Simulation Software Market Size, Share & Industry Analysis, By Deployment (Cloud and On-premises), By Application (Product Engineering, Research & Development, and Gamification), By Industry (Automotive, Manufacturing, Electronics & Semiconductor, Aerospace & Defense, Healthcare, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

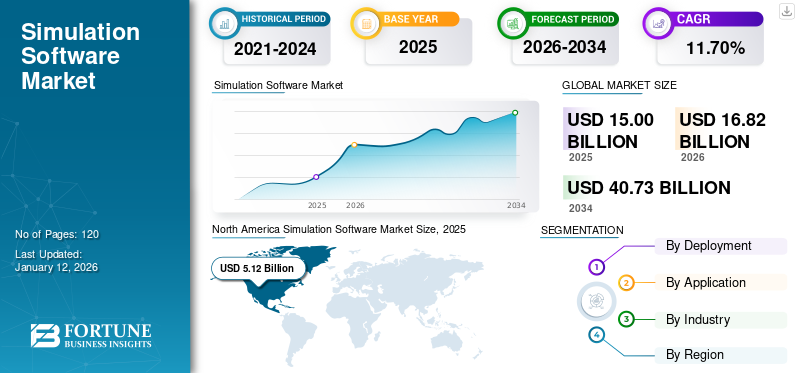

The global simulation software market was valued at USD 15 billion in 2025. The market is projected to grow from USD 16.82 billion in 2026 and reach USD 40.73 billion by 2034, exhibiting a CAGR of 11.70% during the forecast period. North America dominated the global market with a share of 34.10% in 2025.

Simulation software is a computer program that is used to design models and simulate real-world processes or systems. These software tools use mathematical algorithms and models to replicate the behaviour, characteristics, and interactions of various elements within a system.

Benefits provided by simulation software include reduced training costs, product development costs, and improved equipment/object quality and productivity, among others, are driving its adoption in various industries. Manufacturers use simulation to digitally prototype devices to design and test their functionality, quality, and usability before developing a physical device. This allows manufacturing companies to decrease product recall scenarios, which remains one of the biggest concerns for companies.

The major drivers for the growth of the simulation software market include the rapid increase in the use of simulation software in the medical sector and the increasing use of simulation tools in the automotive, electronics, and aerospace industries. The use of simulation is also increasing for a variety of applications, including engineering, modelling and mock testing, research, manufacturing process optimization, and high-fidelity experiential 3D training.

The pandemic accelerated the adoption of digital technologies across various industries. As organizations sought to optimize operations, increase efficiency, and reduce physical interactions, simulation software became a valuable tool for digitally simulating and optimizing processes, workflows, and systems. Moreover, the healthcare sector witnessed many challenges during the pandemic. In this regard, simulation tools played a crucial role in training healthcare professionals, modeling the spread of the virus, and developing strategies for patient care. Additionally, the demand for healthcare simulations, such as virtual patient models and epidemiological models surged during the pandemic, which propelled the market growth globally.

Simulation Software Market Trends

Adoption of Innovative Technologies in Simulation Tools to Propel the Market Growth

Simulation software is becoming popular among various industry verticals. The tool enables organizations to analyze and optimize performance, predictive maintenance requirements, and simulate various scenarios. Along with its growing popularity, Artificial Intelligence (AI) and Machine Learning (ML) techniques are increasingly being integrated into simulation tools to enhance predictive capabilities, automate processes, and optimize simulations. AI-powered algorithms can now analyze vast amounts of simulation-generated data, enabling organizations to gain insights, make data-driven decisions, and improve overall simulation performance.

Moreover, Virtual Reality (VR) and Augmented Reality (AR) technologies are being integrated with simulation tools to provide immersive and interactive experiences. The technologies enable users to visualize and interact with simulation in a more intuitive and engaging manner. VR and AR simulations find applications in training, education, design, and various industries such as automotive, manufacturing, and healthcare.

Download Free sample to learn more about this report.

Simulation Software Market Growth Factors

Growing Demand for Risk Reduction and Effective Decision Making in Production Plants to Boost Market Growth

Simulation software allows businesses to assess and mitigate risks associated with complex systems or processes. It helps identify potential bottlenecks, weak points, and failure modes early in the development cycle. By simulating real-world scenarios and analyzing data, companies can make informed decisions, optimize designs, and improve their products' overall reliability and safety. Moreover, the tool enables businesses to experiment with different design configurations, materials, and operating conditions without incurring additional expenses. This flexibility encourages creativity, accelerates product iterations, and drives innovation. The tool also helps industries, including manufacturing, healthcare, aerospace & defense, automotive, and others, to enhance their supply chain operations by reducing material wastage and optimizing their production systems. These factors are anticipated to drive the market growth during the forecast period.

