Sonobuoy Market Size, Share & Industry Analysis, By Application (Commercial and Defense), By Solution (Hardware (Transmitter, Receiver, Control Units, Displays, Sensors (Ultrasonic Diffuse Proximity Sensors, Ultrasonic Retro-Reflective Sensors, Ultrasonic Through-Beam Sensors, VME-ADC, and Others), and Others) and Software), By End-user (Line Fit and Retrofit), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

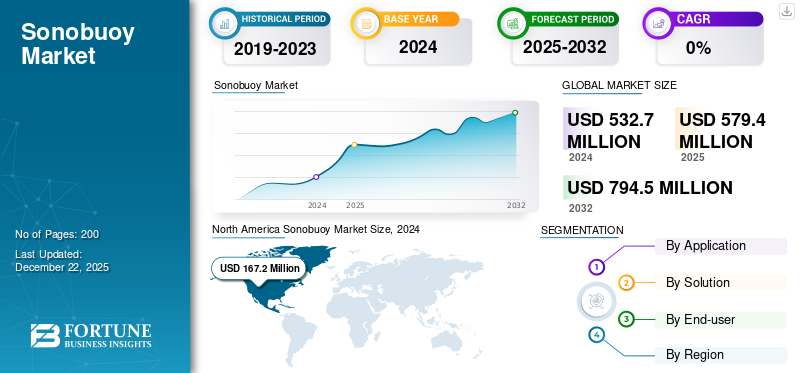

The global sonobuoy market size was valued at USD 532.7 million in 2024. The market is projected to grow from USD 579.4 million in 2025 to USD 794.5 million by 2032, exhibiting a CAGR of 4.61% during the forecast period. North America dominated the sonobuoy market with a market share of 31.39% in 2024.

A sonobuoy is an expendable, small underwater acoustics sonar that was once used for military and scientific applications. It normally comprises a surface-float radio transmitter and an underwater hydrophone or transducer to record underwater noise. Sonobuoys are air-launched, ship-launched, or helicopter-launched. They are categorized into three general types: passive (sensing sounds such as submarine propeller noise), active (sensing acoustic pulses and detecting echoes), and special-purpose (sensing environmental parameters such as temperature or wave height). Sonobuoys are an essential element of anti-submarine warfare (ASW), oceanography, and coastal surveillance through the supply of real-time acoustic intelligence. Their capability of speedy deployment in large numbers enables area-wide coverage and accurate location of the target. Thus, they prove to be a boon for the Navy and the underwater coverage operation of civilians.

Demand for sonobuoys is also experiencing robust growth as defense spending rises with the intensified development and upgrading of world naval fleets. Increased geopolitical tensions and sea battles have caused countries to spend heavily to modernize advanced sonars to intensify anti-submarine warfare and underwater surveillance operations. Technology advances in data analysis, better sound sensors, and longer battery life have greatly enhanced sonobuoy performance and efficiency, favoring them in both military and commercial applications. Additional expansion is encouraged by increasing demand for expendable, low-cost underwater detection systems and the use of sonobuoys on unmanned vehicles. Growth in the market is also inspired by offshore exploration and environmental monitoring expansion, which provides consistent demand in a number of industries.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Military Modernization Programs to Lead to Substantial Market Growth

Overall, defense spending growth is an expected reaction to increasing geopolitical tensions as countries focus on strengthening their military and defense against increased threats of war and geostrategic rivalry. Worldwide defense spending jumped 9.4% in 2024 to an all-time high of USD 2.7 trillion, the worst rate since the late Cold War, fueled by increasing tensions in Europe, the Middle East, and Asia. The U.S., China, Russia, and others have aggressively increased defense budgets, spending on cutting-edge anti-submarine warfare capabilities and naval arms as part of a wider arms race and greater focus on maritime security in contested waters.

At the same time, growing maritime trade, projected to grow 2.4% per year through 2029, heightens demand for secure, resilient shipping routes. This expansion, spurred on by increasing commodity demand and containerized commerce, is also underpinned by threats in the form of piracy, regional war, and cyber-attack, which must be underpinned by strong defense and surveillance systems to secure strategic sea assets and facilitate the free flow of global trade.

MARKET RESTRAINTS

High Cost and Regulatory Compliance Issues to Limit Market Expansion

Advanced sonobuoys place stringent demands on the SONAR sector, requiring state-of-the-art acoustic sensors, durable materials, and sophisticated electronics capable of withstanding harsh seafloor conditions. While investments in next-generation endurance sonobuoys, enhanced signal detection, and improved handling are advancing significantly, they also involve very high upfront costs and per-unit expenses. This makes widespread adoption challenging—particularly for nations with limited defense budgets.

Underwater environmental conditions such as temperature, salinity, and current significantly impact sonar's performance. Underwater vibrations in varied underwater conditions also travel erratically, causing probable errors in underwater target detection and monitoring. In shallow water or turbulence, they are amplified, further discouraging the use of sonobuoys and the convenience of using them under some operational conditions. They all contribute to preventing sonobuoy market growth by making operations more complex and restricting dependability when utilized.

MARKET OPPORTUNITIES

Increasing Military Budgets and Modular Armor Systems for Civilian Demand are Expected to Positively Impact Market Growth

ASW modernization is the pacesetter in the sonobuoy SONAR business as global navies compete to meet the rising threat from next-generation submarines and advance deeper their below-sea-level spying. Modernization has been portrayed as next-generation sonobuoy development, bringing to the fight new acoustic sensors, increased mission duration, and artificial intelligence-based analytics to engage in real-time threat detection and tracking. For instance, the Indian Navy, in response to the growing Chinese submarine presence in the Indian Ocean Region, is also actively augmenting its ASW capabilities and fusing sonobuoys with naval air patrols such as the P-8I Neptune.

International cooperation and co-production also fuel the trend, for instance, the historic India-U.S. collaboration to co-produce U.S.-standard sonobuoys by Ultra Maritime and Bharat Dynamics Limited. This program enhances interoperability and technology transfer and increases domestic production and supply chain resiliency, the foundation of which will be utilized for future defense-industrial cooperation at sea.

Download Free sample to learn more about this report.

SONOBUOY MARKET TRENDS

Increasing Anti-Submarine Warfare Is Expected to Impact Market Growth Positively

Anti-submarine warfare (ASW) has never played a more significant role in light of the growing speed and numbers of contemporary submarines that increasingly have upgraded stealth, distance, and capability with hypersonic missiles. Strategic consequences are ominous: expansive China and Russia utilize advanced submarines as instruments of power projection, disrupting sea lanes and probing critical underwater infrastructure such as telecommunication cables, allowing global finance and internet connectivity. This has made the subsea environment an unforeseen and contested battlefield for which conventional detection and defense methods will prove insufficient.

Advances in technology at a rapid rate-networked sensors, autonomous unmanned systems, and advanced sonobuoys-are transforming ASW by providing persistent wide-area search and timely engagement. The convergence of autonomous systems and distributed sensor networks enables navies to economically cover large ocean areas with reduced human operator exposure to risk.

ASW is, therefore, now a strategic necessity in an attempt to gain maritime supremacy, safeguard critical infrastructure, and preserve the integrity of global trade and communications.

Segmentation Analysis

By Application

Rising Maritime Security Threats Boosted Defense Segment Expansion

Based on application, the market is classified into commercial and defense.

The defense segment accounted for a dominating sonobuoy market share and is anticipated to grow at the highest CAGR in the coming years. The development of sonobuoy SONAR in defense applications is primarily driven by expanding maritime security threats, rising defense budgets, and technological advancements. These variables increase the need for anti-submarine warfare capabilities and underwater surveillance, making sonobuoys a crucial tool for maritime forces. Modern sonobuoys comprising digital signal processing (DSP), improved sensors, and upgraded signal processing capabilities lead to more precise and reliable detection of underwater targets. As submarines become more advanced and stealthy, navies require more modern ASW technologies. Sonobuoys are a key component of ASW systems, empowering the detection and tracking of submarines from aircraft or surface ships. Moreover, some regions, such as Asia Pacific, are encountering significant growth in the sonobuoy market trends due to increased defense spending, rising maritime disputes, and a high focus on strengthening anti-submarine warfare capabilities.

The commercial segment is anticipated to witness steady growth over the forecast period. The development of sonobuoy SONAR in commercial applications is driven by expanding maritime security concerns, technological advancements, and the growing need for environmental monitoring. These factors drive a wider selection of sonobuoys for applications beyond conventional military use, including marine research, resource exploration, and environmental monitoring.

By Solution

Hardware Segment Led as It Enables Underwater Acoustic Detection and Communication

Based on the solution, the market is divided into hardware and software.

The hardware segment accounted for the largest share of the market in 2024 and is expected to grow at the highest CAGR in the coming years. Sonobuoy hardware solutions in SONAR include components that enable underwater acoustic detection and communication. These incorporate hydrophones for detecting sound, signal processing units for filtering and amplifying, and radio transmitters for relaying information to a platform such as an aircraft. Active sonobuoys, moreover, utilize transducers to emit sound pulses and listen for echoes. Particularly, the increasing procurement and modernization of maritime vessels and the deployment of advanced SONAR systems are key drivers. This, along with the development of commercial applications such as marine research and resource exploration, contributes to the overall market development.

The software segment will continue to account for a considerable market share. The development of software solutions in sonobuoy SONAR systems is driven by the increasing need for advanced maritime security, especially in anti-submarine warfare (ASW). Maritime forces globally are modernizing their capabilities to detect, track, and neutralize evolving submarine threats. Sonobuoys, equipped with advanced sonar technology, play a significant role by providing real-time underwater surveillance.

To know how our report can help streamline your business, Speak to Analyst

By End-user

Advancements In Submarine Technology to Boost Retrofit Segment Growth

Based on end-user, the market is divided into line fit and retrofit.

The retrofit segment accounted for a dominating market share in 2024 and is expected to grow at a significant CAGR in the coming years. Numerous maritime forces operate older ships that were not initially equipped with the latest sonar technology, including sonobuoys. To preserve operational effectiveness and counter modern submarine threats, these vessels must be retrofitted with upgraded sonar systems. Advancements in submarine technology, such as quieter designs and more advanced propulsion systems, have made them harder to detect. This requires developing and arranging more modern sonar systems on existing maritime platforms, including sonobuoys. Retrofitting may involve joining new sonobuoys with upgraded capabilities, such as longer-range or more advanced signal processing, to improve submarine tracking and detection.

The line fit segment will continue to account for a considerable market share and is expected to grow at the highest CAGR over the forecast period. Line fit is anticipated to grow as new ships are built with advanced sonar capabilities. Continuous advancements in sonar technology, including improved signal handling and deployment methods, further fuel the demand for sonobuoys. The overall increment in commercial and military maritime activity requires improved underwater surveillance and detection capabilities, driving increased demand for sonobuoys.

Sonobuoy Market Regional Outlook

By region, the market is categorized into North America, Europe, Asia Pacific, and the Rest of the World.

North America

North America Sonobuoy Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominates the global market and has a major share. The North American market for sonobuoys is experiencing growth due to a combination of factors, including increased maritime activity, advancements in underwater surveillance technology, and significant defense spending. The rising demand for anti-submarine warfare capabilities and the need for upgraded maritime security are major drivers. Securing coastlines, exclusive economic zones (EEZs), and key maritime routes requires advanced surveillance tools such as sonobuoys. The U.S. has a significant defense budget allocated to maritime modernization and maritime security, driving the market for sonobuoys.

Europe

Europe accounts for a significant share of the sonobuoy market. European nations contribute to naval modernization and strengthen their defense capabilities, driving a higher demand for advanced sonar systems. Moreover, environmental monitoring and oceanographic research contribute to the market's development. Numerous European countries are effectively upgrading their maritime forces and incorporating cutting-edge technologies such as sonobuoys to enhance their anti-submarine warfare capabilities. Advancing geopolitical landscapes and potential threats require enhanced maritime security measures, further driving the demand for advanced surveillance systems.

Asia Pacific

Asia Pacific is expected to be the fastest-growing region, with a high CAGR over the forecast period. Factors such as regional disputes, piracy, illegal fishing, and the presence of submarines lead nations in the region to contribute to advanced underwater surveillance technology. Smuggling, Piracy, and unlawful fishing in the region require sonobuoys to monitor and observe maritime activities. The ongoing maritime buildup in the region, especially by China, has prompted other nations to support their naval capabilities, including investing in sonobuoy technology.

