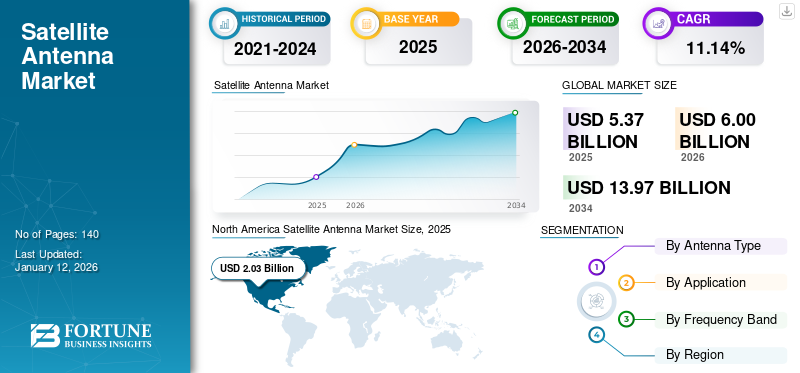

Satellite Antenna Market Size, Share & Industry Analysis, By Antenna Type (Parabolic Reflector, Flat Panel, Horn, Fiberglass Reinforced Plastic, and Others), By Application (Space, Land, Maritime, and Airborne), By Frequency Band (C Band, Ku/Ka Band, X Band, S and L Band, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

The global satellite antenna market size was valued at USD 5.37 billion in 2025 and is projected to grow from USD 6 billion in 2026 to USD 113.97 billion by 2034, exhibiting a CAGR of 11.14% during the forecast period. North America dominated the global satellite antenna market with a share of 37.84% in 2025.

A satellite antenna is a device that receives and transmits signals to and from satellites. This market includes a variety of antennas, including parabolic reflectors, flat panels, horns, fiberglass, reinforced plastic, and iron antenna with mold stamping designed for space, land, maritime, and airborne applications. Factors such as the proliferation of satellite-based navigation systems, the growing need for secure military communications, and the use of satellites for environmental monitoring and space exploration contribute to market growth. Additionally, land mobile connectivity and investments in satcom infrastructure and ground stations shape the market dynamics.

The COVID-19 pandemic increased the demand for satellite antenna systems due to the surge in remote work and online communication. However, it also disrupted global supply chains, delaying production and deployment. Despite budget cuts and project postponements, investments in satellite infrastructure are expected to drive market recovery and growth as communication needs evolve.

Download Free sample to learn more about this report.

Satellite Antenna Market Trends

Modification towards Smaller and More Compact Antennas to Fuel Market Growth

The satellite antenna market is increasingly driven by the shift towards smaller, more compact, and versatile antennas, such as flat-panel and phased array antennas. Antennas developed by companies, such as Kymeta and Starlink offer significant advantages over traditional parabolic dishes. Due to their slim profile and ease of installation, Kymeta's flat-panel antennas provide seamless connectivity for vehicles on the move, including cars, ships, and airplanes. Starlink’s phased-array antennas enable high-speed internet access in remote and underserved areas where installing large satellite dishes is impractical. This shift is driven by the increasing demand for reliable, high-speed internet and communication services, especially in regions where conventional satellite dishes are impractical. Additionally, technological advancements have improved the performance and affordability of these compact antennas, further accelerating their adoption. As connectivity continues to evolve, this trend is expected to influence the satellite antenna market share significantly.

Satellite Antenna Market Growth Factors

Rising Demand for High-speed and Reliable Internet Connectivity to Drive Market Growth

The increasing demand for high-speed, reliable internet connectivity in remote and underserved regions drives the satellite antenna market growth. For instance, satellite internet providers, such as SpaceX's Starlink, are deploying Low Earth Orbit (LEO) satellites to offer high-speed internet access in areas where traditional broadband infrastructure is unavailable. Starlink’s flat-panel antennas are designed to deliver fast, reliable internet even in remote locations, such as rural communities, ships at sea, and isolated research stations. Similarly, OneWeb is expanding its satellite constellation to improve connectivity in underserved regions worldwide. These advancements cater to the growing need for digital inclusion, enabling access to essential services, education, and economic opportunities. As more satellite networks are launched to meet this demand, the market for satellite antennas is expected to expand, supporting the global push for improved connectivity.

