Trade Management Software Market Size, Share & Industry Analysis, By Function (Trade Compliance, Custom Management, Finance Management, Trade Analytics, and Others), By Enterprise Type (Small and Mid-sized Enterprises (SMEs) and Large Enterprises), By Deployment (Cloud and On-premise), By Industry (Automotive, Healthcare & Life Sciences, Manufacturing, Transportation & Logistics, Oil & Gas, Retail & Consumer Goods, and Others), and Regional Forecast, 2026–2034

TRADE MANAGEMENT SOFTWARE MARKET OVERVIEW AND FUTURE

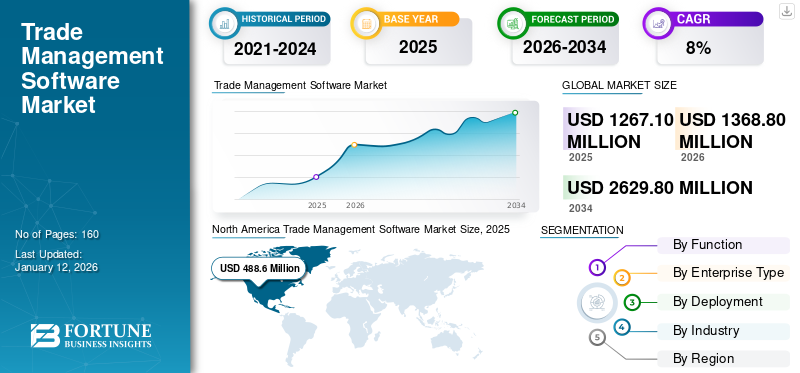

The global trade management software market size was valued at USD 1,267.10 million in 2025. The market is projected to grow from USD 1,368.80 million in 2026 to USD 2,629.80 million by 2034, exhibiting a CAGR of 8.5% during the forecast period. North America dominated the global market with a share of 38.60% in 2025.

Trade management software solutions offer enterprises a comprehensive view of their entire trade network. Local and regional businesses within a country can interconnect with local manufacturers or suppliers across the globe using a unified platform. It results in faster order processing, more accurate inventory management, and deeper insights into their international business presence. With the increasing intricacy of regulations and alterations in the trade environment, the risk of penalties also rises, posing challenges to progress. As a result, it increases the need for organizations to shift from outdated traditional techniques of managing their trade compliance to modernized trade management solutions.

Supply chain networks across the globe have become more complex and fragmented as a result of globalization and outsourcing. These developments improve the range of products for supply chain visibility solutions and increase the volume of international trade. They also heighten the need for solutions to enhance trade processes and expand the number of goods subject to compliance, customs, and tariffs.

The market players, such as e2open, LLC, SAP SE, Oracle Corporation, and Descartes Systems Group Inc., are among the prominent players. They focus on new product innovations, upgrades, and portfolio expansion into new geographical areas to increase their business presence across different regions.

IMPACT OF GENERATIVE AI

Implementation of Generative AI Capabilities to Fuel the Growth of Trade Management Market

The implementation of generative AI aids the growth of various supply chain applications, including risk management, logistics management, trade network management, supplier management, production planning, demand forecasting, and vendor negotiation. Thus, the huge scale of the supply chain work operations across the globe help businesses to witness huge potential with the help of generative AI.

- According to Industry Insights 2024, 43% of all working hours across the complete supply chain function will be impacted by generative AI, either through automating activities (29%) or considerably enhancing the work of human employees (14%).

Generative AI helps to analyze numerous variables, such as customs regulations, tariffs, shipping costs, and trade agreements, to suggest proficient and cost-effective strategies and trade routes. It also aids enterprises in directing multifaceted international trade networks, facilitating compliance while reducing costs.

Furthermore, generative AI enables enterprises to automate trade compliance procedures in trade management, delivering a user-friendly experience for employees. These benefits contribute to the growing uptake of generative AI in the market.

TRADE MANAGEMENT SOFTWARE MARKET TRENDS

Advanced Integration Capabilities of Trade Management Software to be a key Trend in the Market

Integration of trade management software with systems such as CRM, ERP, risk management, invoicing solutions, and others helps enterprises improve productivity and deliver enhanced functionality and user experience. It also supports regulatory compliance, improves decision-making, and provides many more benefits. Hence, market players are developing new solutions with different integrations to support business expansion and progress. For instance,

- In October 2023, Thomson Reuters announced the launch of OneSource E-Invoicing for enterprises functioning across the globe. This platform integrates with institutions, industries, and associates via API connections, simplifying electronic invoicing management for international businesses navigating global e-invoicing regulations.

Such various integrations and assimilation capabilities aid the development of trade management solutions.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Changing Trade Compliance Standards and Regulations to Increase the Demand for Trade Management Solutions

International trade compliance involves the procedures and processes through which goods are exported and imported from between countries, in accordance with the laws, regulations, rules, and necessities of each country involved.

All businesses of different types that are engaged in the import and export of goods and services are accountable for following the principles of trade compliance. Business owners are required to make sure that they comprehend the regulations and procedures that are appropriate to their precise scenarios, as trade rules and regulations vary across countries. For instance,

- In January 2024, The CBSA (Canada Border Services Agency) announced its half-yearly list of trade compliance verification significance. The list is developed to inform the importing community of verification priorities and prepare the stage for new priorities in the coming year.

- The Indian Ministry of Commerce and Industry announced the launch of its new FTP (Foreign Trade Policy) for 2023-28. Prominent focus areas of the government’s new FTP comprise a push for trade payments in Indian rupee, e-commerce exports, and merchanting trade norms.

These types of trade compliance initiatives, regulations, and standards drive the demand for trade management solutions in the market.

Market Restraints

Growing Geopolitical Risks can Hamper Market Progress across Different Geographical Regions

Geopolitical events have resulted in a shift across the risk and compliance landscape. Enterprises across every industry are required to be aware of these changing events affecting trade authorizations and compliance requirements. For example, Russian agreements cannot remain in effect, and new restrictions regarding trade and compliance standards can be announced on an ongoing basis. Additionally, the conflict between Hamas and Israel has further intricated trade authorization and compliance operations in the Middle East. Failure to adhere to these evolving geopolitical regulations can hamper market progress across different regions.

Market Opportunities

Usage of AI and Machine Learning within Trade Management Software to Create Lucrative Market Opportunities

Artificial intelligence (AI) and machine learning-driven platforms provide a wide variety of functionalities, such as automating workflows, data ingestion, real time data visibility, and optical character recognition, that have the potential to transform trade management, making it more effective and efficient.

The usage of AI to collect essential data elements from various document sources enables a simple, no-code incorporation progression with providers, creating a more consistent solution for logistics operations. For instance,

- According to Industry Insights 2024, 72% of enterprises consider AI (artificial intelligence) in supply chain management to be the foremost competitive differentiator by 2025. 37% of supply chain leaders are already using AI or are planning to employ it within the next 24 months.

AI-based data ingestion platform aids forwarders and importers in addressing various challenges that have traditionally troubled the trade management procedure. Some of the key functionalities and related benefits include visibility into the status of all shipments, error-proofing to avoid unintended errors, creating actionable insights and summaries from historical data. Additionally, it emphasizes frequently occurring trends and issues, while ensuring ease of incorporation.

The implementation of such advanced capabilities of artificial intelligence opens up various new market opportunities.

SEGMENTATION ANALYSIS

By Function Analysis

Trade Compliance Dominates as Companies are Enhancing Their Compliance Programs

Based on function, the market is categorized into trade compliance, custom management, finance management, trade analytics, and others (trade content management).

Trade compliance held the highest market share of 30.76% in 2026, owing to several factors, such as regulatory and security requirements, risk management, competitive benefit, geopolitical volatility, enhanced due diligence, and competitive benefit, among other advantages. Several businesses are working to enhance their compliance programs, particularly in response to augmented enforcement of U.S. trade sanctions and export controls.

Trade analytics is anticipated to grow with the highest CAGR during the forecast period. By removing trade barriers such as tariffs and quotas, countries can expand their markets and access a wider range of goods and services. For instance,

- The NAFTA (North American Free Trade Agreement) has been instrumental in enhancing trade between the U.S., Mexico, and Canada, resulting in significant economic growth for all three countries. This has paved the way for growth in trade analytics in the region.

By Enterprise Type Analysis

Rising Demand for Trade Management Software among SMEs to Fuel SMEs Progress

By enterprise type, the market is bifurcated into small and mid-sized enterprises (SMEs) and large enterprises.

SMEs are projected to grow with the highest CAGR during the study period, as small-scale businesses are using emerging technologies for their entrance across international trade markets. This adoption helps them stay competitive and gain a competitive edge, with trade management solutions playing a crucial role in this transformation. For instance,

- In August 2023, Infor announced a collaboration with DBS to introduce pre-shipment funding for SMEs (small and medium-sized enterprises) dealers within the Infor Nexus supply chain ecosystem. With the newest trade financing solution, the collaboration between Infor Nexus and DBS Bank finalizes the complete pre-shipment and post-shipment financing series, founding an end-to-end digital functioning capital financing solution.

Large enterprises registered the highest market share of 72.11% in 2026, as they must scale their infrastructure to address the needs of the remote workforce and support their products and services on a large scale. It provides them with insights with the help of advanced analytics, empowering them in better decision-making.

By Deployment Analysis

Growing Adoption of Cloud-based Deployment to Aid Cloud Deployment

As per deployment, the market is divided into cloud and on-premise.

The cloud segment accounts for the highest market share of 62.59% in 2026 and is estimated to grow with the highest CAGR during the forecast period. This growth is due to its easy upgradability, accessibility, maintenance packages, and flexible pricing models. Hence, the adoption of cloud-based solutions is increasing along with the growing investments in this segment.

For instance,

- As per OpenText Survey Insights 2023, 67% of enterprises stated that the cloud is probable to change how they incorporate and implement their supply chain operations. AI and machine learning, considered the second-most effective technology, were ranked highly by 44% of respondents.

On-premise deployment can be useful for enterprises that are subject to need information regarding their data and other regulatory controls. Trade management software can help firms handle trade-linked operations and enhance supply chains efficiently.

By Industry Analysis

Transportation & Logistics is the Leading Industry with Increased Benefits of Trade Management Solutions

By industry, the market is divided into automotive, healthcare & life sciences, manufacturing, transportation & logistics, oil & gas, retail & consumer goods, and others (IT & telecom, energy & utilities, etc.).

Transportation & logistics is projected to grow with the highest CAGR during the study period. Implementing trade management solutions across the end-to-end supply chain helps break down silos and enhance visibility. Enterprises integrate their global trade procedures and mechanisms with transportation, supply management, and logistics systems to increase coordination and transparency. For instance,

- As per the 2023 Enterprise Survey on Supply Chain Digital Transformation by S&P Global Market Intelligence, 67% of shipping and logistics companies report having a formal strategy for digital transformation. This strategy is designed to digitize their business processes actively.

Retail and consumer goods held the largest trade management software market share in 2023. The increasing complexity of global supply networks and the demand for efficient inventory management and order fulfillment make deploying sophisticated trade management solutions essential. Additionally, growing rivalry in retail and consumer goods sectors is driving enterprises to reduce their supply chain expenditures and boost operational productivity, thereby leading to a need for trade management software solutions.

To know how our report can help streamline your business, Speak to Analyst

TRADE MANAGEMENT SOFTWARE MARKET REGIONAL OUTLOOK

Geographically, the market is studied across North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America

North America Trade Management Software Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 488.6 million in 2025 and USD 525 million in 2026. The region’s strict trade regulations increase the need for trade management solutions to ensure smooth compliance and avoid missing tax and duty deadlines. For instance,

- In March 2022, Canada provided approximately USD 1.5 million to support developing and least-developed nations in enhancing their participation in global agricultural trade, as per the World Trade Organization (WTO). The funding, provided by the Standards and Trade Development Facility (STDF), helps these countries meet international food, plant, and animal health standards, enabling them to access regional and global markets more effectively.

The U.S. government aims to boost its utilization of domestically manufactured goods, which will drive export growth in line with international imports. The U.S. market is projected to reach USD 343 million by 2026. This trend is expected to lead to an increased demand for trade management software to monitor and adhere to the regulatory standards of various countries. For instance,

- According to the World Bank's data, meeting the border compliance requirements and completing the necessary documentation for importing goods into the U.S. takes 9 hours per shipment. These elements are expected to promote market growth in the region.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe is projected to grow with a significant CAGR during the forecast period. The demand for enhanced software solutions has arisen owing to the region's complicated trade environment and varied regulations across various countries to ensure compliance and improve efficiency. Furthermore, the rising emphasis on improving supply chain productivity and cost reduction among European enterprises has determined the need for trade management solutions. The UK market is projected to reach USD 77.1 million by 2026, while the Germany market is projected to reach USD 73.9 million by 2026.

For instance,

- The CSRD (Corporate Sustainability Reporting Directive) from the EU represents a significant step toward a more sustainable and transparent future. In the 2024 financial year, companies falling under the CSRD will be required to adhere to the European Sustainability Reporting Standards (ESRS) for the first time.

Asia Pacific

Asia Pacific is anticipated to grow with the highest CAGR during the forecast period. The growing economies in the region and the increasing complexity of global supply chains have created a critical requirement for effective solutions for managing trade. The Japan market is projected to reach USD 64.3 million by 2026, the China market is projected to reach USD 71.2 million by 2026, and the India market is projected to reach USD 53.9 million by 2026. Additionally, governmental efforts to improve trade facilitation and develop infrastructure are creating a favorable environment for adopting trade management technology. For instance,

- In February 2024, the Global Trade Research Initiative (GTRI) reported that India's proposed trade agreements with the U.K., Oman, and the European Free Trade Association (EFTA) would reflect India's commitment to economic integration and trade liberalization.

Middle East & Africa

Digital adoption is gaining momentum in the Middle East, as governments are executing various national initiatives. Governments, organizations, and other associations are conducting digital technology adoption programs supported by technologies such as the Internet of Things, cloud computing, artificial intelligence, and machine learning. This is contributing to the trade management software market growth in the region.

South America

The market in South America is projected to grow with a considerable CAGR. The growing acceptance of digital technologies in both government and corporate sectors, such as manufacturing, retail, and automotive, aids market progress.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Market Players are Constantly Engaging in Strategic Alliances, Mergers, and Acquisitions to Keep Up with Changing Technology

The market players are increasing their product portfolio due to the increasing demand for more automated technology-driven trade management solutions. Market players are implementing various business strategies, such as partnerships, mergers, and acquisitions, to expand their businesses across the world. These players sell their products in various regions worldwide, such as the U.S., Asia Pacific, and Europe, among others.

Major Players in the Trade Management Software Market

To know how our report can help streamline your business, Speak to Analyst

LIST OF TRADE MANAGEMENT SOFTWARE COMPANIES PROFILED:

- Oracle Corporation (U.S.)

- SAP SE (Germany)

- Thomson Reuters (U.S.)

- e2open, LLC. (U.S.)

- The Descartes Systems Group Inc. (Canada)

- Expeditors International of Washington, Inc. (U.S.)

- Livingston International (Canada)

- Infor, Inc. (U.S.)

- QAD Inc. (U.S.)

- MIC (Austria)

- Aptean (U.S.)

- Centrade (U.S.)

- Webb Fontaine (U.A.E.)

- Shipsy.io (India)

- WiseTech Global (Australia)

- AEB SE (Germany)

- Focus Softnet Pvt Ltd (India)

- Bamboo Rose, Inc. (U.S.)

- Zonos (U.S.)

- ImportYeti (U.S.)

- Trademo Technologies Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- September 2024: Descartes announced the acquisition of MyCarrierPortal, a provider of risk monitoring and carrier onboarding solutions for the trucking sector. MCP’s solutions aid freight shippers and brokers in quickly setting up their carrier needs with the help of an onboarding platform. The platform collects data on carriers and screens them for appropriateness based on the risk and compliance criteria of the broker.

- July 2024: Livingston International announced an alliance with 1TCC, a provider of customs brokerage, global trade, and freight forwarding advisory services. The partnership aims to help businesses across the globe overcome the irresistible tasks in international trade. The new alliance allows 1TCC customers to benefit from Livingston’s expertise in customs compliance and customs brokerage to import cargo effortlessly.

- June 2024: Thomson Reuters announced the expansion of its alliance with SAP to aid customers in computerizing U.S. tax reporting. The incorporation combines the Sales & Use Tax Compliance of ONESOURCE with SAP S/4HANA’s Documents and Reporting Compliance module. The collaboration aids businesses using SAP mechanisms to file and automate sales and leverage tax returns in the U.S. straight from SAP Documents and Reporting Compliance through a unified user experience.

- November 2023: Thomson Reuters introduced new automation and AI capabilities, increasing proficiency and saving time for experts in corporate tax departments. The company unveiled the development of generative AI-based proficiencies in its tax products, such as ONESOURCE Global Trade Management and Checkpoint Edge.

- March 2022: E2open announced the acquisition of Logistyx Technologies, a provider of worldwide e-commerce and parcel shipping and contentment technology. With the amalgamation, e2open improves its global footprint in multi-carrier shipment management for e-commerce, providing enterprises with a wide range of shipping competencies to scale and respond to changing market needs.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Strategic investment in international trade provides significant business opportunities for market players. It helps them to expand their business presence, capitalize on the global economy, and diversify their operations. Building strong relationships with regional partners, distributors, and suppliers further facilitates efficient business expansion. The expansion of businesses globally has resulted in a significant rise in global trade.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.5% from 2026 to 2034 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Function

By Enterprise Type

By Deployment

By Industry

By Region

|

|

Key Companies Profiled in the Report |

Oracle Corporation (U.S.), SAP SE (Germany), Thomson Reuters (U.S.), e2open (U.S.), LLC, The Descartes Systems Group Inc. (Canada), Expeditors International of Washington, Inc. (U.S.), Livingston International (Canada), etc. |

Frequently Asked Questions

The market is projected to reach USD 2,629.80 million by 2034.

In 2024, the market was valued at USD 1,267.10 million.

The market is projected to grow at a CAGR of 8.5% during the forecast period.

By function, the trade compliance segment leads the market.

Changing trade compliance standards and regulations is a key factor driving the growth of the market.

Oracle Corporation, SAP SE, Thomson Reuters, e2open, LLC, The Descartes Systems Group Inc., Expeditors International of Washington, Inc., and Livingston International, are the top players in the market.

North America held the highest market share in 2025.

By industry, the transportation & logistics is expected to grow with a highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us