Smart Speakers Market Size, Share & Industry Analysis, By OS Type (Android-based, iOS-based, and webOS-based), By Technology (Bluetooth/Wi-Fi, Near Field Communication (NFC), and Others), By Application (Residential and Commercial), By Distribution Channel (Online and Offline), By Power Source (Wired and Wireless), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

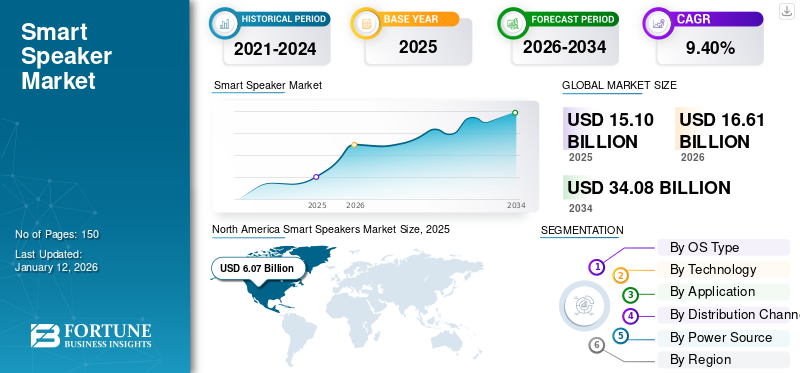

The global smart speakers market size was valued at USD 15.10 billion in 2025 and is projected to grow from USD 16.61 billion in 2026 to USD 34.08 billion by 2034, exhibiting a CAGR of 9.40% during the forecast period. North America dominated the global market with a share of 40.20% in 2025. Additionally, the U.S. smart speaker market is predicted to grow significantly, reaching an estimated value of USD 18.16 billion by 2032.

Smart speakers combine the features of a traditional speaker with voice-enabled technology, enabling users to interact through spoken commands. They link to the internet to carry out a range of tasks, such as home automation, voice control, information and assistance, scheduling and reminders, communication, and other entertainment. Google LLC (Alphabet, Inc.), Sonos, Inc., Amazon.com, Inc., and Samsung are among the top market players. They are enhancing their offerings with new advancements, integrations with new technologies, collaborations, and many more.

These devices are becoming ordinary in households across the globe, with the growing adoption of early products such as Siri and Alexa for entertainment and other purposes. For instance,

- As per an Adobe Analytics survey, some of the usual voice searches on smart speakers include requests for music at 70% and the weather forecast at 64%. These are trailed by answering fun questions at 53%, online search at 47%, news at 46%, and asking for directions at 34%.

As voice activated technologies have drastically upgraded, new products such as Apple HomePod and Google Home are entering the market. Other big tech companies are also rushing to unveil their smart devices and incorporations to keep up with the changing consumer demand.

IMPACT OF GENERATIVE AI

Integration of Generative AI Capabilities to Create Numerous New Prospects

The integration of generative AI and chatbot capabilities into voice assistants can help to revolutionize the market. The advancement can enhance their functionality, placing them as valued assets within homes.

Generative AI can offer voice assistants a greater cognitive knowledge of user intentions. By enabling assistants to access the chatbot’s widespread knowledge and competencies through language models, GenAI features can be implemented as a back-end facility for assistants. It allows them to handle complex tasks, engage in evocative conversations, and offer accurate responses. For instance,

- In June 2024, Amazon announced to launch the subscription-based Alexa Plus with the capabilities of generative AI. The new version, Alexa Plus or Remarkable Alexa, provides modernized conversational AI competencies.

SMART SPEAKERS MARKET TRENDS

Integration of Voice-enabled Shopping or Payment Alternatives to Fuel Market Progress

Voice-enabled shopping or payment alternatives are being integrated into several platforms, with collaborations forming among financial institutions and e-commerce sites to enable voice-driven transactions. The smart assistants allow users to accomplish tasks, control smart home devices, get information, and make purchases by voice commands. The unified integration of voice assistants into smart speakers advances their usability and functionality.

Additionally, the COVID-19 pandemic has accelerated the growth of online shopping and voice commerce, with more customers preferring to place orders using voice assistance. This shift has created opportunities for voice-activated shopping or payment alternatives for these smart devices. For instance,

- According to industry experts, online orders for pickup increased by 202% between March and May 2020, with approximately 30% of these orders coming from first-time online order customers.

