Tactical Optics Market Size, Share & Industry Analysis, By Product (Rifle Scope & Sights, Cameras & Display, Sighting Devices, Rangefinders, and Others), By Range (<3 km, 3 km to 25 km, and >25 km), By Application (Intelligence, Surveillance, and Reconnaissance (ISR), Search and Rescue (SAR), Patrolling, and Others) By Platform (Airborne, Naval, and Ground), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

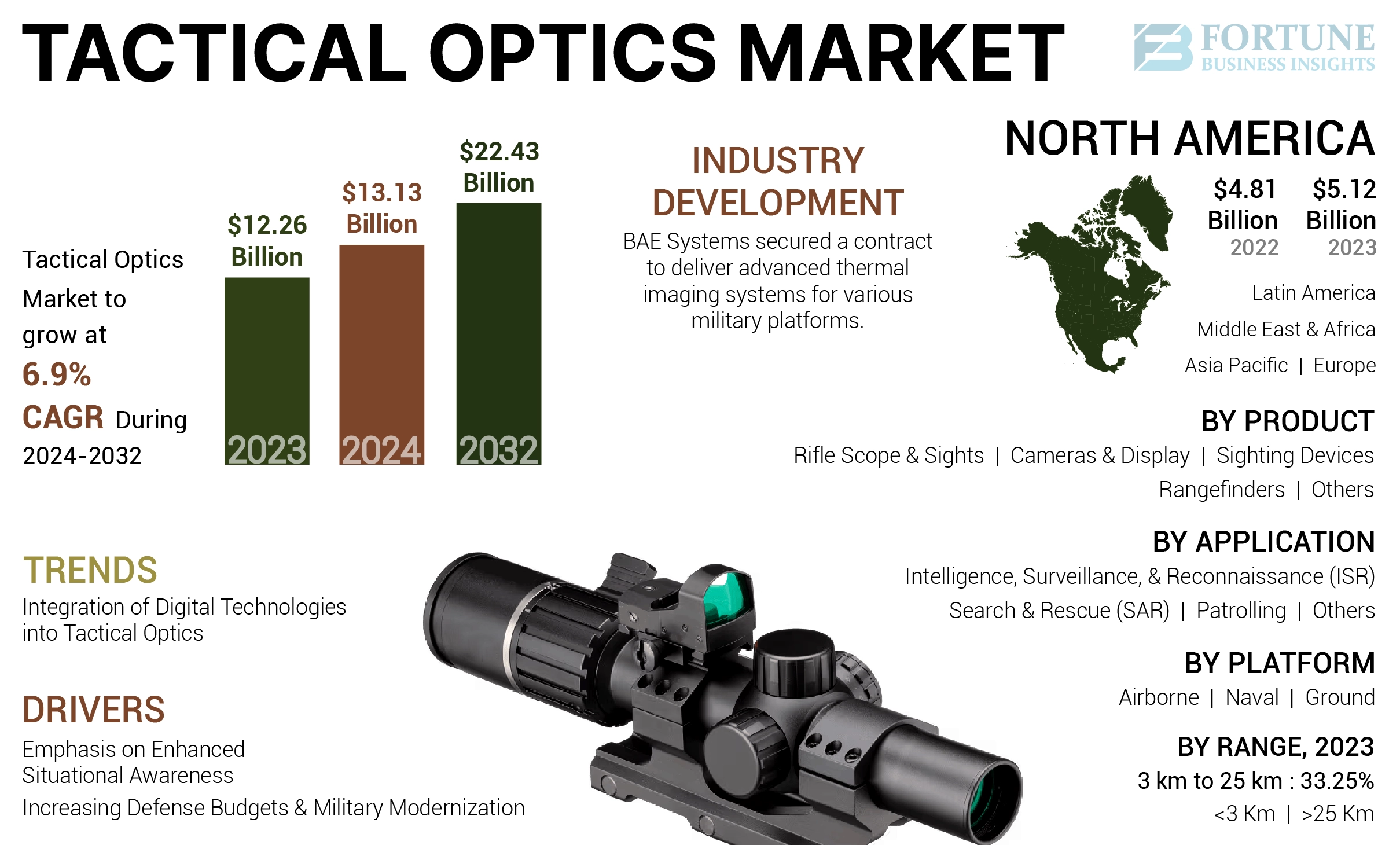

The global tactical optics market size was valued at USD 12.26 billion in 2023. The market is projected to grow from USD 13.13 billion in 2024 to USD 22.43 billion by 2032, exhibiting a CAGR of 6.9% during the forecast period. North America dominated the tactical optics market with a market share of 41.76% in 2023.

