instance, in June 2025, the European Medicines Agency (EMA) accepted GSK’s regulatory application for the expansion of its RSV vaccine - Arexvy to include adults from 18 years of age.

Asia Pacific

Asia Pacific is anticipated to grow with a notable CAGR over the study period. Government initiatives to encourage vaccination drive and RSV awareness coupled with increasing incidence of RSV infection, and large birth cohorts in the region are boosting the growth of the market in the region.

- For instance, according to the data published by the Immunisation Coalition, in 2024, the number of RSV cases in Australia was 175,786.

Latin America and the Middle East & Africa

The Middle East & Africa and Latin America regions accounted for comparatively lesser market share in 2024 owing to limited availability of approved products. However, factors such as rising demand for immunization, focus on awareness campaigns, and initiatives by governments are likely to boost market growth in the coming years.

COMPETITIVE LANDSCAPE

Key Industry Players

Pfizer Inc. and GSK plc Dominated Market Due to Presence of Approved Products

The RSV vaccines market is highly consolidated with companies such as GSK plc, and Pfizer Inc. capturing a dominating market share in 2024. Presence of approved products and strong focus on research activities for new product launches supported the dominance of these companies in the global market.

- For instance, in March 2025, during the 13th International RSV Symposium in Iguazu, Brazil, GSK plc showcased its latest research findings on the respiratory syncytial virus (RSV).

The other prominent pharmaceutical companies, such as Moderna Inc., AstraZeneca, and Sanofi, held a significant portion of the market share. Strong focus on R&D initiatives for approvals and launches of new products globally is maintaining their positions in the market.

LIST OF KEY RSV VACCINES COMPANIES PROFILED

- GSK plc (U.K.)

- Pfizer Inc. (U.S.)

- Sanofi (France)

- Moderna Inc. (U.S.)

- Blue Lake Biotechnology (U.S.)

- Codagenix (U.S.)

- AstraZeneca (U.S.)

- Virometix (Switzerland)

KEY INDUSTRY DEVELOPMENTS

- June 2025: Immunisation Foundation Australia celebrated RSV Awareness Week in Australia to raise awareness of RSV and its impact.

- November 2024: Indian Academy of Pediatrics (IAP) collaborated with AstraZeneca India to raise awareness of Respiratory Syncytial Virus (RSV) related to premature infants.

- May 2024: The U.S. FDA approved mRNA-based RSV vaccine mRESVIA developed by Moderna Inc. for the prevention of RSV infection in adults.

- April 2024: Pfizer Inc. introduced an RSV awareness campaign in the UAE. Through collaborative efforts, the company aims to help safeguard human health.

- August 2023: The U.S. FDA approved Pfizer’s ABRYSVO (Respiratory Syncytial Virus Vaccine) for active immunization of pregnant individuals 32-36 weeks of gestational age.

REPORT COVERAGE

The global RSV vaccines market report comprises a detailed industry overview and a study of market dynamics. The report includes an analysis of the market drivers, restraints, opportunities, challenges, and trends influencing the market. The research report also highlights the prevalence of key infectious diseases, pipeline analysis, and key developments within the industry, as well as discusses the launch of new products by major players in the market. Furthermore, the report explores the impact of tariffs on the industry and provides an overview of the impact on the market situation during the forecast period.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 15.21% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Product

|

|

By Type

|

|

|

By Age Group

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 1.05 billion in 2025 and is projected to reach USD 3.4 billion by 2034.

In 2025, the market in North America stood at USD 0.61 billion.

Growing at a CAGR of 15.21%, the market will exhibit remarkable growth over the forecast period.

Adults segment held the dominating position in this market by age group.

Increasing number of approved products, competitive pipeline candidates, and strong government support and funding are the key factors driving the market.

GSK plc., Pfizer, Inc., and Moderna Inc. are the prominent market players.

North America dominated the market by holding the largest share in 2025.

Increased awareness regarding immunization among the population, supportive regulatory bodies, and increasing vaccination coverage are expected to drive the adoption of the product.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us