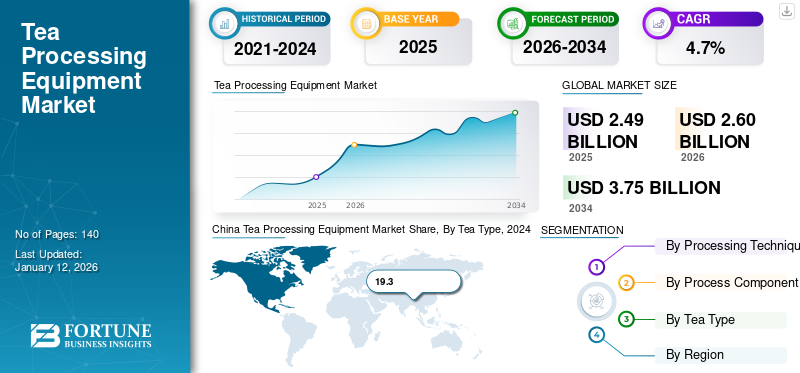

Tea Processing Equipment Market Size, Share & COVID-19 Impact Analysis, By Processing Technique (CTC Tea Processing Machine and Orthodox Tea Processing Machine), By Processing Component (Tea Sorting Equipment, Tea Powder Grinding, Tea Rolling Machine, Fermenting Machine, and Tea Drying Equipment), By Tea Type (Black Tea, Green Tea, and Others (Oolong Tea, Yellow Tea)), and Regional Forecast, 2026-2034

Tea Processing Equipment Market Size

The global tea processing equipment market size was valued at USD 2.49 billion in 2025. The market is projected to grow from USD 2.6 billion in 2026 to USD 3.75 billion by 2034, exhibiting a CAGR of 4.7% during the forecast period. Asia Pacific dominated the global market with a share of 37.80% in 2025.

Tea is a widely consumed beverage in the world. Tea processing equipment performs essential tasks such as withering, sorting, fermenting, rolling, and drying. The type and method of tea consumption differ across the globe. The types differ according to the fermentation or oxidation technique used to manufacture; further, chemical, physical, and thermodynamic conditions should be considered while manufacturing.

Tea processing equipment is used highly for commercial purposes. Thus, it is used for producing tea on a large scale. Tea manufacturers use orthodox tea machines, tea sorting equipment, tea drying equipment, CTC tea processing equipment, fiber extractors, tea powder grinding, and tea grading equipment daily. The market size is increasing as consuming tea brings many health benefits, from anti-inflammatory to antioxidant and weight loss effects.

COVID-19 IMPACT

Leaf-Picking Activities were Disrupted due to Unavailability of Labor during COVID-19 Pandemic

The COVID-19 pandemic hindered the global tea processing equipment market growth. Ocean freight, air freight, and land transport - all the possible ways of tea exportation were halted. Further, due to the cooler-than-usual weather and labor shortage, leaf plucking in 60% of the tea-producing countries was disrupted. For instance, Turkey has a high self-sufficiency rate; however, it was hampered by labor shortage due to shortage of migrant workers. Moreover, food sustainability, safety, and security have all suffered due to the pandemic. This results in manufacturers to comply with the safety standards of their equipment to sustain in the market.

Tea Processing Equipment Market Trends

Download Free sample to learn more about this report.

Growing Awareness of Health Benefits and Increasing Demand for Iced Tea to Bolster Market Growth

Tea has been associated with a range of health benefits, including reducing the risk of chronic diseases such as heart disease, cancer, and diabetes. This has led to an increase in demand for high quality tea and the need for more advanced processing equipment.

Iced tea is a popular and refreshing beverage, especially in the summer months, and its popularity is growing globally. This has led to an increase in demand for tea processing machines specifically designed for the production of iced tea. These machines are designed to produce high-quality iced tea, with the right balance of flavor and sweetness, and the ability to produce large quantities of iced tea efficiently and cost effectively. With the growing demand for iced tea, the global tea processing equipment market share is expected to continue to grow and evolve, with innovative machines being introduced to meet the needs of the industry.

Tea Processing Equipment Market Growth Factors

DRIVING FACTORS

Government Initiatives and Advancements in Technology to Drive the Market Growth

Many governments around the world have been actively supporting the tea processing industry, which has helped to increase the market share. This includes providing financial support for the development and expansion of tea processing facilities and promoting the export of tea and tea products.

The tea processing industry has constantly been evolving with new technologies and innovations being introduced. This has led to an increase in demand for high-tech processing equipment, which can improve the quality of tea, reduce processing time and cost, and increase efficiency. For instance, the conventional method of preparing tea is by hand-picking the leaves and then boiling and steaming them. However, this process required labor and ample time. This has triggered the requirement for equipment to automate this process.

RESTRAINING FACTORS

Competition from Low-cost Countries and Lack of Skilled Labor to Hinder the Growth of the Market

The tea processing equipment industry is highly competitive, with many players operating globally, including multinational corporations and small local manufacturers. The market is subject to intense competition from low-cost countries such as India and Southeast Asia, which can produce equipment at a lower price. This can make it difficult for manufacturers in higher-cost countries to compete and can limit the tea processing machine equipment market growth in these regions. However, manufacturers in high-cost countries can still compete by focusing on producing high-quality, specialized equipment that is in demand and by investing in research & development to bring innovative tea processing equipment to the market.

The tea processing industry requires skilled laborers to operate and maintain equipment and the shortage of skilled workers can be a hindrance to the growth of the market.

Tea Processing Equipment Market Segmentation Analysis

By Processing Technique Analysis

Due to Efficiency, CTC Tea Processing Machine Segment Holds a Major Share in Processing Technique

By processing technique, the market is bifurcated into CTC tea processing machine and orthodox tea processing machine. The main difference between these two techniques is the way in which the leaves are processed.

CTC stands for crush, tear, and curl. It is a modern, highly automated tea processing method involving machines to crush, tear, and curl tea leaves. CTC is typically used for black tea. Moreover, due to high demand for black tea and their efficiency, the CTC tea processing machine segment is expected to hold a larger share. Orthodox tea processing is a traditional tea processing method involving the manual rolling and twisting of the tea leaves to shape them. It is more time-consuming and labor-intensive than CTC, but it produces a higher-quality product. The CTC tea processing machine segment will account for 59.62% market share in 2026.

By Processing Component Analysis

Tea Sorting Equipment Segment Holds the Largest Share as it Offers Consistent Quality and Flavor

Based on processing component, the market is divided into tea sorting equipment, tea powder grinding, tea rolling machine, fermenting machine, and tea drying equipment.

Sorting is the process that involves separating tea leaves into different grades based on their size, quantity, and color. Tea sorting equipment is expensive, but despite the high cost, it is important in tea processing. It helps ensure consistent quality and flavor in the final product, which is critical to maintaining a competitive edge in the market. Owing to this factor, the tea sorting equipment segment holds a larger share. The tea sorting equipment segment is projected to dominate the market with a share of 52.69% in 2026.

Tea powder grinding machines help to reduce tea leaves to a fine powder form. Tea rolling machines are used in the tea-making process to shape and manipulate tea leaves. It helps to release the essential oils and flavors from tea leaves. The fermentation machine controls the rate and intensity of tea fermentation. To dry and preserve the tea leaves from spoiling, tea drying machines are used. It also helps to preserve unique aromas and flavors that are characteristic of different types of tea.

By Tea Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Black Tea to Sustain Largest Share Owing to Surging Demand

The three tea types are black tea, green tea, and others (oolong, white, and other flavored teas). Out of which, green tea is the least fermented (oxidized); black tea is fully fermented; and oolong is semi-fermented, within the range of 10%-70% oxidation. White tea is made up of new buds and can be slightly oxidized or non-oxidized. The black tea segment is anticipated to hold a dominant market share of 60% in 2026.

As per our analysis, black tea segment holds the largest share due to rising demand worldwide. An important phase in black tea manufacturing is fermentation; this factor determines tea quality. During this process, beneficial chemicals are formed on the leaves, contributing to black tea's health benefits. Therefore, black tea is popular among health-conscious individuals.

REGIONAL INSIGHTS

Asia Pacific Tea Processing Equipment Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

The report covers a detailed scope and thorough market analysis of five main regions, North America, South America, Asia Pacific, Europe, and the Middle East & Africa.

Asia Pacific

According to our analysis, Asia Pacific holds a major share of the global market owing to the largest tea-producing countries such as China and India. In addition, Southeast Asia is also emerging in this market, and with the rising population in this region, consumption is increasing. These factors are driving the market. A strong presence of manufacturers and the rising adoption of advanced machinery are set to proliferate the market in this region. The Japan market is forecast to reach USD 0.06 billion by 2026, the China market is set to reach USD 0.38 billion by 2026, and the India market is likely to reach USD 0.26 billion by 2026.

As per our analysis, China is set to dominate in the Asia Pacific region due to its high population count and increasing green tea demand worldwide. China is the largest green tea producer in the world. Increasing export production of tea, easy availability of tea processing equipment at an affordable price, and government support are set to drive the market in China. In addition, investments are being made to cater for this rising demand.