Thus, the move toward contactless experiences has altered various aspects of interactions with restaurants, causing shifts in buyer behavior and solutions to satisfy consumer demands.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Rising Demand for Multi-room and Multi-user Support Drives Market Growth

The rising number of smart speakers offering multi-room audio aids has gained traction in recent years. Additionally, the capability to generate several user profiles, which simplifies personalized proficiencies from one room to another in quick succession, contributes to the growing popularity of smart devices.

With multi-room audio and multi-audio support, users can develop synchronized audio experiences in multiple rooms by connecting compatible devices. This feature is appropriate for parties, events, or enjoying music throughout the home. Multi-room audio abilities have become a prominent selling point for many brands. For instance,

- In November 2022, Defunc collaborated with Salora to introduce a range of Wi-Fi products in India, including smart multi-room Wi-Fi home speaker solutions and TWS (truly wireless stereo) EarPods and Earbuds. The Wi-Fi home speakers comprise one small speaker, one large speaker, and five prototypes of Earbuds.

Market Restraints

Lack of Control over Security and Data Privacy can Hinder Market Development

Smart speakers are vulnerable to security threats, which could eventually lead to hacker attacks. When hackers identify a vulnerability, they can use it to get control over the smart devices and consequently hack into other smart home devices. Security threats are linked to the risk of breaches, as these devices store substantial amounts of data, including user preferences and voice recordings. If a vendor’s servers are breached, it can lead to the exploitation of this private and sensitive data for malicious purposes. Thus, a lack of control over security and privacy can lead to major cyber-attacks and data breaches, thereby hampering market smart speakers market growth.

Market Opportunities

Integration with Smart Home Devices to Create Various New Market Opportunities

Connecting smart speakers with different Internet of Things (IoT) gadgets, including thermostats, lighting, and security systems, acts as central command hubs for a rising number of smart home ecosystems. For instance,

- According to Amazon Insights 2024, a 100% rise in requests to Alexa was observed for control-compatible smart home appliances in the past three years. Moreover, approximately 80% of smart home users of Alexa have started by buying an Echo Smart Speakers combined with a smart bulb. Such efforts and expanded customer awareness have led to a 200% growth in smart home devices linked to Alexa in India over the last three years.

From regulating lighting and thermostats to playing music in various rooms, these devices are becoming the command centers of smart homes. This trend is driving the adoption of smart home development and ecosystems of compatible devices.

SEGMENTATION ANALYSIS

By OS Type Analysis

iOS-based Smart Speakers to Gain Traction Due to Increased Demand for Premium Products

Based on OS type, the market is categorized into Android-based, iOS-based, and webOS-based.

The iOS-based segment is projected to grow with the highest CAGR during the study period, owing to a shift in preference of consumers toward premium products. Additionally, advanced offerings by Apple are increasing the demand for iOS-based smart devices. For instance,

- In January 2023, Apple announced the launch of the HomePod to deliver enhanced audio quality, advanced Siri capabilities, and a secure and safe smart home experience. HomePod provides modernized computational audio for an innovative listening experience, comprising aid for immersive Spatial Audio tracks.

Android-based segment is projected highest market share of 53.28% in 2026. Prominent market players such as Google, Amazon, and Lenovo use Android-based OS-type. Additionally, these players hold a maximum share of the market, thereby contributing to the growing market progress.

By Technology Analysis

Bluetooth Secures Highest Market Share due to Advanced features of Bluetooth/WiFi

By technology, the market is divided into Bluetooth/Wi-Fi, near field communication (NFC), and others (Zigbee, Z-wave, etc.).

Bluetooth holds the highest market share of 67.43% in 2026. Bluetooth and Wi-Fi-based solutions have several advantages and are compact, lightweight, wireless, fast, and offer simplified access to streaming services, better control, and convenience. Hence, various market players are enhancing their solutions with Bluetooth technology. For instance,

- In January 2024, Sunplus announced a collaboration with Ceva to introduce Bluetooth audio to airlyra SoC, a range of wireless speakers, soundbars, and other wireless audio devices. The partnership incorporates Ceva's RivieraWaves Bluetooth audio solution into Sunplus’s airlyra range of HD audio processors, directing soundbars, wireless speakers, and other wireless audio devices.

NFC (Near Field Communication) is a short-range wireless mechanism that enables devices to interact securely and quickly. NFC can be implemented in smart speakers to connect smart speakers to smartphones, and other smart home devices.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Residential Segment Dominated Owing to Rising Demand for Voice-controlled Devices

By applications, the market is divided into residential and commercial.

