Transit Packaging Market Size, Share & Industry Analysis, By Material (Plastic, Paper & Paperboard, Metal, and Wood), By Packaging Type (Flexible, Rigid, and Protective), By Product Type (Boxes & Cartons, Trays & Crates, Pallets, Intermediate Bulk Containers, Barrels & Drums, Inserts & Dividers, and Others), By End Use (Food & Beverages, Automotive, Industrial, E-commerce, Electricals & Electronics, Chemicals, Healthcare, and Others), and Regional Forecast, 2026[PQ4Ky3ZaUf]-2034

KEY MARKET INSIGHTS

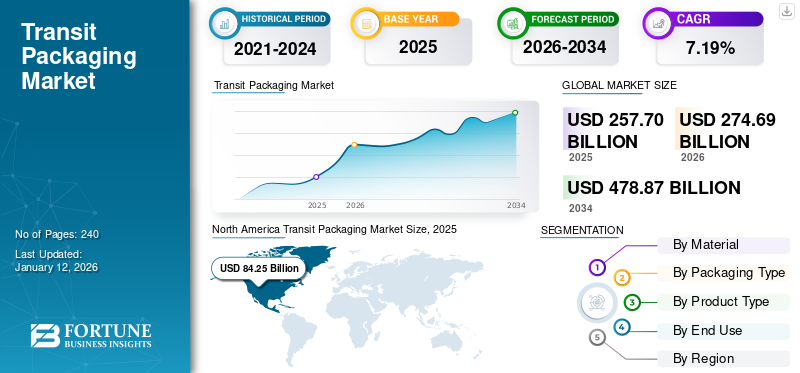

The global transit packaging market size was valued at USD 257.7 billion in 2025 and is projected to be worth USD 274.69 billion in 2026 and reach USD 478.87 billion by 2034, exhibiting a CAGR of 7.19% during the forecast period. North America dominated the transit packaging market with a market share of 32.69% in 2025. Moreover, the transit packaging market in the U.S. is projected to grow significantly, reaching an estimated value of USD 108.63 billion by 2032, driven by the growing demand for transit packagig in the pharmaceutical sector.

Transit packaging is an effective packaging solution that offers excellent product protection from damage during shipping, handling, storage, and transportation. In addition, it offers several benefits, including environmental friendliness and temperature tolerance, further driving the global market growth. The growing demand for boxes and cartons in the food & beverage, healthcare, and automotive sectors is highly contributing to the market share.

The sudden emergence of the COVID-19 virus adversely affected various end-use sectors and the supply chain in the market. However, the significant growth in the healthcare, food and beverages, and e-commerce industries propelled market growth during the pandemic.

Global Transit Packaging Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 257.7 billion

- 2026 Market Size: USD 274.69 billion

- 2034 Forecast Market Size: USD 478.87 billion

- CAGR: 7.19% from 2026–2034

Market Share:

- North America dominated the transit packaging market with a 32.69% share in 2025, driven by strong demand from food, beverage, automotive, and e-commerce sectors. The U.S. transit packaging market alone is projected to reach USD 108.63 billion by 2032, largely supported by rising demand from the pharmaceutical sector.

Regional Insights:

- North America: Dominant region led by major packaging manufacturers and strong demand from established industries like food, automotive, and e-commerce.

- Europe: The second-largest market, fueled by the expansion of personal care, food, and home care sectors.

- Asia Pacific: Fastest-growing region, with booming e-commerce and electronic exports, particularly from China and India.

- Latin America: Moderate growth driven by developing food & beverage sectors.

Transit Packaging Market Trends

Rapidly Increasing E-commerce Sectors Emerge as a Key Market Trend

The transit packaging market is growing rapidly due to the potential benefits offered by the packaging solution to numerous end-use industries. Along with the rising utilization of such products in various industries, the rapidly emerging e-commerce sector booms as a key trend for transit packaging market growth. The growing demand for e-commerce products has been a major growth contributor. The utilization of corrugated boxes & cartons, cushioning products such as honeycomb, air pillows, and bubble wraps are in high demand by the e-commerce sector, thus emerging as a key market trend. Moreover, the online shopping trend and high demand for online food delivery among consumers also enhances market growth.

Download Free sample to learn more about this report.

Transit Packaging Market Growth Factors

Rising Demand for Transit Packaging to Pack Pharmaceutical Products Drives Market Growth

Transit packaging is majorly utilized for the packaging of pharmaceuticals, drugs, and medicines to protect the products from damage. It is also used to preserve the quality of the pharmaceutical product and is very helpful in efficient storage and easy handling. The packaging also eliminates the chances of product contamination. Moreover, it provides an added layer of protection to keep the pharmaceutical product safe inside and safeguards the medicine against external factors such as temperature variations and contaminants.

Since this packaging product depicts clear information about the products, it makes the segregation and shipping process easier. Hence, the growing demand for transit packaging in the pharmaceutical sector drives the market growth.

Augmenting Demand for Transit Packaging from Food & Beverage Sector Propels Market Growth

Transit packaging solutions are gaining traction in the food and beverage industry. The packaging solution is essential in protecting the product from contamination and damage during transportation. It also offers efficient storage and easy handling of the food and beverage items. The growing demand for online food delivery is contributing to the demand for transit products for efficient packaging.

The shipping, storing, and distributing of food & beverage products across numerous regions become feasible with transit products. Hence, the rising demand for such packaging solutions from the food and beverage industry drives transit packaging market share.

RESTRAINING FACTORS

High Raw Material Costs & Increasing Environmental Concerns May Restrain Market Growth

The raw materials utilized for the manufacturing of transit product packaging are expensive. The manufacturing of several products such as IBCs, barrels, pallets, and several other products requires many materials, and the high upfront costs associated with the manufacturing are analyzed to hinder market growth. Moreover, the rapidly increasing environmental concerns among consumers and manufacturers for plastic usage and its harm to the environment are also hampering the market growth.

Transit Packaging Market Segmentation Analysis

By Material Analysis

Rising Utilization of Paper & Paperboard Material by Various End-use Industries Fosters Segmental Growth

By material, the market is segregated into plastic, paper & paperboard, metal, and wood. The paper & paperboard is the dominating material segment and is estimated to attain rapid growth during the forecast period. The boxes, cartons, trays, and other products manufactured with paper & paperboard material are highly utilized by many end-use industries for product packaging. The material offers high durability and is a top-shelf and easy-to-handle solution for many products, further boosting the segmental growth. The paper & paperboard segment accounted for 47.70% of the total market share in 2026.

Plastic is the second-dominating material. The increasing demand for films, barrels, drums, bubble wraps, and other products for transportation and storage of products bolsters the plastic segment growth.

To know how our report can help streamline your business, Speak to Analyst

By Packaging Type Analysis

Potential Benefits Offered by the Rigid Packaging Products Aids Segmental Growth

In terms of packaging type, the market is divided into flexible, rigid, and protective. The rigid is the leading packaging type segment and has been analyzed to witness significant growth in the coming years. The rigid packaging type provides excellent protection for the products packaged inside through its structure and support. The rigid packaging products are highly impact-resistant, owing to which the manufacturers highly utilize them. Moreover, the handling of bulk products and shipment of fragile goods are feasible with rigid packaging, further driving the segment’s growth. The rigid packaging segment accounted for 47.54% of the total market share in 2026.

Protective packaging, offering cushioning and product protection, constitute the second dominant segment, driving its significant growth

By Product Type Analysis

Augmenting Demand for Boxes & Cartons Among Major Industries Boosts Segmental Growth

By product type, the market is divided into boxes & cartons, trays & crates, pallets, intermediate bulk containers, barrels & drums, inserts & dividers, and others. The boxes & cartons is the dominating segment and is analyzed to grow rapidly over the projected timeframe. The boxes & cartons offer a constant cushion for goods, keeping items safe during transit, shipping, and handling. They also withstand wear & tear of several transport activities, can be customized, and provide overall product protection, owing to which there is a huge demand from major industries such as food & beverages, automotive, healthcare, and others, further driving the segmental growth. The boxes & cartons segment accounted for 29.87% of the total market share in 2026.

The pallets is the second-dominating product type segment. Pallets provide excellent protection to goods and ensure that they are secured in one place.

By End Use Analysis

Substantial Rise in the Demand for Food & Beverage Products Enhances Segmental Growth

In terms of end use, the market is segregated into food & beverages, automotive, industrial, e-commerce, electricals & electronics, chemicals, healthcare, and others. The food & beverages is the dominating end use segment and is forecast to grow robustly in the upcoming years. Such packaging solutions are efficient in increasing profit for food manufacturers & producers by eliminating breakage, spoilage, and the chances of mold growth. They also increase the shelf life of products, and subsequently, the rising demand for food & beverage products from customers all across the world enhances segmental growth. The food & beverages segment accounted for 23.72% of the total market share in 2026.

Healthcare is the second-dominating end use segment. The rising demand for pharmaceutical drugs and medical devices is contributing to the segment’s growth.

REGIONAL INSIGHTS

The market is analyzed across Latin America, Europe, Asia Pacific, the Middle East & Africa, and North America.

North America Transit Packaging Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America was the dominating region in the global transit packaging market, with the market size valued at USD 84.25 billion in 2025 and increasing to USD 90.33 billion in 2026. The presence of leading manufacturers of transport packaging in the region is the major factor driving market growth. The augmenting demand for returnable and cost-effective packaging solutions by the well-established food, beverages, automotive, and e-commerce sectors in the U.S. also drives the growth in the region. The US market is projected to reach USD 68.85 billion by 2026.

Europe is the second-dominating region. The growing personal care, food, and home care industries in the region have a high demand for boxes, cartons, pallets, and protective packaging products, boosting the regional growth. The UK market is projected to reach USD 13.03 billion by 2026, while the Germany market is projected to reach USD 17.18 billion by 2026.

Asia Pacific is the fastest-growing region and is forecast to witness significant growth over the projected timeframe. The rising export of electronic products from various parts of the region and the rapidly growing e-commerce sectors are the major contributors to the market growth in this region. The Japan market is projected to reach USD 11.34 billion by 2026, the China market is projected to reach USD 18.48 billion by 2026, and the India market is projected to reach USD 14.81 billion by 2026.

Latin America is studied to grow moderately during the projected period. The region’s developing food & beverage industries thrive on the demand for transit product packaging, thus enhancing the market growth.

List of Key Companies in Transit Packaging Market

Prominent Companies to Observe Significant Growth Opportunities with New Product Launches

The global transit packaging market is highly competitive and fragmented. A few significant players are leading the market by delivering innovative packaging solutions in the packaging industry. These major players consistently emphasize the expansion of their customer base across regions by innovating their existing product range.

Major players in the transit packaging industry include Mondi, WestRock Company, International Paper, Nefab AB, Smurfit Kappa, ProAmpac, and others. Many other players in the market are emphasizing market scenarios and delivering advanced packaging solutions.

List of Key Companies Profiled:

- Mondi (U.K.)

- WestRock Company (U.S.)

- International Paper (U.S.)

- Nefab AB (Sweden)

- Smurfit Kappa (Ireland)

- ProAmpac (U.S.)

- Sealed Air (U.S.)

- Stora Enso Oyj (Finland)

- DS Smith (U.K.)

- Greif, Inc. (U.S.)

- Sonoco Products Company (U.S.)

- Rengo Co. Ltd. (Japan)

- Mauser Packaging Solutions (U.S.)

- Schütz GmbH & Co. KGaA (Germany)

- Time Technoplast Ltd. (India)

KEY INDUSTRY DEVELOPMENTS:

- September 2023 – International Paper announced the opening of its newest state-of-the-art corrugated packaging facility in Atglen, PA. The new facility is built to manufacture corrugated packaging for processed food, produce, beverage, shipping, distribution & e-commerce customers.

- April 2023 –Greif, Inc., declared the acquisition of a leading North American intermediate bulk container & plastic drum reconditioning company, Centurion Container LLC. The acquisition holds 9% to 80% in an all-cash transaction for USD 145 million, subject to customary closing adjustments, and will enhance the company’s product portfolio.

- July 2022 – Sealed Air declared the launch of a BUBBLE WRAP brand paper bubble mailer, which is a fiber-based padded mailer and can be easily recycled in curbside bins. The product is smaller and lighter as compared to the traditional boxes and reduces shipping costs and dimensional weight.

- March 2022 – Mauser Packaging Solutions announced the expansion of its Infinity Series, which includes monolayer and multilayer IBCs and drums. The company also paved the way for the use of PCR in the industrial packaging sector.

- June 2020 – International Paper Company announced the launch of new and innovative corrugated dividers with the aim of supporting the COVID-19 de-escalation in EMEA. The dividers are available in varied forms and shapes and offer customers several options to return safely and efficiently to their business operations and contribute to the environmentally friendly solution strategy.

REPORT COVERAGE

The research report provides a detailed market analysis and focuses on key aspects, such as top market players, competitive landscape, product/service types, market segmentation, Porter’s five forces analysis, and leading segments of the product. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the abovementioned factors, the report encompasses several factors that have contributed to the market intelligence and growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.19% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material

|

|

By Packaging Type

|

|

|

By Product Type

|

|

|

By End Use

|

|

|

By Region

|

Frequently Asked Questions

The Fortune Business Insights study shows that the global market size was valued at USD 257.7 billion in 2025.

The market is projected to record a CAGR of 7.19% during the forecast period.

The market size of North America was valued at USD 84.25 billion in 2025.

Based on material, the paper & paperboard is the dominating segment and holds the largest market share.

The global market value is expected to reach USD 478.87 billion by 2034.

The key market drivers are the rising demand for transit packaging for pharmaceutical product packaging and from the food & beverages sector.

The top players in the market are Mondi, WestRock Company, International Paper, Nefab AB, Smurfit Kappa, and ProAmpac, among others.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us