South America Cosmetics Market Size, Share & COVID-19 Impact Analysis, By Category (Hair Care, Skin Care, Makeup, and Others), By Gender (Men and Women), By Distribution Channel (Specialty Stores, Hypermarkets/Supermarkets, Online Channels, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

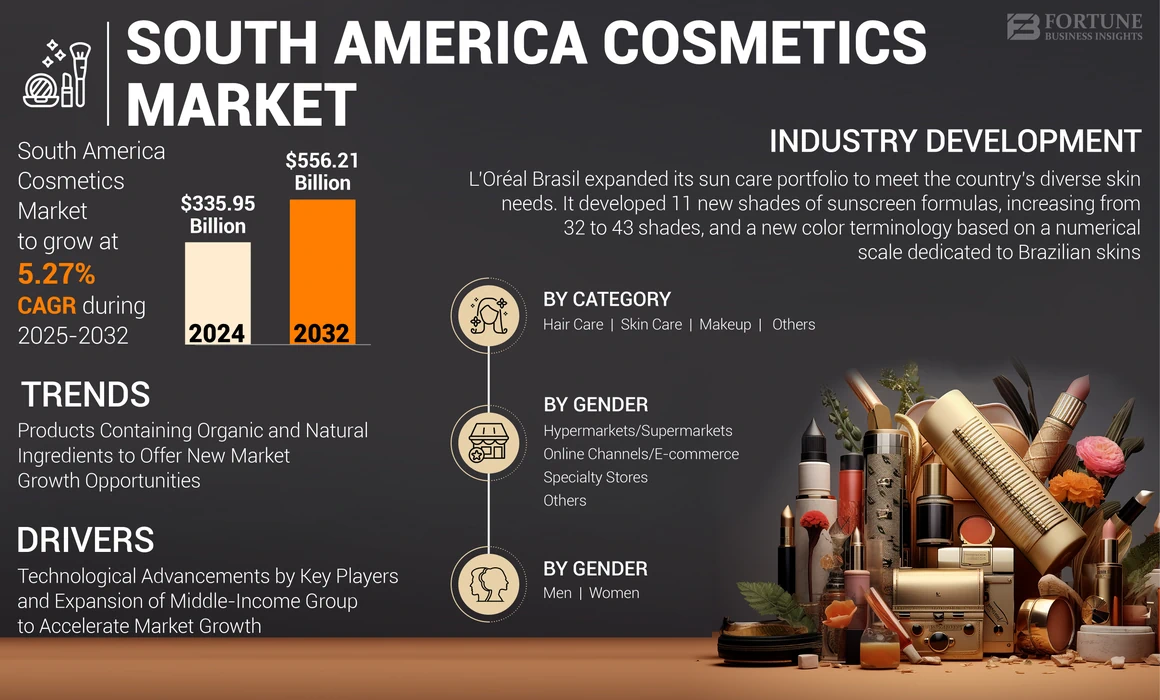

South America is the fourth largest region in the global cosmetics market. It is projected to register a CAGR of 5.27% during the forecast period. The global market is projected to grow from USD 335.95 billion in 2024 to USD 556.21 billion by 2032.

The trend of grooming and self-care has skyrocketed in recent years, with women at the epicenter of this industry. The emerging glamor industry is boosting the demand for cosmetics among the young generation so that they can alter their appearance. Social media has strongly influenced this generation, with attractive product promotions showcasing newer trends. The South America cosmetics market growth is driven by increasing consumer preference for innovative beauty products. In recent times, the market has witnessed robust expansion due to developments in social media platforms, backed by rising urbanization, growing spending on beauty products, and increasing disposable income.

- Local companies, such as Natura Cosmétics and Grupo Boticário, dominate a large part of the market. Brazil is the major consumer of deodorants, fragrances, and sun protection in the world.

- The Brazilian Association of the Cosmetic, Toiletry and Fragrance Industry (ABIHPEC) and Humane Society International (HSI), an animal rights advocacy group, passed a federal law banning Brazilian manufacturers of personal hygiene products, perfumes & cosmetics from testing cosmetic products on animals in Brazil.

This report on this market covers the following countries/regions - Brazil, Argentina, and the Rest of South America.

LATEST TRENDS

Products Containing Organic and Natural Ingredients to Offer New Market Growth Opportunities

As natural beauty ingredients are gaining popularity, the need for natural preservatives is also rising, resulting in research opportunities for organic preservatives. Consumers' buying behaviors have shifted to organic and natural cosmetics as consumers are becoming aware of the harmful effects of chemical ingredients on their health and environment. Hence, sustainability has become a priority across all industries. The pandemic-induced lockdowns changed how people lived and worked. This consequently reduced the negative impact on the environment.

- The makeup industry is moving toward consumer-driven, sustainable, and clean ingredient formulations. Based on the rapidly evolving body of science, brands are developing cosmetics that will cater to people’s daily beautification needs. The choices for customers include vegan, non-toxic, paraben-free, with manufacturers focusing on upcycling waste and creating skincare products.

DRIVING FACTORS

Technological Advancements by Key Players and Expansion of Middle-Income Group to Accelerate Market Growth

Brazilians have recently adopted the health and wellness trend as the income of the middle class population has expanded in recent years due to economic growth. The large production capacity of various cosmetics, such as makeup, hair & skin care products in countries, such as Columbia, Brazil, and Argentina, is driving the South America cosmetics market growth. Additionally, recent developments in AR technology-based consultative cosmetic solutions by start-up companies in Brazil and Argentina may build consumers’ confidence in purchasing these products, thereby supporting the market growth in the region.

- For instance, in 2019, Natura & Co. launched various digital platforms, such as consultant apps and mobile websites in Brazil and other Latin America to connect 1.6 million cosmetic consumers.

- Products with logos of ‘Organic’, ‘Natural’ and ‘Vegan’ are gaining more attention due to their sustainable characteristics. That includes non-toxic, safer products with no added synthetic chemicals and no animal-derived ingredients.

- In addition, the robust internet penetration and entry of many beauty brands to explore and expand their business on online platforms has become essential during the post-pandemic period. To gain a prominent market share, makeup brands run regular discounts on online platforms.

- In 2021, the consolidated net revenue of Natura & Co. reached USD 40.16 billion in 2021.

To know how our report can help streamline your business, Speak to Analyst

RESTRAINING FACTORS

Relative Side Effects of Cosmetics to Limit Market Growth

Skin-harming ingredients and additives, such as preservatives, stabilizers, mineral pigments, and dye, are used while manufacturing these products. These substances may cause an allergic reaction, irritation, discoloration, texture alteration, or permanent damage to the skin. Increased usage and unregulated production have led to a steep rise in side effects. The most common chemical found in products is paraben, which is used as a preservative in deodorants, moisturizers, shampoos, body washes, and makeup, increasing the chances of breast cancer. Moreover, men who use products that contain parabens can have lower sperm count and less testosterone, which can disrupt the functioning of the endocrine system.

- In Brazil, a regulatory requirement from ANVISA, Resolution RDC 48/2013, applies to companies under Good Manufacturing Practices for manufacturing personal hygiene products, cosmetics, and fragrances.

KEY INDUSTRY PLAYERS

Regarding the competitive landscape, Natura & Co, Grupo Boticário, L’Oréal S.A., and the Estée Lauder Companies Inc. are the key players leading the South America cosmetics market share due to their diversified product offerings, active involvement in R&D investments to speed up the process of product launches and approvals during the forecast period.

Other prominent players, such as Unilever, Johnson & Johnson In., Procter & Gamble Co., and Beiersdorf AG, are also leading the market due to their robust distribution networks and diverse product portfolios. Other significant players are Kao Corporation and Shiseido Co., Ltd. These companies are focused on strengthening their product portfolios and distribution networks through strategic collaborations and partnerships to increase their share in the market.

LIST OF KEY COMPANIES PROFILED:

- L'Oréal S.A. (France)

- Unilever plc (U.K.)

- The Procter & Gamble Company (U.S.)

- The Estée Lauder Companies Inc. (U.S.)

- Beiersdorf AG (Germany)

- Shiseido Co., Ltd. (Japan)

- Coty Inc. (U.S.)

- Kao Corporation (Japan)

- Johnson & Johnson Services, Inc. (U.S.)

- Grupo Boticário (Brazil)

- Natura & Co. (Brazil)

KEY INDUSTRY DEVELOPMENTS:

- October 2022: L’Oréal Brasil expanded its sun care portfolio to meet the country’s diverse skin needs. It developed 11 new shades of sunscreen formulas, increasing from 32 to 43 shades, and a new color terminology based on a numerical scale dedicated to Brazilian skins.

- March 2021: The Estée Lauder Companies Inc. partnered with Sephora Brazil to launch and distribute its wide range of franchises and products including Double Wear, Revitalizing Supreme+, Pure Color, Bronze Goddess, and Advanced Night Repair in-store and online.

- March 2021: Argentina banned cosmetic products containing microbeads due to the growing concern about pollution and its environmental impact.

REPORT COVERAGE

The South America cosmetics market research report provides qualitative and quantitative insights into the market and a detailed analysis of the regional market size & growth rate for all possible segments in the market. The research report elaborates on the market dynamics, competitive landscape, and forecast. Various key insights are presented in the report including an overview of the regulatory scenario in key countries, new product launches, key industry developments – mergers, acquisitions & partnerships, and the impact of COVID-19 on the market.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.27% from 2025 to 2032 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Category, Gender, Distribution Channel, and Country/Sub-Region |

|

By Category |

|

|

By Gender |

|

|

By Distribution Channel |

|

|

By Country/Sub-Region |

|

Frequently Asked Questions

Recording a CAGR of 5.27%, the market will exhibit steady growth over the forecast period of 2025-2032.

Technological advancements by key players and expansion of middle-income group are likely to drive the market growth.

L’Oréal Professional, Unilever, Procter & Gamble, and the Estée Lauder Companies Inc. are the major players in the South American market.

Brazil dominated the market in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us