Smart Flooring Market Size, Share & COVID-19 Impact Analysis, By Component (Hardware, Software), By End-user (Commercial, Residential), By Application (Healthcare & Rehabilitation, Gaming & Sports, Security, Retail, Smart Homes, Others (Malls, Event Centers)), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

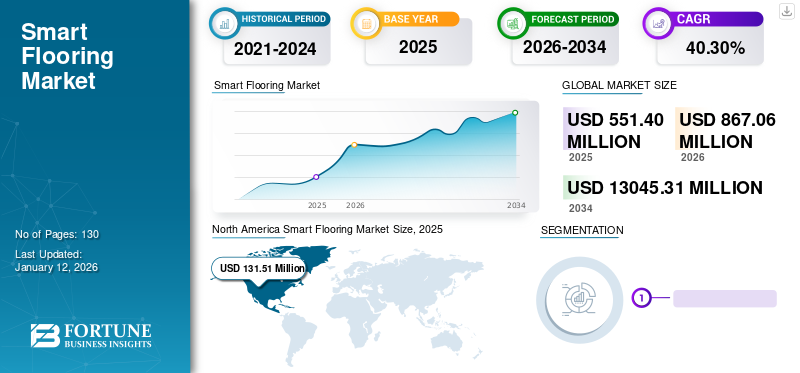

The global smart flooring market size was valued at USD 551.4 million in 2025 and is projected to grow from USD 867.06 million in 2026 to USD 13,045.31 million by 2034, exhibiting a CAGR of 40.30% during the forecast period. North America dominated the global smart flooring market with a share of 35.70% in 2025.

Smart (intelligent) flooring is an integrated sensor & microelectronics underlay that can be deployed under any kind of flooring such as carpet, PVC, and laminate. It enables users to track people's speed, falls, spills, and gait without any need for pressure-based sensors. In addition to monitoring movements, some advancements also enable electricity generation. With such innovative features, the technology is being implemented in various areas by key players in the market. For instance,

- In November 2021, the Pavegen pathway was installed at COP26 UNFCCC Pavillion. COP26 was a platform where Mark Carney and Mike Bloomberg discussed the U.K.'s approach toward sustainability. Every footstep across the array produced 2-5 joules of kinetic energy, turning into cash donations to help ocean clean-up charities.

With high-tech enhancements in the market, the growth of the global smart flooring market share can be attributed to several sectors, such as gaming, sports, healthcare, malls, and musical events.

COVID-19 IMPACT:

The COVID-19 pandemic surged the demand for smart home products, and awareness regarding these products increased during this period. According to a survey, around 80% of consumers were unaware of smart home technology before the pandemic. Social distancing became the norm during the outbreak and products, such as smart cameras and smart security systems, gained traction across residential and commercial spaces.

The adoption of smart building technologies and connected equipment increased with the enforcement of new policies during the pandemic. The ability of smart building technologies helps to monitor and implement these policies, thus improving building efficiency.

Smart floors - one of the elements of smart buildings - also gained popularity during the pandemic as they ensured the safety of customers while lining up for coffee and food. For instance, the Australian Graphene Industry Association introduced On-Q-Mat, which used state-of-the-art technology to ensure social distancing.

Hence, smart flooring ensured social distancing during the pandemic. However, post-pandemic, the technology solutions will gain traction in residential and commercial spaces for various applications.

LATEST TRENDS:

Download Free sample to learn more about this report.

Smart Floors across Retail Sector and Kinetic Dance Floors to Augment Market Growth

Smart floors capture kinetic energy from human movement and transform it into electrical energy. This technology is being used on dance floors to generate electricity. As more companies are leaning toward sustainability, intelligent flooring solutions have gained immense popularity in recent years. According to the United Nations, heat and electricity generation is the most significant source of global greenhouse gas emissions, accounting for about 35%.

Along with key players, governments across the world have also recognized the importance of kinetic dance floors, which can harness power and generate electricity. Governments in several countries have started different initiatives to regulate the power of kinetic dance floors. For instance,

- In December 2022 – A one-day event was organized by the Petroleum and Natural Gas Ministry of India, where renewable energy was generated through dance. The power generated through these floors was used to charge electric automobiles.

These initiatives are steadily impacting the market growth.

DRIVING FACTORS:

Rising Awareness of Benefits of Smart Flooring Solutions is Driving Market Growth

On the component level, floor sensors are mounted on devices to generate data. This data is used for several purposes, from people management to energy conservation.

IoT sensors have been popular in smart homes and buildings, typically installed in equipment or ceilings. However, with the recent advancements in IoT technology, users are becoming aware of the benefits of smart floors.

Furthermore, key vendors in the market are constantly partnering and merging with leading smart flooring companies to enhance their solution capabilities. This strategy combines the best of their expertise with the acquired firm's capabilities. As the market is still emerging, the vendors aim to develop their solutions according to their customers’ changing requirements.

