Self-Injection Device Market Size, Share & Industry Analysis, By Product Type (Pen Injectors, Autoinjectors, Needle Free Injectors, and Wearable Injectors), By Delivery Type (On body Delivery and Patient Controlled Delivery), By Type (Disposable and Reusable), By Application (Autoimmune Disorders, Diabetes, Pain Management, and Others), By End-user (Pharmaceutical & Biotechnology Companies and Contract Research & Manufacturing Organizations), and Regional Forecast, 2026-2034

SELF-INJECTION DEVICE MARKET SIZE AND FUTURE OUTLOOK

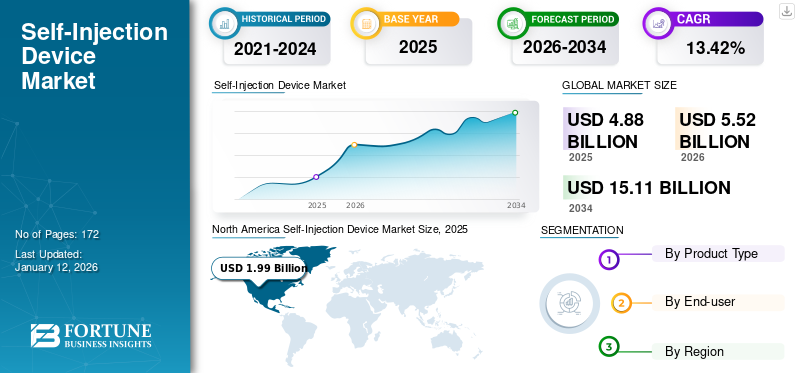

The global self-injection device market size was valued at USD 4.88 billion in 2025. The market is projected to grow from USD 5.52 billion in 2026 to USD 15.11 billion by 2034, exhibiting a CAGR of 13.42% during the forecast period. North America dominated the self-injection device market with a market share of 40.75% in 2025. The market is expected to witness notable growth in the coming years. It encompasses some prominent players such as Ypsomed AG, SHL Medical AG, and BD.

A self-injection device is a medical instrument that enables patients to administer medications independently, eliminating the need for healthcare professionals. These devices include auto-injectors, pen injectors, needle-free injectors, and wearable injectors. In recent years, the market has witnessed a significant increase in the adoption of these devices among the general population.

Conditions such as diabetes, anaphylaxis, rheumatoid arthritis, and multiple sclerosis require the frequent administration of medications, often over a lifetime. This presents a large patient pool suffering from these conditions and subsequently drives the demand for self-injection devices for the treatment of these chronic conditions. These devices offer a convenient, efficient solution for patients to self-administer treatments in home settings, reducing the need for frequent hospital visits and improving overall quality of life.

Additionally, factors such as the increasing prevalence of diabetes cases, aging populations, and technological advancements in drug delivery have also contributed to market growth.

Global Self-Injection Device Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 4.88 billion

- 2026 Market Size: USD 5.52 billion

- 2034 Forecast Market Size: USD 15.11 billion

- CAGR: 13.42% from 2026–2034

Market Share:

- Region: North America dominated the market with a 40.75% share in 2025. This is due to the presence of well-established players, the increasing prevalence of diabetes and autoimmune diseases, and rising initiatives by prominent companies to launch advanced self-injection products.

- By Product Type: The Pen Injectors segment held the largest market share. The segment's dominance is attributed to its ease of use, convenience, and widespread adoption for managing chronic conditions such as diabetes and autoimmune diseases, coupled with an increasing number of new product launches by key players.

Key Country Highlights:

- Japan: As a key country in the fastest-growing Asia Pacific region, Japan's market is driven by the increasing prevalence of chronic diseases, such as diabetes, and a large patient pool that is creating higher demand for self-injection devices.

- United States: The market is fueled by a high prevalence of chronic diseases, including the 20.5 million adults with coronary artery disease, which underscores the need for rapid treatment options like autoinjectors. High adoption rates and significant healthcare expenditure are also major drivers.

- China: As an emerging country with a very large patient pool for conditions like diabetes, China is a key growth driver in the Asia Pacific region, creating substantial demand for user-friendly self-injection devices.

- Europe: The market is propelled by the increasing incidence of chronic diseases and the launch of innovative products by key regional players. For example, the introduction of connected add-on devices that convert conventional pens into smart solutions is enhancing disease management and driving adoption.

