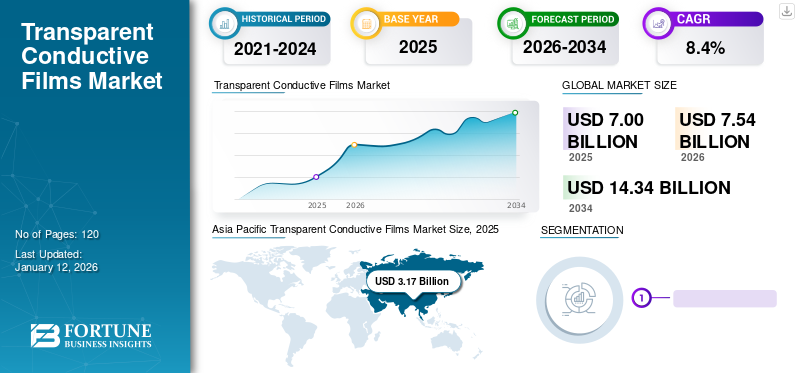

Transparent Conductive Films Market Size, Share & Industry Analysis, By Material (Indium Tin Oxide (ITO) on Glass, Indium Tin Oxide (ITO) on PET, Silver Nanowire, Carbon Nanotubes, Metal Mesh, and Others), By Application (Consumer Electronics, Automotive, Smart Glass, Solar Cells, Transparent Heaters, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

The global transparent conductive films market size was valued at USD 7 billion in 2025 and is projected to grow from USD 7.54 billion in 2026 to USD 14.34 billion by 2034, exhibiting a CAGR of 8.4% during the forecast period. Asia Pacific dominated the global market with a share of 45.40% in 2025.

Thin films of optically transparent and electrically conductive material are known as Transparent Conducting Films (TCFs). These films have excellent resistance to heat and chemicals and offer exceptional transparency. They exhibit high optical transparency and achieve high electrical conductivity over large surface areas. Due to their cost-effective nature, customizability, and compatibility with a wide range of metals to meet specific needs, these films are widely used in flexible, bendable, and wearable displays across the globe.

The market growth is expected to be driven by the growing need for touchscreen displays and the increasing adoption of smart electronics. The growth in product demand is attributed to the rising developments in nanotechnology and flexible and bendable electronic devices. In addition, there is an increasing inclination toward touch User Interface (UI) because it eliminates the need for external devices such as a keyboard and mouse, allows for swift and efficient menu option selection, and provides high durability and reliability. Moreover, the expansion of the solar energy sector is fostering a growing potential for market share.

The COVID-19 pandemic has had a significant impact on the growth of the market for transparent conductive films, leading many companies in the industry to seek ways to offset their losses due to supply chain disruptions and reduced sales. Technological innovations backed by the government gave a boost to new and existing projects. In addition, local producers and SMEs received financial assistance from the government, which enabled them to access subsidized and discounted raw materials.

Transparent Conductive Films Market Trends

Rising Demand for Anti-reflective Coatings to Meet Consumer Preference is a Key Trend

Consumers are increasingly favoring high-quality, glare-free screens, leading to a rise in demand for anti-reflective coatings and transparent conductive films in displays. By reducing reflections, this combination improves visibility and delivers optimal viewing experiences. The integration of transparent conductive films with anti-reflective coatings is becoming essential in devices such as smartphones, tablets, and laptops, where users seek clear, sharp displays free from unwanted glare or reflections.

Download Free sample to learn more about this report.

Transparent Conductive Films Market Growth Factors

Increasing Demand for Touchscreens to Aid Market Growth

The manufacturing of touchscreens relies on transparent conductive films as a crucial element, offering a transparent and conductive layer for touch functionality. With the growing use of tablets, laptops, smartphones, and other touchscreen devices, the need for TCFs is also on the rise. The shift toward larger screens and higher-resolution displays is fueling the increasing demand for TCFs. TCFs play a key role in the production of OLED displays, LCDs, and other high-resolution screens that necessitate a transparent and conductive layer. According to an industry analyst, in 2022, approximately 1.43 billion smartphones have been shipped and sold globally, and it is expected to reach 7.7 billion by 2027.

In addition, the rising favorability of flexible screens, such as foldable tablets and smartphones, is escalating the need for TCFs. Transparent coating films are essential for flexible displays to offer a see-through and conductive layer that can endure the folding and bending of the screen. As a result, the demand for touchscreens is anticipated to keep growing, bolstered by the increasing appeal of smart gadgets and the shift toward more advanced displays. This is likely to result in a continual surge in the demand for transparent conductive films in the foreseeable future, thereby propelling market revenue.

