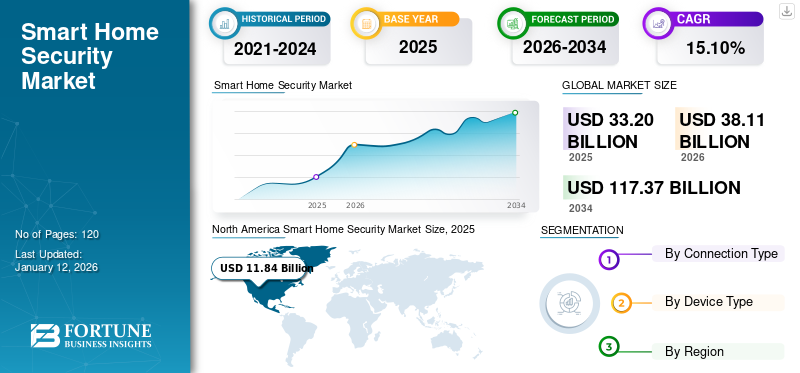

Smart Home Security Market Size, Share & Industry Analysis, By Connection Type (Wired and Wireless), By Device Type (Smart Camera Systems, Smart Alarms, Smart Sensors and Detectors, Smart Locks, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

The global smart home security market size was valued at USD 33.2 billion in 2025 and is projected to grow from USD 38.11 billion in 2026 to USD 117.37 billion by 2034, exhibiting a CAGR of 15.10% during the forecast period. North America dominated the global market with a share of 35.70% in 2025.

A smart home security system is an automatic system that uses a network of interconnected components and devices to protect the house. This system is capable of monitoring all possible damages, such as home invasions, break-ins, fire, flood, or other environmental disasters. The system relies on a combination of sensors that communicate via radio frequency or cable with the central controller, which then communicates with the external world. According to Dream Casa, in 2022, at least 72% of millennials said that they were willing to pay more if a property was already equipped with smart home systems.

Download Free sample to learn more about this report.

The market’s growth is expected to be driven by rising awareness of and concerns for home security, and developments in connectivity and IoT technologies. The product demand is increasing due to the requirement of remote monitoring and control features that allow homeowners to access and use their security systems via their mobile phones or tablets from any location. Moreover, the integration of these security systems with home automation systems is expected to drive market share.

The expansion of the market was significantly affected by the COVID-19 pandemic. During this period, global sales fell sharply as a result of production delays and temporary shutdowns of transport systems.

IMPACT OF GENERATIVE AI

Advanced Capabilities of Generative AI for Home Security Fueled Market Growth

Generative AI has the potential to make daily life more convenient, efficient, and secure when integrated with the smart home security ecosystem. By continuously observing unusual activity, this form of AI can help enhance the security of smart homes. It is capable of detecting possible security violations and taking proactive precautions to protect the house.

Generative AI has created a positive impact on the market as it helps detect potential threats easily and distinguish between familiar faces and potential intruders by leveraging technologies, such as motion detection, ML, and facial recognition. Moreover, the market for smart home security is on track to attain its most substantial level of transformative change as major language models are being developed to support generative AI.

Smart Home Security Market Trends

Rapid Adoption of Do-It-Yourself (DIY) Solutions in Smart Home Security to Emerge As Key Trend

The growth of this market is driven by the rapid acceptance of DIY solutions. DIY smart security systems are becoming a huge success due to their ease of installation, affordability, and empowerment for the consumer in securing their home. These DIY systems provide users with the convenience of remote monitoring and real time alerts on their mobile devices. It keeps them connected to their homes, which brings them peace of mind when they are not present. It can easily be expanded or upgraded as needed.

Adapting to the changing security requirements, users can start with a basic setup and add more devices over time. The rapid adoption of DIY solutions is expected to continue driving this market as consumers seek accessible and cost-effective ways to increase security in their homes. This trend will encourage homeowners to participate actively in the protection of their homes, which will contribute to the smart home security market growth.

