Solar Generator Market Size, Share & Industry Analysis, By Storage Capacity (Below 1500 Wh, 1500 Wh – 2500 Wh, and Above 2500 Wh) and By End-User (Residential, Commercial, and Industrial), and Regional Forecast, 2026-2034

Solar Generator Market Size

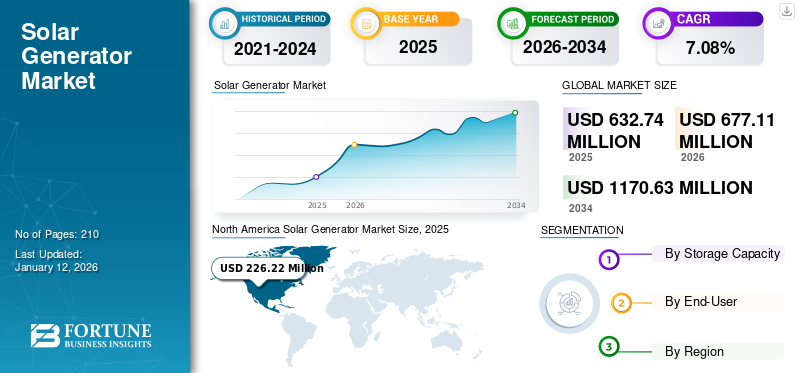

The global solar generator market size was valued at USD 632.74 million in 2025 and is projected to grow from USD 677.11 million in 2026 to USD 1170.63 million by 2034, exhibiting a CAGR of 7.08% during the forecast period. North America dominated the global market with a share of 35.75% in 2025.

Solar generators are becoming a prevalent alternative to standby and gas generators. A solar powered generator is a portable power plant that uses sunlight to generate electricity through solar panels. Electrical energy is stored in a battery called a power plant, which is then used to power devices. As climate change affects the world, people will switch to renewable energy to meet all their electricity needs. Portable solar powered generators do not produce harmful gases and are more reliable than their fuel-powered equivalents.

The COVID-19 pandemic halted many operations, such as manufacturing units and transportation. It caused labor shortages, affecting the supply and demand chain. Additionally, suffering from a weakened global economy and an uncertain political landscape led to increased raw material prices and logistics costs. Travel restrictions that affected the installation of new PV generators continued to slow activity. All these challenges threatened business management, significantly impacting end-users in the market.

Solar Generator Market Trends

Increasing Integration of Solar Powered Generators with Smart Homes to Propel Market Growth

More homes are shifting toward smart home solutions with integrated home automation systems, and PV generators are designed to integrate with these systems. Furthermore, the development in the adoption of renewable energy has increased the demand for solar generators. Smart home technology permits homeowners to control their appliances remotely using smartphones or other devices. It is designed to work with smart home systems that can be managed remotely, allowing homeowners to monitor their energy use and adjust settings to maximize efficiency. Advances in battery technology have made it possible to build more compact and portable PV generators for home usage. This trend is anticipated to continue in the coming years as manufacturers design generators that are lighter and easier to transport. Some of the latest generators weigh as little as 10 pounds, making them ideal for camping, outdoor events, and other activities requiring electricity.

Download Free sample to learn more about this report.

Solar Generator Market Growth Factors

Growing Developed Technologies and Innovative Functions in Solar Generators Have Increased Market Size

One of the most promising drivers in the solar generator market is the increasing efficiency of solar panels. In the past decade, significant advances have been made in solar cell manufacturing technology, resulting in panels that can transform more sunlight into electricity. This results in more efficient generators, allowing them to last longer and produce more electricity. Another area of innovation in the industry is battery technology. Solar panels are a vital part of a PV panel generator, and the battery allows the storage of the electricity produced by the panels. In recent years, battery technology has made great strides, making batteries smaller, lighter, and more efficient than ever before. These advances have made it possible to build solar powered generators that are more compact and portable and provide much power.

As new generators come onto the market, many are using new lithium iron phosphate (LiFePO4) batteries instead of the existing lithium-ion batteries. LiFePO4 offers several advantages, including a much longer charging and discharging lifespan. They are also safer and often faster to charge. For example, in June 2023, Jackery Inc. launched the Jackery Explorer 2000 Plus, which can power devices up to 6000W.

Government Subsidies/Policies for Various Solar Generation Activities Fuel Market Expansion

Government policies have a significant impact on the use of solar energy and generators. They can encourage or discourage investment and growth and promote a favorable corporate climate. Government solar energy laws can take the form of mandates, subsidies, and tax breaks.

The introduction of Renewable Portfolio Standards (RPS) is one of the government policies that has had a significant impact on promoting the use of solar energy. RPS requires utilities to produce a predetermined portion of their electricity from renewable sources, including solar energy. These rules can create a safe market for solar energy and stimulate investment and growth.

