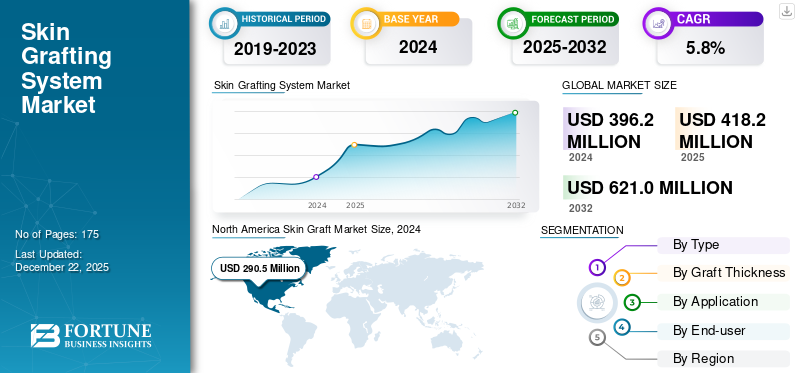

Skin Graft Market Size, Share & Industry Analysis, By Type (Allograft and Xenograft), By Graft Thickness (Split-Thickness, Full-Thickness, and Composite Graft), By Application (Burns, Cancer Reconstruction, Infections and Ulcers, and Others), By End User (Hospitals, Specialty Clinics, and Research and Academic Centers), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global skin graft market size was valued at USD 418.2 million in 2025. The market is projected to grow from USD 441.7 million in 2026 to USD 699.2 million by 2034, exhibiting a CAGR of 5.90% during the forecast period. North America dominated the skin graft market with a market share of 73.40% in 2025.

Skin grafting is the surgical technique of transferring skin tissue from a donor site to resurface an area where there is damaged or missing skin. The skin grafts are generally classified as autografts, allografts, and xenografts. Autografts are considered to be the gold standard owing to their superior compatibility and minimal rejection rate. Allografts and xenografts provide the benefits of off-the-shelf options, and synthetic and bioengineered grafts are intended to transcend availability limitations, offering wound cover or temporary covers to facilitate healing.

The market for skin grafts is witnessing rapid growth owing to rising rates of burns, chronic wounds, and increased focus on reconstructive surgery. Moreover, advances in graft materials and biomaterials are also set to contribute positively to market growth. Additionally, rising traffic and occupational accidents worldwide are also projected to offer a substantial opportunity for market growth. Furthermore, aging populations in developed nations, who are prone to chronic ailments with impaired healing, are likely to generate a considerable demand for better wound management solutions, thereby driving the growth of the skin graft market.

A few of the key players in the market include MIMEDX Group, Inc., MTF Biologics, and Tissue Regenix. Such players are focusing on technological development, significant investments, and strategic agreements in order to hold a significant share of the market.

MARKET DYNAMICS

Market Drivers

Substantial Growth in Prevalence of Burn Injuries and Skin Traumas to Accelerate Market Growth

The growing incidence of burn injuries and skin trauma cases globally is a primary driver for the skin graft market. Moreover, increasing industrialization in low- and middle-income countries has led to a rise in workplace accidents, significantly increasing the demand for skin graft procedures.

- For instance, according to data published by the World Health Organization, an estimated 180,000 deaths annually are caused by burns, with millions more suffering non-fatal injuries.

In addition, the rise in cosmetic and reconstructive surgeries, such as post-tumor excision, trauma repair, or congenital deformities, is further estimated to have a positive impact on the skin graft market. Furthermore, medical education and awareness campaigns promoting early surgical intervention in burn care are encouraging greater adoption of skin grafts in both emergency and long-term care scenarios, helping to sustain the demand for grafting procedures globally.

Market Restraints

Limited Availability of Donor Sites to Hamper Market Growth

The limited availability of healthy donor sites in patients requiring large or multiple grafts is projected to deter the market growth. This is particularly critical in the case of severe burns covering more than 50% of the total body surface area, where harvesting autologous skin becomes impractical. In addition, donor site morbidity, pain, and the risk of secondary infections offer major limitations to the use of skin grafts.