Smart flooring technology also has potential applications in hospitals and other related medical facilities including retirement homes. This technology helps medical staff monitor a patient's condition in real-time, allowing them to follow their rehabilitation progress or know when a patient falls on the ground.

RESTRAINING FACTORS:

High Cost of Installing Relevant Software Likely to Curb Market Growth

Smart flooring is a sensitive floor system comprising sensors, walkable solar panels, interactivity, and big data. It uses lots of smaller circuits to integrate the larger ones. This dramatically increases the cost of integration and installation.

As the technology is still new and in its nascent stage, the installation cost of smart flooring is much higher than that of the traditional flooring system. This factor limits the implementation of this technology within small- and medium-sized enterprises and personalized home care systems.

SEGMENTATION

By Component Analysis

Surge in Use of Smart Fabrics and Smart Carpets to Enhance Adoption of Hardware

There are two components in the smart flooring market - hardware and software. Hardware segment is expected to hold the maximum share during the forecast period.

In 2026, the Hardware segment is projected to lead the market with a 66.52% share. Numerous applications of hardware solutions, such as sensors, smart fabrics, smart mats, and smart carpets, are driving their adoption. Various players and institutes in the industry are innovating their products by using smart technology. For instance,

- In June 2021, MIT (Massachusetts Institute of Technology) introduced an intelligent carpet that gives insights into human behavior. The carpet’s sensors transform kinetic energy produced by human movements into an electrical signal that helps in power generation. The smart carpet can be used in smart homes, healthcare centers, and gaming for self-powered personalized use.

These innovations will fuel the smart flooring market growth.

By End-user Analysis

Rising Usage of Smart Floors in Commercial Sector Will Drive Market Expansion

Smart flooring solutions are being used in commercial as well as residential. The commercial segment generated the highest revenue for the market in 2024, and might record the highest CAGR during the analysis period.

The Commercial segment is forecast to represent 76.06% of total market share in 2026. Corporate offices and plazas are more inclined toward adopting smart technologies as they provide an effective way for office staff to manage the functional space of these establishments. As the data can be directly sent to the control center or a mobile dashboard, it enables managers to monitor the building from any location.

The residential segment is also considerably growing due to rising requirements for personalized smart technologies for senior living and smart homes. Various key players in the market are forming alliances to deliver enhanced solutions. For instance,

- In November 2021, Scanalytics announced its partnership with Ardex, one of the leading developers of high-performance building materials, to provide residential and commercial applications in intelligent flooring. The partnership leverages the existing data, software, and floor-sensing solutions along with Ardex’s intelligent floor systems.

- In October 2022, Cini, Mosaic Design Studio's CEO, renovated an Opera-style mansion in Columbus for senior living. The renovation comprised high-tech technologies specially designed for senior living including smart flooring, lighting design, and many other facilities.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Usage of Smart Floors in Healthcare & Rehabilitation Fuels Market Progress

Smart flooring solutions are being used for different applications such as healthcare & rehabilitation, gaming & sports, retail, security, smart homes, and others.

As per FBI analysis, the healthcare & rehabilitation segment accounted for the largest market with a share of 23.77% in 2026. With easier & faster fall detections, enhanced safety & security, and proactive care, the usage of intelligent flooring in nursing homes and care homes has increased substantially. Various care homes and senior living centers have started installing smart floors to provide better facilities. For instance,

- In May 2022, Future-Shape started the construction of a new care facility in Traunreut, Germany along with its project partners. The energy-saving house project is estimated to be ready by the end of 2023. The advanced assistance system ‘SensFloor’ is mounted beneath the floor, taking care of senior citizens 24/7 and conveying immediate alerts to the caretakers.

The gaming & sports segment will likely record the maximum CAGR during the forecast period. The growing popularity of physical games among youth and children is expanding the applications of intelligent flooring solutions. Key players, such as Energy Floors and Pavegen, have designed and developed smart floors specifically for gamers.

REGIONAL INSIGHTS

North America Smart Flooring Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The market is geographically studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific, and each region is further studied across countries.

According to our research, North America dominated the market with a valuation of USD 191.73 million in 2025 and USD 294.46 million in 2026, owing to emerging smart technologies and the rising adoption of smart buildings in the region. North America is also a prominent place for top events, such as music festivals, sports leagues, and product or service launches, thereby boosting the scope of intelligent flooring applications in the region. This is why key players in the market are expanding their reach in the North America region. The U.S. market is valued at USD 231.36 million by 2026. For instance,

- In November 2021, Scanalytics received a contract from the U.S. Department of Energy ARPA-E (Advanced Research Projects Agency-Energy) to improve the utility usage and occupant comfort in buildings. The contract came up with a total funding of USD 2.1 million since the start of the project. The company received the plus-up contract after proficiently completing the first project with the ARPA-E sensor program.

The report also indicates that Asia Pacific will witness the highest CAGR during the forecast period. The increasing adoption of smart buildings in countries, such as India, Singapore, China, Malaysia, and others, will cater to the demand for smart technologies in the region. The region also has a vast presence of emerging tech-based start-ups that contribute toward technological developments in various countries across the region. The Japan market is valued at USD 56.14 million by 2026, the China market is valued at USD 76.63 million by 2026, and the India market is valued at USD 15.47 million by 2026.

With the presence of key players, such as Pavegen, Future-Shape GmbH, among others in Europe, the region has seen significant growth in the market. Government initiatives and technological advancements introduced by these leading companies are driving the European market growth. The UK market is valued at USD 36 million by 2026, while the Germany market is valued at USD 40.97 million by 2026. For instance,

- Green Pea, a shopping center in Italy, is the first shopping mall in the world built with sustainable solutions and materials. All the entrances in the mall are installed with energy floors. These floors transform kinetic energy generated from human movements into electricity.

The Middle East & Africa region is predicted to show moderate growth during the forecast period. The region is inclined toward reducing carbon emissions and adopting smart technologies, thereby increasing the demand for energy-efficient smart building solutions. According to a report by the IDC, MEA’s annual investments in smart city technologies reached USD 2.3 billion in 2021. Such hefty investments will create growth opportunities for advanced technologies, such as smart homes and smart flooring.

South America is the most rapidly urbanizing region, and according to research, around 90% of citizens in South America will live in cities by the end of 2050. The region has witnessed significant investments in public infrastructure projects that exhibit the high usage of Internet of Things in intelligent solutions. Thus, South America is estimated to have considerable growth during the analysis period.

KEY INDUSTRY PLAYERS:

Increasing Focus on Global Expansion to Strengthen Key Players’ Market Position

The key players are keen on developing smart technologies in numerous applications, such as gaming & sports, retail, rehabilitation, and security. Securing funds to streamline smart building technologies is one of the key strategies enterprises adopt. Likewise, market players strategically collaborate and form alliances worldwide for global expansion.

List of the Key Companies Profiled:

- Pavegen (U.K.)

- Future-Shape Gmbh (Germany)

- Scanalytics Inc. (U.S.)

- Energy Floors (Netherlands)

- MariCare (Finland)

- Technis SA (Switzerland)

- Wixalia (France)

- American Pro Marketing, LLC. (Smart Step) (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- In February 2023, Warewell LLC announced that it had added anti-fatigue matting of Smart Step to its product portfolio. This will help Smart Step serve more markets and expand its reach in different countries. Industrialized and non-industrialized consumers will benefit from Smart Step's lay-flat design, solid construction, and color collection.

- In July 2021, Technis introduced the new Outdoor SmartMat solution for theme parks, home gardens, sports, and other art festivals. The new Outdoor SmartMat is waterproof and can be used for both indoor and outdoor events. The new innovation installs counting solutions over strategic areas for evaluating specific events.

- In September 2020, Technis received funding to enhance its growth strategies. The investment allowed the lead investor, m3 GROUPE, to become an exclusive provider of Technis’ solutions in Switzerland. The company also expanded its reach by opening its first office in Paris.

- In September 2020, MariCare announced the integration and certification of its Elsi smart floor solutions with Skyresponse. The integration provided value to all the partners within Skyresponse with the advantage of using MariCare's solutions. Skyresponse AB is a SaaS (Software as a Service) company that provides cloud-based alarm management systems and related facilities.

- In April 2020, Technis launched the Stop&Go terminal to complete its real-time flow management solution. The digital terminal independently regulates the movement of people for entry and exit. The Stop passage display system is used to detect the limit of carrying capacity. The terminal can be used in supermarkets, public places, offices, sports halls, restaurants, or universities to regulate the movement of people.

REPORT COVERAGE

The study on the market includes prominent areas globally to gain enhanced insights into various industrial sectors. Additionally, the research provides an understanding of the recent industry developments and evaluates modern solutions being adopted globally. It also highlights some growth-stimulating boundaries and components, allowing the reader to obtain an all-inclusive understanding of the market.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 40.30% from 2026 to 2034 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Component, End-user, Application, Region |

|

By Component |

|

|

By End-user |

|

|

By Application |

|

|

By Region |

|

Frequently Asked Questions

The market is projected to reach USD 13,045.31 million by 2034.

In 2025, the market stood at USD 551.4 million.

The market is projected to register a CAGR of 40.30% in the forecast period of 2026-2034.

The gaming & sports application segment is likely to lead the market.

Energy-generating kinetic dance floors will boost the sale of the product.

Pavegen, Future-Shape GmbH, Energy Floors, Technis SA, and MariCare, among others, are the top players in the market.

North America is expected to hold the highest market share.

Healthcare has the largest market share by application.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us