Security Printing Market Size, Share & Industry Analysis, By Printing Type (Offset Lithographic Printing, Flexographic Printing, Roto Gravure Printing, Letterpress Printing, Screen Printing, and Others), By Application (Government Documents, Financial Instruments, Product Authentication Labels, Tickets & Coupons, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

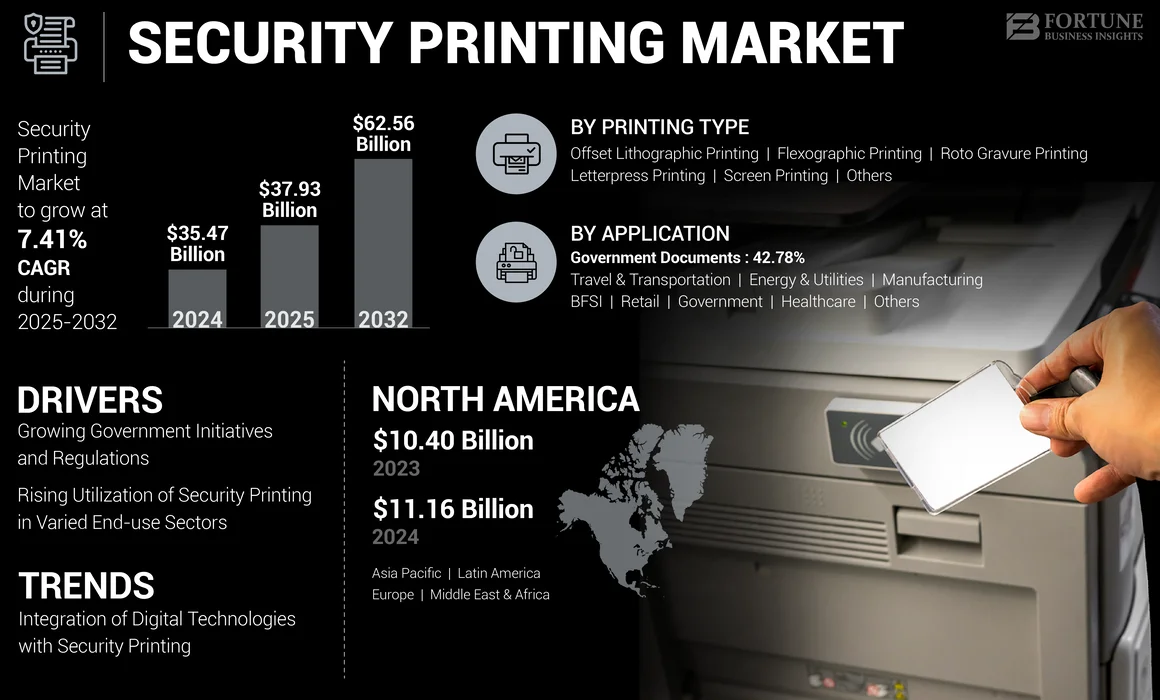

The global security printing market size was valued at USD 35.47 billion in 2024. It is projected to be worth USD 37.93 billion in 2025 and reach USD 62.56 billion by 2032, exhibiting a CAGR of 7.41% during the forecast period. North America dominated the security printing market with a market share of 31.46% in 2024.

Security printing involves the professional printing of documents and products that inhibit the production of unauthorized duplicates. This form of printing can be accomplished with high-quality, secure printers or reliable printing software. The rise in fraud and illicit activities worldwide has boosted the need for official documents, leading to the expansion of the security printing industry. The increasing advancement of methods, such as holograms, watermarks, micro printing, security threads, and numbering, is driving the global market growth.

Arrow System Inc. and Orion Security Print are the leading manufacturers, accounting for the largest global security printing market share.

MARKET DYNAMICS

MARKET DRIVERS

Rising Utilization of Security Printing in Varied End-use Sectors Drives Market Growth

Packaging across industries (pharmaceuticals, food & beverages, and luxury goods) is increasingly incorporating anti-counterfeiting features, including security labels, holographic seals, and tamper-evident labels. These labels authenticate the product and serve as a deterrent to fraud. The increased demand for security printing solutions, especially in supply chains, is pushing the development of security printing solutions that integrate tracking systems.