Further, hospitals in low-resource settings lack the necessary infrastructure, trained personnel, and sterile environments required for safe skin graft harvesting and transplantation, further restricting market reach. These clinical and logistical limitations, combined with patient discomfort and the potential for poor aesthetic outcomes, act as significant barriers to widespread skin graft adoption.

Market Opportunities

Penetration of Skin Grafting in Emerging Nations to Offer Lucrative Opportunity for Market Growth

Extensive focus on penetration of skin grafting technology in low and middle income countries to offer a significant opportunity for global skin graft market growth during the forecast period. Patients with burns and traumas in much of developing countries lack timely visits and proper treatment options. Offering skin grafting in healthcare institutions, the company offers a substantial opportunity for market growth by catering to the demand for burns treatments in these countries.

- For instance, according to data published by the Directorate General of Health Services in November 2024, an estimated 6 to 7 million people in India suffer from burns per year in India.

Furthermore, innovations in minimally invasive harvesting tools and portable surgical kits are making skin graft procedures more scalable and safer for use in decentralized healthcare settings. There’s also an opportunity to improve graft site regeneration techniques to allow repeated harvesting from the same donor area. This would be particularly useful in pediatric cases or in burn victims with limited healthy skin.

Market Challenges

High Cost and Reimbursement Issues to Offer Significant Challenge to Market Growth

High cost and pressure on reimbursement are some of the key challenges for the skin graft market. The market is witnessing a considerable financial burden on patients due to the high cost of skin grafts and the overall procedure. Moreover, limited shelf life, with demanding storage, generates risk of wastage, driving additional costs. For instance, the average cost of allografts can range from USD 10,000 to USD 25,000 from cultivation to surgical procedure.

Moreover, there is a challenge of consistency in the treatment outcome of the skin grafts. While some patients recover promptly, however, those with comorbidities such as diabetes or infection respond poorly.

- For instance, according to a study published in Menoufia Medical Journal in February 2025, an estimated 20% of the population with diabetic foot ulcers failed to recover from the wound after applying a skin graft.

SKIN GRAFT MARKET TRENDS

Shift of Preference for Bioengineered and Synthetic Skin Grafts to be a New Market Trend

There is a gradual shift of preference from traditional skin grafts to bioengineered skin grafts. Hospitals and clinics are moving toward the use of xenografts, allografts, and lab-grown replacements instead of strictly adhering to classic grafting. Such high-end products work toward superior ulcer, chronic wound, and burn healing and decreased complications. In addition, steady interest is also being seen in 3D bioprinted and stem-cell-based skin substitute products, providing natural integration and patient-specific therapy.

- For instance, in May 2025, Concord Burns Unit in Australia announced the world's first clinical trial for the implantation of 3D printed skin of the patient’s own cells.

Moreover, healthcare providers are also focusing on the utilization of products with longer shelf life and easier handling, with minimal wastage.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Type

Product Approvals and Extensive Benefits of Allografts Boosted Allograft Segment Growth

Based on type, the market is segmented into allograft and xenograft.

The allograft segment dominated the market in 58.52% 2026. Certain factors, such as a rising number of product launches, increasing awareness of allografts, and a growing number of product approvals, are estimated to accelerate segment growth.

- For instance, in May 2025, Kolosis BIO and MTF Biologics announced the launch of new allografts for the treatment of cardiac conditions. The new allografts are intended to be used for cardiac surgeries.

On the other hand, the xenografts segment is projected to exhibit a considerable CAGR owing to comparatively lower cost, wide availability, and enhanced clinical utility. Additionally, growing awareness in emerging markets and government initiatives are also estimated to expand burn care access.

To know how our report can help streamline your business, Speak to Analyst

By Graft Thickness

Superior Benefits of Split-Thickness on Burns to Accelerate Segment Growth

Based on graft thickness, the market is segregated into split-thickness, full-thickness, and composite grafts.