Smart Home Security Market Growth Factors

Rising Awareness of and Concerns for Home Security to Aid Market Growth

The growth of the smart home security market is driven by increasing awareness of and growing concern over home safety. As the threat of crime continues to grow, homeowners are increasingly looking for robust security measures to safeguard their homes. This increase in awareness is a direct response to the pressing need for real time monitoring and immediate alerts, which has led to the adoption of advanced smart home security systems. In 2023, according to Alarms.org, if homeowners do not have a security system, the probability of burglary goes up by 300%.

The need for proactive security solutions has been underlined by the evolution of the threat landscape, ranging from burglary to unauthorized entry. Technological solutions that not only provide immediate protection, but also continuous supervision are being increasingly favored by homeowners.

RESTRAINING FACTORS

High Initial Costs and Affordability Barriers to Hinder Market Expansion

Due to the comparatively higher starting costs related to the implementation of wide-ranging security systems, the market is facing challenges in its growth. For many capable consumers, mainly in price-sensitive markets, affordability remains a major obstacle. Budget-conscious individuals are likely to be influenced by the cost of buying and installing advanced security equipment, together with subscription fees for tracking services, to adopt such solutions. Market players need to focus on affordable product development, discover innovative pricing strategies, and make consumers aware about the long-term value of smart homes to overcome this challenge.

Smart Home Security Market Segmentation Analysis

By Connection Type Analysis

Strong Encryption for Security and Reliability of Wired Systems Boosted Market Growth

Based on connection type, the market is segmented into wired and wireless.

The wired segment held a dominant position in the market with a market share of 55.97% in 2026. Wired systems are reliable and deploy strong encryption to protect signal security. They are connected to a home via a phone or electricity system and require professional installation. These systems are less susceptible to interference and hacking, making them a popular choice for those prioritizing stability and strong home security.

The wireless segment is expected to record the fastest growth rate in the coming years. Smart home security systems have started incorporating wireless technology for ease of installation and flexibility. The system can be monitored and controlled remotely through smartphone apps. Due to their beneficial features, the popularity of wireless security systems has grown. Moreover, they make life easier for building owners by using wireless alarm systems in apartments.

By Device Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Smart Camera Systems Segment Dominated Market Owing to Continuous Development of Cutting-edge Technologies

Based on device type, the market is categorized into smart camera systems, smart alarms, smart sensors & detectors, smart locks, and others.

In 2023, the smart camera systems segment dominated by holding the largest smart home security market share of 32.62% in 2026. These systems offer visual insights into homes, enabling virtual remote monitoring from any location due to the continuous development of cutting-edge technologies. Smart camera systems offer a variety of uses, including threat detection, crime deterrence, enhanced customer service, optimized operation, and data collection for business intelligence. Advances in technologies, such as ML, AI, and computer vision are enhancing the reliability and accuracy of these surveillance systems, thereby enabling the automation of tasks and offering real time alerts.

The smart sensors & detectors segment is expected to record the highest CAGR during the forecast period. These devices are an essential part of control and monitoring mechanisms, providing a wide range of applications in various scenarios including combat reconnaissance, smart grids, exploration, and scientific research. Smart sensors and detectors are designed to detect specific events or changes in the home environment and trigger automated responses.

REGIONAL INSIGHTS

Based on geography, the market has been studied across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

North America

North America Smart Home Security Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America held the dominant share in 2026 valuing at USD 13.31 Billion and also took the leading share in 2025 with USD USD 11.84 Billion. The market’s growth in the region is expected to be stimulated by the development of advanced technological security capabilities and rising adoption of Internet of Things (IoT) technology. According to the global Web Index Smart Home 2021, in the U.S., around 19% of internet users owned smart home products, and in Canada, around 18% of internet users owned these products. Moreover, approximately 17 million households in North America use smart home devices. The global web index also states that in 2022, more than 6.7% of the U.S. households had used smart home devices compared to 2021. As per the Smart Home Stats, in the U.S., homeowners save up to USD 98 by using smart devices at home, and around 57% of Americans said that using smart devices in their homes saves their time. These factors are bolstering the regional market’s growth. The U.S. market is projected to reach USD 7.53 billion by 2026.