RESTRAINING FACTORS

Durability Concerns for Long-Term Performance May Hamper Market Growth

Concerns about durability pose a significant challenge for certain products, directly impacting transparent conductive films market growth. Potential adopters may be deterred by issues about the long-term performance and reliability of these films. In addition, industries in need of resilient and long-lasting solutions may hesitate to integrate transparent conductive films into their applications, thereby restricting market expansion.

Transparent Conductive Films Market Segmentation Analysis

By Material Analysis

Advanced Features and Applications of Indium Tin Oxide (ITO) on Glass Boosted Segment Growth

Based on material, the market is segmented into Indium Tin Oxide (ITO) on glass, Indium Tin Oxide (ITO) on PET, silver nanowire, carbon nanotubes, metal mesh, and others.

In terms of market share, the Indium Tin Oxide (ITO) on glass segment dominated the market with share of 25.99% in 2026. ITO on glass has a wide range of uses, including micro structuring applications, OLED and LED displays, coverslips for medical technology, and heat-resistant microscope slides. Moreover, it is suitable for circuit substrates for electronics, transparent and conductive coatings for organic solar cells, touch-sensitive display technology and touch screens, conductive coatings for transparent electrodes, infrared mirrors, de-icing windows, reflective infrared filters, and anodes for OLEDs. Furthermore, indium, which is the primary material in ITO films, is a scarce metal with uneven distribution. As a result, there is a concern regarding its consistent supply and the potential for rising prices.

The carbon nanotubes segment is anticipated to register the highest CAGR during the forecast period. Carbon nanomaterials constitute a broad category of substances encompassing graphene, fullerenes, nanotubes, nanofibers, and other related compounds. Films made of carbon nanotubes exhibit an impressive blend of physical and chemical characteristics, including mechanical stability, flexibility, and stretchability, strong adhesion to different substrates, chemical inertness, and outstanding electrical and optical properties. In contrast to metallic films, these highly conductive films are lightweight and flexible, making them suitable for a wide range of electrical devices, such as electromagnetic shields, modulators, antennas, bolometers, and others. In February 2022, MIPT and Skoltech physicists discovered a method to alter and deliberately adjust the electronic characteristics of carbon nanotubes to satisfy the needs of new electronic gadgets.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Consumer Electronics Dominated Due To Delivery of Responsive Touch Capabilities in the Devices

Based on application, the market is categorized into consumer electronics, automotive, smart glass, solar cells, transparent heaters, and others.

In terms of market share, the consumer electronics segment dominated the market with share of 27.86% in 2026. The rising prevalence of smartphones, tablets, and other touch-capable devices has created an ongoing demand for transparent and conductive materials that can deliver responsive touch capabilities without sacrificing optical clarity. These materials enable precise touch detection while preserving optical transparency. As the popularity of flexible and foldable displays in consumer electronics grows, such as in smartphones and wearable devices, the significance of flexible and stretchable TCFs has also increased.

The smart glass segment is poised to expand at the highest CAGR during the forecast period. Smart glass relies on transparent conductive films, which are essential for functions such as switchable windows, privacy glass, and dynamic facades. These films allow for adjustable transparency, light manipulation, and improved energy efficiency. The demand for smart glass is growing because of progress in nanotechnology, better coatings for increased durability and functionality, integration with IoT for smart building applications, and the creation of self-cleaning or anti-fogging features.

REGIONAL INSIGHTS

By geography, the market is segmented into South America, North America, the Middle East & Africa, Europe, and Asia Pacific.

Asia Pacific

Asia Pacific Transparent Conductive Films Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific accounted for the maximum revenue with USD 3.17 billion in 2025. The outsourcing of manufacturing activities to low-cost developing countries is expected to drive up the demand for high-quality TCFs equipment in Asia. The electronics industry has a high demand for these films because they can produce versatile-shaped products and complex models using injection molding, which is suitable for the industry's needs. China and Japan hold the title of the world's largest base for electronics production. They are actively engaged in the manufacturing of electronic products, including smartphones, TVs, portable computing devices, gaming systems, and other personal devices. The Japan market is projected to reach USD 0.62 billion by 2026, the China market is projected to reach USD 0.92 billion by 2026, and the India market is projected to reach USD 0.44 billion by 2026.