It involves printing labels with unique identifiers that can be scanned at various points in the supply chain to verify authenticity. With the rise in counterfeit drugs, the demand for secure packaging and labeling solutions is significant. This growth is driven by increasing incidents of counterfeiting and fraud, leading to heightened demand for secure printing solutions across various sectors. Governments and private companies are investing in advanced security printing techniques to protect consumers and ensure product safety. The combination of physical security printing solutions and digital technologies (e.g., blockchain) is thus analyzed to drive market growth.

Growing Government Initiatives & Regulations to Propel Market Growth

Governments are continuously working to upgrade their national currencies by incorporating new security features to prevent counterfeiting. Innovations such as polymer-based notes, security threads, and color-changing inks are being incorporated into currencies worldwide. Countries have set regulations that require businesses to implement secure labeling and printing technologies for various products. For example, in the pharmaceutical sector, regulations such as the Falsified Medicines Directive (FMD) require secure packaging and traceability of medicines. The rise in global terrorism and identity fraud has driven governments to adopt security printing measures for national IDs, passports, driving licenses, and voter IDs. This ensures the protection of citizens' data and the prevention of identity theft. The rapidly augmenting government regulations and initiatives thus boost the growth of the security print market.

MARKET RESTRAINTS

Rising Environmental Concerns & High Cost of Advanced Technologies to Hinder Market Growth

Most of the effective security features, such as holograms, micro printing, and RFID tags, require specialized materials and advanced printing technologies. These can be costly to develop and produce, leading to higher production costs for printers and customers. This is especially challenging for small-to-medium enterprises (SMEs) that wish to integrate such solutions. Many security printing technologies rely on materials and print processes that are not environmentally friendly, such as plastics, holographic films, and certain types of inks. As sustainability becomes a priority, companies are under pressure to find alternatives that are both effective and eco-friendly. It is thus analyzed to hinder the security printing market growth.

MARKET OPPORTUNITIES

Utilization of Holography, Anti-counterfeiting & Multilayered Security Will Generate Growth Opportunities

Holographic printing has become one of the most common security features used in currencies, official documents, and consumer goods packaging. The market for security holograms is expanding as industries, such as pharmaceuticals, electronics, and luxury goods, adopt holographic features to combat counterfeiting. Combining holography with other security features, such as micro printing, invisible inks, UV features, and color-shifting inks, is gaining traction. This trend is particularly evident in the currency and ID card sectors, where multiple security features are layered to increase the complexity of counterfeiting. The rapidly increasing utilization of holography, anti-counterfeiting & multilayered security will thus offer lucrative growth opportunities.

MARKET CHALLENGES

Rising Counterfeiting and Regulatory & Compliance Pressures Challenges to Market Growth

Different countries have varying regulations and standards for security printing, particularly when it comes to government documents and financial instruments. Keeping up with these regulations, ensuring compliance, and implementing country-specific features can be costly and complex. As security printing evolves, counterfeiters are also adopting more sophisticated technologies to replicate documents, packaging, and currency. Adhering to varying international regulations and standards requires continuous updates and adaptations in security printing processes, which can be resource-intensive.

Advanced counterfeiting techniques such as 3D printing and digital manipulation challenge the effectiveness of even the most advanced security features. The ease of accessing counterfeit goods globally via the internet makes it difficult to control and combat counterfeit operations. Counterfeiters can operate from different regions, making it harder to track and prevent the circulation of fake products and documents, thus challenging the market growth.

Download Free sample to learn more about this report.