Europe

The UK market is projected to reach USD 1.39 billion by 2026, while the Germany market is projected to reach USD 1.66 billion by 2026.

Asia Pacific

Asia Pacific is estimated to record the fastest growth rate in the coming years. This growth is anticipated to be driven by the widespread adoption of advanced autonomous technologies and the increasing popularity of digitalization in this region. These factors will provide lucrative market opportunities. The Japan market is projected to reach USD 1.3 billion by 2026, the China market is projected to reach USD 2.26 billion by 2026, and the India market is projected to reach USD 1.3 billion by 2026.

Middle East & Africa

The Middle East & Africa might record the second-highest CAGR in the future. This growth is attributed to a high mobile penetration rate, digital transformation, and a rise in security needs among the residents.

List of Key Companies in Smart Home Security Market

Market Players to Use Important Business Strategies to Expand Operations

Major market players are focusing on offering improved smart home security solutions to help users strengthen their home security and lifestyle experiences. They are also signing acquisition and merger agreements with small and local organizations to increase their business operations. Moreover, strategic partnerships and many other business expansion strategies are helping these key players boost the demand for their products.

List of Key Companies Profiled:

- Johnson Controls (U.S.)

- Resideo Technologies, Inc. (U.S.)

- Abode Systems, Inc. (U.S.)

- Vivint, Inc. (U.S.)

- ADT (U.S.)

- SimpliSafe, Inc. (U.S.)

- Ring LLC (U.S.)

- Brinks Home (U.S.)

- Hangzhou Hikvision Digital Technology Co., Ltd. (China)

- Snap One, LLC (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- June 2023: SimpliSafe, a provider of smart home security systems, announced the launch of the Smart Alarm Wireless Indoor Security Camera and 24/7 live guard protection. By providing the monitoring personnel with the ability to communicate directly with intruders, the new alarm camera assists this professional surveillance feature to help prevent crimes in real time.

- June 2023: Volt, a provider of smart home solutions, partnered with Ring, an Amazon company, as an ideal Ring dealer. As a result, customers of Volt can take advantage of Ring's popular smart home security products, such as surveillance cameras and video doorbells through this collaboration. To meet the growing demand for advanced home security systems on the market, Volt intended to strengthen its position through this partnership.

- March 2023: ADT launched the latest ADT Self Setup Smart Home Security System, which is a completely integrated DIY offering and enhanced DIY system from Google and ADT. The new system provides convenient control of the new ADT+ app by integrating Google Nest smart home products with ADT life safety and security technologies, as well as SMART monitoring.

- February 2023: Costco partnered with ADT to offer packages with a 13 and 9-piece system, both of which include Google Nest products. Professional installation and ADT's SMART monitoring are also part of these packages.

- November 2022: SimpliSafe extended its fast protection technology to provide customers with a faster and more effective response in emergencies. The Fast Protect suite of products and features claims to improve the experience of alarms by providing an exceptional emergency response with software and highly qualified professional monitoring agents.

REPORT COVERAGE

An Infographic Representation of Smart Home Security Market

To get information on various segments, share your queries with us

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies and leading product types. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 15.1% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Connection Type

By Device Type

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market value is projected to reach USD 117.37 billion by 2034.

In 2025, the market value stood at USD 33.2 billion.

The market is projected to record a CAGR of 15.1% during the forecast period.

In 2026, the smart camera systems segment led the market.

Rising awareness of and concerns for home security will aid market growth.

Johnson Controls, Resideo Technologies, Inc., Abode Systems, Inc., Vivint, Inc., ADT, SimpliSafe, Inc., Ring LLC, Brinks Home, Hangzhou Hikvision Digital Technology Co., Ltd., and Snap One, LLC. are the top companies in the global market.

In 2025, North America held the largest market share.

Asia Pacific is expected to exhibit the highest growth rate during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic