South Africa Water Bottle Market Size, Share, and Industry Analysis, By Type (Insulated, Non-Insulated, Filter Water Bottle, Infuser Water Bottle, and Others ), By Material (Plastic, Stainless Steel, Glass, and Others), By Distribution Channel (Offline and Online), and Forecast, 2024-2032

KEY MARKET INSIGHTS

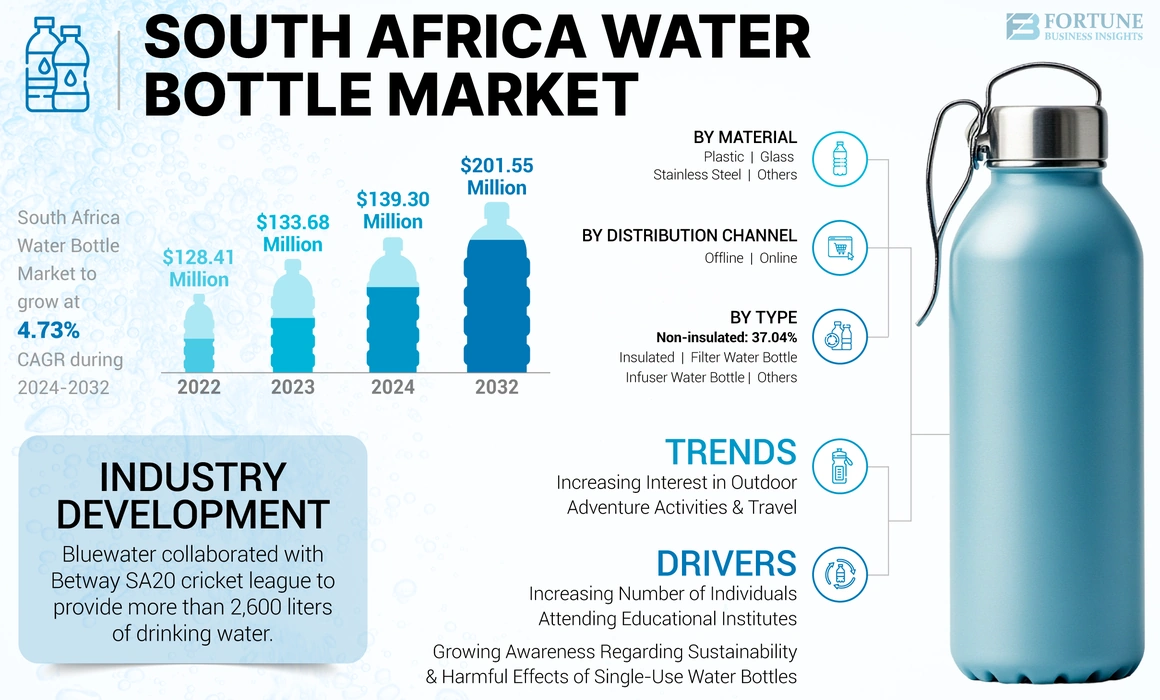

The South Africa water bottle market size was valued at USD 133.68 million in 2023. The market is expected to grow from USD 139.30 million in 2024 to USD 201.55 million by 2032, exhibiting a CAGR of 4.73% during the forecast period.

Water bottles are containers designed to carry water made from various materials, including plastic and stainless steel. These bottles play a significant role in reducing the usage of single-use bottled water and negatively impact the demand for bottled water countrywide. Furthermore, rising health benefits and consumer spending coupled with increasing demand for the product to reduce dehydration drive the market growth. The growing population and increasing popularity of reusable bottles countrywide boosts the demand for the product. Moreover, the growing trend of carrying water bottles to workplaces and educational institutions for easy access to clean drinking water fuels market growth.

Increasing environmental awareness among individuals and rising government regulations for reducing the usage of single-use plastics propels the demand for eco-friendly products. Furthermore, the rising availability of products made using sustainable and recycled materials boosts product demand among environmentally conscious consumers.

The sudden outbreak of the COVID-19 pandemic affected the Africa reusable water bottle market and the South Africa water bottle market in 2020. Moreover, the lockdown imposed by the government affected manufacturing capacities and the supply chain. Offices and schools were shutdown in 2020, negatively impacting the market growth.

South Africa Water Bottle Market Trends

Increasing Interest in Outdoor Adventure Activities & Travel to Provide Growth Opportunities

The rapidly growing trend of exploring various attractive locations and seeking new experiences, notably among youth, has increased tourism across South Africa. In addition, changing consumer lifestyles and affordable transportation options have increased travel in the country. Moreover, recent years have witnessed increasing awareness regarding various attractive locations in South Africa, such as Kruger National Park, Constantia Valley, Robben Island, Boulders Beach, Table Mountain, Cape Point, Durban Botanic Gardens, Umhlanga Rocks, Storms River Bridge, and Cango Caves, through social media platforms and travel websites which have further increased travel in the country.

Download Free sample to learn more about this report.

South Africa Water Bottle Market Growth Factors

Increasing Number of Individuals Attending Educational Institutes to Bolster Product Adoption

A sizable number of educational institutes, including schools and colleges across South Africa, boost product demand as numerous students attending these institutes use water bottles to frequently drink water and stay hydrated, which assists them in focusing on their studies.

The South African government considers education a priority and takes initiatives to provide individuals access to schooling. Furthermore, the Department of Basic Education (DBE) monitors the performance of education and emphasizes improving school infrastructure in the country. In addition, government regulations increase the number of students in educational institutes, which supports the South Africa water bottle market growth.

Growing Awareness Regarding Sustainability & Harmful Effects of Single-Use Water Bottles to Support Market Growth

The growing awareness regarding sustainability across South Africa has reshaped consumer preferences and increased demand for environmentally friendly products. As a result, numerous consumers in the country are seeking sustainable products with reduced environmental footprint.

Sustainable products are eco-friendly and efficient and remain functional over several uses. They are made of materials, including glass and stainless steel. Moreover, these bottles are long-lasting and highly resistant to corrosion. These factors have led to sustainable products becoming a popular choice among eco-conscious consumers emphasizing a sustainable lifestyle.

RESTRAINING FACTORS

Rising Consumer Consciousness Regarding Plastic Pollution May Hamper Product Demand

South Africa faces significant pollution challenges due to plastic waste, industrial emissions, mining, and other activities. For instance, according to the UN Environment Programme, a Kenya-based authority emphasizing environmental issues, approximately 90.000-250,000 tonnes of waste enter the oceans surrounding South Africa yearly, including the Southern, the Atlantic Ocean, and the Indian Ocean.

In addition, products made using stainless steel and glass typically cost more than their counterparts due to their quality materials and production process, and they are also slightly heavier. Moreover, products made of glass are fragile and prone to shattering, making them a less suitable option for outdoor recreational activities, thus hampering product adoption in South Africa.

South Africa Water Bottle Market Segmentation Analysis

By Type Analysis

Less Complex & Lightweight Feature of Non-insulated Bottles to Propel Segment Growth

By type, the South Africa market is segmented into insulated, non-insulated, filter water bottle, infuser water bottle, and others.

The non-insulated segment held a major South Africa water bottle market share in 2023. Non-insulated products are more lightweight than insulated bottles due to the absence of additional insulating layers. Furthermore, these bottles are less complex and often fit with bottle holders, backpack pockets, and car cup holders, making them more popular among travelers and outdoor enthusiasts.

The insulated segment is expected to grow significantly throughout the forecast period. Insulated products have high-temperature retention owing to double-walled vacuum insulation, allowing water to be kept hot or cold for up to 24 hours, thus boosting product demand nationwide.

To know how our report can help streamline your business, Speak to Analyst

By Material Analysis

Rising Popularity of BPA-free Plastic Water Bottles to Favor Market Expansion

By material, the market is segmented into plastic, stainless steel, glass, and others.

The plastic segment dominated the market in 2023. Plastic bottles are generally more affordable compared to alternatives, such as metal and glass bottles. Moreover, the rising availability of plastic bottles made using sustainable and BPA-free materials, including Tritan, boosts product demand among health-conscious and eco-conscious consumers.

The stainless steel segment is expected to grow significantly over the forecast period. The popularity of stainless steel bottles is growing significantly owing to increasing environmental awareness among individuals.

By Distribution Channel Analysis

Increasing Number of Retail Stores to Impel Offline Segment Expansion

Based on distribution channel, the market is bifurcated into offline and online.

The offline segment held a major market share in 2023. The extensive availability of a wide array of products, offering individuals multiple choices, propels the segment's growth. Moreover, several retail companies are focusing on acquisitions to expand their reach in South Africa. For instance, in November 2022, Walmart, a U.S.-based retail company, signed an agreement to acquire the remaining 47% stake in Massmart, a South Africa-based retail company.

The online segment is expected to grow significantly through the forecast period. The growing popularity of online shopping, coupled with the increasing number of smartphone users countrywide, drives the segment’s growth.

KEY INDUSTRY PLAYERS

Prominent Players Focus on Collaboration and Product Launches to Diversify Product Portfolio

The market is witnessing the presence of prominent players who are focusing on boosting brand presence and increasing consumer loyalty to be stay ahead of the competition. In recent years, to gain a competitive advantage and diversify their portfolios, market players have also focused on collaborations and new product launches.

List of Top South Africa Water Bottle Companies:

- Steely (South Africa)

- Sky Glow Hydration Accessories (South Africa)

- Flasky (South Africa)

- Hydro Cell (U.S.)

- Laycol Manufacturing (South Africa)

- Mayborn Group Limited (U.K.)

- SKAULT (South Africa)

- Feemio Group Co., Ltd. (China)

- Legend SA (South Africa)

- Buzio (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: Bluewater, a Sweden-based beverage solution & water purification company, collaborated with Betway SA20 cricket league, a South Africa-based cricket tournament, to provide more than 2,600 liters of drinking water and stainless steel water bottles to the staff and players at the tournament.

REPORT COVERAGE

The South Africa water bottle market report analyzes the market sizes in-depth and highlights crucial aspects such as prominent companies, market dynamics, and competitive landscape. Besides this, the research report provides insights into the market trends and market segment & highlights significant industry developments.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 4.73% from 2024 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

|

|

By Material

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the South Africa market was USD 133.68 million in 2023 and is anticipated to reach USD 201.55 million by 2032.

Ascending at a CAGR of 4.73%, the market is slated to exhibit steady growth over the forecast period.

By type, the non-insulated segment leads the global market.

The increasing number of individuals attending educational institutes is set to bolster product adoption.

Steely, Laycol Manufacturing, Feemio Group Co., Ltd., SkyGlow Hydration Accessories, and Flasky are the leading companies globally.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us