SECURITY PRINTING MARKET TRENDS

Integration of Digital Technologies with Security Printing Emerges as a Key Trend

The use of digital printing allows for personalization and the inclusion of unique security features on documents and packaging. This is especially valuable in applications such as ID cards, tax stamps, stock certificates, and banknotes, where each item needs a unique security feature to prevent counterfeiting. As consumers demand greater traceability and security, smart packaging solutions are incorporating QR codes, RFID chips, and NFC tags to protect products against counterfeiting. Digital printing technologies are key to producing these sophisticated and secure packaging solutions.

- North America witnessed a security printing market growth from USD 10.40 billion in 2023 to USD 11.16 billion in 2024.

The integration of digital technologies, such as RFID tags, biometric authentication, and QR codes, is enhancing the security features of printed materials. These advancements make it more challenging for counterfeiters to replicate sensitive documents and products. The increasing demand for digital printing methods that allow for personalization and high-quality security features is an opportunity for innovation. Digital security print can help implement more complex designs that are difficult to replicate. The integration of digital technologies with security printing thus emerges as a key market trend.

IMPACT OF COVID-19

The COVID-19 pandemic had a moderate impact on security printing due to the ongoing need for specific security documents such as government IDs, healthcare certifications provided by the government, and pharmaceutical packaging to prevent counterfeit medications. It amplified the need for security printing. Nonetheless, because of travel limitations, there was a drop in the issuance of passports, visas, and other paperwork.

SEGMENTATION ANALYSIS

By Printing Type

Significant Benefits Offered by Offset Lithographic Printing Drives Segmental Growth

Based on printing type, the market is segmented into offset lithographic printing, flexographic printing, roto gravure printing, letterpress printing, screen printing, and others.

Offset lithographic printing is the dominating printing type segment and is analyzed to witness massive growth during the forecast period. This printing type is a cost-effective method for generating high-quality prints in significant volumes. It is frequently utilized for producing newspapers, magazines, pamphlets, stationery, and books. It also offers companies an economical option, quick production times, superior quality, and consistent outcomes. It creates clear pictures and uniform colors, thus boosting segmental growth. The segment dominated the market in 2024 with a share of 32%.

Flexographic printing is the second-dominating printing type segment and is expected to grow rapidly in the coming years. Flexography maintains a consistently elevated standard of print quality on various materials/substrates without requiring special coatings, thereby lowering the overall cost per unit and fostering the segment’s growth.

By Application

To know how our report can help streamline your business, Speak to Analyst

Rising Utilization from Government Bodies Enhances Segmental Growth

Based on application, the security printing market is segmented into government documents, financial instruments, product authentication labels, tickets & coupons, and others.

Government documents held the largest market share in the application segment. Security printing helps protect government documents from fraud and counterfeiters. It also helps to protect sensitive information, financial systems, and consumers. It also helps to prevent the misuse of sensitive information, intellectual property, and personal ID information. The rising utilization of security print from government bodies for crucial documents thrives the segment’s growth. The segment is likely to capture 43% of the market share in 2025.

The application of financial instruments is the second most dominant segment and is projected to grow rapidly soon. Security features such as threads, holograms, and watermarks have become standard. Watermarks, commonly found in banknotes, provide straightforward public identification and protect against scanning, chemicals, mechanical alterations, and reproduction, thus enhancing segmental growth. This segment is estimated to grow with a considerable CAGR of 6.38% during the forecast period (2025-2032).

SECURITY PRINTING MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Security Printing Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Increasing Demand for Anti-Counterfeit Solutions Drives North American Market Growth

North America dominated the market with a valuation of USD 10.40 billion in 2023 and USD 11.16 billion in 2024. As counterfeiting and fraud continue to rise in industries such as currency, identification cards, documents, and consumer goods, there is a growing demand for advanced security printing solutions to protect products and currencies. Counterfeiting leads to massive financial losses for companies and governments. This has spurred the adoption of security printing methods such as holograms, watermarks, micro-texts, and color-shifting inks to protect against the replication of products. The U.S. market is projected to reach a market value of USD 9.41 billion in 2025.