MARKET DYNAMICS:

MARKET DRIVERS

Technological Advancements in Drug Delivery Technologies to Boost Market Growth

One of the important factors that has driven the market growth is the technological advancements in drug delivery technologies. Continuous advancements in self-injection technologies have made them more user-friendly and efficient.

The innovations in self-injection devices mainly focus on improving user experience, device efficiency, and safety, which, in turn, results in growing adoption among patients and healthcare providers. Some of the modern autoinjectors now feature improved designs with ergonomic benefits, making them easier to handle and operate, especially for patients with limited dexterity. This includes features such as one-button activation, automated needle retraction, and audible or visual feedback to ensure correct dosage delivery.

- For instance, in September 2021, Owen Mumford Pharmaceutical Services, a division of Owen Mumford Ltd., introduced the Aidaptus autoinjector platform. Aidaptus is a two-step, single-use device compatible with both 1mL and 2.25mL pre-filled glass syringes, offering flexibility within a single platform.

Furthermore, the development of innovative electromechanical auto-injector devices is another advancement in this space. These devices feature customizable injection speeds, electronic injection logs and reminders, a consistent rate of injection, and step-by-step, real-time instructions. Such advances in the self-injection devices are expected to drive the market growth in the near future.

Other Drivers:

Rising Prevalence of Chronic Diseases to Bolster Market Growth:

The increasing incidence of chronic diseases, such as diabetes, rheumatoid arthritis, and multiple sclerosis, has led to a higher demand for self-injection devices. Diabetes is considered a major public health concern around the world. The prevalence of this disease is rising among the population at an alarming rate.

- For instance, according to the National Institutes of Health (NIH) article published in 2023, the global incidence of anaphylaxis was found to be approximately 46 cases per 100,000 population per year.

Growing Demand for Self-Injection:

As the global burden of several chronic diseases is increasing rapidly, the demand for self-injection devices is also increasing. Patients are increasingly opting for self-administration of medications due to its convenience and cost-effectiveness. Along with this, some other advantages of these devices include ease of use and portability, which further boost the market demand.

Favorable Government Initiatives:

Regulatory bodies are taking steps to streamline the approval process for self-injection devices, encouraging manufacturers to invest in research and development. With the growing demand for self-injection devices such as autoinjector, pen injection, and others, the operating players and government organizations are focusing on investments to advance the technology.

- For instance, in October 2024, the Bill & Melinda Gates Foundation granted funding of USD 425,000 to ApiJect for the development of low-cost blow-fill-seal prefilled injection devices.

Increasing Geriatric Population:

The aging population is more prone to chronic diseases, creating a significant demand for self-injection devices. With the use of these devices for drug administration, patients can spend less time with physicians and can have the drug administered in the comfort of their homes/places. In addition, self-injection plays an integral role in managing and treating many symptoms of many age-related health conditions. In fact, the majority (70%) of home healthcare patients are 65 years of age and above. Such factors increase the demand for these devices, which, in turn, propels the self-injection device market growth.

MARKET RESTRAINTS

Limited Availability of Advanced Devices across Developing Countries Hinder Market Growth

Even though the demand for self-injection devices such as pen injection and autoinjectors is rapidly growing, there are certain limitations to this. Limited availability of advanced drug delivery devices in low and middle-income countries is one of the factors limiting the overall market growth. Several studies have demonstrated that the penetration of self-injection devices is higher in high-income countries than in low- and middle-income countries.

- For instance, in a study published in 2020, it was stated that out of the world’s 195 countries, the availability of Adrenaline Autoinjectors (AAI) as a first-aid treatment for anaphylaxis is limited to only 32% of countries. Most of these are high-income countries.

This is further supported by a large proportion of undiagnosed patients globally, especially for diabetes. Emerging countries, including India, China, and others, contribute to the dominant share of the undiagnosed diabetes population.

MARKET OPPORTUNITIES

Surge in Collaboration between Device Manufacturers and Drug Developers to Create Lucrative Growth Opportunities

In the past few years, the demand for self-injection devices has grown tremendously owing to their various advantages over traditional drug delivery devices. This has resulted in the growing popularity of self-injection systems among the general population. To capture this growing demand, various key players are adopting growth strategies, such as acquisition and collaborations, in order to introduce innovative products in the market that will cater to the unmet needs of people who are at high risk of developing chronic diseases.

In recent years, such strategic initiatives are growing rapidly, resulting in offering lucrative opportunities for both pharmaceutical companies as well as technology manufacturers.

MARKET CHALLENGES

High Cost of Self-Injection Devices to Limit Market Growth

The demand for effective treatment alternatives to treat several chronic diseases is increasing globally, owing to high disease prevalence. Similarly, the adoption of therapeutics among the patient population to treat these diseases has increased. Even though there are several drugs approved for the treatment that can be administered using self-injection devices, the high cost of these limits their adoption to a certain extent.

The premium pricing of these devices, such as wearable autoinjectors, results in making them unaffordable to a large population, especially in low- and middle-income countries. This limits the accessibility for many patients and healthcare providers.

- For instance, according to an article published in July 2022 in Healio, the cost of epinephrine autoinjectors remains high even after the introduction of generic options for the same.

Other Challenges:

Safety Concerns:

Safety concerns associated with the improper use of these devices and regulatory scrutiny on new drugs are anticipated to challenge the market growth to a certain extent. There is a risk of misuse or improper administration of the drug if patients are not adequately trained, necessitating proper patient education. Thus, there is a need for proper training for the patient or its caregiver to administer the drug using self-injection devices safely.

Technical Complexity:

Some self-injection devices may be complex to operate for certain patients, especially elderly individuals or those with limited dexterity. Some chronic conditions, such as rheumatoid arthritis, impair manual dexterity and can make treatment self-administration challenging. Such scenarios may hamper the market growth.

Regulatory Challenges:

Compliance with regulatory requirements can be a barrier to market entry for manufacturers, with strict regulations and lengthy approval processes potentially delaying product launches.

Differences in approval processes across countries and the long process time required to meet the U.S. FDA and other global regulatory standards further create the challenge of easily launching new devices in the market.

Limited Awareness:

Despite the benefits of self-injection devices, there is still a lack of awareness among patients and healthcare professionals. Along with this, the lack of well-established healthcare infrastructure in rural areas also hamper market growth.

SELF-INJECTION DEVICE MARKET TRENDS

Patient Preference for Self-Administration of Drugs

There is an increasing preference among patients toward self-administration, driven by the convenience and flexibility it offers. The convenience and efficiency of these devices have increased their adoption among patients seeking more control over their treatment regimens. As awareness of these devices grows, particularly through increased prescriptions by healthcare professionals, more patients are opting for self-injection devices over conventional injection methods.

Owing to the advantages offered by self-injection devices, such as ease of use, portability, increased patient adherence, and others, there has been a growing trend of self-administration of drugs by patients.

The prevalence of self-medication was observed to be around 80% across the world and around 78.6% in India.

Download Free sample to learn more about this report.

Other Trends:

Development of Wearable Injectors:

The market is witnessing a shift toward the development of wearable injectors, which offer the advantage of prolonged drug delivery and improved patient compliance. Wearable injectors offer several advantages, such as precise and controlled dosing of medications, which, in turn, ensure accurate delivery of the required dosage. Along with that, automatic needle retraction or safety mechanisms have boosted its adoption among the patient population.

- In April 2024, Ypsomed AG collaborated with ten23 Health with the aim of enhancing the commercialization of the company’s YpsoDose wearable injector for the subcutaneous self-injection of large-volume doses.

Regulatory Approvals:

With the substantially growing demand for self-injection devices, regulatory authorities across several countries are also actively involved in approving the products. An increasing number of regulatory approvals are facilitating the adoption of self-injection devices.

- For instance, in October 2023, Enable Injections, Inc. announced the U.S. Food and Drug Administration (FDA) approval for the EMPAVELI Injector (enFuse) to facilitate the subcutaneous delivery of EMPAVELI (pegcetacoplan) for adults suffering from paroxysmal nocturnal hemoglobinuria (PNH).

IMPACT OF COVID-19

As a result of the COVID-19 pandemic, the global self-injection devices market experienced faster growth than in 2019. The major market players, such as BD, Ypsomed AG, and others, reported a positive growth in their self-injection systems revenues during the period.

- For instance, BD, one of the leading players in the market, witnessed a growth of 15.1% in pharmaceutical systems, which includes self-injection device sales in 2020 compared to the 8.4% growth recorded in the year 2019. The company, in its 2020 annual report, stated that the revenue for the pharmaceutical system’s unit reflected continued strength in demand for pre-fillable products, including self-injection systems.

Furthermore, it is expected that following COVID-19, self-administered drugs will continue to grow owing to the development of biologics, biosimilars, and novel therapeutics to treat various diseases in the coming years.

Segmentation Analysis

By Product Type

Widespread Adoption Proliferated Pen Injector Segment Growth

On the basis of product type, the market is segmented into pen injectors, autoinjectors, needle free injectors, and wearable injectors.

The pen injectors segment captured the largest self-injection device market share in 2024. The dominance of the segment can be attributed to factors such as ease of use, convenience, and widespread adoption of these devices for conditions such as diabetes and autoimmune diseases. Additionally, an increase in the focus of key market players on launching new pen injectors is expected to boost the growth of the segment in the market. The pen injectors segment is projected to dominate the market with a share of 67.10% in 2026.

- For instance, in February 2023, Phillips Medisize introduced a disposable pen injector designed to provide biopharmaceutical companies with a ready-to-use, pre-filled injection option to facilitate the quicker delivery of various drug therapies.

On the other hand, the autoinjector segment is anticipated to grow at a notable rate in the coming years. The growth can be credited to factors such as portability, ease of use, and rapid intramuscular delivery of medication for instant relief from autoimmune responses. Additionally, the presence of key players with strategic initiatives is propelling the growth of the segment.

- For instance, in January 2024, SHL Medical and FUJIFILM Diosynth Biotechnologies signed a collaboration agreement for the enhancement of autoinjector services.

To know how our report can help streamline your business, Speak to Analyst

By Delivery Type Analysis

Easy Availability of Patient Controlled Devices Augmented Segment Growth

In terms of delivery type, the global market is segmented into on body delivery and patient controlled delivery.

The patient controlled delivery segment held a dominant share of the market in 2024. The growth of the segment is majorly due to the benefits associated with the devices, that is, enhanced convenience, safety, and customization according to individuals' needs. Additionally, the increasing prevalence of diseases such as diabetes, autoimmune diseases, hormonal disorders, and inflammatory diseases requires faster and more convenient drug administration for patient comfort. Also, the pharma and biotech companies are focusing on launching patient-controlled self-injection devices to boost the segment’s growth in the market. The patient controlled delivery segment is projected to dominate the market with a share of 92.10% in 2026.

- For instance, in March 2024, Mallinckrodt plc, a global specialty pharmaceutical company, launched Acthar Gel (repository corticotropin injection) Single-Dose Pre-filled SelfJect Injector.

The on body delivery segment is poised to grow at a considerable CAGR over the study period. On body delivery devices are worn on the body for a longer duration to minimize the pain associated with injections. The features such as automatic needle insertion enable patients to maintain a level of mobility and flexibility in their daily lives. Additionally, increasing approval for the on-body delivery devices for drug delivery is expected to boost the segment’s growth.

By Type

High Adoption of Disposable Products Impelled Segment Growth

Based on type, the global market is segmented into disposable and reusable.

The disposable segment dominated the market in 2024. The increasing prevalence of diabetes, allergy, and anaphylaxis raises the demand for efficient treatment for reducing the chances of morbidity and improving quality of life. Such scenarios boosted the growth of the disposable self-injections devices segment in the market. The disposable segment is expected to lead the market, contributing 94.55% globally in 2026.

- For instance, according to the data from the Centre of Disease Control National Centre for Health Statistics. 1 in 3 U.S. adults and more than 1 in 4 U.S. children reported having a seasonal allergy, eczema, or food allergy in 2021. Thus, such a number of cases is expected to propel the adoption of disposable autoinjectors in the region for quick onset of action.

The reusable segment is anticipated to grow at a significant CAGR in the coming years. The segmental growth is attributed to the benefits associated with it, such as safety and ease of use, as they reduce the volume of storage and waste footprint (and are thus more environmentally friendly) and more cost-effective. Furthermore, the growing prevalence of chronic diseases, such as rheumatoid arthritis and multiple sclerosis, is expected to increase the adoption of reusable autoinjectors market.

By Application

High Prevalence of Diabetes Boosted Segment Growth

Based on application, the global market is categorized into autoimmune disorders, diabetes, pain management, and others.

The diabetes segment held the leading position in the global market in 2024. The dominance of the segment is attributed to the increase in the prevalence of diabetes across the globe. Also, the increased focus of the key players in the market on launching self-injection devices for diabetes treatment is expected to boost the segment’s growth. The diabetes segment will account for 70.49% market share in 2026.

- For instance, according to the data published by the Centers for Disease Control (CDC) National Diabetes Statistics Report, in 2022, the number of cases of diabetes has risen to an estimated 37.3 million. Such a rising number of diabetes cases in the region increases the adoption of self-injection devices and boosts the growth of the segment.

The autoimmune disorders segment held the second-highest share of the segment. The rising prevalence of autoimmune disorders, such as rheumatoid arthritis and multiple sclerosis, in which the immune system attacks the joints and nervous system, respectively. In such cases, the drug self-injection devices are used to weaken the immune system to reduce joint pain and swelling for rheumatoid arthritis patients.

- For instance, according to the article published by UCB Canada Inc., it was stated that by 2036, this number of patients suffering from rheumatoid arthritis is expected to grow to an estimated 7.5 million Canadian adults.

By End-user

High Demand from Pharmaceutical and Biotechnology Companies Boosted Segment Growth

On the basis of end-user, the global market is segmented into pharmaceutical & biotechnology companies and contract research & manufacturing organizations.

The pharmaceutical & biotechnology companies segment held the highest share of the market in 2024. The highest share can be credited to the increasing collaboration activities amongst the pharmaceutical and biotechnology companies and the self-injection device manufacturers to launch a drug-device self-injection combination.

- For instance, in October 2022, BD collaborated with Biocorp, a manufacturer of medical devices and delivery systems. The agreement focuses on utilizing Near Field Communication (NFC) technology to monitor adherence to self-administered drug therapies, such as biologics.

The contract research & manufacturing organizations segment is poised to grow at a considerable CAGR during the forecast period. The segment growth can be attributed to the active involvement of CDMOs in drug development, the growing number of CDMOs, and strategic alliances between the operating players in the market.

SELF-INJECTION DEVICE MARKET REGIONAL OUTLOOK

Regionally, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America:

North America to Dominate Due to Growing Investments in R&D and Increasing Prevalence of Diabetes

North America Self-Injection Device Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America self-injection device market was valued at USD 1.75 billion in 2024 and is expected to maintain its dominance throughout the study period. The presence of well-established players, the increasing prevalence of diabetes and autoimmune diseases, and rising initiatives by prominent market players to launch advanced products for self-injection are some of the key factors supporting the dominance of the region in the global market. The U.S. dominated the North American region with the highest share in 2024. The high adoption rate of innovative technologies in the U.S. and increasing healthcare expenditure are the primary factors leading to the country's market growth. Furthermore, the rising prevalence of chronic diseases and increased demand for advanced drug delivery systems for quick, accurate, and fast onset of action also fuel market growth in the region. The U.S. market is expected to reach USD 2.17 billion by 2026.

- For instance, as per the data published in December 2023 by the National Heart, Lung, and Blood Institute, about 20.5 million U.S. adults had coronary artery disease in 2023. Thus, the connection between CVD and anaphylaxis underscores the importance of rapid treatment with autoinjectors in patients and drives market growth.

Europe:

Europe held the second leading position in the global market. This can be ascribed to factors such as the increasing prevalence of chronic diseases in European countries and the presence of key players with advanced product launches for self-injection delivery. The UK market is anticipated to reach USD 0.37 billion by 2026, while the Germany market is estimated to reach USD 0.18 billion by 2026.

- For instance, in January 2022, SHL Medical AG introduced InsulCheck DOSE, a connected add-on device designed to convert conventional pen injectors into intelligent solutions to enhance the monitoring of disease management routines.

Asia Pacific:

On the other hand, Asia Pacific region is estimated to witness the fastest growth in the near future. Emerging countries such as China and India are at the forefront of this growth. Key factors contributing to this include the increasing prevalence of asthma, allergy, cardiovascular disorders, and diabetes in the region and the large patient pool leading to increased demand for self-injection devices. The Japan market is forecast to reach USD 0.31 billion by 2026, the China market is set to reach USD 0.39 billion by 2026, and the India market is poised to reach USD 0.11 billion by 2026.

- For instance, as per the article published by BioMed Central Ltd in April 2023, the burden of type 2 Diabetes Mellitus (T2DM) in India is massive, with 77.0 million individuals. Furthermore, the article mentions that the country ranks second for having the highest type 2 diabetes cases globally.

Latin America:

The market in Latin America is predicted to grow at an adequate CAGR during the study period. The growing prevalence of diabetes and the requirement for regular insulin injections among patients for its treatment has majorly driven regional growth.

- For instance, as per the article published by NCBI in September 2020, Chile prioritized the diagnosis and treatment of type 2 diabetes through a universal health care package, largely focused on the clinical dimensions of the disease.

Middle East & Africa:

The Middle East & Africa is poised to witness slower growth during the study period. However, the high number of patients suffering from chronic diseases, coupled with increasing research and development activities to build low-cost replacements for the currently available products, are boosting the market growth in the region.

- For instance, according to the International Diabetes Federation (IDF), in 2021, around 4,274,100 cases of diabetes in adults were registered in Saudi Arabia.

COMPETITIVE LANDSCAPE

Key Market Players

Ypsomed AG, BD, and SHL Medical AG Account for Substantial Share of Global Market in Terms of Revenue

BD is a leading player with a dominating share of the global market. The company offers a wide range of medical devices, including self-injection systems. In recent years, the company has witnessed strong revenue growth driven by the increased demand for self-injection devices for various therapies. BD is also actively engaged in undertaking strategic initiatives to strengthen its market presence.

Ypsomed AG is another leading developer and manufacturer of injection and infusion systems for self-medication. The high market share is attributed to its robust focus on the launch of new products to diversify its portfolio and collaborations with pharmaceutical companies.

- In October 2023, Ypsomed AG announced the enhancement of the self-injection device platforms with the integration of human factor services.

Other players operating in the global market are SHL Medical AG, Owen Mumford Limited, Gerresheimer AG, and others. These companies are focusing on product launches and collaborations with pharmaceutical companies to boost their market presence.

LIST OF KEY SELF-INJECTION COMPANIES PROFILED:

- SHL Medical AG (Switzerland)

- BD (U.S.)

- Crossject (France)

- PharmaJet (U.S.)

- Ypsomed AG (Switzerland)

- Owen Mumford Limited (U.K.)

- Recipharm AB (Sweden)

- Gerresheimer AG (Germany)

- Halozyme Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2024: Nemera launched a reusable autoinjector platform at the Convention on Pharmaceutical Ingredients (CPHI) Worldwide in Milan.

- September 2024: SHL Medical AG launched Elexy, a reusable electromechanical drug delivery device that helps to support digital therapeutics and a wide range of specialty formulations.

- January 2024: Nemera announced that ANVISA1 approved the state-of-the-art pen injector platform PENDURA AD for commercialization in Brazil.

- July 2023: Crossject announced the signing of a commercial agreement for the launch of ZENEO Midazolam in Australia & New Zealand.

- May 2022: Jabil Inc. launched the Qfinity autoinjector platform. It is a simple, reusable, and modular solution for Subcutaneous (SC) drug self-administration.

REPORT COVERAGE

The global self-injection device market research report provides a detailed analysis. It focuses on key aspects such as an overview of the prevalence of key diseases globally, product type, product launches, and key industry developments such as partnerships, mergers and acquisitions. Besides this, it also offers insights into the market trends and highlights key industry dynamics. In addition to the aforementioned factors, it encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.42% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type, Delivery Type, Type, Application, End-user , and Region |

|

By Product Type |

· Pen Injectors · Autoinjectors · Needle Free Injectors · Wearable Injectors |

|

By Delivery Type |

· On body Delivery · Patient Controlled Delivery |

|

By Type |

· Disposable · Reusable |

|

By Application |

· Autoimmune Disorders · Diabetes · Pain Management · Others |

|

By End-user |

· Pharmaceutical & Biotechnology Companies · Contract Research & Manufacturing Organizations |

|

By Region |

· North America (By Product Type, Delivery Type, Type, Application, End-user, and Country) o U.S. o Canada · Europe (By Product Type, Delivery Type, Type, Application, End-user, and Country/Sub-Region) o Germany o France o U.K. o Spain o Italy o Scandinavia o Rest of Europe · Asia Pacific (By Product Type, Delivery Type, Type, Application, End-user, and Country/Sub-Region) o China o India o Japan o Australia o Southeast Asia o Rest of the Asia Pacific · Latin America (By Product Type, Delivery Type, Type, Application, End-user, and Country/Sub-Region) o Mexico o Brazil o Rest of Latin America · Middle East & Africa (By Product Type, Delivery Type, Type, Application, End-user, and Country/Sub-Region) o GCC o South Africa o Rest of the Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 4.88 billion in 2025 and is projected to record a valuation of USD 15.11 billion by 2034.

The market is projected to grow at a CAGR of 13.42% during the forecast period of 2026-2034.

Based on product type, the pen injectors segment led the market during the forecast period.

Growing prevalence of chronic diseases and technological advancements in drug delivery technologies are the key factors driving the market growth.

Ypsomed AG, BD, and SHL Medical AG are the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us