Tramadol Market Size, Share & Industry Analysis, By Dosage Form (Tablets, Capsules, Injections, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

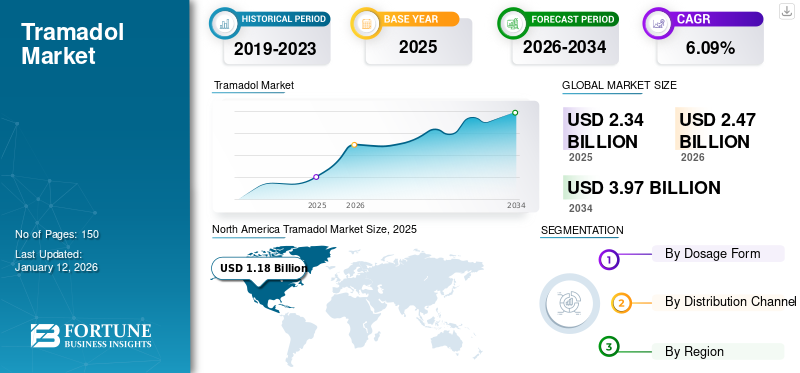

The global tramadol market size was valued at USD 2.34 billion in 2025 and is projected to grow from USD 2.47 billion in 2026 to USD 3.97 billion by 2034, exhibiting a CAGR of 6.09% during the forecast period. North America dominated the tramadol market with a market share of 50.26% in 2025.

Tramadol is a synthetic opioid pain reliever used to manage mild to moderately severe pain. It is prescribed to treat the pain associated with acute and chronic diseases such as osteoarthritis, post-operative pain, dental, neuropathic pain, cancer, and others. The increase in the prevalence of pain-related diseases increases the demand for the drug in the market.

- For instance, in July 2023, according to the statistics published by the World Health Organization (WHO) in 2019, about 528.0 million people are suffering from osteoarthritis worldwide, with a 113.0% increase in cases since 1990. This requires tramadol to relieve the pain associated with the disease and thus increase the growth of the market.

There are different forms of tramadols available, such as tablets and capsules, along with extended-release and immediate-release modes of delivery. Healthcare professionals have favored the usage of tramadol due to its effectiveness in treating moderate to moderately severe pain. Various benefits associated with the drug contributed to an increase in prescriptions by practitioners, thereby bolstering the expansion of the market.

The growing research and development activities by key players for the expansion and the increasing regulatory approvals for the combinations of drugs to treat new indications are expected to propel the market growth.

The negative impact of COVID-19 was observed on the market growth during the pandemic. The sudden decrease in patient visits for neuropathic pain, dental pain, and osteoarthritis and the decrease in elective and non-elective surgeries contributed to the decrease in prescriptions of tramadols. However, in 2022, the market rebounded to pre-pandemic levels and is projected to experience moderate CAGR throughout the forecasted period. The surge in the number of patients in hospitals for surgeries after the ease of pandemic restrictions tends to increase the prescriptions of pain management drugs.

Tramadol Market Snapshot & Highlights

Tramadol Market Size & Forecast

- 2025 Market Size: USD 2.34 billion

- 2026 Market Size: USD 2.47 billion

- 2034 Forecast Market Size: USD 3.97 billion

- CAGR: 6.09% from 2026–2034

Market Share

- North America dominated the global tramadol market with a 50.26% share in 2025, driven by a high prevalence of chronic pain, cancer-related pain, and well-established healthcare infrastructure that ensures broad access to pain management solutions. The presence of major pharmaceutical players and strong regulatory support for opioid-based treatments further reinforced the region’s leadership.

- By dosage form, tablets held the largest market share in 2024, attributed to their ease of use, cost-effectiveness, and availability in multiple formulations (immediate, extended, and sustained-release). The tablet form remains the most prescribed due to its proven efficacy, patient compliance, and reduced dosing frequency.

Key Country Highlights

- Japan: Rising geriatric population and increasing cases of osteoarthritis are major drivers of tramadol demand. Additionally, Japan is actively participating in clinical trials and introducing new drug combinations to enhance pain relief outcomes with lower side effects.

- United States: The high burden of chronic diseases such as cancer and osteoarthritis, along with strong federal healthcare initiatives, including R&D funding for advanced pain therapies, supports market growth. Approximately 30.5 million tramadol prescriptions were dispensed in the U.S. in 2021.

- China: The large population and increased surgical volume as part of hospital modernization, combined with rising awareness about pain management, are driving demand. Initiatives like Grünenthal’s licensing agreement with Mundipharma to distribute Tramal in China have improved drug access.

- Europe: The region’s robust pharmaceutical manufacturing base and regulatory initiatives focused on minimizing opioid abuse through safer drug combinations support moderate growth. Approvals for novel tramadol-based formulations—like Seglentis by Esteve Pharmaceuticals—are improving the region’s market outlook.

Tramadol Market Trends

Rise in the Number of Regulatory Approvals for New Indications to Drive Market Growth

In recent years, the market has seen the adoption of tramadol due to its notable effects on relieving pain. Each new indication approval signifies a strategic expansion, tapping into unmet medical needs and diversifying the utility of the drug. The rise in the number of regulatory approvals and launches by market players shapes the tramadol market growth.

- For instance, in October 2021, Esteve Pharmaceuticals, an international pharmaceutical innovator, received FDA approval for its first proprietary research product named Seglentis. It is a novel co-crystal form of celecoxib and tramadol hydrochloride used to treat acute pain in adults. It is a new treatment option for pain management with multimodal analgesia.

Furthermore, an increase in the number of clinical trials for the different combinations of tramadol for a variety of indications to reduce the risk of adverse events associated with the drug, such as abuse and dependence. Such market trends help to propel the market growth during the forecast period.

Download Free sample to learn more about this report.

Tramadol Market Growth Factors

Increased Prevalence of Pain Related to Chronic Diseases Propels the Market Growth

The increasing number of chronic disease cases and surgeries is the result of lifestyle changes and the aging population globally. The rise in the prevalence of pain related to chronic diseases such as neuropathic pain, dental pain, heart pain, renal pain, and other pain associated with surgeries is likely to increase the prescriptions of tramadol by healthcare professionals.

Additionally, the drug is used to manage severe pain, which requires around-the-clock, long-term opioid treatment when all other alternative treatments are inadequate to reduce pain. Furthermore, the efficiency of tramadol in relieving the pain associated with cancer is adopted and recommended by the oncology councils globally.

- For instance, according to the Malaysian Association for the Study of Pain (MASP), usage of weak opioids, such as tramadol, is used for relieving mild to moderate cancer pain.

As this drug is the choice of practitioners for pain relief, it is expected to boost the global market size during the forecast period.

Surge in Research and Development Initiatives for the Development of Novel Products Boosts the Market Expansion

In recent years, certain research and development initiatives to develop novel formulations have taken place to enhance delivery efficacy and address the limitations associated with the drug. These driving factors are potentially expanding the growth of the global tramadol market.

Furthermore, the rise in clinical trials exploring various tramadol formulations and combinations by market players results in increased launches of new pain relief products, driving market growth during the forecast period.

- For instance, in May 2022, CrystalGenomics, Inc. got approval for the phase I clinical trial of polmacoxib and tramadol combination to compare the pharmacokinetic compatibility of both drugs that are developed to treat acute and chronic pain in osteoarthritis. The combination has a 75.0% phase transition success rate (PTSR), indicating its progress into Phase II.

Moreover, benefits associated such as its efficacy in relieving pain, are eventually driving the expansion of the tramadol market.

RESTRAINING FACTORS

Adverse Events Associated with Drugs Restrict the Market Growth

The organ systems commonly affected by these drugs are the central nervous system, gastrointestinal, and neuromuscular, along with the cardiovascular system, dermatologic, endocrine, and visual systems. It is essential to take this drug precisely as prescribed due to its potential for addiction, dependence, and side effects such as vomiting, drowsiness, dizziness, headache, and nausea. The serious side effects include respiratory depression, seizure, tachycardia, hypertension, serotonin syndrome, and manic syndrome. The use of this drug is banned in children younger than 12 years of age, which poses a substantial barrier to product adoption.

- For instance, as per the data published in the journal Annals of Child Neurology from the Korean Child Neurology Society in June 2023, a 15-year-old girl without a history of seizures experienced tramadol-induced status epilepticus due to intravenous administration of tramadol after undergoing laparoscopic left ovarian cystectomy surgery.

Moreover, according to the U.S. Food and Drug Administration, Drug Safety Podcast in January 2022, the FDA restricted the use of tramadol in children as nine cases of serious breathing problems, including three deaths, were registered during the period 1969 to 2016 due to tramadol in April 2017. Therefore, the use is contraindicated in children younger than 18 years to treat pain associated with surgery of tonsils removal.

Moreover, certain factors, such as neonatal opioid withdrawal syndrome due to concomitant use in pregnancy, are anticipated to restrict the market growth globally.

Tramadol Market Segmentation Analysis

By Dosage Form Analysis

Widespread Acceptance and Ease of Usage of Tablets to Boost Tablets Segment Growth

Based on dosage form, the market is fragmented into tablets, capsules, injections, and others.

The tablets segment accounting for 40.92% of the market share in 2026 and is expected to expand at a substantial CAGR during the forecast period. The large share of the segment is attributed to factors, such as ease of manufacturing, the convenience of dosing and administration, and cost-effectiveness compared to other dosage forms. Moreover, tramadol tablets come in various formulations, including immediate-release, extended-release, and sustained-release, that provide prolonged analgesic effects and thus, reduce the frequency of dosing. The variations and the widespread acceptance of tablets contribute to the segment dominance in the global tramadol market.

Furthermore, the capsules segment has demonstrated considerable growth due to its benefits, such as alternative options for patients with difficulty swallowing the tablet. It can incorporate a variety of drug combinations with tramadol by masking the bitter taste and improving the bioavailability of the drug.

Additionally, the injections segment held a substantial portion of the market. This growth is augmented by the popularity of injections that provide a faster onset of pain relief compared to other formulations, making them useful in emergency or acute pain management situations. Along with that, injections are commonly used in hospitals or clinical settings for immediate pain relief after surgeries, severe injuries, or in situations where quick pain control is necessary.

Moreover, other segments are growing in popularity these days. The others segments include suspensions, oral solutions, and others. The approval and launches of the formulations by the market players are enhancing the segment's expansion.

- For instance, in September 2020, Athena Biosciences got FDA approval for its Qdolo (tramadol) oral solution for the management of severe pain requiring opioid analgesics, where alternative treatments are inefficient.

To know how our report can help streamline your business, Speak to Analyst

By Distribution Channel Analysis

Increasing Distribution of the Drug among Hospital Settings Led to the Segment Growth

Based on the distribution channel, the global market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies.

By distribution channel, hospital pharmacies dominated the market with a 56.42% share in 2026. The growth is attributed to the large number of surgeries in hospital settings and frequent prescriptions for acute pain management for post-surgery severe injuries during inpatient care. Thus, hospital pharmacies serve as crucial points for dispensing medications directly to patients under medical supervision.

Moreover, hospital pharmacies directly manage the distribution of injectable medications, ensuring timely and proper administration.

- For instance, in May 2023, as per the data published by the Diversion Control Division, around 30.5 million prescriptions for tramadol were dispensed in the U.S. in 2021, as reported in IQVIA National Prescription Audit.

The retail pharmacies segment accounted for a considerable global tramadol market share. It ensures the availability of medications, provides essential healthcare information, and offers convenient access to prescription and non-prescription medications.

Furthermore, the online pharmacies segment is anticipated to hold a substantial portion of the market. Online pharmacies have gained popularity in recent days as they offer a convenient way for individuals to purchase prescription medications without physically visiting the pharmacy. These factors augmented the growth of the segment during the forecast period.

REGIONAL INSIGHTS

Based on geography, the market is classified into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Tramadol Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America held a dominant position in the market with a revenue of USD 1.18 billion in 2025. The region's high prevalence of chronic pain leads to a high demand for pain management drugs.

- For instance, according to the data published by the American Cancer Society, an estimated 1.9 million population in America will be diagnosed with cancer in 2022. This increases the usage of drugs to relieve the pain associated with cancer. Thus, the high prevalence rate of cancer and pain related to it propels the growth of the market in the North American region.

Additionally, advanced healthcare facilities and infrastructure in the region and active participation in pharmaceutical research and development activities results in the launches of new formulations and combination therapies, contributing to the dominance of the region in the market.

Europe

Europe commanded a considerable market share in 2024. The growth is ascribed to the presence of robust healthcare facilities and strong research and development initiatives by key players to launch new combinations of the drug to reduce adverse events associated with it. The UK market is valued at USD 0.08 billion by 2026, while the Germany market is valued at USD 0.19 billion by 2026.

Asia Pacific

On the other hand, the Asia Pacific is anticipated to expand by 2032. The market growth across the region is ascribed to the increasing aging population and prevalence of chronic disorders and injuries, resulting in increasing usage of tramadol to reduce the pain associated with surgeries, supporting the growing adoption of the drug in the market. The Japan market is valued at USD 0.18 billion by 2026, the China market is valued at USD 0.11 billion by 2026, and the India market is valued at USD 0.06 billion by 2026.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa regions are anticipated to expand at a comparatively low CAGR during the forecast period. The disparities in the healthcare infrastructure and access to quality medical facilities accounted for the low share of the market. However, the growing incidence of chronic pain conditions, coupled with an aging population, drives the need for effective pain relief solutions, subsequently boosting the demand for the drug in the region.

Key Industry Players

Established Brand presence of Key Companies Sustain their Market Position

The competitive landscape of the market reflects a fragmented structure. Some prominent players, such as Grünenthal, Zydus Group, and GSK plc. held a significant position in the global tramadol market in 2024 due to its established brand presence and strong strategic partnerships with various players and healthcare settings.

Mundipharma International, Vertical Pharmaceuticals, LLC, Janssen Global Services, LLC, and Cipher Pharmaceuticals Inc. are also some other key players in terms of market share in the global market. Certain strategic initiatives, such as the focus on research and development activities, approvals from regulatory bodies, and innovative launches, are anticipated to boost their market presence in key countries during the forecast period.

LIST OF TOP TRAMADOL COMPANIES PROFILED:

- Grünenthal (Germany)

- Mundipharma International (U.K.)

- Zydus Group (India)

- GSK plc (U.K.)

- Vertical Pharmaceuticals, LLC (U.S.)

- Janssen Global Services, LLC (U.S.)

- Cipher Pharmaceuticals Inc. (Canada)

KEY INDUSTRY DEVELOPMENTS:

- April 2023- Cipher Pharmaceuticals Inc. attended a Bloom Burton & Co. Healthcare Investor Conference 2023 to showcase their diversified portfolio of commercial and early to late-stage products and expand its global footprints.

- November 2022- Grünenthal partnered with Kyowa Kirin Co., Ltd. to establish a medicine portfolio across six therapeutic areas, including 13 brands, with most of the revenue derived from pain management medicines.

- July 2022- Grünenthal collaborated with Uniklinik RWTH Aachen and RWTH Aachen University to develop advanced next-generation pain medications.

- October 2020- Avenue Therapeutics received a Complete Response Letter and approval from the U.S. FDA for the development of intravenous (IV) tramadol for the U.S. market.

- January 2018- Grünenthal announced its partnership with Mundipharma International and entered into a License and Distribution Agreement to enter the Chinese markets with the aim of distributing Tramal (tramadol) to improve the quality of life of the people in China.

REPORT COVERAGE

The global market report focuses on an industry overview and market dynamics, such as the drivers, restraints, opportunities, and trends. Besides this, the market research report provides information related to the prevalence of key chronic diseases by key countries/ regions in the market. Furthermore, the global market analysis also focuses on key industry developments and pipeline analysis. In addition, the impact of COVID-19 and the industry overview during the pandemic are covered in the report.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD billion) |

|

Growth Rate |

CAGR of 6.09% from 2026-2034 |

|

Segmentation |

By Dosage Form

|

|

By Distribution Channel

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market is expected to grow from $2.47 billion in 2026 to $3.97 billion by 2034, exhibiting a CAGR of 6.09% during the forecast period.

In 2025, the North America market stood at USD 1.18 billion.

The market is expected to exhibit a CAGR of 6.09% during the forecast period.

Tablets under the dosage form segment led the market.

North America region dominated the market in 2025.

The contributing factors, such as the rising number of chronic diseases, the number of surgeries, growing initiatives for research activities, and increasing regulatory approvals.

The key trend in this market is the increase in the number of regulatory approvals for the new indications of drugs.

Grünenthal, Zydus Group, and GSK plc. are the top players in the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us