- According to the U.S. Customs & Border Protection, in 2023, counterfeit pharmaceuticals made up nearly half of all health & safety products. CBP seized over 1.5 million counterfeit pharmaceutical items, more than any other category of counterfeit goods. E-commerce sales have added to large volumes of low-value, small packages being imported into the U.S. Over 90% of all counterfeit seizures happen in the international mail and express surroundings, which are channels that minor e-commerce packages destined for the U.S. travel through.

Europe

Shift Toward Sustainable, Recycled, and Cost-Effective Solutions Boosts Market Growth in Europe

Europe is the third-largest contributor to the market anticipated to be worth USD 8.80 billion in 2025. As environmental concerns rise, many security printing solutions are being designed with sustainability in mind. There is a growing emphasis on developing eco-friendly and sustainable security printing methods. The U.K. market is expanding and is set to reach USD 1.46 billion in 2025. This includes the use of recyclable materials and environmentally friendly inks, aligning with global sustainability goals. Printing technologies that minimize waste, use recyclable materials, and require less energy are becoming popular.

- According to the Confederation of European Paper Industries, in 2021, paper was recycled at a rate of 71.4% in Europe, which was recorded as the highest recycling rate for paper in the world. Paper-based packaging is even recycled at 82%.

Germany is estimated to be valued at USD 1.66 billion in 2025, while France is poised to grow with a valuation of USD 1.18 billion in the same year.

Asia Pacific

Fostering Demand from Healthcare Industry Boosts Market Growth in Asia Pacific

Asia Pacific is the second-dominating region of the global security printing market expected to hit USD 9.46 billion in 2025, exhibiting a CAGR of 8.59% during the forecast period. Counterfeit drugs have become a major global issue. Security printing is now widely used in pharmaceutical packaging, including tamper-evident seals, holograms, and special barcodes, to ensure product authenticity and safety. It is also used in various aspects of healthcare, from insurance cards to medical prescriptions, to prevent fraud and identity theft. With the rapid growth in the pharmaceutical sector in major countries, the demand for security prints has increased. China is estimated to reach USD 3.05 billion in 2025.

- According to the Department of Pharmaceuticals, India now ranks 3rd worldwide by volume of production and 14th by value, thereby accounting for around 10% of the world’s production by volume and 1.5% by value.

India is set to be valued at USD 2.54 billion in 2025, while France is expected to gain USD 1.78 billion in the same year.

Latin America

Growth of E-commerce & Online Transactions Drives Market Growth in Latin America

Latin America is set to be worth USD 5.53 billion in 2025. The region is expected to experience steady growth during the projected period. As e-commerce grows, the need for secure payment options and credit card authentication systems rises. Security printing on credit cards, gift cards, and payment vouchers, incorporating features such as magnetic stripes, EMV chips, and QR codes, helps ensure secure transactions. Moreover, with the boom in global shipping, security printing is applied to tracking labels and invoices to protect against fraud and counterfeiting in the logistics industry.

- According to the International Trade Administration, Brazil is the largest economy in Latin America and continues to witness speedy e-commerce growth of 14.3%. The Southeast region, where São Paulo and Rio de Janeiro are located, has the most sales in Brazil. This region accounts for 51% of the e-commerce market growth.

Middle East & Africa

Adoption of Smart and Secure Labels Boosts Market Growth in Middle East & Africa

The Middle East region is projected to experience significant growth during this period. The increasing use of smart labels and packaging solutions in industries such as pharmaceuticals, cosmetics, and electronics is another key driver. These labels often include features such as holograms, NFC chips, and RFID tags that offer an extra layer of security. The increasing imports of cosmetic products also contribute to the development. Saudi Arabia is expected to stand at USD 1.20 billion in 2025.

- The top five African/Middle Eastern countries to which the U.S. exports cosmetics to are the UAE, South Africa, Saudi Arabia, Israel, and Nigeria. The biggest market for U.S. cosmetics exports to Africa is South Africa (approximately USD 56 million in 2023), which accounts for nearly half of all U.S. exports to Africa.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Market Participants to Witness Significant Growth Opportunities with New Product Launches

The global security printing market is highly fragmented and competitive. A few significant players are dominating the packaging industry by offering innovative packaging solutions. These major market players constantly focus on expanding their customer base across regions by innovating their existing range of products. The market report also highlights the key developments by the manufacturers.