RESTRAINING FACTORS

Requirement of High Cost in Developing and Deploying Satellite Technologies to Impede Market Growth

The high cost of developing and deploying advanced satellite antenna technologies is a restraint in the market. The initial investment can be substantial for manufacturing sophisticated antennas, including flat-panel and phased-array types, and the infrastructure needed for satellite launches and ground stations. Additionally, regulatory barriers and investments in SATCOM infrastructure and ground stations can further increase costs and delay market entry. These financial and regulatory challenges can hinder new entrants and smaller companies. Moreover, technological limitations in achieving broad frequency coverage and minimizing signal interference can also constrain market growth.

Satellite Antenna Market Segmentation Analysis

By Antenna Type Analysis

Ability to Receive Weak Satellite Signals to Boost Segment Growth for Parabolic Reflector

Based on antenna type, the market is segmented into parabolic reflector, flat panel, horn, fiberglass reinforced plastic, and others.

Parabolic reflector antennas hold the highest share, with a 34.03% in 2026, due to their high gain and directivity, which enable them to focus and receive weak satellite signals effectively. Their established reliability and performance for various applications, including television broadcasting and satellite communications, contributes to their widespread use.

Flat-panel antennas are expected to grow at the highest CAGR in the market due to their compact size, ease of installation, and versatility in fixed and mobile applications. Their ability to provide high-speed, reliable connectivity in diverse environments, including remote and urban areas, drives their increasing adoption. For instance,

- In March 2023, Kymeta and Eutelsat Group declared that the Kymeta Hawk u8 LEO terminal is accepted for land applications on the OneWeb LEO network. It is the first flat-panel antenna to receive such approval for land use on this network.

By Application Analysis

Need for High Performance and Reliable Communication to Boost Segment Growth for Space Applications

Based on application, the market is segregated into space, land, maritime, and airborne.

Space applications hold the highest share with a contributon of 36.89% globally in 2026, due to the critical role that antennas play in satellite communications, earth observation, and scientific research. The need for high-performance, reliable communication links for data transmission, weather monitoring, and space exploration drives significant demand in this sector.

Airborne applications are expected to grow at the highest CAGR in the market due to the increasing demand for in-flight connectivity and real-time data transmission for aviation and defense. Advancements in antenna technology enable aircraft to use high-speed internet and communication capabilities, enhancing passenger experience and operational efficiency. Furthermore, the rise of electronically steered antennas in aerospace defense further propels the segment growth. For instance,

- In October 2023, Honeywell introduced JetWave X, a next-generation in-flight connectivity solution tailored for business aviation. JetWave X leverages Viasat's Ka-band network, including ViaSat-3 and Global Xpress (GX) satellites, to deliver unmatched coverage and data speeds. Building on the JetWave™ SATCOM system, JetWave X offers easier installation and greater network flexibility, compatible with any Viasat Ka-band satellite.

To know how our report can help streamline your business, Speak to Analyst

By Frequency Band Analysis

Need for Higher Bandwidth and Improved Signal Quality to Fuel Segment Growth for Ku/Ka Band

Based on frequency band, the market is classified into C band, Ku/Ka band, X band, S and L band, and others.

The Ku/Ka band holds the highest share in the market with a share of 38.66% in 2026, due to its high data transmission rates and suitability for broadband services. These frequency bands offer greater bandwidth and improved signal quality, making them ideal for satellite television, internet services, and high-speed data communications applications.

The C band holds the second highest share in the market due to its reliable signal propagation and ability to penetrate various weather conditions, such as rain, which can affect higher frequency bands. Its extensive television broadcasting and communications use in various regions contribute to its significant market presence.

REGIONAL INSIGHTS

The global market scope is classified across five regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America

North America Satellite Antenna Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America holds the highest share of the market due to its advanced telecommunication infrastructure and high demand for satellite services. North America dominated the global market in 2025, with a market size of USD 2.03 billion.North America dominated the global market in 2025, with a market size of USD 2.03 billion.The region's extensive use of satellite TV, internet services, and defense communications drives significant market activity. For instance, companies such as HughesNet and DirecTV rely heavily on satellite antennas to deliver services across the globe. Furthermore, the region’s space exploration, satellite technology investment, and development of electronically steered antennas in aerospace defense further bolster its leading market position. The U.S. market is projected to reach USD 1.32 billion by 2026.

Asia Pacific

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific is expected to grow at the highest CAGR in the market due to rapid urbanization, expanding telecommunications infrastructure, and increasing demand for satellite-based services. Countries, including Japan, India, and China, invest heavily in satellite networks to improve connectivity in remote areas and support growing digital economies. For instance, India's GSAT satellites and China's Tiantong system drive market expansion by enhancing communication and internet access across vast and underserved regions. The Japan market is projected to reach USD 0.37 billion by 2026, the China market is projected to reach USD 0.47 billion by 2026, and the India market is projected to reach USD 0.3 billion by 2026.