RESTRAINING FACTORS

High Initial Deployment Cost and Complexity of the Product to Hamper Market Expansion

Simulation tools often require substantial upfront investment in terms of software licenses, hardware infrastructure, and skilled personnel. The cost of acquiring and maintaining simulation tools and the required hardware resources can be a barrier for Small & Medium-sized Enterprises (SMEs) or organizations with budget constraints. Furthermore, the installation of this tool requires specialized knowledge and expertise to operate effectively, as it involves complex algorithms and modelling techniques. Users need to understand the software’s functionalities and simulation techniques to operate and utilize the software effectively. These factors could hinder the adoption and effective use of the product.

Simulation Software Market Segmentation Analysis

By Deployment Analysis

Increasing Popularity of Cloud-based Simulation Software to Fuel Market Growth

Based on deployment, the market is bifurcated into cloud and on-premises.

The cloud segment held the maximum market share with a share of 79.85% in 2026. The segment is expected to continue its dominance by growing at the highest CAGR during the forecast period. Cloud-based simulation tools offer scalability, allowing users to scale their computational resources up or down based on their needs. Moreover, cloud-based deployment eliminates the need for organizations to invest in expensive hardware infrastructure and maintenance. Instead, users pay for computing resources and the storage that they consume on a pay-as-you-go basis.

The on-premises segment is anticipated to grow at a moderate CAGR during the forecast period. The deployment can provide better performance and lower latency for simulation tools, as the infrastructure is located within an organization’s premises.

By Application Analysis

Growing Adoption of Simulation Tools in R&D Activities to Make Research Process Cost Efficient

Based on application, the market is classified into product engineering, research & development, and gamification.

The research & development segment held the largest share in the market with a share of 54.04% in 2026.. The product allows researchers to virtually test and reaffirm designs before physical prototypes are built. By simulating different scenarios and optimizing designs digitally, R&D teams can save costs associated with physical prototyping, testing, and rework. Simulation enables faster designs, reducing the time required to bring new products or technologies to market. Additionally, the tool enables researchers to explore a wide range of design possibilities, analyzing their performance under different conditions. Owing to these features, the product is anticipated to continue its adoption in R&D activities during the forecast period.

The product engineering segment is expected to grow at a significant CAGR during the forecast period, as the simulation tool enables engineers to model and analyze a product. For instance, a mold flow simulation tool is used in injection molding processes to predict the flow of molten plastic within the mold cavity. The tool helps engineers optimize mold design, identify potential defects, improve fill balance, and minimize production issues such as warpage and shrinkage.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Design Optimization Capability of Simulation Tool to Propel its Adoption in Manufacturing

By industry, the market is categorized into automotive, manufacturing, electronics & semiconductor, aerospace & defense, healthcare, and others (education, media & entertainment).

The manufacturing segment accounted for the maximum share in the market with a share of 27.05% in 2026.. The product is utilized to optimize manufacturing processes such as machining, welding, casting, and assembly. It enables manufacturers to simulate these processes, identify bottlenecks, optimize parameters, and improve efficiency. By analyzing process variables, manufacturers can enhance production throughput, reduce scrap and rework, and optimize resource utilization. Also, the software helps manufacturers reduce the costs associated with physical prototyping and testing. Considering these factors, the adoption of simulation tools in manufacturing plays an important role in accelerating market growth.

The healthcare segment is anticipated to grow at the highest CAGR during the forecast period as simulation tools help improve patient care, enhance medical training, and streamline healthcare processes. These tools also provide a realistic and safe environment for medical professionals to practice and refine their skills. They help them learn clinical decision-making and enhance procedural competence. Thus, increasing usage of simulation tools in the healthcare industry is expected to propel market growth.