Europe

Europe is estimated to grow at the highest rate during the forecast period. Vehicles in the region are being equipped with better driving experience equipment, such as transparent heaters, smart glasses, and others. The industry's changing requirements fuel the need for advanced transparent conductive films that align with Europe's ongoing dedication to technological advancement. The UK market is projected to reach USD 0.19 billion by 2026, while the Germany market is projected to reach USD 0.23 billion by 2026.

North America

North America is slated to record the second-highest growth rate in the market during the forecast period. The demand for products is growing because of the increased use in the photovoltaic industry. The region’s dominant presence in the market is fueled by the expanding utilization of these films in solar technology. The U.S. market is projected to reach USD 1.23 billion by 2026.

Middle East & Africa

The Middle East & Africa is poised to witness a significant growth rate in the market during the forecast period. The increase in product demand is due to the widespread use of smartphones and the shift toward digitalization.

South America

South America transparent coating films market is poised for significant growth during the forecast period. This growth is driven by the increasing demand for the films' low power consumption properties, strengthening demand in the region for several applications.

KEY INDUSTRY PLAYERS

Leading Companies Deploy Various Market Strategies to Propel Geographical Reach

Major industry players operating in the market are providing advanced conductive films to help users in their safety and better user experience. Manufacturers of transparent conductive films prioritize acquiring small and local firms to expand their business reach. Moreover, mergers & acquisitions, leading investments, and strategic partnerships contribute to an increase in demand for products.

List of Top Transparent Conductive Films Companies:

- C3Nano Inc. (U.S.)

- Canatu (Finland)

- TDK Corporation (Germany)

- Dontech (U.S.)

- TEIJIN LIMITED (Japan)

- Nano Cintech (Spain)

- Panasonic Corporation (Japan)

- Cambrios (U.S.)

- Nitto Denko Corporation (Japan)

- TOYOBO CO., LTD. (Japan)

KEY INDUSTRY DEVELOPMENTS:

- September 2023: Panasonic Industry Co., Ltd. and Meta Materials Inc. collaborated to strategically develop from design to mass production. This collaboration aims to enhance the supply of NANOWEB films and speed up the expansion of the transparent conductive film industry. This opens up new possibilities for applications in the consumer electronics and automotive sectors, including transparent film antennas, electromagnetic shielding, and heaters.

- May 2023: Canatu and Webasto collaborated to integrate a stationary film heater into the Roof Sensor Module (RSM). By integrating Canatu's anti-fogging and deicing system into the RSM, the goal is to secure dependable ADAS sensor functionality in challenging weather conditions. In addition, the Canatu film heaters are suitable for use with camera systems.

- October 2022: C3Nano, Inc. revealed its intentions to expand its Ultra-Nanowire product range, pushing forward new industry uses deploying plated nanowires. Drawing from C3Nano's original primary-shell nanowire technologies, the silver nanowires are coated with nano-scale layers of a noble metal, producing a much more durable and dependable material collection that is well-suited for conductive coatings, advanced composites, bio-compatibility, and more other applications.

- August 2022: C3Nano, Inc. confirmed the successful conclusion of a USD 35 million growth capital funding round, which includes both equity and debt. This capital allows C3Nano to increase its capacity for synthesizing and producing silver nanowires at its California facility and allocate additional resources to expedite the innovation and commercialization of its nanowire-based technologies.

- February 2022: Panasonic Corporation has revealed that its Industry Company has successfully brought to market a dual-sided full-wiring transparent conductive film that boasts both high transmissivity and low resistance. This marks the first instance in the industry of utilizing its distinctive roll-to-roll construction method.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as prominent companies, leading materials, and applications. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

An Infographic Representation of Transparent Conductive Films Market

To get information on various segments, share your queries with us

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.4% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material

By Application

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 14.34 billion by 2034.

In 2025, the market value stood at USD 7 billion.

The market is projected to grow at a CAGR of 8.4% during the forecast period.

By application, the consumer electronics segment led the market in 2025.

The increasing demand for touchscreens is slated to aid market growth.

C3Nano Inc., Canatu, TDK Corporation, Dontech, TEIJIN LIMITED, Nano Cintech, Panasonic Corporation, Cambrios, Nitto Denko Corporation, and TOYOBO CO., LTD. are the top companies in the global market.

In 2025, Asia Pacific held the largest market share.

Europe is expected to exhibit the highest growth rate during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic