Speech Analytics Market Size, Share & Industry Analysis, By Deployment (Cloud and On-premise), By Application (Sentimental Analysis, Compliance Monitoring, Agent Performance Monitoring, Customer Experience Management, and Others (Coaching and Social Media Analytics)), By Enterprise Type (SMEs and Large Enterprise), By End-user (IT & Telecom, BFSI, Healthcare, Retail & E-commerce, Travel & Hospitality, and Other (Government, Legal, and Automotive)), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

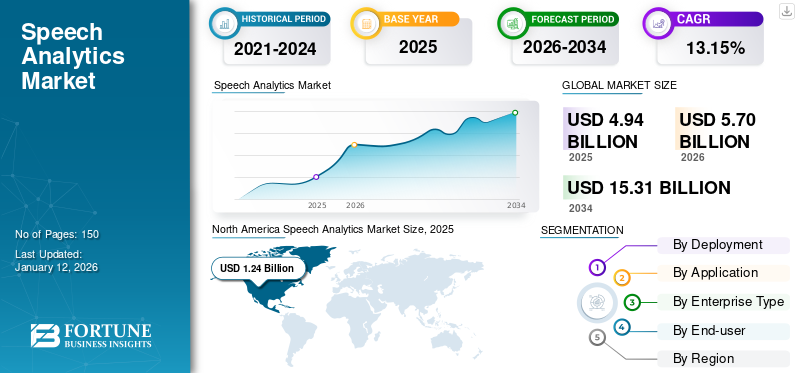

The global speech analytics market size was valued at USD 4.94 billion in 2025 and is projected to grow from USD 5.70 billion in 2026 to USD 15.31 billion by 2034, exhibiting a CAGR of 13.15% during the forecast period. Europe dominated the speech analytics market with a market share of 26.87% in 2025.

Speech analytics is a technology that leverages speech recognition, machine learning, and natural language processing to convert vocal words into text. The software analyzes the text by recognizing patterns, specific keywords, and discussions based on customer sentiment, likings, and needs.

The analytical tools offer real-time voice records by providing direct feedback for the contact center and improvement. This tool allows agents to understand customers' needs and satisfaction and improve performance.

Global Speech Analytics Market Overview

Market Size:

- 2025 Value: USD 4.94 billion

- 2026 Value: USD 5.70 billion

- 2034 Forecast Value: USD 15.31 billion

- CAGR (2026–2034): 13.15%

Market Share:

- Regional Leader: North America accounted for about 26.87% share in 2025.

- Fastest-Growing Region: Asia Pacific is expected to record the highest CAGR due to rising adoption in contact center outsourcing and digital transformation in countries like India and China.

Industry Trends:

- Cloud deployment is rapidly gaining popularity due to its scalability and flexibility, though on-premise models remain significant.

- Key applications include sentiment analysis, compliance monitoring, agent performance, customer experience management, coaching, and social media analytics. Customer experience management is projected to grow fastest.

- IT & Telecom is expected to witness the highest growth among verticals, with BFSI, healthcare, retail, and government also contributing significantly.

- Vendors are increasingly integrating generative AI and machine learning to enable predictive analytics, auto-summarization, and real-time insights.

Driving Factors:

- Growing use of speech analytics in call centers to improve compliance, agent efficiency, and operational performance.

- Adoption of AI-powered tools that enhance sentiment analysis, voice-to-text conversion, and actionable insights.

- Rising need for real-time analytics to boost customer satisfaction and reduce operational costs.

Moreover, as agencies develop a strategic approach to integrate flexibility and scalability into their collection efforts, speech technology has become essential to the growth strategy. Various call center-based companies are adopting platforms to provide a positive consumer experience while bolstering revenue and boosting agent productivity without neglecting compliance. For instance,

- According to a survey by Account Recovery.net, 67% of companies use speech analytics to reduce non-compliance, improve agent performance, and reduce staff quality assurance. In addition, 20% of the companies plan to deploy and integrate speech analytical solutions over the next two years.

The report provides a study of the speech analytics solutions offered by market players such as Verint, NICE, Avaya, Genesys, OpenText, Uniphore, OpenText, and others.

COVID-19 IMPACT

Growing Cloud Workload Security Demand and Subsequent Investments Favored Market Growth during COVID-19 Pandemic

The COVID-19 pandemic affected markets around the globe, which further drastically changed conversations between companies and customers. Various customer service centers perceived an unprecedented increase in the overall volume of calls from displeased consumers.

Moreover, the pandemic led customer service centers from in-office to work-from-home operations despite compliance and security reservations, which brought the contact center industry back on the list of essential services. This drove the surge in call volume with the need to understand the users, which in turn became a necessary part of survival for the business. For instance,

- In May 2022, Navy Federal Credit Union, an American global credit union, collaborated with Verint Systems Inc. to deploy speech analytical solutions to address new challenges. The company faced doubled and tripled inbound call volume during the pandemic. The solution assisted company executives in establishing policy and shaping services while reducing the risk of bad financial decisions with smart collection calls.

Thus, the COVID-19 pandemic positively impacted the market due to increased demand by organizations to improve customer experience and businesses.

Speech Analytics Market Trends

Adoption of Machine Learning and AI in Solutions for Better Customer Experience to Propel the Market Expansion

Various businesses use speech analytical solutions to improve their customer support processes. With the power of NLP and AI/ML, agents can visualize low satisfaction rates while undertaking necessary remediations to increase customer experience significantly. Companies can save time and money using an intelligent system to understand customer concerns, requests, and sentiments.

In addition, integrating artificial intelligence (AI) allows organizations to analyze root causes to understand and identify positive and negative sentiment scores. The AI and ML technologies offer predictive insights from unstructured data that help organizations understand agent’s soft-skill behaviors, sales effectiveness, customer churn, and others. For instance,

- In May 2023, Canary Speech, Inc. announced the integration of artificial intelligence in their voice analysis technology to address various mental health encounters, enable early interference, reduce healthcare costs, and measure remote patient monitoring solutions.

The integration of AI/ML will further support agents in automating work by interacting and identifying self-service automation opportunities in real-time, favoring the market growth during the forecast period.

Download Free sample to learn more about this report.

Speech Analytics Market Growth Factors

Increasing Demand for Speech Analytics Solutions Across Call Center Services to Aid the Market Growth

The adoption of solutions allow users to analyze the calls between customers and call center agents by providing intelligence to organizations to improve customer experience and drive the operation process.

In addition, call centers are adopting solutions to analyze text, allowing organizations to discover insights that improve future interactions or positively impact one-to-one customer interactions in real time. The solutions further enable the users to improve customer experience quality assurance and reduce micromanagement in business operations. For instance,

- In April 2023, SESTEK, a conversational automation company, collaborated with CCC, a prominent business processing outsourcing organization, to deploy speech analytics, voice AI, and voice recognition by driving growth and creating new opportunities within the public and services sectors.

Moreover, stringent compliance regulation for contact centers is vital, as it prevents legal and regulatory implications by keeping a real-time check on customer calls, making the solution an integral part of customer satisfaction.

RESTRAINING FACTORS

Increasing Cost of Solutions and Privacy Concerns to Restrain the Market Growth

Privacy and data security are significant problems for the user of speech analytics. The audio or text transcripts consist of personal data or other sensitive information depending on the setting within which the audio was collected. As a result, meeting high-level security level requirements for the clients is a challenge.

Moreover, the increase in costs of technology also limits the market growth. The presence of various providers with equally good offerings makes it challenging to choose the right option for solution. For instance,

- According to a LiveVox survey, 58% of contact center professionals are yet to adopt the speech analytical solutions due to an increase in price, 39% citing a lack of clarity around ROI and recognizing that analytical solution would require too many internal resources to operate.

Therefore, the more complex nature of incorporating this type of intelligence is a major restraining factor for the global market.

Speech Analytics Market Segmentation Analysis

By Deployment Analysis

Increasing Requirement and Adoption of Cloud based Solution to Drive Market Growth

Based on deployment, the market is segmented into cloud and on-premise.

The cloud segment is projected to dominate the speech analytics market with a 52.60% share in 2026 as organizations focus on technological advancements and more organizations shift IT infrastructure to the cloud. With the deployment over the cloud, it allows businesses to reduce costs, quicken deployments, collect data, and share files quickly without requiring an integrated location.

Various players are offering and integrating solution in the cloud by providing precise risk management and deep analytics, creating avenues, plans for the future, and critical insights for increasing the efficiency of businesses. For instance,

- In June 2023, NICE announced the launch of the CXone cloud platform across the EU Sovereign Cloud Platform. The platform would enable organizations from any industry across the European region to integrate CXone as their platform while following regulatory and compliance requirements.

Owing to this, organizations shifted their applications and data to the cloud. Therefore, the speech analytical solution has become an essential tool for analyzing customer emotion, thus drives market growth.

By Application Analysis

Adopting the Solution for Improving Customer Experience by Enterprises to Boost the Market Growth

Customer interaction analytics solutions contain essential information such as customer preferences, competitor insights, and actionable analytics. Deploying the solutions to customer interactions offers valuable insights and anticipates when and if customers will churn and impede such actions. Based on application, the market is segmented into sentimental analysis, compliance monitoring, agent performance monitoring, customer experience management, and others. The customer experience management segment is expected to lead the market, contributing 26.18% globally in 2026 due to customer experience acting as a successful business's driving force. Improving customer experiences is a significant focus area for prominent brands. Adopting a platform ensures quality customer experiences for sales and support services and improves business practices and agent performance quality, allowing managers to focus on customer satisfaction. For instance,

- In November 2022, Verint collaborated with Startek, a global provider of customer experience management solutions and services, by integrating Verint Speech Analytical solution to develop insights from the company’s customer interactions. The platform enables the Startek to take a more holistic approach to identifying call drivers and root reasons through advanced analytical solutions and identifying areas of opportunity.

Moreover, with the partnership between technology and experience, the solution will drive organizational transformation, from agent coaching to product improvement and marketing opportunities.

By Enterprise Type Analysis

Large Enterprise Segment Leads the Market Owing to Rising Demand for Speech Analytics Solutions

With rapid changes in enterprises, the requirement for solutions for customer satisfaction and agent performance has increased. Based on enterprise type, the market is divided into SMEs and large enterprises.

The large enterprise segment will account for 56.23% market share in 2026 due to improving customer service and developing effective marketing and sales insights. Adopting a platform by large enterprises improves digital customer experience and efficiency with security measures, regulatory compliance, and sensitive data protection complements.

The deployment of solution by small and medium-sized enterprises (SMEs) is rising at a steady rate as these organizations benefit in several ways. Adopting the platform will enable SMEs to monitor customer service calls and collect feedback on how employees interact with customers. This information can improve training and allow employees to provide the best possible service.

Thus, SMEs are anticipated to grow significantly during the forecast period.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

IT & Telecom Segment to Exhibit the Highest CAGR Due to Improvement for Business Operation and Customer Satisfaction

Based on end-user, the market is subdivided into IT & telecom, BFSI, healthcare, retail and e-commerce, travel & hospitality, and others.

The IT & telecom segment is expected to account for 26.58% of the market in 2026. This growth can be attributed to the soaring adoption of real-time solutions by telecom, insurance, banking, and BPO industry leaders to improve their strategic outcomes and drive customer satisfaction.

The telecom and business process outsourcing (BPO) industry is revolutionizing due to rising customer queries and support required, which is further finding it increasingly more work to cater to customers' demands. Adopting solutions with the integration of machine learning will help agents resolve customer queries quickly and adequately. For instance,

- In March 2023, AWS introduced call analytics capabilities to its Amazon Chime SDK by reducing the cost and time of creating insights from voice analysis, real-time audio calls, and transcription. The capabilities would classify and detect participants expressing a positive or negative tone.

The product adoption will assist organizations in securing customers' sensitive data and improve business growth.

REGIONAL INSIGHTS

Geographically, the market is categorized into five key regions: North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America Speech Analytics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America was valued at USD 1.24 billion in 2025 is expected to continue its dominance due to the growing adoption of Industry 4.0 and digital transformation, which has increased the demand for analytics solutions across the region. The North America market is divided across Mexico, Canada, and the U.S.

The U.S. is expected to have a highest CAGR owing to the presence of prominent regional players and several service providers. The country benefits from groundbreaking technologies by advancing the seamless integration of solution. For instance,

- In March 2023, Aural Analytics, Inc., a clinical-grade speech analytical platform provider, announced that the U.S. Food and Drug Administration titled its Speech Vitals- ALS technology as an innovative device.

In addition, Canada is expected to show prominent growth over the study period . This is due to Canadian business leaders strategizing their business value through investment and technological advancements to help reduce contact in both the customer and the agent expedition.