Europe

Europe holds a significant market share due to its mature telecommunications infrastructure and high market saturation. Additionally, the steady demand for satellite services, such as satellite TV and data communications, drives the demand for satellite antennas, contributing to the regional market share. For instance, the region's established networks, such as Eutelsat, SES, and Airbus government solutions, result in incremental regional market development throughout the anticipated period. The UK market is projected to reach USD 0.27 billion by 2026, and the Germany market is projected to reach USD 0.23 billion by 2026.

Middle East & Africa

The Middle East & Africa is expected to grow at the second highest CAGR in the market due to increasing investments in infrastructure and rising demand for connectivity in underserved areas. For instance, initiatives such as the African Union's satellite projects and expanding satellite internet services in remote regions drive the market growth. Additionally, geopolitical developments and economic diversification efforts in the Middle East contribute to the region's increasing adoption of satellite technologies.

South America

South America is expected to grow at the slowest CAGR in the market due to economic challenges and slower infrastructure development than other regions. Limited investment in satellite technology and slower adoption of advanced services contribute to this trend. For instance, initiatives such as the Brazilian Amazon satellite project aim to improve connectivity, but economic constraints, and lower market penetration of high-speed satellite services result in slower growth than other regions.

KEY INDUSTRY PLAYERS

Key Players Launch New Products to Strengthen Market Positioning

Global market players launch new product portfolios to enhance their market positioning by leveraging technological advancements, addressing diverse consumer needs, and staying ahead of competitors. They prioritize portfolio enhancement and strategic collaborations, acquisitions, and partnerships to strengthen their product offerings. Such strategic product launches help companies maintain and grow their market share in a rapidly evolving industry.

List of Top Satellite Antenna Companies:

- Honeywell International Inc. (U.S.)

- Viasat, Inc. (U.S.)

- Gilat Satellite Networks (Israel)

- L3Harris Technologies (U.S.)

- Mitsubishi Electric Corporation (Japan)

- Norsat International Inc. (Canada)

- Kymeta Corporation (U.S.)

- Intellian Technologies Inc. (South Korea)

- Comtech Telecommunications Corp. (U.S.)

- Cobham Limited (U.K.)

- Airbus Defence and Space (Germany)

KEY INDUSTRY DEVELOPMENTS:

- May 2024: Pasternack released a series of millimeter-wave horn antennas designed for test and measurement applications. This line features dual-polarized horn antennas and waveguide probes, providing advanced flexibility and performance across the 22 to 170 GHz frequency range.

- April 2024: Antenna Experts, a rapidly expanding organization, launched its parabolic reflector antennas, designed to offer a seamless wireless communication experience.

- March 2024: Hanwha Phasor, a satellite communications company, will release its Phasor L3300B land antenna in Q3 2024. This Active Electronically Steered Antenna (AESA), developed for commercial and military applications, offers uninterrupted connectivity with dual simultaneous receive channels, enabling seamless transitions between satellites without losing the current connection.

- March 2024: Antenna Experts, a leading horn antenna manufacturer, introduced new high-gain horn antennas to address the growing need for high-performance and reliable communication solutions across various industries. The company is committed to delivering top-quality horn antennas to enhance seamless and efficient communication for all sectors.

- October 2023: At AUSA, Kymeta announced the launch of the Osprey u8 HGL, a hybrid GEO/LEO terminal designed for military use. Utilizing Eutelsat Group's LEO satellite network, this customizable solution offers on-the-move connectivity and can be easily mounted on various military vehicles and vessels.

- June 2023: Kymeta and OneWeb announced the commercial launch of Kymeta's Peregrine u8 LEO terminal. This electronically steered flat-panel antenna is the first to provide maritime connectivity via OneWeb's LEO network.

REPORT COVERAGE

The market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.14% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Antenna Type

By Application

By Frequency Band

By Region

|

Frequently Asked Questions

The market is projected to record a valuation of USD 13.97 billion by 2034.

In 2025, the market was valued at USD 5.37 billion.

The market is projected to record a CAGR of 11.14% during the forecast period.

The parabolic reflector leads the market.

Rising demand for high-speed and reliable internet connectivity is expected to drive the market growth.

Honeywell International Inc., Viasat, Inc., Gilat Satellite Networks, and L3Harris Technologies are the top players in the market.

North America is expected to hold the highest market share.

By frequency band, Ku/Ka band is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us