Tactical optics refers to a class of optical equipment specifically designed to improve visibility, accuracy, and situational awareness in high-risk environments, such as military operations, law enforcement, and self-care situations. These devices are designed to perform well under difficult conditions and provide users with the necessary tools to make decisions in critical situations. Weapon scopes & sights include riflescopes, red dot sights, holographic sights, night vision devices, thermal imaging scopes, handheld sighting devices, binoculars, rangefinders, cameras & displays, and others.

Global Tactical Optics Market Overview

Market Size:

- 2023 Value: USD 12.26 billion

- 2024 Value: USD 13.13 billion

- 2032 Forecast Value: USD 22.43 billion, with a CAGR of 6.9% from 2024–2032

Market Share:

- North America held the largest share in 2023 at 41.76%, supported by advanced military programs and high defense budgets

- By Product: Rifle scopes & sights led the market due to technological advancements in smart optics

- By Range: >25 km segment expected to grow at the highest CAGR, driven by long-range ISR and sniper applications

- By Application: ISR dominated in 2023, driven by real-time data needs and situational awareness in combat

- By Platform: Airborne segment projected to dominate by 2025, holding a 28% share due to widespread drone and UAV deployment

Key Country Highlights:

- U.S.: Market valued at USD 5.12 billion in 2023; Leonardo DRS received USD 117 million contract in 2024 for thermal weapons

- Japan: Tactical optics market expected to reach USD 0.33 billion by 2025

- China: Forecasted to grow at a CAGR of 7.99%, backed by defense modernization

- Europe: Second-largest market in 2023, expected to grow at a CAGR of 7.03%, driven by AR-integrated surveillance systems

The applications of combat optics are diverse and critical across various sectors. From enhancing military effectiveness through ISR capabilities to improving law enforcement operations and supporting civilian recreational activities, tactical optics play an essential role in modern operations. Furthermore, combat optics play an important role in ISR operations by providing critical data for decision-making. Military and security personnel can gather real-time information through long-term surveillance and target tracking. Advanced features, such as thermal imaging and night vision, allow operators to monitor various conditions and increase visibility and are widely used in naval ships, aircraft and armored vehicles.

Innovations, such as improved lens coatings, enhanced reticle designs, and image stabilization technologies, are enhancing the performance of tactical optics. Companies are forming partnerships with technology providers and maintenance contractors to integrate advanced features into tactical optics owing to the various weapon modernization programs across the globe.

The tactical optics market witnessed a notable influence from the COVID-19 pandemic, particularly in terms of production, supply chains, and military budgets. Numerous governments encountered economic challenges as a result of the pandemic, resulting in decreased defense budgets. The reduction in funding impacted the procurement strategies for tactical optics and other defense-related technologies

Tactical Optics Market Trends

Integration of Digital Technologies into Tactical Optics is a Prominent Trend Shaping the Market

Modern optics are increasingly equipped with ballistic calculators, which compute bullet trajectories by factoring in variables, such as air resistance and wind conditions. This feature allows users to make informed decisions quickly, improving accuracy during engagements. Digital networks are becoming the standard, providing users with real-time data overlays to help them achieve their goals without manual calculations. These improvements greatly increase the accuracy of recording in dynamic environments.

Many contemporary tactical optics come with Bluetooth connectivity, enabling seamless integration with smartphones and tablets. This connectivity allows users to transmit data for tracking and analyzing shooting performance, facilitating adjustments for improved accuracy. Devices, such as the ATN X-Sight 4K Pro exemplify this trend, offering features, such as real-time video streaming to mobile devices, which is particularly valuable for training and performance analysis.

Combat optics also incorporate advanced imaging technologies, such as thermal imaging and night vision, allowing operators to see clearly in low-light or obscured conditions. These features are critical for modern warfare and surveillance operations.