To know how our report can help streamline your business, Speak to Analyst

Europe

The Europe market is estimated to register a significant market share during the analysis period. This is due to the demand for contact center services across the European region and the popularity of e-commerce, which has led to an increase in customer contact. The UK market reaching USD 0.23 billion by 2026 and the Germany market reaching USD 0.36 billion by 2026.

Asia Pacific

Asia Pacific region is witnessing a prominent surge due to the consistent growth of outsourcing industries in countries such as China, India, Australia, Indonesia, Vietnam, and the Philippines to improve efficiency, customer experience, employee experience, and so on through technology. The Japan market reaching USD 0.33 billion by 2026, the China market reaching USD 0.19 billion by 2026, and the India market reaching USD 0.30 billion by 2026. For instance,

- In February 2023, Bharti Airtel Telecom, a telecom provider, partnered with Nvidia to develop and deploy an AI-based solution to improve the customer experience for all inbound calls to its contact center. Airtel will leverage its deep learning-based automatic speech recognition (ASR) with Nvidia's NVIDIANeMo conversational AI toolkit to accurately understand language and changes to its operations to serve agents and consumers better.

Middle East and South America

The market growth in the Middle East and South America is mainly due to the rising economic value of queries, services, and requests, strengthening platform investment across the region.

Key Industry Players

Leading Companies Focus on Expansion of their Product Offerings to Secure Competitive Edge

Major players in the global market, such as Verint, NICE, Avaya, Genesys, OpenText, Uniphore and others, are focused on expanding their geographic presence. The players are introducing new products and specific solutions to attract a vast customer base, improving revenue.

List of Top Speech Analytics Companies

- Verint (U.S.)

- NICE (Israel)

- Avaya (U.S.)

- Genesys (U.S.)

- OpenText (U.S.)

- Uniphore (U.S.)

- CallMiner (U.S.)

- Talkdesk (U.S.)

- AWS (U.S.)

- LiveVox, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2023 - NICE acquired LiveVox, an AI-driven proactive provider, to create a unified platform by combining all voice and digital interactions, attended and unattended, inbound and outbound calling with intelligent conversational AI. The acquisition would integrate NICE’s platform CXone with LiveVox’s proactive outreach portfolio to enable the organizations to deploy conversational AI across all types of engagements on a unified platform.

- October 2023 - Talkdesk announced product updates of its Talkdesk CX Cloud platform and Industry Experience Cloud that deepen the integration of generative AI. With the upgradation, companies across industries can deploy and monitor the contact center without coding experience and create a personalized customer experience.

- August 2023 - Kura, the UK’s independent outsourcer, announced a partnership with Avaya to transform its contact center capability by integrating Avaya Enterprise Cloud. The solution would allow the Kura user to offer services such as speech analytics, digital and social channels to clients, and inbound and outbound contact center services on a robust platform.

- July 2023 – Genesys announced the expansion of generative AI capabilities using the power of Large Language Models (LLMs). The Genesys Cloud CX platform would integrate auto-summarization to help organizations improve speed, quality, and accuracy, enabling employees to capture conversational intelligence from voice and digital interactions.

- June 2023 – Avaya renamed Avaya professional services into Avaya Customer Experience Services (ACES). The enhanced services would help clients navigate their digital transformation journeys by maintaining present voice-based customizations while simultaneously delivering AI and cloud-based capabilities.

REPORT COVERAGE

The research report includes prominent regions across the globe to get a better knowledge of this market. Furthermore, it provides insights into the most recent industry and market trends and an analysis of technologies adopted on a global scale. It also emphasizes some of the growth-stimulating restrictions and elements, allowing the reader to obtain a thorough understanding of the industry.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.15% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Deployment

By Application

By Enterprise Type

By End-user

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 15.31 billion by 2034.

In 2025, the market was valued at USD 4.94 billion.

The market is projected to grow at a CAGR of 13.15% during the forecast period.

Based on application, the customer experience management segment is set to grow at the highest CAGR over the study period.

The increasing demand for speech analytics solutions across call center services is a key factor aiding the market growth.

Verint, NICE, Avaya, Genesys, OpenText, Uniphore, Talkdesk, AWS are the top players in the market.

North America holds the highest market share.

By end-user, the IT & telecom segment is expected to grow at the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us