Government tax breaks and subsidies for installing solar energy can also reduce the initial costs of implementing solar energy. These regulations could make solar energy more accessible to homes and businesses, increasing demand and usage. The rising government aid for the solar industry in many developing countries will propel the progress of the solar generator market.

RESTRAINING FACTORS

High Cost of Solar Generators and Changing Weather Conditions Discourages Market Growth

The increased cost of the solar powered generator is the major challenge for increasing the solar generator market growth during the forecast period. These generators require a significant investment than traditional gas generators. The cost of these generators is higher than other kinds of generators. The range of solar powered generators is between USD 500 and USD 4000. In contrast, diesel and other fuel generators cost less for the same storage capacity.

Weather also plays an essential role in the growth of the market. On rainy and cloudy days, the efficiency of the solar system is not as high as in the summer season. In summer, the efficiency is higher due to solar radiation. Photovoltaic panels can consume direct or indirect sunlight to generate electricity and are most effective in direct sunlight. Solar panels continue to function even when light is reflected or partially blocked by clouds. However, in case of unpredicted extreme climate activity, these kinds of generators do not generate electricity.

Solar Generator Market Segmentation Analysis

By Storage Capacity Analysis

Above 2500 Wh Segment Leads Market with Heightened Demand for Solar Generators with High Capacity

Based on storage capacity, the market is segmented into below 1500 Wh, 1500 Wh to 2500 Wh, and above 2500 Wh.

The above 2500 Wh segment led the global market share of 39.06% in 2026. Solar powered generators are best used to charge devices and power small appliances, and above 2500 Wh is the category where these applications are fitted. Their portability makes them a great backup power source for boating or RV trips. Moreover, they are clean and do not need much fuel. PV generators can power some essential home appliances in an emergency. However, no portable generator can supply the entire home network with electricity. Users consider installing a rooftop solar panel system with a battery. This provides consumers with more home backup power in an emergency and also helps reduce electricity bills.

To know how our report can help streamline your business, Speak to Analyst

By End-User Analysis

Growing Demand for Charging Facilities at Home and In Small-Scale Home Appliances Will Drive Residential Segment Growth

Based on end-user, the market is segmented into residential, commercial, and industrial. The residential end-user dominates the market share of 51.68% in 2026. Solar generators have emerged as a sustainable and reliable alternative to meet residential energy needs and offer a greener solution compared to traditional generators. The energy stored in batteries is usually in the form of Direct Current (DC). All these factors make solar energy generators ideal for residential use in charging facilities, home appliances, and other areas.

In the case of commercial end-user, the growing use of solar power in RVs, vans, food trucks, workshops, and cabins is making the segment grow. In the industrial sector, conventional energy sources are dominant; therefore, the use of these generators does not proliferate.

REGIONAL INSIGHTS

The global market has been analyzed in four key regions: North America, Europe, Asia Pacific, and the rest of the world.

North America

North America Solar Generator Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 226.22 million in 2025 and USD 244.31 million in 2026. North America dominates the solar generator market share and is expected to be the fastest-growing region over the forecast period, driven by a thriving solar industry ecosystem with a well-established supply chain. This ecosystem includes numerous solar system manufacturers, system integrators, and service providers and contributes to an efficient procurement, installation, and maintenance process of these generators. Additionally, the region benefits from a highly skilled workforce and extensive expertise in solar power generation systems, strengthening its position as a dominant player in the market. A homegrown company in the region, Jackery Inc., has sold more than 3 million units in the last five years and continues to grow in the market with a promising category of PV generators. The U.S. market is projected to reach USD 225.34 million by 2026.

Additionally, higher investment in R&D to develop advanced batteries and fast-charging products is expected to boost market progression in North America. Growing demand for smooth and clean power supply is also increasing consumer awareness along with technological advancements and accessibility of various categories of advanced solar powered generator systems, and increasing acceptance of these across the region supports the adoption of PV generators in the region within the urban districts.

Europe

Further, Europe is following up in North America's footsteps and is significantly growing its business in the market. Solar panels on roofs, electric cars, and windmills on the horizon are becoming a common sight everywhere in Europe. Renewable and clean energy play a key role in determining Europe's ability to achieve climate neutrality by 2050 and ensuring a stable energy supply at an affordable price. Although the transition to a clean and renewable energy system is already underway, it must accelerate and transform key sectors, including transport, and create the necessary infrastructure and governance. The UK market is projected to reach USD 46.25 million by 2026, while the Germany market is projected to reach USD 54.12 million by 2026.

The European Green Deal and its policy initiatives, including RePowerEU, aim to facilitate this with a positive approach to solar energy. With this policy, the market is flourishing and will continue to grow during the forecast period. Further, according to a recent study, solar power production in Europe increased by almost 11% in the first half of 2022 compared to the same period in 2021. A significant factor behind the progress in pan-European solar generation has been a sharp increase in capacity additions across the continent. Overall, integrated solar capacity in Europe increased by almost 20% in 2022 compared to 2021. Germany, Europe's largest solar producer, increased capacity by 12.1% to 66.55 terawatts (TWh), while the second-largest producer, Italy, added 11% last year.