The split-thickness held a significant portion of the market in 66.58% 2026 due to its quick healing capabilities and superior wound closer facilities. In addition, the low risk of graft failure is also projected to accelerate segment growth by 2032. Moreover, split-thickness grafts are considerably used by the majority of hospitals worldwide as a first-line choice of therapy on large wound surfaces.

Composite grafts are expected to register the fastest growth. These grafts easily combine skin with other tissue components such as cartilage or fat. This functionality of composite grafts is beneficial for reconstructive surgeries for areas such as the nose, ears, and eyelids, where structural support and cosmetic outcomes are critical. Moreover, rising demand for advanced aesthetic reconstruction, coupled with expanding surgical expertise, is boosting the adoption of composite grafts across both developed and emerging markets.

By Application

High Utilization of Skin Grafts for Burns Due to Its Superior Benefits Boosted Segment Growth

Based on application, the market is fragmented into burns, cancer reconstruction, infections and ulcers, and others.

The burns segment dominated the global skin graft market in 76.91% 2026 and is expected to expand at the fastest CAGR during the forecast period. The segment growth is attributed to the substantial adoption of skin grafts for the treatment of burn injuries. High prevalence of burns across the globe offers a significant opportunity for its adoption during the forecast period.

- For instance, in October 2021, UC Health announced the introduction of new treatments for burn injuries. The new treatment focuses on regenerative medicine technology with the help of a skin grafting procedure.

The infections and ulcers segment is estimated to register considerable growth during the forecast period. Substantial prevalence of infections and ulcers to boost segment growth by 2032.

By End-user

Availability of Sufficient Resources in Hospitals Boosted Hospitals Segment Growth

By end-user, the market is segmented into hospitals, specialty clinics, and research and academic centers.

The hospital segment dominated the global skin graft market in 64.36% 2026 and is expected to expand at the fastest CAGR during the forecast period. Hospitals are capable of managing the greatest number of patients, which makes them the natural choice for high-volume skin graft operations. Hospitals are usually the preferred destination in emergency situations, where there is a need for instant grafting in order to preserve life and avoid harm. Their structured infrastructure, high-technology surgical facilities, and higher bargaining power help them dominate the segment on a global scale.

The specialty clinics segment is likely to record significant growth during the forecast period. These centers are usually specialized in dermatology, plastic surgery, and wound care. Also, such centers are gaining popularity among patients who opt for procedures that are readily available, less time-consuming, and outside of a hospital setup.

SKIN GRAFT MARKET REGIONAL OUTLOOK

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Skin Graft Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market in 2025, with the regional market standing at USD 306.8 million in 2025. The growth of the North America skin graft market is attributed to its mature healthcare industry, presence of skin graft manufacturing companies, and substantial prevalence of burn injuries. The U.S. market is projected to reach USD 306 billion by 2026.

The U.S. market growth is attributed to a focus on reconstructive surgeries, a high burden of chronic wounds, and advanced healthcare infrastructure. In addition, an increasing number of product launches is also projected to have a positive impact on the market growth during the forecast period.

- For instance, in February 2025, LifeNet Health announced the launch of its new product, OraGen. It is a dental bone graft intended for dental regeneration.

Europe

The market in Europe held a significant share in 2024 and continues to be a key region in the skin graft market, driven by an increasing number of product approvals and industry developments. Moreover, countries such as Germany, the U.K., and France are witnessing heightened demand for reconstructive surgeries due to the effectiveness of skin grafts on chronic wounds. The U.K. market is projected to reach USD 13.4 billion by 2026, while the Germany market is projected to reach USD 10.9 billion by 2026.

- For instance, in April 2023, ZimVie Inc. announced the launch of RegenerOss Bone Graft Plug and RegenerOss CC allograft particulate.

Asia Pacific

Asia Pacific is expected to witness the highest CAGR during the forecast period, making it the fastest-growing region in the market, driven by increasing awareness of the benefits offered by skin grafts and the entry of international companies in the region. The Japan market is projected to reach USD 11.6 billion by 2026, the China market is projected to reach USD 10.5 billion by 2026, and the India market is projected to reach USD 6.6 billion by 2026.