- Product Overview: Next Generation Squad Weapon – Fire Control (NGSW-FC)

Company: Vortex Optics

Key Features: Variable Magnification Optic, Integrated Ballistic Calculator, Laser Rangefinder, Intra-Soldier Wireless Connectivity, and others.

- In January 2022, Vortex Optics was awarded a follow-on contract by the U.S. Army to produce fire control systems for the Next Generation Squad Weapon (NGSW) program. This includes advanced optics with integrated digital technologies, such as ballistic calculators and smart reticles designed to enhance target acquisition and shooting accuracy.

- In October 2024, QinetiQ won a three-year contract to provide digital security technology and engineering and programming expertise to help power the next generation of military communications. The contract is part of the Land Environment Tactical Communications and Information Systems (LETacCIS) project, which will enable the British Army to make informed and timely decisions when operating on the front line.

Download Free sample to learn more about this report.

Tactical Optics Market Growth Factors

Increasing Defense Budgets and Military Modernization Supports Market Growth

Countries globally are significantly increasing their defense budgets in response to rising geopolitical tensions and security threats. This trend is particularly evident in North America, Europe, and Asia Pacific. Governments are investing heavily in modernizing their military forces along with border coastal patrol, which includes upgrading existing equipment and acquiring advanced technologies, such as tactical optics. For example, the U.S. defense budget for fiscal year 2023 was set at USD 858 billion, reflecting a commitment to modernizing military capabilities, including optics.

Military forces are undergoing extensive modernization programs aimed at replacing outdated equipment with advanced systems that improve operational effectiveness. This includes upgrading weapons with state-of-the-art optical systems that enhance accuracy and situational awareness.

- In March 2023, the Indian Army awarded a contract to DRDO (Defense Research and Development Organization) for the development of a smart rifle scope that utilizes advanced digital technology for enhanced target acquisition. This scope is designed to improve the accuracy and effectiveness of infantry units, integrating features, such as ballistic calculations, range finding, and environmental data analysis. The contract is part of India's broader modernization efforts to enhance its military capabilities.

- In February 2023, the U.K. Ministry of Defence awarded a contract to Thales Group for the supply of enhanced night vision devices for its armed forces. The contract includes advanced optics that incorporate digital technologies, allowing soldiers to operate effectively in low-light conditions. This initiative is part of the U.K.’s commitment to modernizing its military equipment in response to evolving threats.

- North America witnessed tactical optics market growth from USD 4.81 Billion in 2022 to USD 5.12 Billion in 2023.

Increasing Emphasis on Enhanced Situational Awareness is a Significant Market Driver

The need for enhanced situational awareness is becoming increasingly critical in modern military and law enforcement operations. As conflicts evolve and urban environments become more complex, the ability to accurately assess surroundings and identify threats has never been more important. Combat optics play a pivotal role in providing the necessary visual enhancements that enable personnel to operate effectively in high-stakes scenarios. This emphasis on situational awareness is driving the tactical optics market growth significantly.

Combat optics, such as holographic sights, night vision goggles, and thermal imaging devices, allow operators to navigate complex environments, detect threats, and engage targets with accuracy. The demand for these advanced optical systems is increasing as military and law enforcement agencies recognize their importance in ensuring mission success while maintaining public safety.

Moreover, the growing importance of Intelligence, Surveillance, and Reconnaissance (ISR) operations further underscores the need for enhanced situational awareness in optics. ISR missions require comprehensive data collection and analysis to inform strategic decision-making. Combat optics equipped with high-resolution imaging capabilities enable military and security personnel to conduct long-range observations and monitor critical locations effectively. The ability to gather intelligence in various conditions through advanced features, such as thermal imaging and night vision, enhances overall situational awareness and operational readiness.

- In November 2022, L3Harris Technologies announced the release of its 10,000 Advanced Night Vision Goggles for the U.S. Army and received new production orders for additional ENVG-Bs. When connected to Falcon IV tactical radios through the Intra-Soldier wireless network, the ENVG-B will deliver additional space-based information closer to warfighters, bringing intelligence, browsing, and video projection to motions to accelerate the signal and provide immersive combat space vision.

RESTRAINING FACTORS

High Cost of Tactical Optics Equipment to Negatively Impact Market Growth

The high cost associated with tactical optics equipment is a major barrier to the market’s growth. Advanced optical systems that include features, such as high-quality lenses, integrated digital technologies, and special coatings require significant investment in research and development. This increases production costs, which are passed on to end-users. The costs involved in research and development, manufacturing processes, and the necessary training for personnel to utilize these systems effectively contribute to the overall price tag of combat optics.

The complexity of advanced optics technologies exacerbates this problem. High-quality tactical lenses have many advanced features, such as ball counters, laser rangefinders, and digital overlays that provide users with real-time data. While these improvements greatly enhance operational efficiency, they also increase production costs. For instance, advanced optics, such as high-end rifle scopes or night vision devices, can range from USD 600 to several thousand dollars. For instance, premium brands, such as Aimpoint and Trijicon, offer optics that can cost over USD 1,000 each.

Tactical Optics Market Segmentation Analysis

By Product Analysis

Rifle Scope & Sights Dominate the Market Due to Several Technological Advancements

Based on product, the market is categorized into rifle scope & sights, cameras & display, sighting devices, rangefinders, and others.

The rifle scope & sights segment accounted for the largest market share in 2023. The continuous innovation in rifle scopes & sights has significantly enhanced their functionality and effectiveness. Modern weapon scopes & sights now incorporate advanced features, such as ballistic calculators, night vision capabilities, and thermal imaging. These technologies improve target acquisition and accuracy in various conditions, making them essential tools for military personnel and law enforcement agencies. In February 2022, the U.S. Marine Corps awarded a USD 64 million contract to Trijicon for the Squad Common Optic (SCO). This contract includes the delivery of approximately 19,000 units designed to enhance shooter accuracy and target acquisition for infantry units. The SCO features variable magnification from 1x to 8x, allowing Marines to engage targets at varying distances effectively.

The camera & display segment is projected to witness significant growth during the study period. Innovations in camera technology, such as high-resolution imaging, thermal imaging, and night vision capabilities, are making tactical optics more effective. These advancements allow for better performance in various environmental conditions, including low-light situations. In November 2024, British soldiers will be equipped with TALON Fused Weapon Sights to enhance their performance in low-light environments and enhance rifle accuracy during nighttime operations, as revealed in a statement by the Ministry of Defence. Qioptiq, a company located in St Asaph, Denbighshire, has secured a contract to provide the British Army with up to 10,000 cutting-edge rifle sights.

By Range Analysis

Precision in Military Operations Induces High Demand for Optics with a Range of >25 Km

By range, the market is classified into <3 km, 3km to 25km and >25 km.

The >25 km segment is projected to grow with the highest CAGR during the study period. >25 km is considered in products for long-range optics. Sniper scopes, spotting scopes, and surveillance binoculars are increasingly being utilized in military and law enforcement scenarios where high precision is required. These tools are designed to meet the demands of both conventional and asymmetric warfare environments. In October 2024, the U.S. Army announced a new contract for precision sniper rifle scopes as part of its ongoing modernization efforts. This program aims to enhance long-range shooting capabilities with advanced optics that provide improved targeting precision and situational awareness on the battlefield.

The 3km to 25km segment is anticipated to witness significant growth during the forecast period. The integration of tactical optics with new weapon systems, such as the Next Generation Squad Weapons (NGSW), enhances their effectiveness. These systems often require optics capable of engaging targets effectively at distances up to 600 meters or more. The <3km segment is projected to generate USD 2.99 million in revenue by 2025. The 3km to 25km segment is expected to hold a 33.25% share in 2023.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Rising Need for Real-Time Data to Fuel the Intelligence, Surveillance, and Reconnaissance (ISR) Segment Growth

Based on application, the market is divided into Intelligence, Surveillance, and Reconnaissance (ISR), Search and Rescue (SAR), patrolling, and others.

The Intelligence, Surveillance, and Reconnaissance (ISR) segment dominated the market share in 2023 and is expected to grow with a substantial CAGR. Modern optics are designed to operate effectively under various environmental conditions, providing high-quality imagery and data collection capabilities during both day and night operations. In January 2024, Northrop Grumman announced upgrades to the RQ-4 Global Hawk UAV, which will include enhanced optical systems for ISR applications. The upgrades aim to provide high-resolution imagery and data crucial for mission planning and execution.

The Search & Rescue (SAR) segment will observe a significant growth rate during the analysis period. The growing use of Unmanned Aerial Vehicles (UAVs) equipped with tactical optics for SAR missions is a significant trend. Drones can cover large areas quickly and provide real-time video feeds, making them invaluable for search operations. In October 2024, Northrop Grumman announced a partnership to develop UAVs equipped with advanced optical sensors specifically designed for SAR missions. This initiative aims to enhance the capabilities of aerial surveillance during emergency response operations.

By Platform Analysis

Airborne Combat Optics Set for Expedited Demand Due to Enhanced Situational Awareness Capabilities

Based on platform, the market is divided into airborne, naval, and ground.

The airborne segment is anticipated to dominate the market and grow at the highest CAGR during the forecast period. Airborne combat optics play a critical role in enhancing situational awareness for military commanders. For instance, UAVs equipped with high-resolution camera displays and advanced optics can provide detailed imagery and data from the battlefield, enabling more informed decision-making processes. In July 2023, Teledyne FLIR Defense was awarded a USD 94 million Indefinite Delivery, Indefinite Quantity (IDIQ) contract to provide its Black Hornet 3 Personal Reconnaissance Systems (PRS) to the U.S. Army. The Black Hornet is a nano-UAV equipped with high-resolution cameras capable of transmitting live video and HD still images back to the operator, enhancing situational awareness and decision-making processes on the battlefield. The airborne segment is expected to hold a 28% share in 2025.

The naval segment is anticipated to grow at a significant CAGR during the forecast period. Innovations in Electro-Optical and Infrared (EO/IR) technologies are improving the capabilities of naval optics. These advancements enable better target acquisition, surveillance, and situational awareness in complex maritime environments. In January 2023, Elbit Systems secured a contract worth USD 95 million from the Israeli Ministry of Defense. The agreement entails providing and servicing electro-optical systems for the infantry of the Israeli Defense Forces (IDF) for the next 10 years.

REGIONAL INSIGHTS

The global market regions are segmented as North America, Europe, Asia Pacific, the Middle East & Africa and Latin America.

North America Tactical Optics Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America’s market was valued at USD 5.12 billion in 2023 and is expected to dominate primarily due to substantial military spending by the U.S. and Canada. The region benefits from a strong defense infrastructure, well-established research and development centers, and a significant presence of major optical manufacturers. Continuous investments in military modernization programs have led to increased demand for advanced optics. The U.S. military's focus on enhancing operational capabilities through cutting-edge technology is a significant driver. In September 2024, the U.S. military awarded a USD 117 million contract to Leonardo DRS to continue working on the next generation of thermal weapons.

Asia Pacific is anticipated to grow at the highest CAGR during the forecast period. The region’s tactical optics market growth is fueled by increasing defense budgets and modernization efforts among China, India, and Japan. Countries are investing heavily in modernizing their armed forces, which includes upgrading optical systems for better operational effectiveness.

- In July 2024, the Defense Ministry of India approved upgrades for the Su-30 MKI aircraft, which will include advanced targeting and optical systems as part of enhancing their operational effectiveness.

- The tactical optics market in Japan is expected to reach USD 0.33 billion by 2025.

- China is projected to witness a strong CAGR of 7.99% during the forecast period.

Europe accounted for the second-highest market share in 2023 due to high demand from military units and civilian sports shooters. The U.K., Germany, and France are leading consumers of optics due to their ongoing defense initiatives. European countries are increasingly adopting advanced technologies, such as Augmented Reality (AR), in their optical systems to improve situational awareness and target acquisition surveillance systems.

- In June 2023, the European Defence Agency's TALOS project, which includes contributions from QinetiQ and other partners, successfully concluded in June 2023. This project focused on developing advanced laser technologies for military applications, demonstrating a commitment to integrating sophisticated optical systems into defense capabilities.

- Europe is anticipated to grow at a CAGR of 7.03% during the forecast period.

The market in the Middle East & Africa is characterized by increasing demand driven by heightened security challenges and ongoing military conflicts in the region. Countries are investing in advanced optical systems to enhance their military capabilities, particularly in response to threats from terrorism and regional instability, and to upgrade military law enforcement and civilian sectors.

Latin America is in its developing stage but shows potential for growth due to rising interest in security and defense capabilities among various nations. Brazil, Mexico, and Argentina are increasingly recognizing the importance of modern optical systems for both military and law enforcement applications.

- In July 2024, the Brazilian Army announced plans to procure advanced optics as part of its modernization program. This initiative aims to enhance surveillance and targeting capabilities for ground forces.

KEY INDUSTRY PLAYERS

Key Players Focus on Providing Technically Advanced Tactical Optics to Gain Market Share

The tactical optics market share analysis is consolidated, with several global and regional players operating in this industry, such as Kongsberg Defense & Aerospace, Raytheon Corporation, Elbit Systems, Saab AB, BAE Systems, Thales Group, L3 Harris Technologies Inc., and others. Moreover, there is an increased procurement of EO/IR cameras for border coastal surveillance. Companies, such as Raytheon and Elbit Systems, are developing advanced EO/IR systems that provide enhanced targeting capabilities in various environmental conditions, including low-light scenarios. Such developments give significant growth of EO/IR cameras for border coastal surveillance. In March 2023, Elbit Systems announced a contract to supply electro-optic equipment for infantry soldiers, further solidifying its position as a key player in the market.

List of Top Tactical Optics Companies:

- Kongsberg Defence & Aerospace (Norway)

- Raytheon Corporation (U.S.)

- Elbit Systems Ltd. (Israel)

- Saab AB (Sweden)

- BAE Systems (U.K)

- Thales Group (France)

- L3 Harris Technologies Inc. (U.S)

- Leonardo SPA (Italy)

- Lockheed Martin Corporation (U.S.)

- Northrop Grumman Corporation (U.S.)

- Hensoldt AG (Germany)

- Teledyne FLIR LLC (U.S)

KEY INDUSTRY DEVELOPMENTS:

- October 2024 – BAE Systems secured a contract to deliver advanced thermal imaging systems for various military platforms, further enhancing targeting capabilities in challenging environments.

- October 2024 – Thales Group announced that it would produce the first shipment of 300-night vision goggles for the French military under the Bi-NYX contract. The 300 glasses delivered to the DGA are the first batch of an order for 2,000 units delivered in December 2023. The remaining 1,700 glasses will be delivered by the end of this year.

- September 2024 – L3Harris Technologies was awarded a five-year, USD 587.4 million contract to supply custom circuits designed to upgrade the U.S. Navy's Aerial electronic attack capability.

- March 2024 – The U.S. Army awarded Teledyne FLIR a USD 15 million contract to provide a range of thermal imaging weapons. The equipment, which tracks the thermal signatures of enemies, is supposed to be useful to soldiers in low-light areas. The work will be done in Massachusetts, with a set date of January 2025.

- October 2023 – The U.K. surveillance specialist Chess Dynamics was selected by the Defense Materiel Administration (NDMA) to provide a Tier 1 target location error (TLE) vehicle tracking system for its Observation Targeting and Surveillance Systems (OTAS) project.

REPORT COVERAGE

The market research report provides detailed information on the market and focuses on leading companies, product types, and applications. Besides this, the report offers insights into the market trends, segmentation, and competitive landscape, demand for tactical optics and highlights key industry developments. In addition to the above factors, it contains several factors that have contributed to the sizing of the global market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE AND SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 6.9% from 2024-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By Range

|

|

|

By Application

|

|

|

By Platform

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights stated that the global market size was valued at USD 12.26 billion in 2023 and is projected to reach at USD 22.43 billion by 2032.

Registering a CAGR of 6.9%, the market will exhibit rapid growth during the forecast period of 2024-2032.

The rifle scope & sights segment will dominate this market during the forecast period.

Kongsberg Defense & Aerospace, Raytheon Corporation, Elbit Systems, Saab AB, BAE Systems, Thales Group, and L3 Harris Technologies Inc. are the leading players in the market.

North America dominated the market in terms of share in 2023.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us