Asia Pacific

In Asia Pacific, the generator market is focused on conventional fuels such as diesel/kerosene; therefore growth of solar generators is considerable. Further, the cost of these generators is much more than diesel generators for the same amount of energy production. Therefore the rise of PV generators is stagnant in the region. In the rest of the world, the market is at the introduction stage, mainly focused on Saudi Arabia, UAE, and South Africa, where new-age technology, such as cabin workshop drones, is in use. The Japan market is projected to reach USD 10.02 million by 2026, the China market is projected to reach USD 51.42 million by 2026, and the India market is projected to reach USD 19.77 million by 2026.

List of Key Companies in Solar Generator Market

Jackery Inc. is Expected to Account for a Significant Market Share Owing to its Extensive Product Portfolio and Strong Brand Value

Jackery Inc. focuses on improving its sales, distribution, and marketing channels through partnerships with various local partners to strengthen its global product reach. The company encourages investments in renewable energy sources. The company addresses the rising demand for solar powered generators within a range limit in a very short time. Therefore, the growth in market share by the company is inevitable and promising to grow in the near future.

In recent developments, Jackery announced its presence at the prestigious Consumer Electronics Show (CES) 2024 in January 2023. Jackery invites attendees to witness the debut of two innovative products: the Mars Bot solar generator, the Jackery solar generator for rooftop tents, and shop windows from the entire Plus series. The Mars Bot is the epitome of sustainable technology, combining cutting-edge robotics with solar innovation. This futuristic outdoor companion redefines the boundaries of portable energy solutions with many smart features designed to enhance the outdoor experience. Whether it is an adventure, exploration, home backup, or rescue scenario, the Mars Bot Solar Generator promises to enhance every moment.

LIST OF TOP SOLAR GENERATOR COMPANIES:

- Custom Manufacturing & Engineering Inc. (U.S.)

- Renogy (U.S.)

- Jackery Inc. (U.S.)

- EcoFlow (U.S.)

- Oukitel (China)

- Maxoak Corporation (China)

- Growatt (China)

- Goal Zero (U.S.)

- Lion Energy (U.S.)

- Bluetti (U.S.)

- Mobile Solar Power (U.S.)

- Anker Solix (U.S.)

- Solar Line (U.S.)

- SolSolutions (U.S.)

- BioLite Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2024: EcoFlow launched DELTA Pro Ultra, the world's most powerful intelligent hybrid battery generator and backup system. This innovative product was recognized as a 2024 CES Innovation Awards winner for its exceptional design and innovative technology.

- January 2023: Jackery added two more innovative portable solar powered generators to its premium Pro family, the 3000 Pro, and 1500 Pro, offering outdoor enthusiasts a more comprehensive range of power options. Two new products debuted at the world's largest technology event, CES 2023. With the 1000 Pro and 2000 Pro coming in 2022, the flagship Jackery Solar Generator Pro family is complete.

- November 2022: Renogy launched the Phoenix 200, a completely redesigned and updated part of its flagship Phoenix Power Station. The Phoenix 200 is the perfect gift for outdoor enthusiasts and those who want to be prepared for emergencies. Compact, lightweight, and efficient, the Phoenix 200 is the perfect everyday powerhouse.

- September 2022: Renogy announced its entry into the home energy storage market with two home battery product lines. Renogy, a pioneer in solar solutions in the mobile and off-grid markets, brings the same reputation for innovation and value in efficiency for home energy storage. Renogy's first home energy storage products include Lycan Power Box PRO, an easy and affordable way for homeowners to upgrade their grid. A connected system with time-shifted solar energy provides renewable energy during power outages.

- January 2022: Bluetti launched the sodium ion solar generator NA300 and the compatible battery module B480. Bluetti said that this first-generation sodium-ion battery stands out for its thermal stability, fast charging capacity, low temperature, and integration efficiency. The sodium-ion power plant has four 20-amp standard wall outlets and a 30-amp L14-30 output port powered by a 3000W pure sine wave inverter built into the system.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and leading product applications. Besides, the report offers insights into the latest market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.08% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Storage Capacity

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

The Fortune Business Insights study shows that the global market was USD 632.74 million in 2025.

The global market is projected to record a CAGR of 7.08% during the forecast period.

The market size of North America stood at USD 226.22 million in 2025.

Based on end-user, the residential segment holds a dominating share of the global market.

The global market size is expected to reach USD 1170.63 million by 2034.

Increasingly developed technologies and new innovative functions are coming up in the market, and government subsidies/policies for various solar generation policies are key drivers.

Jackery Inc., EcoFlow Inc., SolSolution, and Bluetti, among others, are some of the top players actively operating across the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us