- For instance, in January 2023, MIMEDX announced the launch of EPIFIX in Japan. The company has signed a distribution agreement with GUNZE MEDICAL LIMITED for this product.

Latin America and Middle East & Africa

Latin America and the Middle East are gradually gaining momentum in the skin graft market. In Latin America, countries such as Brazil are witnessing growth due to the increasing incidence of burns and chronic wound conditions. In the Middle East and Africa, countries are focusing on investments in healthcare infrastructure and medical manufacturing, driving demand for novel technologies for skin restructuring.

- For instance, according to the data published by investdubai.gov.ae, Dubai aimed to attract USD 2.5 billion worth of investments in manufacturing industries and pharmaceutical research in 2022.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Players Emphasize Expansion to Boost their Market Share

The global skin graft market is semi-consolidated, with MTF Biologics accounting for the maximum share in the global market due to its wide range of service portfolio. The increasing focus on facility expansion of prominent players and the growing number of product launches are responsible for the substantial market shares of the companies. Additionally, other players such as Tissue Regenix, Lifenet Health, Evergen, and MIMEDX Group and others are also actively engaged in order to expand their percentage in the global skin graft market. The industry is witnessing a rising trend of acquisitions and mergers, with key players seeking to consolidate their position and boost their contribution in the global skin graft market share.

LIST OF KEY SKIN GRAFT MARKET COMPANIES PROFILED

- AlloSource (U.S.)

- MTF Biologics (U.S.)

- Promethean LifeSciences, Inc. (U.S.)

- Tissue Regenix (U.K.)

- LifeNet Health (U.S.)

- Australian Biotechnologies (Australia)

- Evergen (U.S.)

- Flower Orthopedics Corporation (U.S.)

- Hospital Innovations (U.K.)

- Kerecis (Iceland)

KEY INDUSTRY DEVELOPMENTS

- June 2025: A group of researchers from Sheba Tel Hashomer Medical Center and Tel Aviv University (TAU) announced the launch development of bioengineered skin, especially for burn injury patients.

- April 2025: CUTISS entered into a strategic collaboration with Tecan with the aim of developing bioengineered human skin tissue. The duo is planning to incorporate automation in the manufacturing process.

- July 2025: Polynovo announced its plan to expand its manufacturing facility to boost graft production.

- December 2024: Kerecis announced the launch of a silicone-fish combination graft for surgical and trauma cases. The product enables repairing of soft-tissue repair.

- July 2024: MiMedx Group, Inc. announced the launch of HELIOGEN collagen grafts. The product is designed for the treatment of complex wounds.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.90% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type · Allografts · Xenografts |

|

By Graft Thickness · Split-Thickness · Full-Thickness · Composite Graft |

|

|

By Application · Burns · Cancer Reconstruction · Infections and Ulcers · Others |

|

|

By End-user · Hospitals · Specialty Clinics · Research and Academic Centers |

|

|

By Region · North America (By Type, Graft-thickness, Application, End-user, and Country) o U.S. o Canada · Europe (By Type, Graft-thickness, Application, End-user, and Country/Sub-region) o Germany o U.K. o France o Spain o Italy o Rest of Europe · Asia Pacific (By Type, Graft-thickness, Application, End-user, and Country/Sub-region) o China o Japan o India o Australia o Rest of Asia Pacific · Latin America (By Type, Graft-thickness, Application, End-user, and Country/Sub-region) o Brazil o Mexico o Rest of Latin America · Middle East & Africa (By Type, Graft-thickness, Application, End-user, and Country/Sub-region) o GCC o South Africa · Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 418.2 million in 2025 and is projected to reach USD 699.2 million by 2034.

In 2025, the market value stood at USD 306.8 billion.

The market is expected to exhibit a CAGR of 5.90% during the forecast period (2026-2034).

By type, the allograft segment led the market.

The key factors driving the market are the increasing prevalence of burns and the rising number of product launches in the global market.

Kerecis (Coloplast), LifeNet Health Inc., and MTF Biologics are the top players in the market.

North America dominated the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us