Major players in the industry include Arrow System Inc., Orion Security Print, Eltronis, A1 Security Print, ECO3, JUI Group, and others. Numerous other companies operating in the market are focused on market scenarios and delivering advanced packaging solutions.

Some of the Key Companies Profiled in the Report:

- Arrow System Inc. (U.S.)

- Orion Security Print (U.K.)

- Eltronis UK (U.K.)

- A1 Security Print (U.K.)

- ECO3 (Belgium)

- JUI Group (India)

- CETIS d.d (Slovenia)

- The Flesh Company (U.S.)

- TROY Group, Inc. (U.S.)

- Agfa-Gevaert Group (Belgium)

- Ennis, Inc. (U.S.)

- MDV Group (Germany)

- Lithotech (South Africa)

- Madras Security Printers (India)

- AUSTRIACARD AG (Austria)

KEY INDUSTRY DEVELOPMENTS

- September 2024: HP Indigo and Agfa Offset Solutions (now ECO3) launched variable design solutions for brand protection and security printing. The designs provide security and safeguard against counterfeiting and diversion while effortlessly integrating with the original design, maintaining the appearance and essence of the original document or product.

- June 2024: Hitech Print Systems strengthened its dedication to excellence and innovation by acquiring a second nine-color pre-owned Rotatek RK 250 Plus press. This notable enhancement to its production capabilities is set to increase the company's output and further raise its quality and efficiency standards. Hitech focuses on the security printing of crucial documents such as question papers, answer sheets, OMR forms, university diplomas, certificates, and cheques, among others.

- January 2024: IHMA declared the launch of the Security Image Register (SIR). The secure registry of holographic images, created by the International Hologram Manufacturers Association (IHMA) to protect hologram copyright and support hologram use in security and authentication printing, has been reintroduced as the Security Image Register (SIR).

- January 2024: Cartor Security Printers, a company specializing in security printing, was purchased by Spectra Systems Corporation, a leader in machine-readable rapid banknote verification, brand protection solutions, and gaming security software. The acquisition aims to enhance Spectra's footprint in the polymer banknote substrate sector and open new pathways for marketing its security offerings.

- April 2019: Authentix, the leader in authentication and information services, declared its acquisition of Security Print Solutions Limited (“SPS”) via its U.K. entity, Authentix Limited. This strategic move enhances our secure technology portfolio to bolster tax recovery programs for governments and broadens the range of services for our brand protection clients.

INVESTMENT ANALYSIS AND OPPORTUNITIES

In September 2024, the New Graphics Security Printer, located in New Delhi, revealed the investment in a Konica Minolta AccurioPress C7090. The machine has been operational on the company shop floor for the past one and a half years. The firm caters to a variety of clients, as it does not restrict itself to a particular niche. Rather, it manages several printing requirements, such as books, cards, and digital prints.

REPORT COVERAGE

The market research report provides a detailed market analysis. The security printing market overview also focuses on key aspects, such as top key players, competitive landscape, service types, market segments, Porter's five forces analysis, and leading segments of the product. Besides, it offers insights into the sterile packaging market trends and highlights key industry developments. In addition to the abovementioned factors, it encompasses several factors that have contributed to the market intelligence & growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 7.41% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Printing Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 35.47 billion in 2024.

The market will likely grow at a CAGR of 7.41% during the forecast period.

The government documents application segment leads the market.

The North American market size stood at USD 11.16 billion in 2024.

The key market drivers are the rising utilization of security printing in varied end-use sectors and growing government initiatives & regulations.

Some of the top players in the market are Arrow System Inc., Orion Security Print, Eltronis, A1 Security Print, ECO3, JUI Group, and others.

The global market size is expected to record a valuation of USD 62.56 billion by 2032.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us