North America

The North America market will grow steadily during the forecast period owing to the growing demand for high-quality tea and tea-based beverages, such as iced tea, bubble tea, and specialty teas. There is also a growing trend toward using organic and sustainably sourced tea, which has surged the demand for processing equipment that can process these types of teas with minimal waste and environmental impact. The U.S. market is estimated to reach USD 0.11 billion by 2026.

South America has a significant presence in the market and will sustain its position during the forecast period. It is a diverse region with a range of climates and tea-growing regions, including countries such as Argentina, Brazil, and Colombia. The market is benefitted from the growing popularity of tea and tea-based beverages, particularly among younger consumers. This rising demand has led to an increase in investment in the market.

Europe

The Europe market will grow steadily due to the increasing popularity of green tea. Further, in Europe, there is a growing trend toward using organic and sustainability-sourced teas, which has driven the demand for tea processing equipment that can process these types of teas with nominal environmental impacts. The UK market is expected to reach USD 0.06 billion by 2026, while the Germany market is anticipated to reach USD 0.09 billion by 2026.

China Tea Processing Equipment Market Share, By Tea Type, 2024

To get more information on the regional analysis of this market, Download Free sample

Middle East & Africa

The Middle East & Africa will grow at a significant rate in the forecast period owing to investments made by governments. In addition, tea processing equipment manufacturers are investing in this region, which is the largest tea-producing region after Asia Pacific. Moreover, for instance, in 2020, the government of Kenya announced a ban on raw tea exportation.

KEY INDUSTRY PLAYERS

Key Players are Upgrading Technologies in Existing Machines to Acquire a Prominent Market Share

Key industry players are being forced to upgrade their product portfolios due to the constantly changing technical environment. As a result, key players are adopting partnership strategies to expand their businesses across the world.

Key manufacturers are working on the development and introduction of new solutions in the market. To achieve this, these players are making noteworthy investments toward the establishment of R&D infrastructure and increasing the annual R&D expenditure. Manufacturers are trying to implement robust marketing strategies to advertise their products and increase their goodwill and brand name in the global market. The increased goodwill and reputation are expected to help vendors in ensuring the reliability of their products and help manufacturers slightly elevate the price of their products, raising the reputable brand perception in the market.

LIST OF TOP TEA PROCESSING EQUIPMENT COMPANIES:

- Steelsworth (India)

- Marshall Fowler Engineers (India)

- Kawasaki Kiko (Japan)

- Bharat Engineering Works (India)

- G.K Tea Industries (India)

- Mesco Equipment Pvt. Ltd. (India)

- Quanzhou Deli Agroforestrial Machinery Co., Ltd. (China)

- T & I Global Ltd. (India)

- Anxi Yongxing Tea Machinery Co. (China)

- Workson Industries (India)

- Nova Hightech Pvt. Ltd. (India)

- GEM Machinery & Allied Services (India)

- Noble Procetech Engineers (India)

KEY INDUSTRY DEVELOPMENTS:

- January 2023: George Steuart Teas unveiled a tea processing and packaging plant in Sri Lanka with the processing capacity of 18 Mnkgs of teas yearly.

- In 2021, Steelsworth launched new products, which are an upgraded version of their main products teamaster CTC gold, tea plucking machine, supervane, and axial flow fan to expand its portfolio.

- In 2021, Workson Industries introduced K1 series CTC machines with various production capacities starting from small tea processing machines to large tea processing machines.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The market research report covers a deep dive analysis of the processing technique, process component, and tea type. It provides information about leading players in the market and their business overview, product offerings, investments (R&D, expansions, and investments), revenue analysis, types, competition analysis, and leading applications of the product. Besides, it offers insights into the competitive landscape, SWOT analysis, and current market trends and highlights key drivers and restraints. In addition to the abovementioned factors, the report encompasses several factors contributing to the market growth in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.7% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Processing Technique, Processing Component, Tea Type, and Region |

|

By Processing Technique |

|

|

By Processing Component |

|

|

By Tea Type |

|

|

By Region |

|

Frequently Asked Questions

According to Fortune Business Insights, the market was valued at USD 2.49 billion in 2025.

According to Fortune Business Insights, the market is expected to be valued at USD 3.75 billion by 2034.

The global market is Estimated to have a remarkable CAGR of 4.7% during the forecast period.

Asia Pacific is expected to hold a major market share in the market. The region stood at USD 0.94 billion in 2025.

Within the tea type segment, black tea is expected to be the leading segment in the market during the forecast period.

Competition from low-cost countries and lack of skilled labor to hinder the growth of the market.

Government initiatives and advancements in technology to drive the market.

T&I Global Ltd. (India), G.K Tea Industries (India), and Steelsworth (India) are the top companies in the market.

Black tea is expected to drive the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us