Rest of the World

The market in the rest of the world is expected to witness considerable growth in the near future. The Middle East & Africa are driven by expanding maritime security threats, the extension of offshore oil and gas exploration, and progressions in sonar technology. The region’s vast coastline and key location make it vulnerable to maritime threats. Sonobuoys are essential for anti-submarine warfare (ASW) and general maritime surveillance, helping to distinguish and track underwater threats and secure national interests. An increased focus on modernizing maritime forces and maritime security drives market expansion in Latin America.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Development and Introduction of New Products by Key Companies Resulted in Their Dominating Positions in Market

The sonobuoy market is characterized by a competitive landscape of established defense primes, specialized sonar manufacturers, and emerging technology start-ups. Key players include Ultra Electronics Holdings, Thales Group, General Dynamics Corporation, and Lockheed Martin Corporation, which leverage their ability and existing relationships with defense organizations to maintain market share. Strategic partnerships and innovative advancements, particularly in artificial intelligence and modular systems, are shaping the competitive dynamics. A growing number of start-ups are focusing on integrating artificial intelligence and machine learning algorithms into sonobuoys to upgrade signal processing and threat detection capabilities, offering a possibly disruptive constraint in the market.

LIST OF KEY SONOBUOY COMPANIES PROFILED

- ASELSAN A.Ş. (Turkey)

- ATLAS ELEKTRONIK INDIA Pvt. Ltd. (India)

- DSIT Solutions Ltd. (Israel)

- EdgeTech (U.S.)

- FURUNO ELECTRIC CO., LTD. (Japan)

- Japan Radio Co. (Japan)

- KONGSBERG (Norway)

- Lockheed Martin Corporation (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- NAVICO (Norway)

- Raytheon Technologies Corporation (U.S.)

- SONARDYNE (U.K.)

- Teledyne Technologies Incorporated. (U.S.)

- Thales Group (France)

- Ultra (U.K.)

KEY INDUSTRY DEVELOPMENTS

- May 2025: Adani Defence & Aerospace partnered with U.S.-based Sparton, a subsidiary of Elbit Systems, to neutralize anti-submarine warfare (ASW) solutions in India to assemble and indigenize sonobuoy systems—mission-critical equipment utilized in anti-submarine warfare (ASW).

- February 2025: The U.S. company Ultra Maritime signed a production planning contract with the Indian Bharat Dynamics Limited (BDL) to take a concrete step forward in the co-production of the U.S. sonobuoys in India. The contract will kickstart the technology exchange from the U.S. to India of U.S.-specification sonobuoys for utilization on India’s maritime patrol aircraft, the P-8I, MH-60R, and MQ-9B Sea Guardian platforms.

- February 2025: Ultra Maritime announced an USD 20.9 million contract from the UK Ministry of Defence (MoD) to supply sonobuoys to the Royal Navy's Merlin Maritime Patrol Helicopter. Sonobuoys are a basic element of the U.K.'s anti-submarine warfare (ASW) capability, delivering undersea domain awareness and empowering the Royal Naval force to protect U.K. domestic waters, the U.K.'s Continuous at Sea Deterrent, and the Carrier Strike Group.

- January 2025: Officials of the Naval Air Systems Command at Patuxent River Naval Air Station, Md., announced a USD 107.1 million order in December to Sparton, an Elbit Systems of America company in De Leon Springs, Fla., for as many as 20,000 AN/SSQ-125 multistatic sonobuoys for airborne ASW operations.

- January 2025: Thales secured a contract with France’s defense procurement agency (DGA) to supply the French Navy with several hundred SonoFlash sonobuoys. The bargain reinforces France’s key ambitions in anti-submarine warfare and upgrades the Navy’s detection capabilities.

REPORT COVERAGE

The global sonobuoy market analysis provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and trends expected to drive the market over the forecast period. It offers information on key regions/countries, key industry developments, new product launches, details on partnerships, mergers & acquisitions, and a number of OEMs in key countries. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 4.61% from 2025-2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Application

|

|

By Solution

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 532.7 Million in 2024 and is projected to reach USD 794.5 Million by 2032.

In 2024, the market value in North America stood at USD 167.2 million.

The market is expected to exhibit a CAGR of 4.61% during the forecast period of 2025-2032.

The defense segment led the market by application.

Increasing military modernization programs boost market expansion.

Major market companies such as Lockheed Martin Corporation, General Dynamics Mission Systems, and Ultra Electronics dominate the market.

North America holds the largest share of the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us