Residential applications held the highest market share of 60.81% in 2026 and are predicted to grow with the highest CAGR during the forecast period. The rising usage of voice-controlled smart devices or assistants among households across the U.S., China, Germany, and the U.K., is driving the growing usage of these solutions among residential users. Additionally, smartphones, equipped with voice assistants and smart devices, are the primary interfaces through which consumers interact with voice tools. For instance,

According to industry experts, the household penetration rate of smart speakers was 13.5% in 2021 and 16.1% in 2022. It is anticipated to reach 30.8% by 2026.

Commercial applications of smart speakers are growing significantly owing to the increasing adoption of these smart solutions across small businesses and enterprises. These solutions help them to plan their projects, meetings, travel management, and other tasks effectively.

By Distribution Channel Analysis

Online Segment Dominated due to Growing Preferences for Online Distribution Channels

Based on distribution channel, the market is bifurcated into online and offline.

Online channels are anticipated to grow at the highest CAGR during the studied period and held the highest market share of 58.40% in 2026. Growing digitization, more reliance on e-commerce by consumers, capability to reach large audiences, better consumer experience, and many other factors contribute to the increasing growth of online distribution channels. Additionally, these channels help brands improve their brand reputation and expand their presence across the globe.

Offline distribution channels include retail outlets and electronics stores. They allow customers to use the product before purchase and may also provide personal demonstrations and assistance.

By Power Source Analysis

Wireless Segment Dominate due to Advanced Benefits of Wireless Technology

By power source, the market is segregated into wireless and wired.

Wireless smart speakers hold the largest market share and are projected to grow at the highest CAGR during the forecast period. Several benefits, such as portability, cross-compatibility, easy wireless connectivity, energy efficiency, and other aspects, are driving the adoption of wireless technology.

Wired smart speakers are usually less expensive as compared to wireless speakers, although they may need more effort and time to set up. There can also be extra costs for connectors, cables, and installation tools.

SMART SPEAKERS MARKET REGIONAL OUTLOOK

North America

North America Smart Speakers Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 6.07 billion in 2025 and USD 6.56 billion in 2026. Owing to a greater number of early adopters of smart home technologies in households across the U.S. and Canada. Additionally, prominent tech firms in the U.S., such as Alphabet, Amazon, and Apple, play a vital role in the market. The continuous innovation and strategic investments from these companies ensure a steady flow of new features and enhanced products, keeping consumers engaged and driving smart speakers market share. The U.S. market is projected to reach USD 5.37 billion by 2026.

Advanced Artificial Intelligence (AI) and Machine Learning (ML) present significant prospects for the U.S. market by improving user experiences, fostering innovation, and enabling more sophisticated functionalities. For instance,

- A survey by CapitalOne Shopping stated that Google Assistant was the most used voice AI in 2023, with 85.4 million users in the U.S. It also stated that 8.2% of smart speakers’ consumers in America used Echo with AI assistant Alexa.

South America

South America is estimated to experience a substantial growth rate during the forecast period. The growing demand for smart home technologies and connected devices across the region creates numerous market opportunities. Various factors, such as language localization, technology integration, and applications across education, media, and entertainment, increase the demand for these smart devices in the region. For instance,

- According to the Brazilian Association of Internet of Things (ABINC), in collaboration with ISG Provider Lens, the overall number of connected devices could reach up to 27.1 billion by 2025 in Brazil.

Europe

Europe holds a noteworthy market share, owing to the larger adoption of smart devices across the U.K., Germany, Italy, and Spain. Additionally, various government initiatives, investments, and collaborations aimed at accelerating the development of smart home applications are boosting market growth in the region. The U.S. market is projected to reach USD 5.37 billion by 2026. For instance,

- In January 2024, the U.K. government, STAC (Smart Things Accelerator Centre), and Glasgow City Council formed an alliance supported by substantial government investment to accomplish Glasgow as a top smart technology and IoT (Internet of Things) innovation hub across Europe. The partnership focused on a combined investment of USD 2.7 million (£2.5 million) from the private and public sectors.

Middle East & Africa

The Middle East & Africa are projected to grow with a significant CAGR during the study period. The increasing demand for smart devices from the growing tech-savvy population drives the market progress within the region. Additionally, governments and market players are increasing their investments and initiatives through strategic alliances and collaborations.