REGIONAL INSIGHTS

By region, the market is analyzed across five major regions: North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America Simulation Software Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is expected to hold a major simulation software market share during the forecast period. North America dominated the global market in 2025, with a market size of USD 5.12 billion. North American research institutions and organizations heavily rely on simulation tools for various R&D activities. The U.S. is expected to showcase significant growth as the U.S. manufacturing, energy, and utility sectors leverage simulation tools for multiple purposes, including process optimization, quality control, analyzing renewable energy integration, and simulating energy distribution networks. The growing technological advancement across all industries in the region is fueling the market growth. The U.S. market is projected to reach USD 3.69 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific is expected to grow at the highest CAGR during the forecast period. The product is gaining traction in the region’s healthcare sector for medical training, surgical planning, and patient care improvement. Medical schools, hospitals, and healthcare organizations in countries such as Japan, South Korea, and Singapore are deploying simulation tools to train medical professionals, simulate surgeries, and enhance patient safety. Thus, these factors are contributing to the growing adoption of simulation tools in the Asia Pacific. The Japan market is projected to reach USD 0.81 billion by 2026, the China market is projected to reach USD 0.88 billion by 2026, and the India market is projected to reach USD 0.66 billion by 2026.

Europe is expected to grow at a noteworthy CAGR during the forecast period. The region is home to leading automotive and aerospace industry players that heavily rely on simulation tools for product design, testing, and optimization. Simulation tools such as Finite Element Analysis (FEA), Computational Fluid Dynamics (CFD), and Multibody Dynamics (MBD) are used for vehicle and aircraft design, crash simulation, aerodynamics analysis, and structural optimization in the region. Moreover, the adoption of this software in Europe is driven by the region’s focus on innovation, sustainability, and advanced manufacturing. The UK market is projected to reach USD 0.93 billion by 2026, while the Germany market is projected to reach USD 0.83 billion by 2026.

The Middle East & Africa and South America are expected to showcase prominent growth during the forecast period. Simulation tools are widely used in the oil & gas sector in the Middle East & Africa. The tool is used for reservoir modeling, drilling optimization, process simulation, and asset management in the sector. In South America, this tool is significantly used for vehicle design, crash simulation, and performance optimization. These factors play a vital role in driving the market growth in these regions.

Key Industry Players

Key Players are Expanding their Solution Offerings to Strengthen their Industry Position

The market players are investing in advanced technologies, such as AI, machine learning, cloud, virtual reality, and augmented reality, to improve the capabilities of their platforms. They are adopting various strategies such as collaborations, partnerships, mergers, and acquisitions to expand their market presence.

List of Top Simulation Software Companies:

- Autodesk Inc. (U.S.)

- ANSYS, Inc. U.S.)

- Dassault Systemes (France)

- Altair Engineering Inc. (U.S.)

- The AnyLogic Company (U.S.)

- Flex Ltd. (Singapore)

- Rockwell Automation, Inc. U.S.)

- Bentley Systems, Inc. (U.S.)

- Simulations Plus (U.S.)

- MathWorks, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- November 2023 – Mitsubishi Electric Corporation partnered with Visual Components, based in Espoo, Finland. The move focused on forming a joint venture, ME Industrial Simulation Software Corporation, to improve and sell 3D simulators for manufacturing applications. As per the agreement, Mitsubishi Electric would hold a 70% stake and Visual Components would hold a 30% stake.

- July 2023 – Vueron, a provider of Light Detection and Ranging (LiDAR) software, partnered with Cognata, a provider of vehicle simulation software. Through this partnership, the company would enhance its LiDAR perception software for autonomous driving systems.

- January 2023 – Ansys Inc., a prominent software company, acquired a simulation software provider Rocky DEM. Through this acquisition, Ansys will incorporate the Discrete Element Method (DEM) tool in its portfolio and expand its geographical presence in the U.S., Brazil, and Spain.

- December 2022 – Ansys Inc. engaged into a definite agreement to acquire DYNAmore Holding GmbH, an automotive simulation provider company. Through this acquisition, Ansys intended to expand its product portfolio and customer base in Europe.

- June 2022 – VI-grade, a driving simulator company, released its 2022.1 software products, including VI-CarRealTime, VI-WorldSim, and VI-DriveSim for driving simulators to accelerate product innovation

REPORT COVERAGE

The market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading product applications. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.70% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Application

By Industry

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market is projected to reach USD 40.73 billion by 2034.

In 2025, the market size stood at USD 15 billion.

The market is projected to grow at a CAGR of 11.70% during the forecast period.

By application, the research & development segment is expected to lead the market.

The growing demand for risk reduction and effective decision-making in production plants is expected to drive the market growth.

ANSYS, Inc., Dassault Systemes, Flex Ltd., Autodesk, Inc., Altair Engineering Inc., Simio LLC, and The AnyLogic Company are the top players in the market.

North America is expected to hold the largest market share over the forecast period.

By industry, the healthcare segment is expected to grow with the highest CAGR over the analysis period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us