Asia Pacific

Asia Pacific is estimated to showcase the highest CAGR over the projection period. The rising demand for automation solutions from residential applications is likely to propel market growth in this region. Various key players are expanding their presence across India, South Korea, Japan, and Australia by introducing new solutions. The Japan market is projected to reach USD 0.6 billion by 2026, the China market is projected to reach USD 1.24 billion by 2026, and the India market is projected to reach USD 0.56 billion by 2026. For instance,

- In June 2023, Amazon announced the launch of Echo Pop to India’s range of Alexa-empowered smart speakers. The Echo Pop comprises a front-facing, custom-designed speaker for a directional sound that is balanced, loud, and clear.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Focus on Developing Advanced Solutions to Expand Business Presence

Prominent market players, such as Amazon, Google LLC, Sonos, Inc., Samsung, Salesforce, Inc., and other players, are focused on offering advanced inventive technologies-smart solutions. These players are increasing their product portfolio due to the rising demand for more automated technology-driven voice-controlled solutions. Market players are implementing various business strategies, such as partnerships, collaborations, and mergers, to extend their businesses across the world.

Major Players in the Smart Speakers Market

Google LLC (Alphabet, Inc.), Amazon.com, Inc., Sonos, Inc., Samsung, and Harman International Industries, Incorporated., among other players, are the largest players in the market.

List of Key Smart Speakers Companies Profiled:

- Google LLC (Alphabet, Inc.) (U.S.)

- Amazon.com, Inc. (U.S.)

- Sonos, Inc. (U.S.)

- Bose Corporation (U.K.)

- Harman International Industries, Incorporated. (U.S.)

- Samsung (South Korea)

- Panasonic Entertainment & Communication Co., Ltd. (Japan)

- DXOMARK (France)

- Altec Lansing (U.S.)

- LG Electronics (South Korea)

- Klipsch Group, Inc. (U.S.)

- Ultimate Ears (U.S.)

- Lenovo (China)

- SK Telecom Co., Ltd. (South Korea)

- Xiaomi (China)

- Masimo (U.S.)

- VIZIO, Inc. (U.S.)

- Tribit (U.S.)

- Polk Audio (U.S.)

- iHome (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- July 2024: Amazon is preparing to launch a paid tier for Alexa called "Remarkable Alexa," which will offer enhanced capabilities through a new tech stack and more generative AI. This move aims to monetize Alexa and Echo speakers, with features including better smart home control and high-resolution audio support.

- July 2024: Apple launched the HomePod mini in three new colors: yellow, orange, and blue. These additions expand the existing lineup, which includes white and space gray, offering users more choices to match their personal style and home décor.

- April 2024: Google is developing new versions of the Nest Hub Max and Nest Audio, aiming to enhance their smart home product lineup. These new models are expected to feature updated hardware and improved functionality to better integrate with Google's ecosystem.

- January 2024: Sonos introduced an 8” In-Ceiling Speaker designed in collaboration with Sonance, offering powerful, balanced sound and a wide listening area. This new speaker features enhanced bass, improved high-frequency dispersion, and compatibility with the Sonos Amp for optimal audio performance.

- January 2023: Apple introduced the new HomePod, featuring advanced sound and intelligent capabilities, including room sensing and Spatial Audio support. The updated HomePod is designed to deliver rich, immersive sound while seamlessly integrating with smart home devices through Siri voice commands.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Major players in the market are dedicated to continuous investments in research and development. They are investing in R&D to incorporate advanced Artificial Intelligence capabilities, enhanced voice recognition, and improved sound quality to differentiate their products. For instance,

- In July 2024, Amazon announced the launch of a paid tier for Alexa called "Remarkable Alexa," which would offer enhanced capabilities through a new tech stack and more generative AI. This move aimed to monetize Amazon Alexa and Amazon Echo speakers, with features including better smart home control and high-resolution audio support.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.40% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By OS Type

By Technology

By Application

By Distribution Channel

By Power Source

By Region

|

|

Companies Profiled in the Report |

Google LLC (Alphabet, Inc.) (U.S.), Amazon.com, Inc. (U.S.) Sonos, Inc., (U.S.) Bose Corporation (U.K.), Harman International Industries, Incorporated. (U.S.), Samsung (South Korea), Panasonic Entertainment & Communication Co., Ltd. (Japan), DXOMARK (France), Altec Lansing (U.S.), LG Electronics (South Korea), etc. |

Frequently Asked Questions

The market is projected to reach USD 34.08 billion by 2034.

In 2026, the market was valued at USD 16.61 billion.

The market is projected to grow at a CAGR of 9.40% during the forecast period.

The android-based led the market in 2026.

Rising demand for multi-room and multi-user support is a key factor driving market growth.

Google LLC (Alphabet, Inc.), Amazon.com, Inc., Sonos, Inc., Bose Corporation, Harman International Industries, Samsung, and Panasonic Entertainment & Communication Co., Ltd. are the top players in the market.

North America dominated the global market with a share of 40.20% in 2025.

By technology, the Bluetooth/Wi-Fi is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us